US Manufacturing PMI Inches Up in September but Sector Remains in Contraction

Only China and the US saw improved PMI readings in September, as manufacturing softened across the rest of the globe

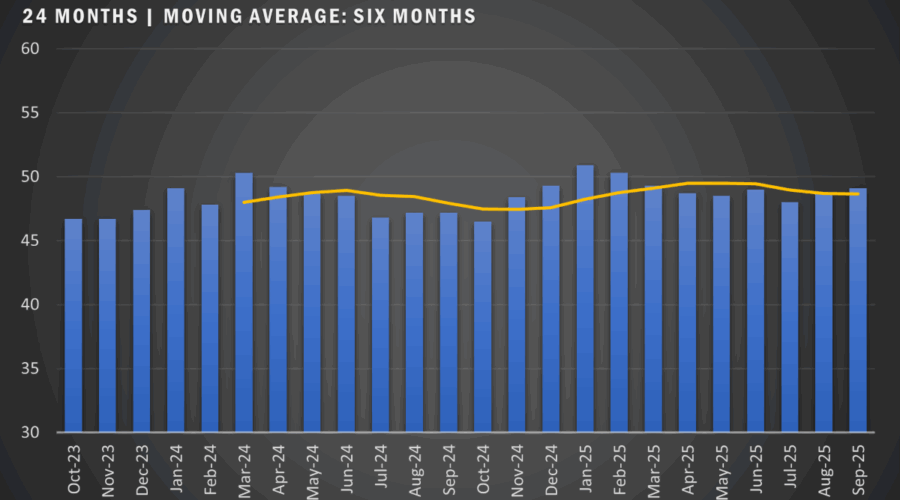

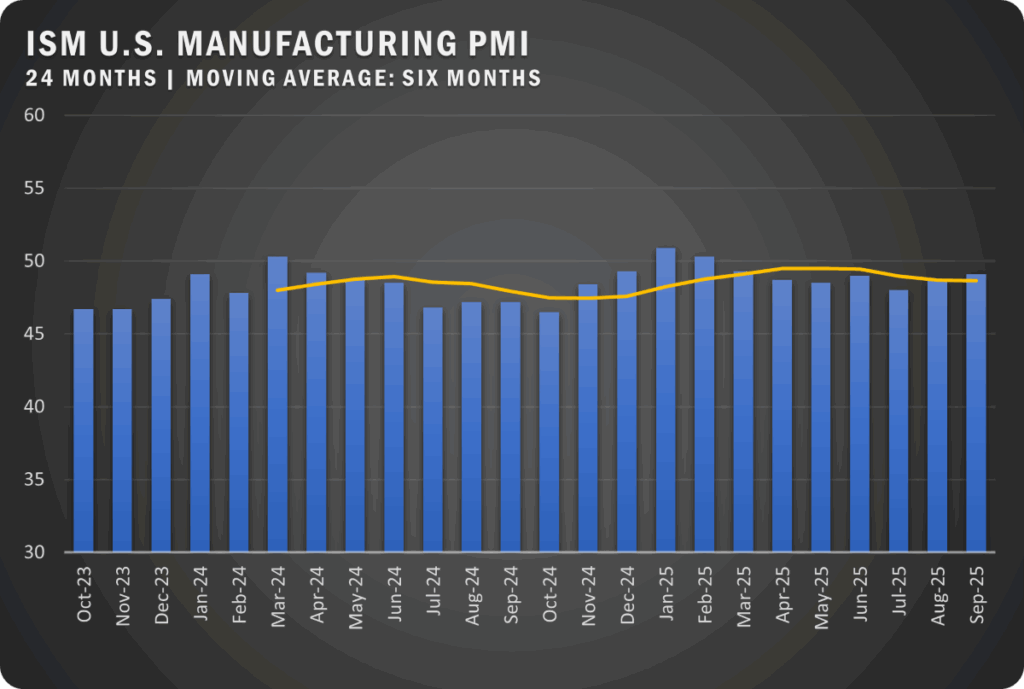

U.S. manufacturing continued to contract in September for the seventh consecutive month, according to the latest ISM Manufacturing PMI Report. Despite a slight improvement in the headline index, manufacturers remain under pressure from weak demand, rising costs and tariff-related disruptions.

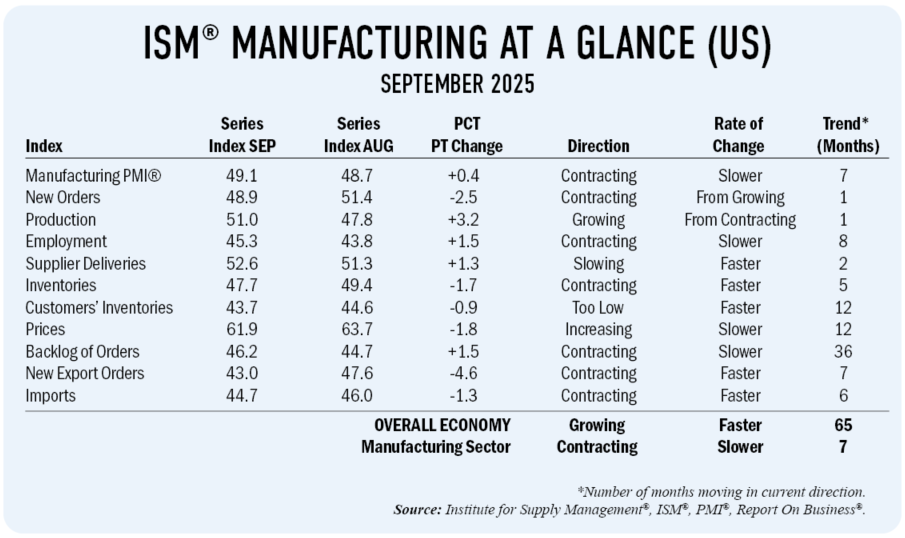

The Manufacturing PMI rose to 49.1 percent in September, up 0.4 percentage points from August’s 48.7 percent, signaling a slower pace of contraction. While the broader U.S. economy marked its 65th month of growth (excluding April 2020), the factory sector saw mixed results as new orders dropped and inventories thinned.

The New Orders Index fell back into contraction territory at 48.9 percent, down 2.5 points from August. Meanwhile, production strengthened, with the Production Index climbing to 51.0 percent, a 3.2-point improvement. The Backlog of Orders Index also gained 1.5 points to 46.2 percent, suggesting some residual momentum from prior months’ activity.

Labor market conditions improved slightly but remain weak, with the Employment Index rising to 45.3 percent. According to survey comments, most companies continue to manage staffing levels conservatively, prioritizing cost control over new hiring even as production edges higher.

On the input side, the Prices Index remained elevated at 61.9 percent, though up at a slower rate. Supplier deliveries slowed further, with the index reaching 52.6 percent, indicating lengthening lead times, while inventories declined to 47.7 percent, reflecting ongoing adjustments to match demand. Import activity continued to slide, with the Imports Index dropping to 44.7 percent.

Export performance worsened, with the New Export Orders Index falling to 43.0 percent, representing its lowest reading in several months. With weak foreign demand and uncertainty in global trade policy, firms are struggling to secure international orders.

Overall, 67 percent of the sector’s GDP was in contraction in September, a slight improvement from August. However, 28 percent of manufacturing GDP registered a PMI at or below 45 percent, up sharply from just 4 percent last month, signaling deepening weakness in key subsectors. Of the six largest manufacturing industries, only Petroleum & Coal Products expanded during the month.

COMMODITIES

Up in Price: Aluminum (22); Copper (3); Copper Products (3); Corn; Corrugate; Electrical Components (8); Electronic Components; Metal-Based Products; Steel* (8); Steel — Stainless (7); and Steel Products (7).

Down in Price: Polypropylene Resin; and Steel* (2).

In Short Supply: Electrical Components (3); Electronic Components (7); Labor; Rare Earth Magnets; and Semiconductors.

Note: The number in parentheses indicates the number of consecutive months the commodity was reported in that condition. An asterisk denotes items reported both up and down in price.

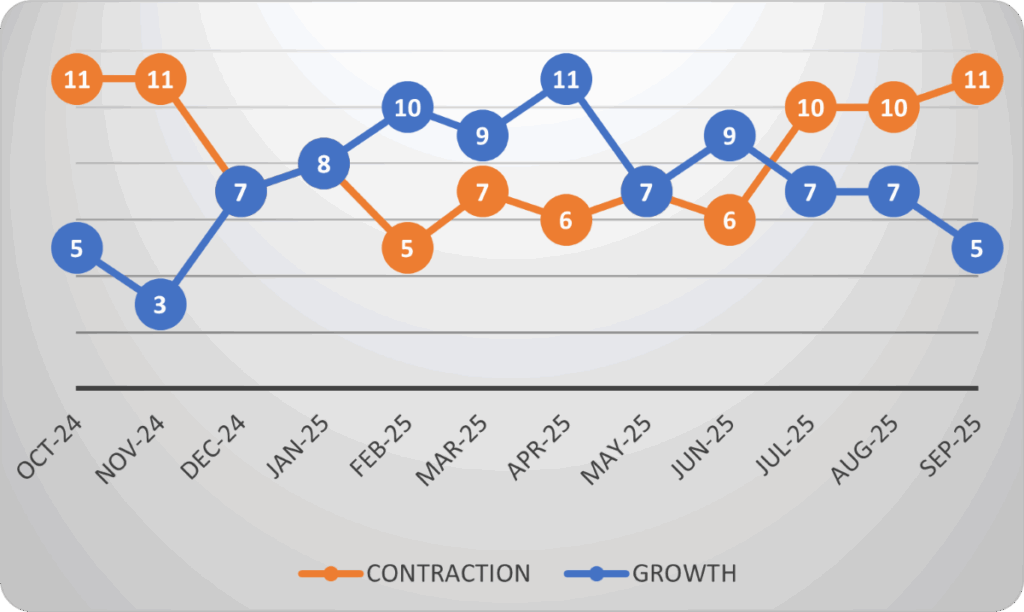

U.S. SECTOR REPORT

ISM Growth Sectors (5): Petroleum & Coal Products; Primary Metals; Textile Mills; Fabricated Metal Products; and Miscellaneous Manufacturing.

ISM Contraction Sectors (11): Wood Products; Apparel, Leather & Allied Products; Plastics & Rubber Products; Paper Products; Furniture & Related Products; Chemical Products; Electrical Equipment, Appliances & Components; Transportation Equipment; Nonmetallic Mineral Products; Machinery; and Computer & Electronic Products.

SEPTEMBER ISM REPORT COMMENTS

(US Manufacturers)

Transportation Equipment: “Business continues to be severely depressed. Profits are down, and extreme taxes (tariffs) are being shouldered by all companies in our space. We have increased price pressures both to our inputs and customer outputs as companies are starting to pass on tariffs via surcharges, raising prices up to 20 percent. The addition of the derivative steel and aluminum tariffs in the middle of the month — with no announcement — was devastating. Interest-rate lowering or the ‘One Big Beautiful Bill’ will not impact our business, as all capital projects are on hold until there is some level of certainty and customers start to place orders for new equipment again. We believe we are in a stagflation period where prices are up but orders are down due to tariff policy, and again, customers are not willing to pay the higher prices, so they are just not buying. Continuing to find ways to reduce overhead, which means letting go of experienced workers.”

Chemical Products: “The tariffs are still causing issues with imported goods into the U.S. In addition to the cost concerns, product is being held up at borders due to documentation issues. The inflation issues continue; low volumes are a constant concern. The European region is not improving as we had expected, causing further concern for long-term business viability.”

Machinery: “Ongoing macroeconomic conditions highlighted by interest-rate management and tariffs continue to impact customer purchasing decisions, resulting in subdued production rates and growing cost concerns on direct material and operations.”

Petroleum & Coal Products: “Lead times have slightly normalized, but tariffs continue to drive additional spend.”

Electrical Equipment, Appliances & Components: “Customer orders are depressed for heavy machinery because tariffs are so impactful to high-end capital equipment. Revenue expectations are flat for the rest of 2025, with no outlook to improve in 2026.”

Food, Beverage & Tobacco Products: “Current business conditions remain volatile, with geopolitical tensions, weather disruptions and shifting trade policies driving uncertainty in agricultural commodities. Oils remain sensitive to biofuel demand and global production. Inflation and evolving consumer trends add further complexity. To manage this, we are emphasizing supplier diversification, long-term contracts and formula-based pricing to balance cost stability with flexibility.”

Computer & Electronic Products: “The semiconductor industry is being impacted by high tariff prices on parts from Korea, China and Europe. Our industry is at a low point right now as we race to get new nanotechnology in the U.S.”

Plastics & Rubber Products: “Business is slowing down. Order books are softening as customers push orders out. Seems to be stemming from concerns about the direction of the U.S. economy.”

Fabricated Metal Products: “Tariffs still affecting vast amounts of increases in hardware, AI and stainless steel. MRO (maintenance, repair and operating) products have continually increased, and the slowdown in agriculture has had stark impacts on bottom lines for raw materials.”

Miscellaneous Manufacturing: “Steel tariffs are killing us.”

Global PMI Notes

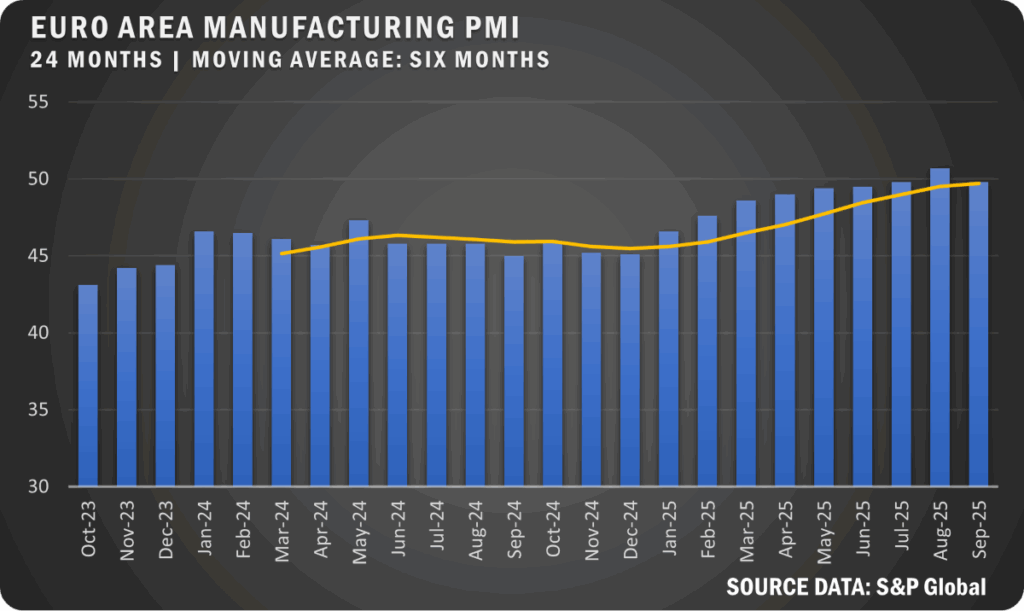

EUROZONE: Eurozone factory activity slipped back into contraction in September, with the PMI easing to 49.8 percent after briefly crossing the growth line in August. Sluggish export sales led to a decline in new orders, prompting job cuts, even as firms raised output slightly and faced falling input costs.

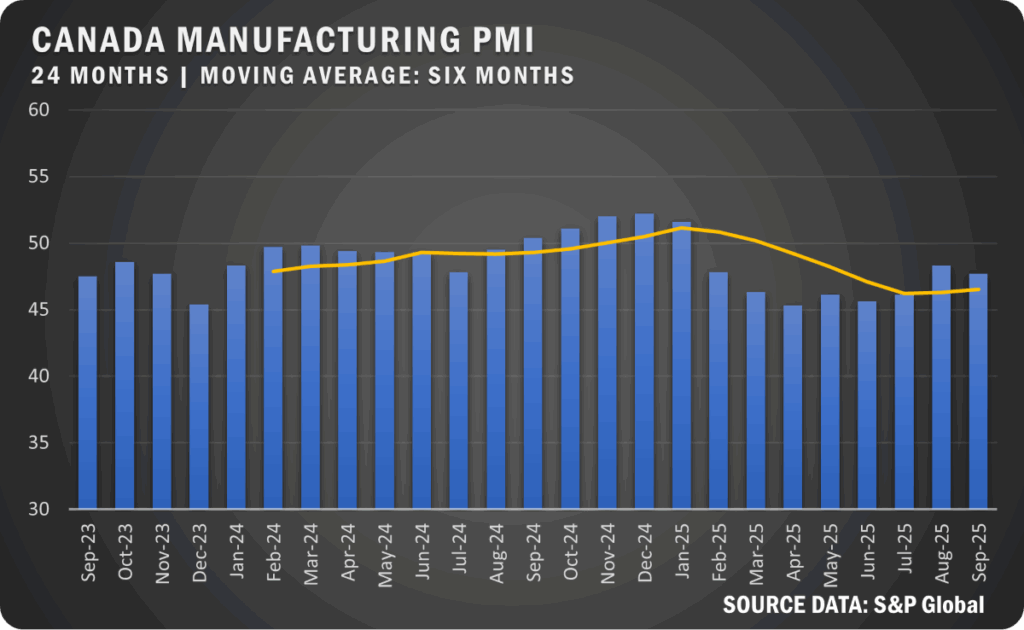

CANADA: Canada’s manufacturing sector contracted for the eighth straight month in September, with the PMI declining to 47.7 percent as U.S. tariffs continued to dampen demand. Job losses persisted but slowed in pace. Cost inflation remained elevated, and selling prices saw their weakest rise in nearly a year.

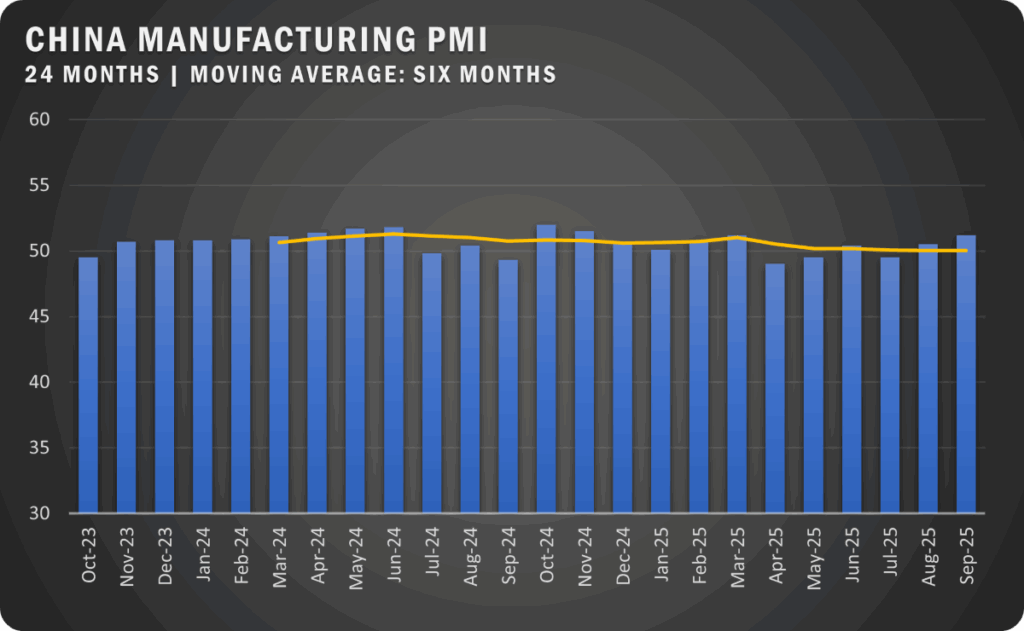

CHINA: China’s manufacturing activity strengthened in September, as the PMI climbed to 51.2 percent to reach its highest mark since March on the back of improved output and a rebound in export orders. Purchasing activity surged, although firms continued to shed jobs, and input costs rose sharply while competitive pressures kept output prices in check.

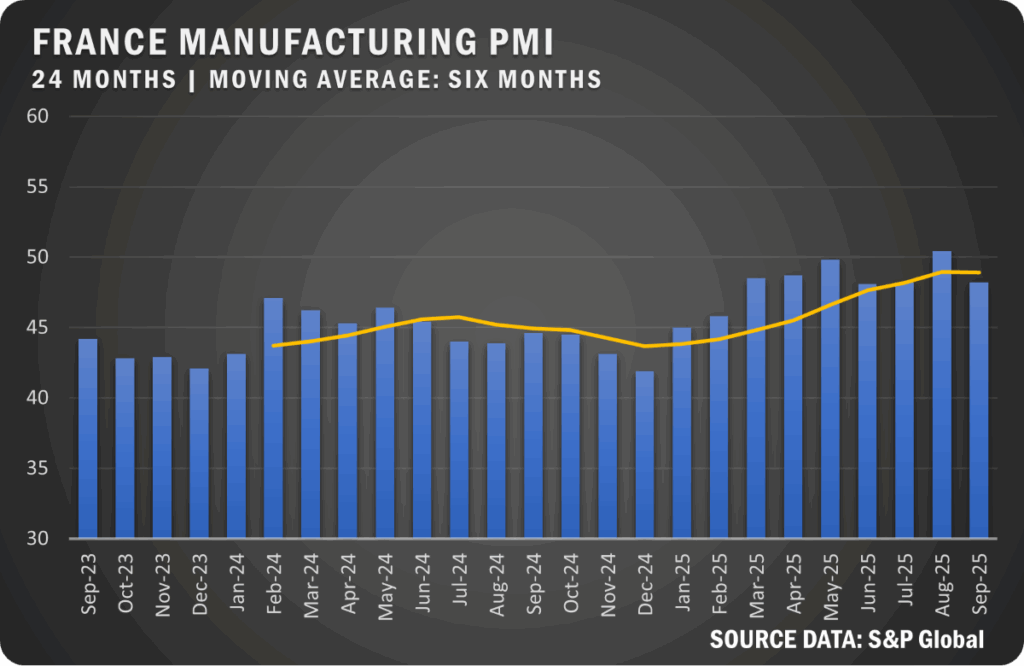

FRANCE: French manufacturing faltered in September, with the PMI dropping to 48.2 percent amid a sharp slowdown in new orders and export sales. Political instability and rising costs weighed on business confidence, prompting firms to reduce inventories and cut back on purchasing despite modest job growth.

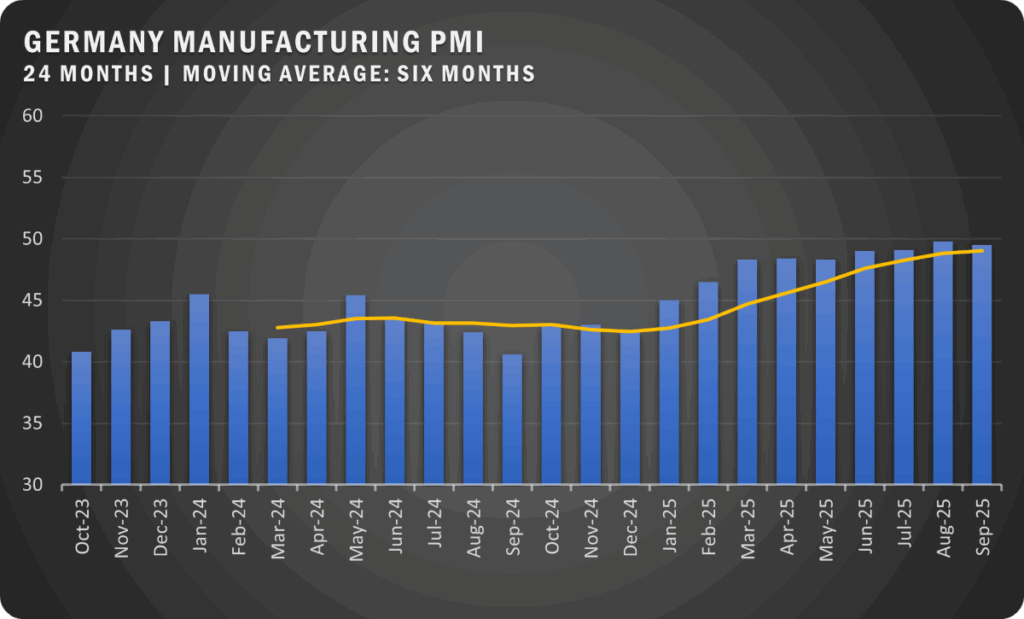

GERMANY: Germany’s PMI edged down to 49.5 percent in September, signaling flat conditions even as production posted its strongest rise in over three years. However, new order inflows declined, employment weakened and business expectations slipped to a nine-month low due to mounting uncertainty and international competition.

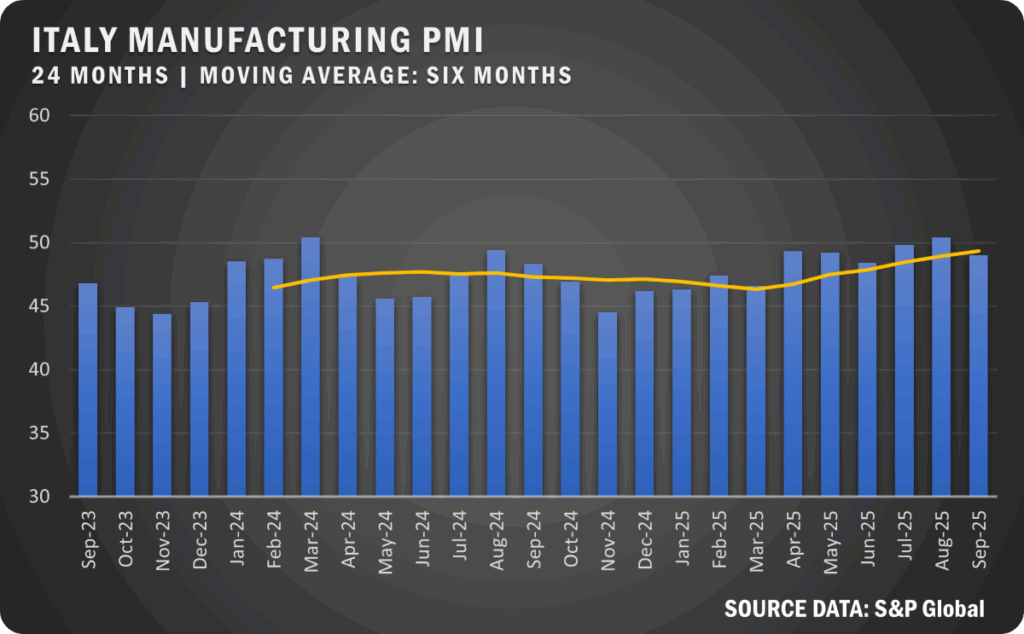

ITALY: Italy’s manufacturing sector contracted more sharply in September, with the PMI falling to 49.0 percent as output and orders declined amid global economic unease. Despite rising cost pressures, employment rebounded modestly, and business sentiment improved on hopes of future expansion and new product launches.

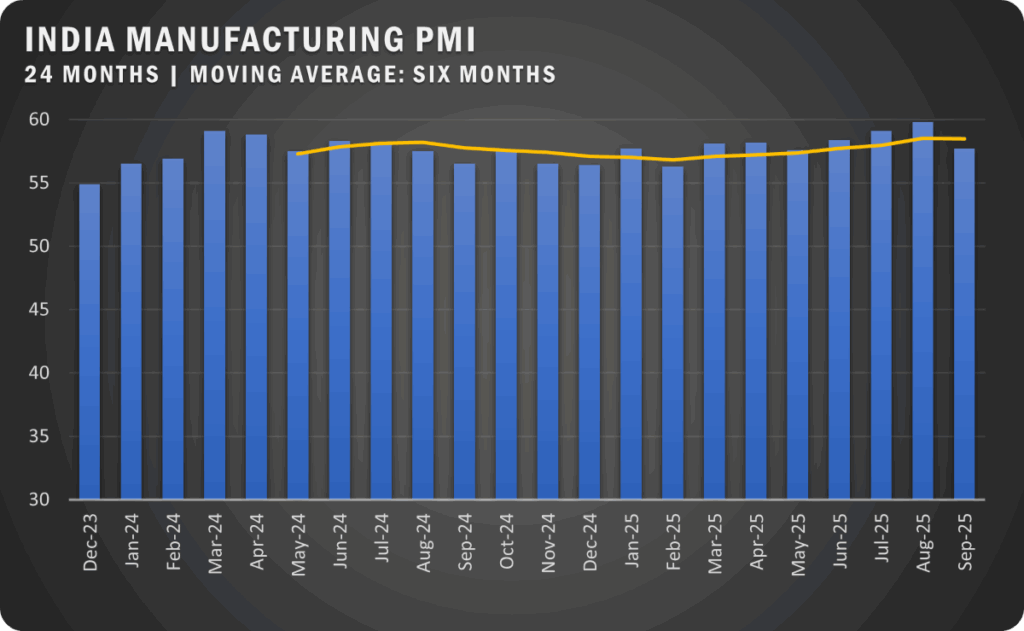

INDIA: India’s factory growth remained solid in September, with the PMI at 57.7 percent, down from August’s multi-year high but still well above trend. Demand stayed strong, yet hiring slowed and cost pressures intensified, pushing selling prices to their fastest rise in nearly 12 years.

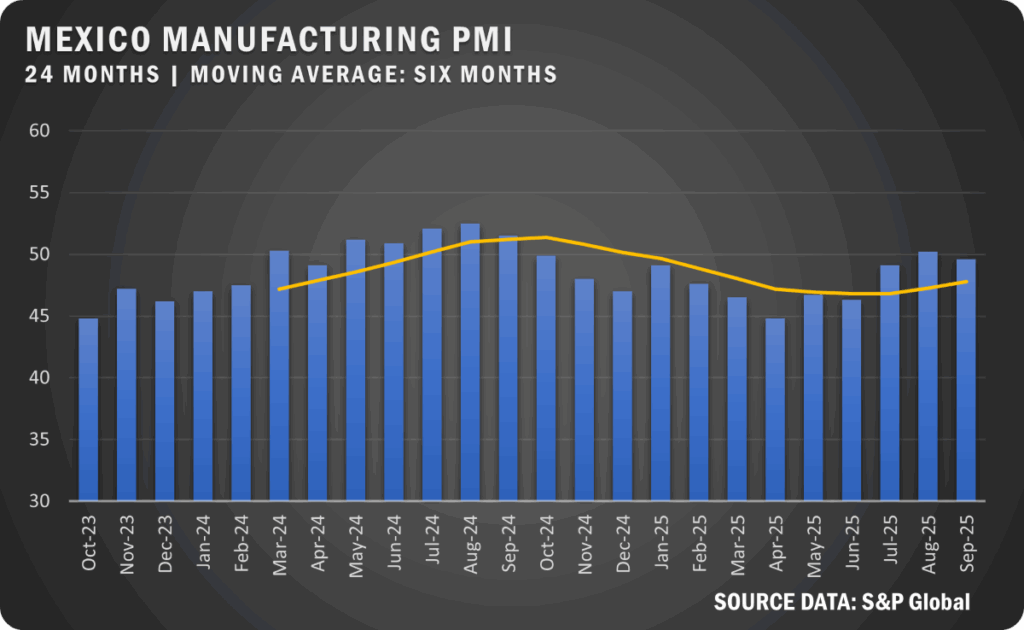

MEXICO: Mexico’s manufacturing PMI slipped to 49.6 percent in September, signaling a slight downturn even as new orders continued to improve. Purchasing activity rose for the first time in 2025, but producers struggled with rising input costs, output losses and another round of job cuts.

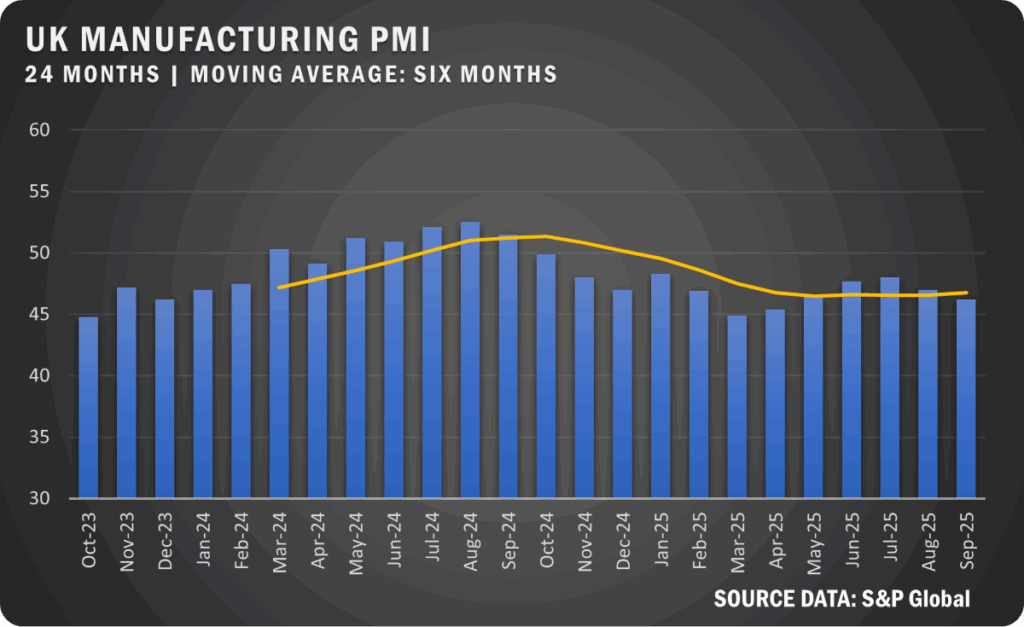

UNITED KINGDOM: UK manufacturing weakened further in September, with the PMI dropping to 46.2 percent to reach a five-month low as prolonged contraction extended to a full year. Output and export orders fell sharply amid supply chain snags and tariff fears, while firms reduced staffing and input buying to manage cost pressures.

Sources: S&P Global, Trading Economics and Institute for Supply Management, PMI (Purchasing Manager Index), Report On Business.

For more information, visit the ISM® website at www.ismworld.org.