U.S. Manufacturing Rebounds as Global Industry Sends Mixed Signals

Improving orders support U.S. output, though tariffs and regional divergence shape 2026 planning

U.S. manufacturing activity returned to expansion in January for the first time in a year, offering a tentative sign of stabilization after a prolonged downturn. The improvement comes as global manufacturing remains uneven, with selective pockets of growth offset by lingering demand weakness, cost pressures, and trade uncertainty across major economies.

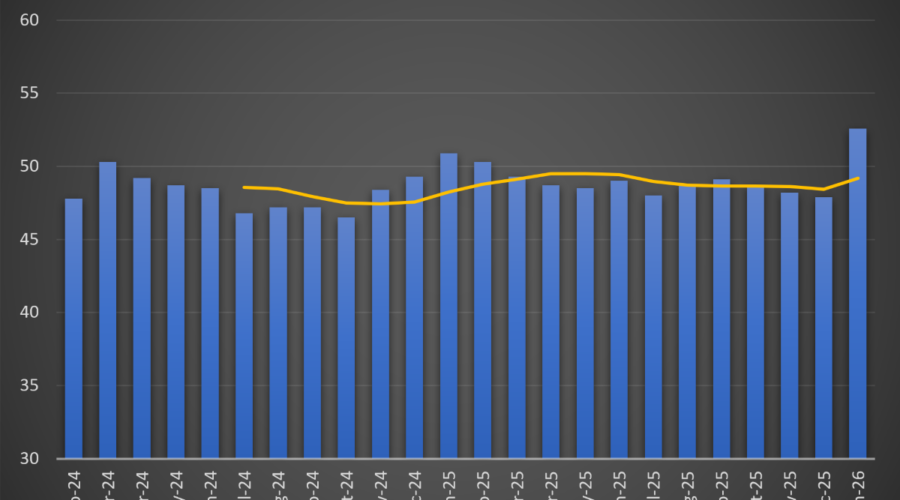

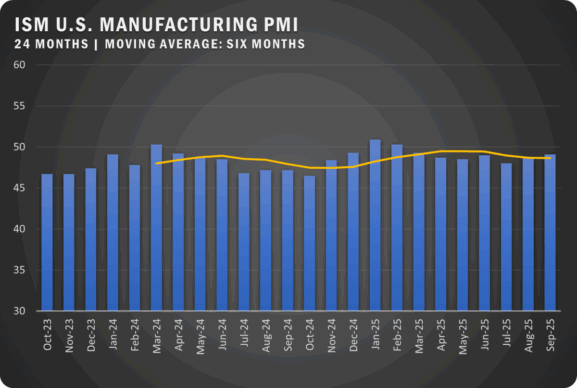

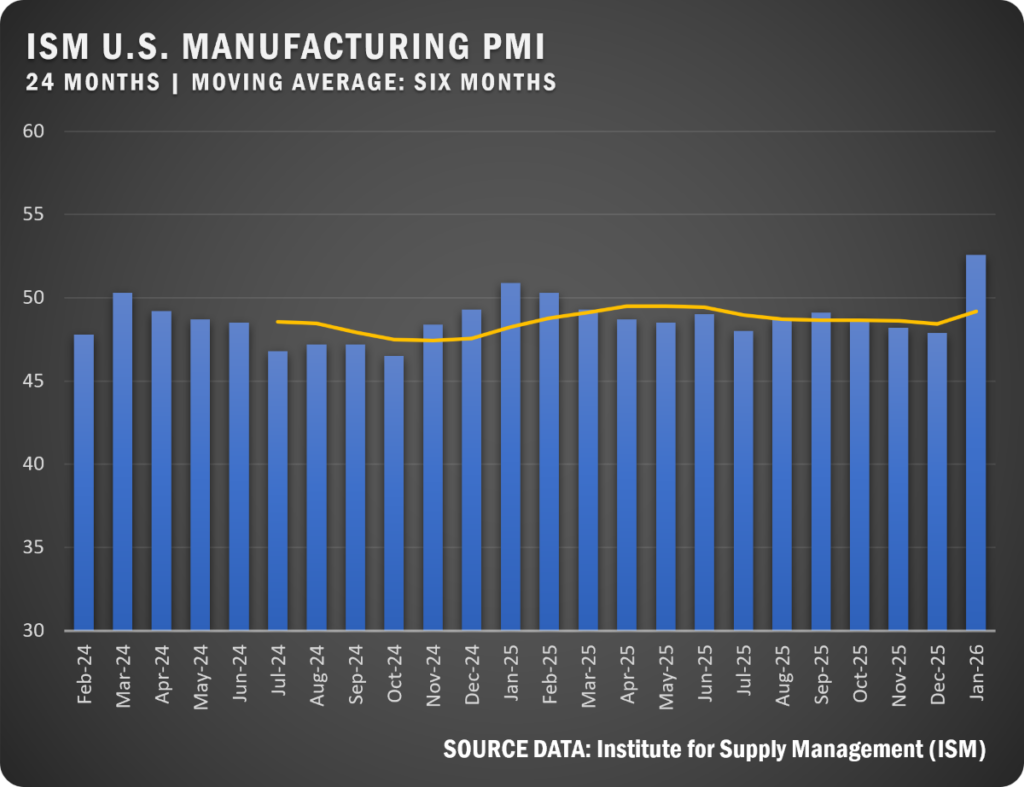

The ISM Manufacturing PMI rose to 52.6 percent in January, a sharp rebound from December’s contractionary reading and the strongest signal of momentum since early 2022. Gains were broad-based across the core components of the index, with new orders, production, supplier deliveries, employment, and inventories all improving month over month—though labor and inventories remain below expansion thresholds.

Demand Shows Early Strength, but Not Without Caveats

The most notable shift came from demand indicators. New orders jumped to their highest level in nearly three years, and order backlogs moved back into expansion, suggesting customers are beginning to replenish after extended destocking cycles. Customer inventories fell further into “too low” territory, historically a setup for increased production in subsequent months.

However, survey feedback indicates some of this demand reflects seasonal reordering and preemptive buying, as manufacturers seek to get ahead of expected price increases tied to tariffs and input inflation. For brush manufacturers, this distinction matters: near-term volume may improve, but visibility beyond the first half of the year remains limited.

Production activity strengthened for a third consecutive month, reinforcing the idea that factories are responding to improved order flow. Yet employment growth lagged, underscoring a cautious approach to capacity expansion. Nearly two-thirds of manufacturers reported managing headcounts rather than hiring, reflecting continued uncertainty around policy, trade, and cost structures.

Costs and Supply Chains Remain a Pressure Point

Pricing pressures intensified in January, with the Prices Index remaining firmly in expansion. Supplier delivery times slowed further, a typical pattern during demand recoveries but also a reminder that supply chains remain sensitive to shifts in volume and sourcing strategies.

Input dynamics were mixed. Imports rebounded sharply, while inventories stayed in contraction, suggesting manufacturers are prioritizing flexibility over stock accumulation. For globally sourced brush components—particularly metals, filaments, and specialty materials—this points to ongoing volatility rather than a return to pre-pandemic supply norms.

Global Manufacturing: Stabilization, Not Synchronization

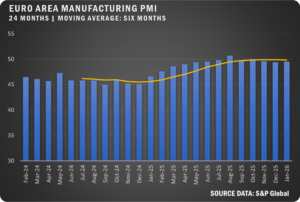

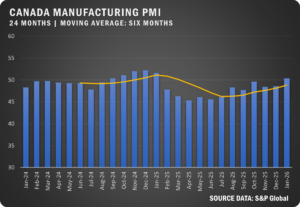

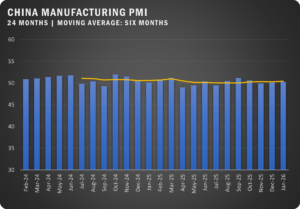

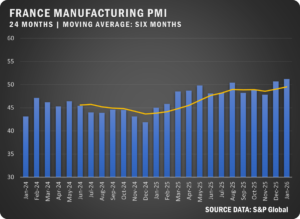

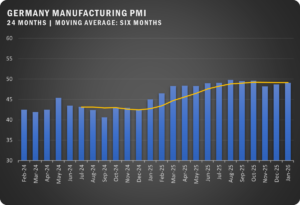

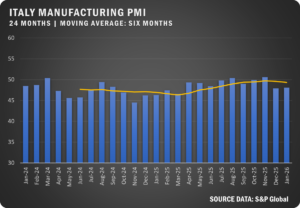

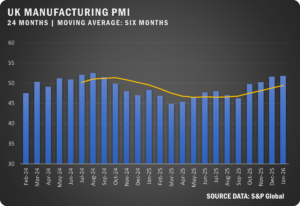

Globally, the January data paints a picture of stabilization without broad acceleration. Canada and the UK moved back into expansion, while China posted modest growth supported by exports and domestic demand. France showed its strongest manufacturing performance in years, while Germany and Italy remained in contraction despite incremental improvement.

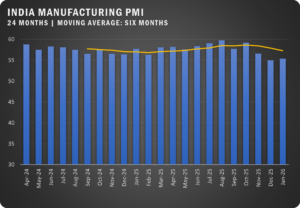

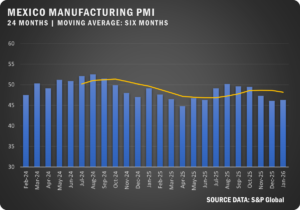

In contrast, Mexico continued to struggle with falling orders and tariff-driven cost pressures, and broader eurozone manufacturing remained subdued even as business confidence improved. India stood out for sustained growth, though business optimism weakened sharply as firms grew cautious about the year ahead.

The divergence matters for export-oriented brush manufacturers. Markets are reopening unevenly, and regional performance will increasingly shape where growth opportunities—and risks—are concentrated.

What This Means for Brush Manufacturers

Taken together, the data suggest the manufacturing downturn may be easing, but the recovery is fragile and uneven. U.S. demand is improving, global trade flows are showing early signs of normalization, and inventories across the system remain lean—factors that support cautious optimism.

At the same time, persistent tariff uncertainty, rising input costs, and restrained capital investment point to a recovery driven more by operational discipline than expansionary bets. For brush manufacturers, the message is clear: flexibility in sourcing, disciplined inventory management, and regional market awareness will be more critical than chasing volume alone.

January’s rebound is meaningful—but leadership decisions in 2026 will hinge on whether demand growth proves durable once the effects of restocking and tariff hedging fade.

GLOBAL PMI NOTES

EUROZONE: Eurozone manufacturing showed marginal improvement in January, with PMI edging higher but remaining in contraction as new orders declined for a third month. Firms continued aggressive cost controls, while rising input inflation and improving business confidence highlighted the tension between near-term weakness and longer-term optimism.

CANADA: Canada’s manufacturing sector returned to expansion as PMI crossed above 50, ending an eleven-month downturn. Output stabilized, staffing levels improved slightly, and price pressures intensified as firms raised selling prices amid higher input costs.

CHINA: China’s manufacturing activity expanded modestly in January, supported by higher domestic and export orders and a gradual pickup in production. Cost pressures increased due to higher metal prices, while business confidence weakened amid growth and margin concerns.

FRANCE: France posted its strongest manufacturing performance since mid-2022, driven by faster production growth and rising backlogs. However, demand remained fragile, input costs increased, and competitive pressures limited pricing power despite improving sentiment.

GERMANY: Germany’s manufacturing PMI improved to a three-month high as output and new orders returned to growth. Workforce reductions and inventory drawdowns continued, while rising input costs and competitive pricing pressures constrained margins.

INDIA: India’s manufacturing sector maintained solid growth, supported by strong domestic demand and expanding output. Despite moderate inflation and ongoing hiring, business confidence fell sharply as firms expressed caution about the year-ahead outlook.

ITALY: Italy’s manufacturing contraction eased slightly, with softer declines in orders and production and improving business confidence. Rising raw material costs pushed prices higher, while employment edged up cautiously despite weak demand.

MEXICO: Mexico’s manufacturing sector remained under pressure as demand and output fell sharply, driven by weak U.S. orders and tariff-related cost increases. Business sentiment turned negative as firms faced persistent inflation, contracting exports, and ongoing job cuts.

UNITED KINGDOM: UK manufacturing accelerated into expansion, posting its fastest growth since mid-2024 as new orders surged and export demand strengthened. Rising input costs filtered through to selling prices, while confidence improved to its highest level in more than a year.

Source: Institute for Supply Management®, PMI® (Purchasing Manager Index), Report On Business®. For more information, visit the ISM® website at www.ismworld.org.