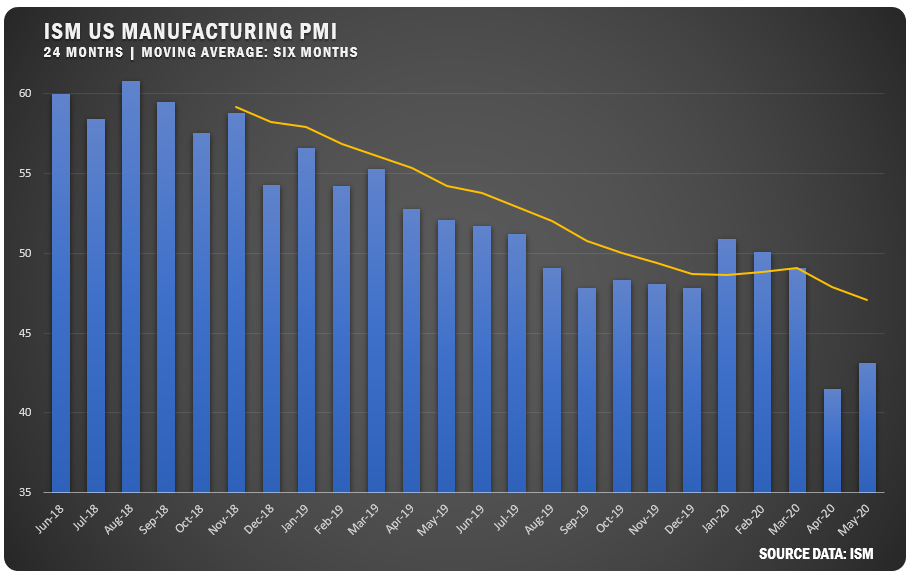

China and Italy Showcase the May PMI Numbers

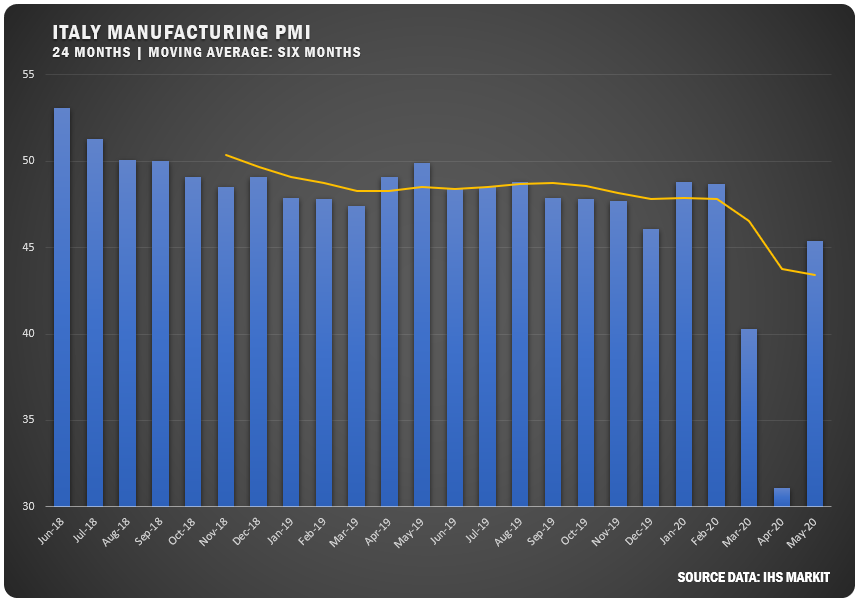

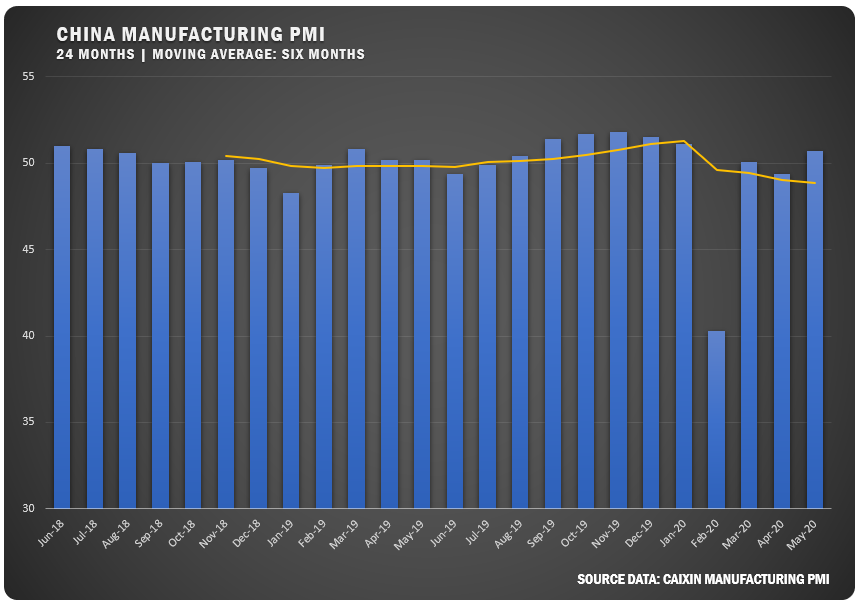

While the Institute for Supply Management® reported a slight uptick to a 43.1 percent PMI for US manufacturers in May, Italy saw a strong rebound from an all-time low of 31.1 in April to 45.4 in May, which pushed the country above their six-month PMI moving average. In addition, China’s manufacturing index bumped up to growth territory with a Caixin Manufacturing index of 50.7 percent in May after showing a slight dip in April.

Starting with the US, the report from ISM says the upward movement for the PMI indicates expansion in the overall economy after the severe contraction in April (which ended 113 consecutive months of growth).

“The coronavirus pandemic impacted all manufacturing sectors for the third straight month. May appears to be a transition month, as many panelists and their suppliers returned to work late in the month. However, demand remains uncertain, likely impacting inventories, customer inventories, employment, imports and backlog of orders. Among the six biggest industry sectors, Food, Beverage & Tobacco Products remains the only industry in expansion. Transportation Equipment; Petroleum & Coal Products; and Fabricated Metal Products continue to contract at strong levels,” says Timothy R. Fiore, Chair for the ISM® Manufacturing Business Survey Committee.

Of the 18 manufacturing industries, six reported growth in May — Nonmetallic Mineral Products; Furniture and Related Products; Apparel, Leather and Allied Products; Food, Beverage and Tobacco Products; Paper Products; and Wood Products.

The 11 industries reporting contraction for April — Printing and Related Support Activities; Primary Metals; Transportation Equipment; Petroleum and Coal Products; Fabricated Metal Products; Machinery; Miscellaneous Manufacturing; Electrical Equipment, Appliances and Components; Chemical Products; Computer and Electronic Products; and Plastics & Rubber Products.

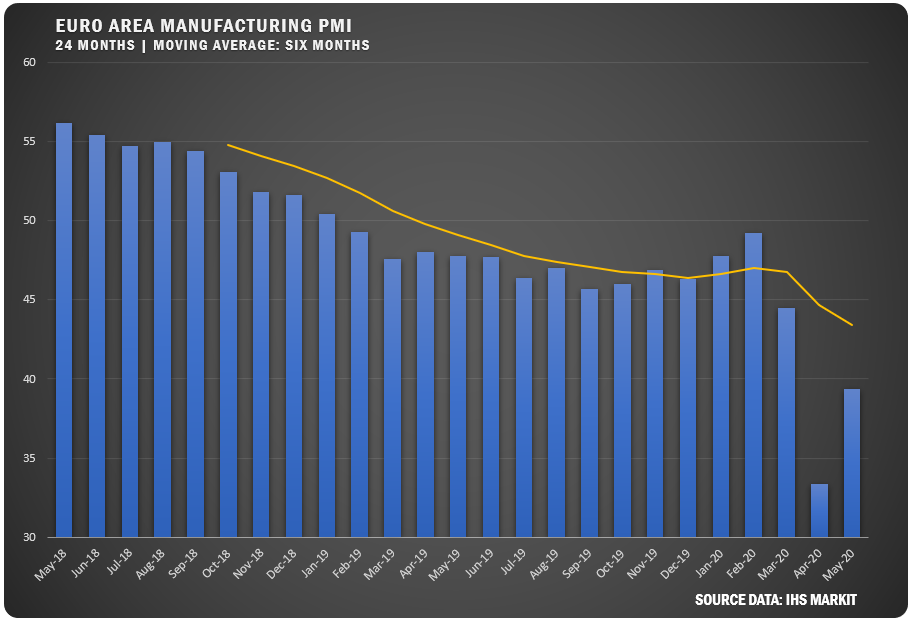

EUROPEAN PMI

Looking at Europe overall, the new figure of 39.4 percent reported by IHS Markit was up significantly from the April low of 33.4, but the current number still represents a major contraction for European manufacturing. Government restrictions related to COVID-19 were still impacting the sector in May, but confidence in the year ahead reached a three-month high.

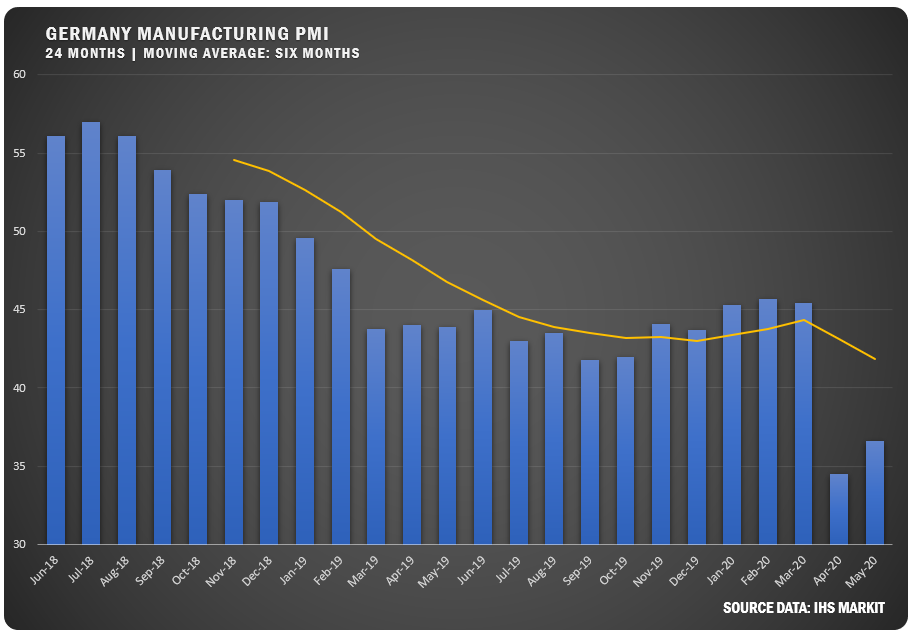

Germany’s May PMI moved up to 36.6 percent, but that was only 2.1 percent up from a low of 34.5 in April. Outputs and new orders continued to decline even after the record drop for both in April and the rated of job losses accelerated.

Italy remains in contraction territory from a manufacturing standpoint, but the 14.3 percent improvement from April was well above the expectation of 37.1.

CHINA EXCEEDS EXPECTATIONS

China moved into growth territory again with a Caixin Manufacturing PMI of 50.7, which represents the highest point since January. The report from Caixin says May data signalled a further increase in output following February’s record decline, with firms widely mentioning the resumption of work due to an easing of COVID-19 related measures.

ISM® PANEL COMMENTS

“Current conditions in the automotive, construction, oil and gas, agriculture equipment and tube/pipe markets are all adversely impacting our business results.” (Chemical Products)

“We see an issue with suppliers that are affecting production. At the same time, social distancing measures in [the] manufacturing plant and customer demand are impacting the rate of production.” (Transportation Equipment)

“Increased COVID-19 sales in the food business has really stressed our production capabilities.” (Food, Beverage and Tobacco Products)

“Fuel sales demand are beginning to rebound in May as stay-at-home orders are lifted across the country.” (Petroleum and Coal Products)

“Returning to full production for automotive, ramp-up will still depend on speed of automotive start-ups. We have built up inventory to stock. Ready to ship.” (Fabricated Metal Products)

“Business activity remains strong for consumable applications and very weak in durable segments.” (Plastics and Rubber Products)

“We have been fortunate that most of our customer base is considered to be a part of the critical workforce, so we have been running at around 80 percent of our normal production volume.” (Primary Metals)

“Getting out from under several suppliers being closed worldwide. Also, looking at what really needs to be in China.” (Machinery)