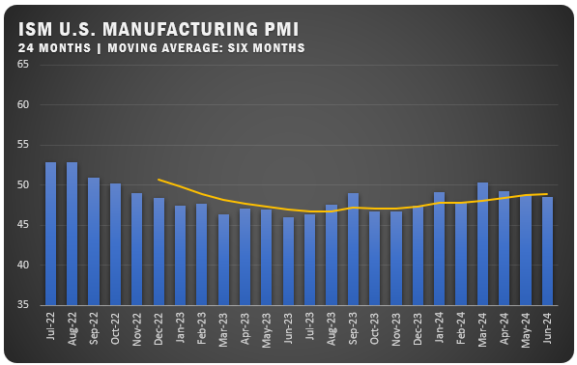

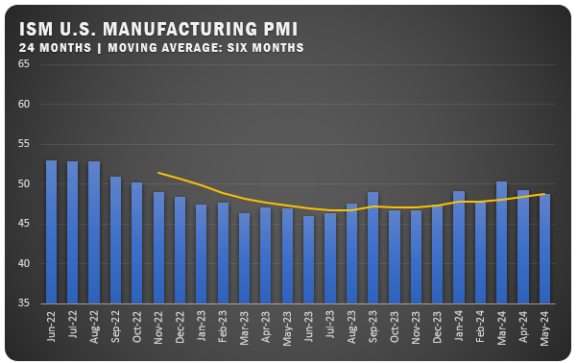

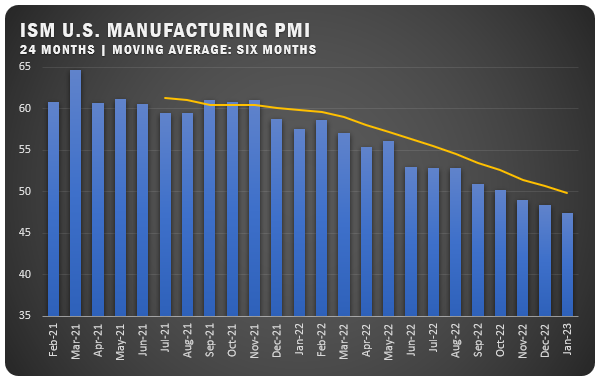

US Manufacturing PMI Slide Continues Into January

India and Italy both register above 50 percent for PMI readings to start the year

While many countries seemed to find a bottom for manufacturing activity, the U.S. continued to slide deeper into contraction territory based on the latest PMI reading from the ISM® Report On Business® for manufacturing. The report tagged U.S. manufacturing with a reading of 47.4 percent for January, which represents a relatively steady decline that began in December of 2021.

“New order rates remain depressed due to buyer and supplier disagreements regarding price levels and delivery lead times; these should be resolved by the second quarter,” says Timothy R. Fiore, Chair of the ISM® Manufacturing Business Survey Committee. “In the meantime, panelists’ companies are attempting to maintain head-count levels during the anticipated slow first half in preparation for a strong performance in the second half of 2023. Eighty-six percent of manufacturing gross domestic product is contracting, up from 85 percent in December. However, 26 percent of sector industries had a composite PMI® calculation of below 45 percent in January, down from 35 percent the previous month.”

The report also indicates a softening in demand with the New Orders Index contracting strongly while the New Export Orders Index showed improvement but still remained below 50 percent. The Customers’ Inventories Index contracted slightly which should be a positive for future production. The Backlog of Orders Index increased for a second straight month but still remains in contraction territory.

On the plus side, panelists’ companies indicate that they are not going to substantially reduce headcounts as they are projecting improvement in the second half of the year.

ISM® REPORT COMMENTS (US Manufacturers)

- “Business is still strong, but we have begun to see softening in some pricing, and lead times seem to be improving.” Computer and Electronic Products

- “Conditions are reasonable. Sales are a little better than planned. Cost pressures are easing for most products. There have been a lot fewer supply disruptions so far this year, and few are expected in the short term. The crystal ball remains a little blurry for the rest of 2023.” Chemical Products

- “Sales have dropped (as expected) at the beginning of the year. The forecast from the sales department is showing even lower sales than we expected. If this holds true, inventory levels will rise slightly over the next month and a half.” Food, Beverage and Tobacco Products

- “Supply chain issues continue to plague our production schedules. Transportation from our overseas suppliers is also contributing to delays. Lead times have doubled for critical electronics, gaskets, sealants and specialized steel.” Transportation Equipment

- “Strong big ag demand continues to drive heightened demand for parts. Large construction/off-highway original equipment manufacturers have strong demand as well creating continued capacity constraints with the supply base.” Machinery

- “Some business segments showing demand softening globally. Many materials showing improved lead times as well as cost deflation.” Electrical Equipment, Appliances and Components

- “Thus far, the outlook for the first half of 2023 looks very soft. Demand for our products has taken a sharp downward turn. Our inventories are high, as well as our customers’. It seems everyone is bracing for a recession.” Fabricated Metal Products

- “Customers are being quite aggressive in pursuing price decreases, far beyond the price relief we are actually receiving from our suppliers.” Miscellaneous Manufacturing

- “Industrial construction is strong. Commercial construction is slower.” Nonmetallic Mineral Products

- “In the past two weeks, we are seeing a slowing of new orders.” Primary Metals

US SECTOR REPORT

ISM® GROWTH SECTORS (2): Miscellaneous Manufacturing; and Transportation Equipment.

ISM® CONTRACTION SECTORS (15): Wood Products; Textile Mills; Paper Products; Furniture and Related Products; Apparel, Leather and Allied Products; Plastics and Rubber Products; Electrical Equipment, Appliances and Components; Primary Metals; Nonmetallic Mineral Products; Fabricated Metal Products; Chemical Products; Machinery; Food, Beverage and Tobacco Products; Petroleum and Coal Products; and Computer and Electronic Products.

GLOBAL MANUFACTURING

EUROPE: The S&P Global Eurozone Manufacturing PMI registered 48.8 percent for January, up one percent from the December reading. It was the third straight month of improvement for Eurozone factory activity as the supply chain continued to remain stable. New orders declined, but at a slower rate despite a continuing decline in export business. Cost inflation hit a 26-month low and business optimism was up.

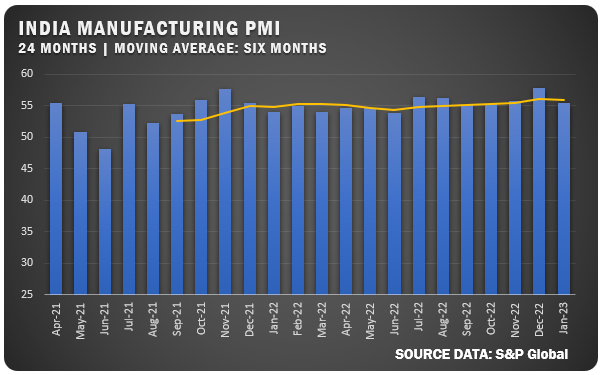

INDIA: While remaining well above the 50-percent line, the S&P Global India Manufacturing PMI slipped to 55.4 percent to start the year after a surge to 57.8 percent in December. Output and new orders grew but at a slower rate. Export sales have driven that growth over the past 10 months. Delivery times were shorter, but input costs hit a three-month high. Prices overall continued to increase.

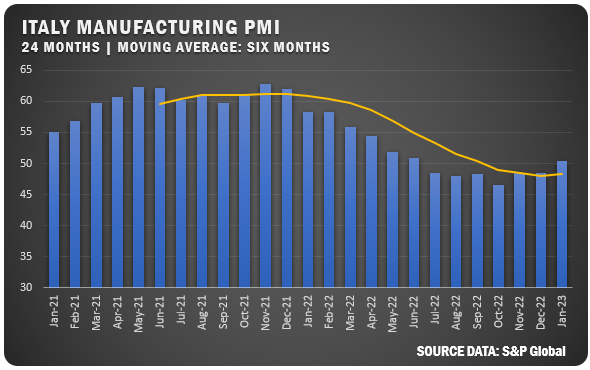

ITALY: The S&P Global Italy Manufacturing PMI pushed into growth territory with a 50.4 percent reading for January. It was the first trip above the 50-percent line since June 2022. Output grew slightly, but new orders were weak as higher borrowing costs and fears of a recession factored in. Employment saw a bump and business confidence improved.

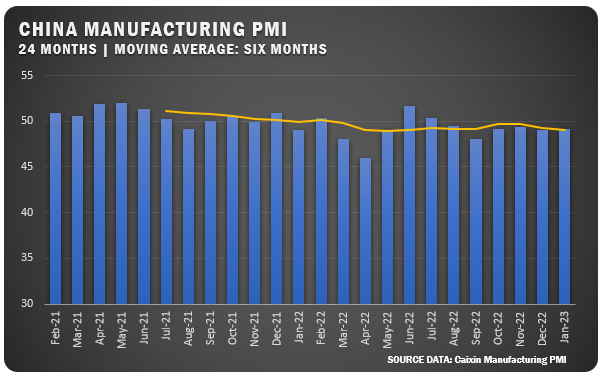

CHINA: The Caixin China General Manufacturing PMI came in at 49.2 percent in January to continue a streak in contraction territory that dates back to August 2022. Output fell but not as severely as in previous months. Export demand was still weak and fell for a sixth straight month. Backlogs of work increased and that helped improve employment figures. Delivery times were improved and business optimism reached the highest level since April 2021.

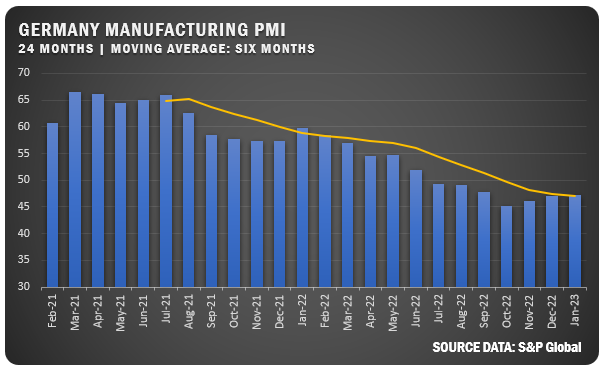

GERMANY: The S&P Global/BME Germany Manufacturing PMI was reported at 47.3 percent for January, up just 0.2 percent from December. Still, it represented a third straight month of improvement. The most significant headwind was a decline in new orders brought about by high inventories, high prices and a slowdown in investment. Export orders were weak, but employment grew for the 23rd straight month. Business optimism was up for the first time since February of last year.

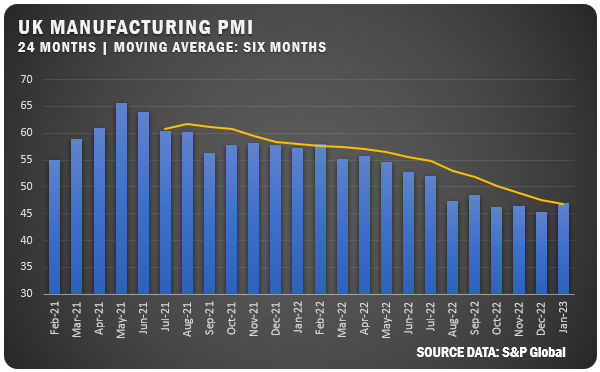

UNITED KINGDOM: The S&P Global/CIPS UK Manufacturing PMI continued to bounce up and down in contraction territory to register 47.0 percent for January 2023. That was up nicely from the December figure of 45.3 percent but represented a sixth month in contraction territory. New orders dropped to continue an eight-month trend based on lower demand from the domestic and export markets. Input costs fell, but selling price inflation increased, while business confidence also pushed up.

Credits: Institute for Supply Management®, PMI®(Purchasing Manager Index), Report On Business®. For more information, visit the ISM® website at www.ismworld.org.