German Manufacturers Lead Global Rebound

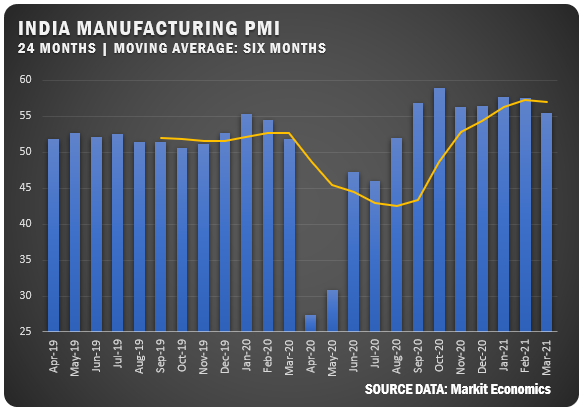

Manufacturing across the world continued to surge in March as Germany, the U.S. and the Eurozone all registered PMI numbers above 60 percent. Demand is strong across the world but China slipped 0.3 percent from February to register a 50.6 PMI reading. India also saw a sharp drop off to 55.4 percent after previously pulling back slightly in February from a January reading of 57.7 percent.

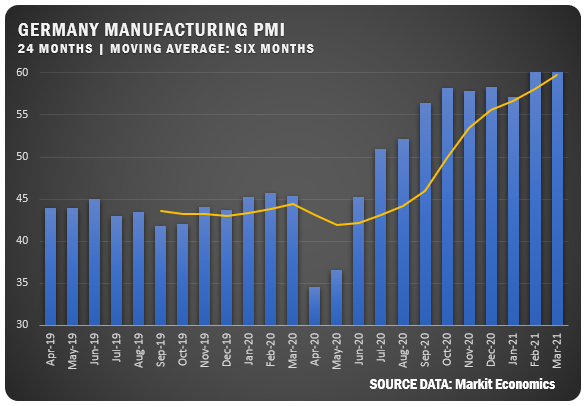

GERMANY: Germany led the pack and saw record growth in factory activity due to steep increases in new orders and output to register a 66.6 percent IHS Markit/BMI PMI for March. Both capacity demand and confidence in the business outlook led to an increase in sector employment – the first in over two years. Supply chain issues are the downside of the scenario as March saw input delivery delays that forced cost inflation to a new 10-year peak.

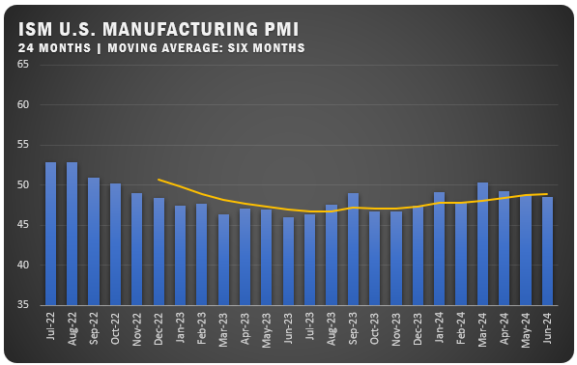

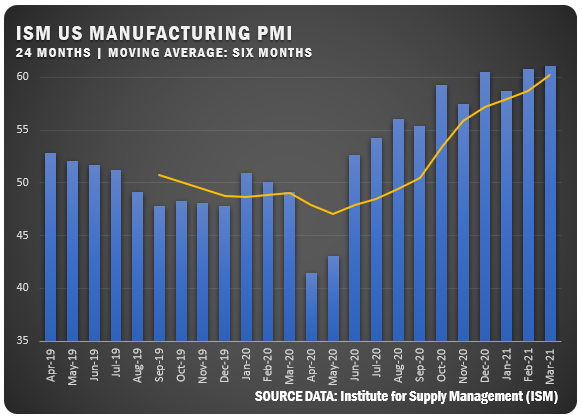

UNITED STATES: The ISM® Report On Business® for March showed a big gain with a PMI of 64.7 percent, an increase of 3.9 percentage points from the February reading of 60.8 percent. “Manufacturing performed well for the 10th straight month, with demand, consumption and inputs registering strong growth compared to February,” says Timothy R. Fiore, ISM® Manufacturing Business Survey Committee Chair. “Labor-market difficulties at panelists’ companies and their suppliers persist. End-user lead times (for refilling customers’ inventories) are extending due to very high demand and output restrictions as supply chains continue to recover from COVID-19 impacts.” (See the Full U.S. March Report)

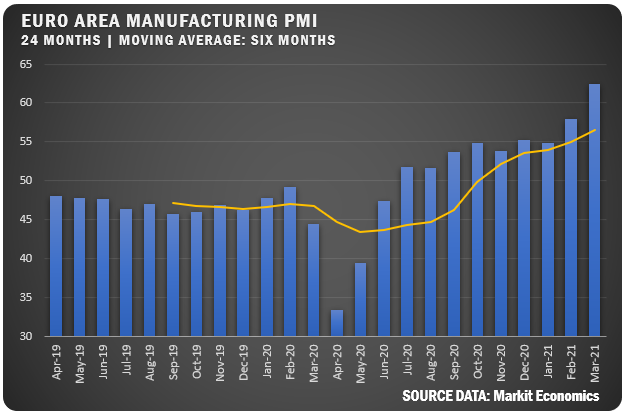

EUROZONE: IHS Markit reported a March PMI of 62.5 percent for Eurozone manufacturers. That was a big increase over February’s reading of 57.9 and IHS Markit says this indicates operating conditions were at their highest level in roughly 24 years. Export orders had their fastest increase in survey history, which pushed up output and new orders. Purchasing activity and employment in the sector also saw impressive increases.

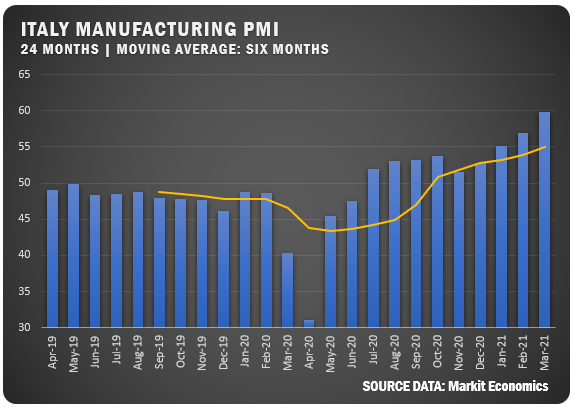

ITALY: Italian manufacturers saw strong improvement with IHS Markit reporting a 2.9 percent increase over February to register a 59.8 percent PMI mark for March. This represents the sharpest improvement in manufacturing conditions for Italy in 21 years. Output and new orders rose as client demand for products surged and helped to push up employment as companies increased staff. Following the overall trend, supplier delays pushed up costs and concerns about inflation.

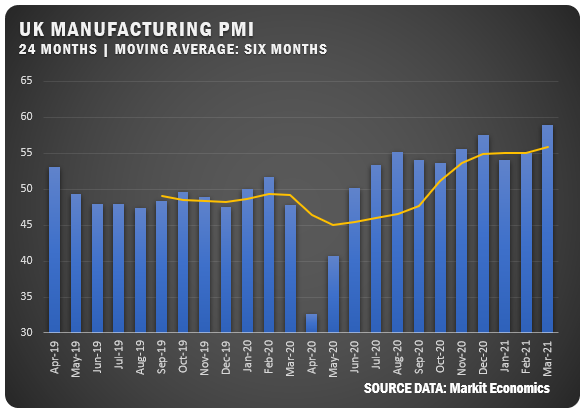

UNITED KINGDOM: The IHS Markit/CIPS UK Manufacturing PMI was reported at 58.9 percent for March 2021, which represented the best month of expansion in factory activity since February 2011. Vaccinations and a planned easing of lockdown restrictions along with stronger domestic and export demand helped drive the strong UK reading. Employment growth reached a seven-year high as backlogs rose. Business confidence is at a seven-year high.

INDIA: IHS Markit reported a solid 55.4 percent PMI for Indian manufacturers for March, but that was a drop of 2.1 percent from February and the second straight month of decline. COVID-19 restrictions and lower demand caused employment to decline for a 12th straight month. Input cost inflation was the highest in three years, but selling prices increased only moderately with companies staying conservative to keep competitive in the market. On the plus side, output and new orders expanded moderately and new export orders grew for a seventh straight month.

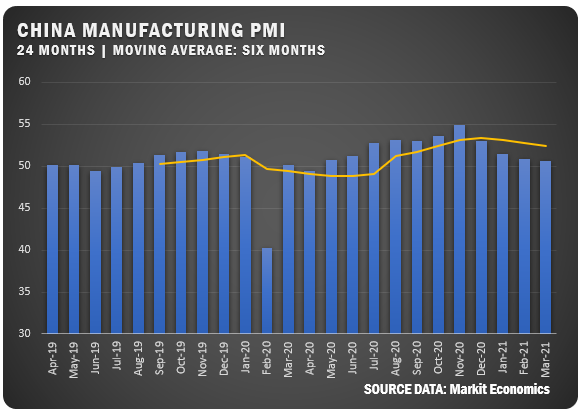

CHINA: The Caixin China General Manufacturing PMI slipped to 50.6 percent in March to hit the lowest mark since April 2020 suggesting the recovery from the COVID-19 pandemic is in jeopardy. Output and new orders improved slightly, while employment levels attempted to stabilize. Stock of purchased items is in negative territory for a third straight month and the number of purchases also plunged. Inflationary pressures intensified, with both input costs and output charges increasing. Export sales improved due to the global increase in COVID-19 vaccinations.