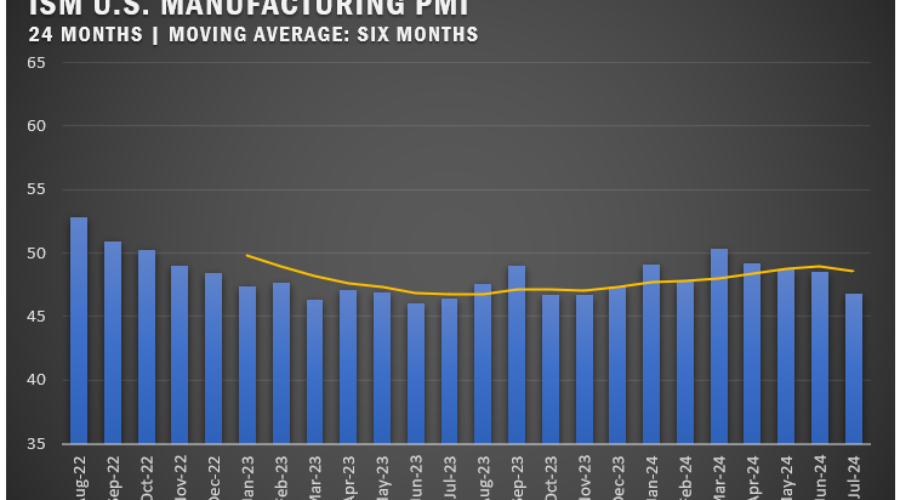

US PMI Falls to 46.8 Percent in July

Other Countries Follow the Trend, But the UK and India Continue to Soar

The ISM U.S. Manufacturing PMI® dropped to 46.8 percent in July as U.S. manufacturing saw a fourth straight month of decline and well below the June figure of 48.5 percent.

“Demand remains subdued, as companies show an unwillingness to invest in capital and inventory due to current federal monetary policy and other conditions,” says Timothy R. Fiore, Chair of the ISM® Manufacturing Business Survey Committee. “Production execution was down compared to June, likely adding to revenue declines, putting additional pressure on profitability. Suppliers continue to have capacity, with lead times improving and shortages not as severe.”

According to the report from ISM, U.S. manufacturing activity entered deeper into contraction. Demand was weak again, output declined and inputs stayed generally accommodative. Other key highlights from the report included:

- The New Orders Index dropped further into contraction and the New Export Orders Index also continued in contraction territory.

- The Backlog of Orders Index remained in strong contraction territory

- The Customers’ Inventories Index moved lower to the higher end of ‘too low’.

- Output declined compared to June, with a combined 8.5-percentage point downward impact on the Manufacturing PMI® calculation.

- U.S. manufacturing firms reduced production levels month over month as head-count reductions continued in July.

- Inputs — defined as supplier deliveries, inventories, prices and imports — generally continued to accommodate future demand growth.

US SECTOR REPORT

ISM® GROWTH SECTORS (5): Printing and Related Support Activities; Petroleum and Coal Products; Miscellaneous Manufacturing; Furniture and Related Products; and Nonmetallic Mineral Products.

ISM® CONTRACTION SECTORS (11): Primary Metals; Plastics and Rubber Products; Machinery; Electrical Equipment, Appliances and Components; Transportation Equipment; Fabricated Metal Products; Food, Beverage and Tobacco Products; Wood Products; Paper Products; Chemical Products; and Computer and Electronic Products.

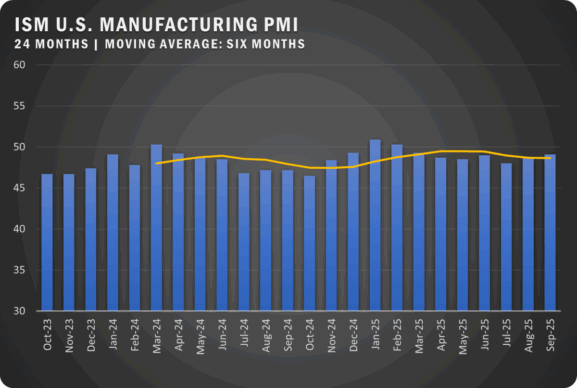

GLOBAL MANUFACTURING

EUROZONE: The HCOB Eurozone Manufacturing PMI held steady at 45.8 percent in July, indicating a continued contraction with 14 consecutive months of declining new orders. Despite a slight upward revision, the sector remains sluggish, with firms cutting jobs and reducing purchasing due to weak demand and rising input costs.

CANADA: Canada’s S&P Global Manufacturing PMI dropped to 47.8 percent in July, marking the biggest decline since December 2023 as market uncertainties and supply chain delays weighed heavily on output and new orders. Employment growth was marginal. Firms faced solid but below-trend input price inflation, leading to modest price increases.

CHINA: China’s Caixin Manufacturing PMI fell to 49.8 percent in July, marking the first decline in factory activity since October 2023, driven by shrinking new orders and lower demand. Despite steady employment numbers, output grew at its slowest pace in nine months. Input cost inflation eased, and selling prices declined due to increased competition.

FRANCE: France’s HCOB Manufacturing PMI dropped to 44.0 percent in July, its sharpest contraction since January, driven by a significant decline in new orders and output. Firms faced rising input costs which resulted in output price increases, with business confidence weakening for the second consecutive month.

GERMANY: Germany’s HCOB Manufacturing PMI registered 43.2 percent in July, signaling a continuing decline in the sector, with accelerated drops in output, new orders, and employment. Input costs stabilized, though firms remain pessimistic about near-term growth prospects.

INDIA: India’s HSBC Manufacturing PMI edged down to 58.1 percent in July, still showing robust demand and strong production volumes. Despite slowing growth, manufacturers continued to hire to increase employment. Rising input costs led to the biggest increase in output prices in 11 years. The business outlook remained optimistic.

ITALY: Italy’s HCOB Manufacturing PMI rose to 47.4 percent in July, suggesting an easing downturn as output and new orders declined at a more modest pace. Firms faced higher input costs but continued to reduce selling prices. Business outlook was positive but dipped to its lowest level this year.

UNITED KINGDOM: The UK’s S&P Global Manufacturing PMI was revised to 52.1 percent for July, marking the strongest expansion in two years, driven by strong production growth and signs of stability in the export market. Rising input costs led to higher output prices. Employment levels increased for the first time since September 2022.

Source: Institute for Supply Management®, PMI® (Purchasing Managers’ Index), Report On Business®. For more information, visit the ISM® website at www.ismworld.org.