DBRS Morningstar: Coronavirus Impact For Italy

DBRS Morningstar is reporting than 300 cases of Coronavirus (COVID-19) identified by Italian authorities over the course of a few days in Northern Italy. At this juncture, Italy appears to have the highest number of cases outside of Asia. This has led the Italian authorities to implement extraordinary measures in several regions of the North to limit the contagion. Schools, sporting events, public gatherings and most public services and offices are suspended for a week and some small cities have been put in quarantine. Private businesses have been affected as well, with a number of institutions encouraging employees to work from home.

Given the negative Italian GDP growth carryover from Q4 2019, the global slowdown, the measures imposed, and on the assumption that public fears regarding the virus are unlikely to subside quickly thereby negatively affecting consumption, Italy could very well experience a technical recession (two consecutive quarters of negative growth). If limited to a temporary demand shock in line with DBRS Morningstar’s baseline assumption of the virus having a modest one to two quarter impact, this is unlikely to have lasting implications for Italy’s economy or for its DBRS Morningstar credit rating (BBB (high), Stable trend). However, risks to growth are tilted to the downside. The unpredictable nature of global transmission patterns appears to suggest at least some risk of a deeper and longer-lasting demand shock. For Italy, a prolonged and severe economic recession leading to a materially higher trend for the public debt-to-GDP ratio could negatively impact the sovereign rating.

The Coronavirus Increases Italian Recession Risk

The already adverse impact of weaker foreign demand is now accompanied with the risk of prolonged and widespread stop-pages in Italian economic activity. The country is highly exposed to the external environment due to its high integration in European manufacturing value chains and now will likely face lower tourism and economic activity. As the number of new cases rises, the Italian authorities face the difficult task of taking appropriate measures to reduce transmission while avoiding stoking any potentially excessive public fears that further dampens growth.

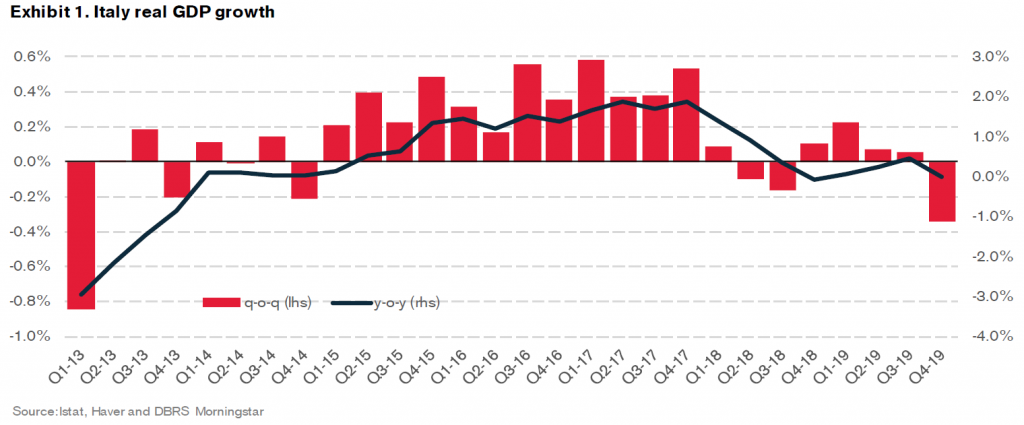

Italy’s GDP growth was the weakest in Europe in 2019 and recent data continue to point to a prolonged poor performance (see Exhibit 1). According to flash estimates by the Italian statistical office, real GDP contracted by 0.3% quarter-on-quarter in Q4 2019, the worst performance since Q1 2013. A negative carryover of 0.2% does not bode well for growth this year if exports, tourism and economic activity are also to materially suffer from the impact of the virus. This will likely depend also on the magnitude of the Italian government’s response to minimize the contagion. Against this background, although it is too early to estimate the full impact, DBRS Morningstar views the government projection included in the 2020 Draft Budgetary Plan of a GDP growth rate of 0.6% year-on-year in 2020 as very ambitious. According to the Bank of Italy governor, the impact of the virus on Italy might go beyond 0.2% of GDP.

The country is the second most important manufacturing economy in terms of value added in Europe and its performance is highly dependent on foreign demand. In 2019 Italy is estimated to have registered the ninth-largest current account surplus in the world in absolute value with total goods exports of EUR 475 billion, equivalent to around 27% of GDP. At the same time, the direct impact of tourism is another important factor as it accounts for around 5% of GDP.

The North of the Country is the Engine of Italian Growth

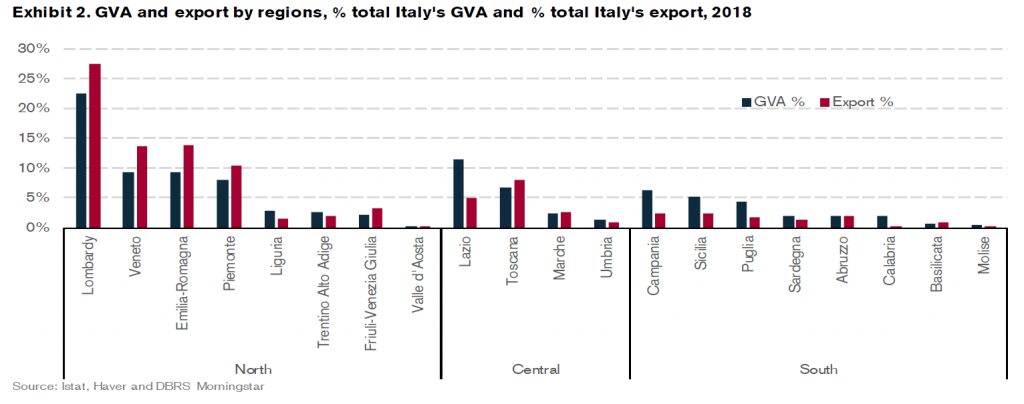

Among the Northern regions of Italy, Lombardy and Veneto have registered the highest number of new cases, and given that they represent Italy’s engine of growth, an extension of restrictive measures might have an outsized economic impact. They cumulatively account for more than 30% of the country’s gross value added and are leaders in the export of manufacturing goods, and account for more than 40% of Italy’s total exports (see Exhibit 2). Together they account for around 28% of total employment in the country.

It is likely that the number of infected people will continue to rise. Increasing public anxiety could add further pressure on policymakers to implement additional measures. The virus shows a high degree of contagion and containment management will be pivotal to avoid hospital saturation with too many cases to treat. The healthcare system in the Northern regions is highly efficient compared with the rest of the country, but its ability to manage should the number of people infected rise exponentially is uncertain. In this scenario, attempts by the Italian authorities to strike a balance between restrictive measures to contain the spread of the virus and to limit the negative impact on the economy will be challenging, and a mismanagement of the situation with an uncontrolled rise of new cases, might adversely affect government stability. Italy’s fiscal space is limited, but DBRS Morningstar expects the announcement of some potential fiscal measures to sustain growth. These, however, might be less effective should the economic impact be more on the supply than the demand side, for example in the event that work stoppages be extended geographically and/ or become prolonged.