March PMI Reflects Pandemic Impact

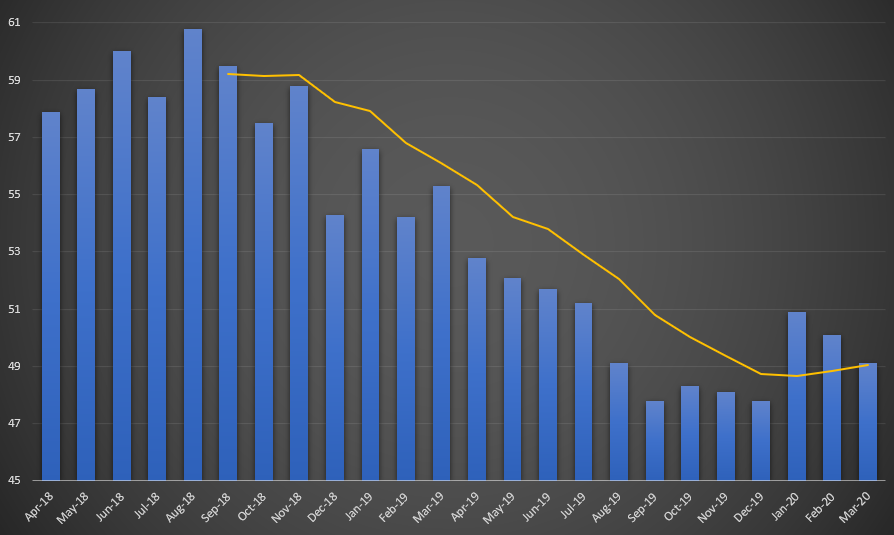

ISM® MANUFACTURING PMI: 24-Month History

The COVID-19 pandemic looks to have snuffed out an expansion that wanted to kick off at the start of the year as the Institute for Supply Management® reported a PMI of 49.1 percent for March. Based on the overall economy, the drop from 50.1 percent in February seems relatively modest. Comments from the ISM® report and panel reflect intense concerns about the future outlook as the world economy is heading into the unknown.

“The coronavirus pandemic and shocks in global energy markets have impacted all manufacturing sectors. Among the six big industry sectors, Food, Beverage and Tobacco Products remains strongest, followed by Chemical Products, which in addition to the pharmaceutical component, is a significant contributor to the Food, Beverage & Tobacco Products Industry and beneficiary of low energy and feedstock prices. Transportation Equipment and Petroleum and Coal Products are the weakest sectors. Sentiment regarding near-term growth this month is strongly negative, by a 2-to-1 ratio,” says Timothy R. Fiore, Chair for ISM®) Manufacturing Business Survey Committee.

Of the 18 manufacturing industries, 10 reported growth in March — Printing & Related Support Activities; Food, Beverage and Tobacco Products; Apparel, Leather and Allied Products; Wood Products; Paper Products; Chemical Products; Computer and Electronic Products; Primary Metals; Miscellaneous Manufacturing; and Plastics and Rubber Products.

The six industries reporting contraction for March — Petroleum and Coal Products; Textile Mills; Transportation Equipment; Furniture and Related Products; Fabricated Metal Products; and Machinery.

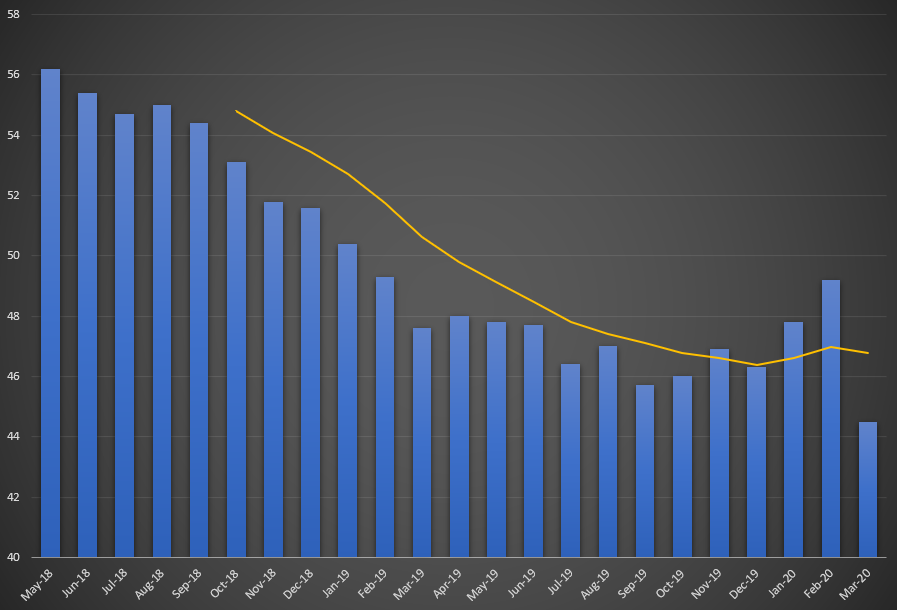

EUROPEAN PMI

Looking across the Atlantic, the European manufacturing PMI numbers tell a similar story with early 2020 progress now reversing course, but with a much bigger drop in March to 44.5 percent. From the 12-month high in February of 49.2, that represented the steepest one-month drop for the sector since July of 2012.

24-Month Euro Area Manufacturing PMI

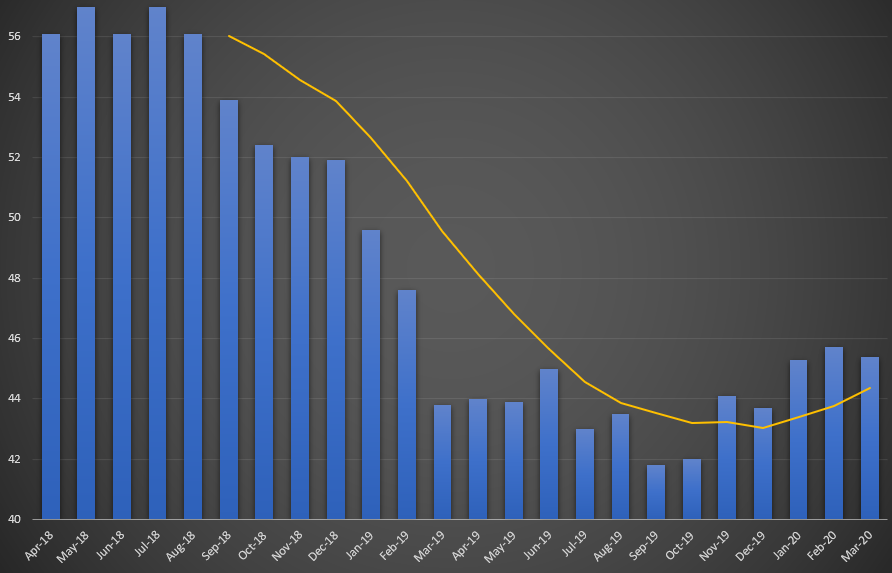

After working on a rally that started in November, Germany’s manufacturing PMI was a bit more resilient with a modest decline from 45.7 percent in February to 45.4 percent for a current reading.

24-Month Manufacturing PMI: Germany

ISM® PANEL COMMENTS

“COVID-19 impact has extended to Europe and North America. The virus escalation is affecting our purchasing and logistics operations. We have incurred air-shipment and production interruptions due to shortages of raw materials and components.”

Transportation Equipment

“We are experiencing a record number of orders due to COVID-19.”

Food, Beverage and Tobacco Products

“COVID-19’s spread in the U.S. may start impacting our domestic business. As for Asian suppliers, they are starting to get back up to speed.”

Fabricated Metal Products

“COVID-19 has caused a 30-percent reduction in productivity in our factory.”

Machinery

“All North American manufacturing plants have ceased operations or drastically scaled back as a result of customer plant closings and other responses to COVID-19.”

Plastics and Rubber Products