US Manufacturing Shows Positive Signs Heading Into Fourth Quarter

European manufacturing remains weak but India and China continue growth

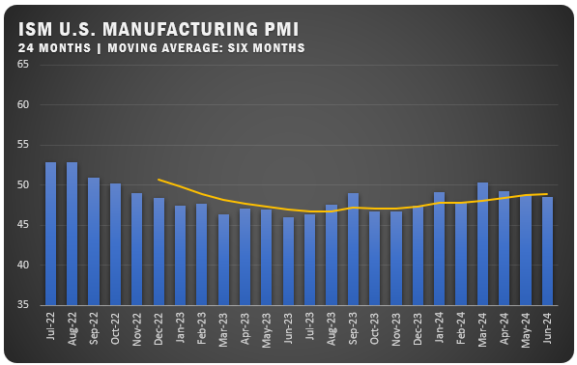

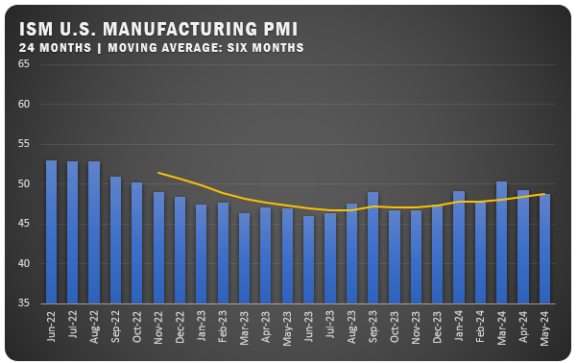

The ISM® US Manufacturing PMI® registered 49 percent in September, 1.4 percentage points higher than the 47.6 percent recorded in August. According to the report issued by Timothy R. Fiore, Chair of the ISM® Manufacturing Business Survey Committee, the overall economy expanded weakly after nine months of contraction following a 30-month period of expansion.

“The U.S. manufacturing sector continued its contraction trend but at a slower rate, recording its best performance since November 2022, when the PMI® also registered 49 percent,” says Fiore. “Companies are still managing outputs appropriately as order softness continues, but the month-over-month PMI® improvement in September is a clear positive.”

The New Orders Index remained in contraction territory at 49.2 percent, 2.4 percentage points higher than the figure of 46.8 percent recorded in August. The Production Index reading of 52.5 percent is a 2.5-percentage point increase compared to August’s figure of 50 percent. The Prices Index registered 43.8 percent, down 4.6 percentage points compared to the reading of 48.4 percent in August. The Backlog of Orders Index registered 42.4 percent, 1.7 percentage points lower than the August reading of 44.1 percent. The Employment Index registered 51.2 percent, up 2.7 percentage points from the 48.5 percent reported in August.

Fiore says, “Demand remains soft, but production execution improved compared to August as panelists’ companies prepared for the fourth quarter and the close of the fiscal year. Suppliers continue to have capacity. Seventy-one percent of manufacturing gross domestic product (GDP) contracted in September, up from 62 percent in August. More importantly, the share of sector GDP registering a composite PMI® calculation at or below 45 percent — a good barometer of overall manufacturing weakness — was 6 percent in September, compared to 15 percent in August and 25 percent in July, a clear positive.”

ISM® REPORT COMMENTS (US Manufacturers)

- “In the evolving supply chain environment, customers are increasingly taking an active role in initiating new projects, looking for cost reduction opportunities and lead-time mitigation, with a growing emphasis on collaboration. Post-pandemic, customers have learned they need partners to navigate rough waters.” Computer & Electronic Products

- “We need to coordinate very closely with suppliers in order to yield a more cost-competitive offer. More back and forth is needed to reach a reasonable total price.” Chemical Products

- “Orders and production remain steady, and we are maintaining a healthy backlog. Continued inflation and wage adjustments continue to drive prices up, although we should get some relief from the markets stabilizing.” Transportation Equipment

- “Cost increases are now generally isolated to specific commodities rather than blanket increases due to ‘inflation.’ ” Food, Beverage & Tobacco Products

- “Markets remain soft. Our customers have about-right inventory levels, but they paid more due to pandemic cost increases. Everyone is holding off on increasing inventories, hoping they can buy at lower costs.” Apparel, Leather & Allied Products

- “Overall, things continue to be very steady: Sales and revenue are as expected, and the supply environment has stabilized greatly versus 2021-22. Some things to watch include the Panama Canal (drought), U.S.-China relations, and the impact the UAW (United Auto Workers) strike could have on suppliers of ours who support automotive production. But overall conditions feel stable.” Miscellaneous Manufacturing

- “Cement negotiations have changed, with cement mills no longer offering annual or guaranteed pricing. We now want to contract more as a commodity, leaning toward quarterly, with fluctuating prices yet to be determined.” Nonmetallic Mineral Products

- “A recession feels imminent. Money continues to be pushed into the bank markets, driving inflation rates really high. Most plants are buying less material or reducing consumption in the name of sustainability, as well as running at 80 percent of capacity. Prices of some products may increase for the upcoming winter weather.” Petroleum & Coal Products

- “Business conditions and market demand remain strong. We are projected to be at capacity in the next 12 months.” Primary Metals

- “New business development is coming onboard. However, many forecasts are set for the beginning of 2024. Hiring and retaining quality people is still a struggle.” Textile Mills

US SECTOR REPORT

ISM® GROWTH SECTORS (5): Nonmetallic Mineral Products; Food, Beverage & Tobacco Products; Textile Mills; Primary Metals; and Petroleum & Coal Products.

ISM® GROWTH SECTORS (11): Printing & Related Support Activities; Furniture & Related Products; Plastics & Rubber Products; Paper Products; Fabricated Metal Products; Wood Products; Computer & Electronic Products; Machinery; Electrical Equipment, Appliances & Components; Chemical Products; and Transportation Equipment.

GLOBAL MANUFACTURING

EUROPE: For September, the HCOB Eurozone Manufacturing PMI remained steady at 43.4 percent, marking the 15th consecutive month of industry contraction. New orders dropped sharply, output declined faster, backlogs of work shrank rapidly, and employment hit a three-year low. Input costs continued to fall, and prices charged dropped for the fifth month in a row. Business confidence hit a ten-month low.

CHINA: For September, the Caixin China General Manufacturing PMI dipped to 50.6 percent from August’s 51.0 reading. The new figure marked a second consecutive month in growth territory. Output grew, while export orders decreased slightly. Employment fell as firms managed costs, and backlogs were relatively unchanged from August. Input costs rose leading to the first increase in output prices in the last seven months. Business sentiment fell to a 12-month low.

GERMANY: The HCOB Germany Manufacturing PMI for September was reported at 39.6 percent indicating a 15th straight month of manufacturing contraction. Output declined the most in nearly three-and-a-half years, driven by a sharp drop in new orders. Factors include customer uncertainty, stock reduction efforts and construction weakness. Backlogs of work fell, leading to a decline in factory employment for a third consecutive month. Input costs and output charges both decreased and expectations for future output deteriorated significantly.

INDIA: The S&P Global India Manufacturing PMI slipped to 57.5 percent in September — down 1.1 percent from the 58.6 percent reading in August. The new figure still marked a 27th consecutive month of manufacturing growth but output expansion slowed as new orders slowed. Export sales growth eased, while employment increased robustly. Backlogs fell slightly, and purchasing activity showed strength. Input cost inflation fell, reaching a three-year low, while prices moved up. Business confidence reached a new high for the year.

ITALY: The HCOB Italy Manufacturing PMI for September was reported at 46.8 percent, up from the August reading of 45.4 percent. Despite the uptick, it still represented a sixth consecutive month in contraction territory for Italian manufacturers. Output and new orders declined at a slower pace, but new export orders fell sharply. Purchasing fell but outpaced the 12-month trend. Factory employment increased slightly. Input costs decreased due to improved lead times and lower material demand, which lowered the cost of output charges. Business confidence hit a new low for 2023.

UNITED KINGDOM: The S&P Global/CIPS UK Manufacturing PMI for September was reported at 44.3 percent, up from the 39-month low of 43.0 percent from the prior month’s reading. Output continued to fall, driven by decreased demand based on cost of living concerns and overall economic uncertainty. Employment continued to decline as backlogs of work fell significantly. Input costs decreased near the August rate, but for the first time in four months selling prices rose. Business confidence continued to weaken.

Source: Institute for Supply Management®, PMI®(Purchasing Manager Index), Report On Business®. For more information, visit the ISM® website at www.ismworld.org.