U.S. Manufacturing Slips Deeper into Contraction

Inventory pullbacks, tariff disruptions and softening export demand weigh on factory performance

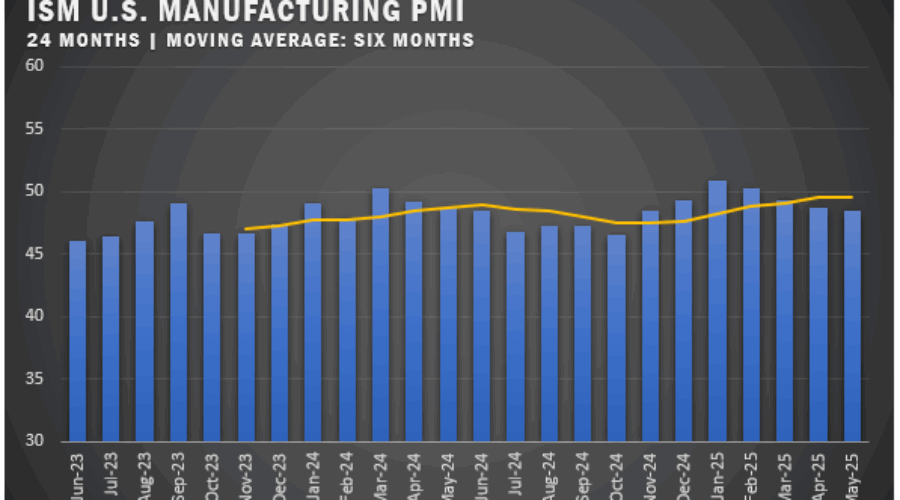

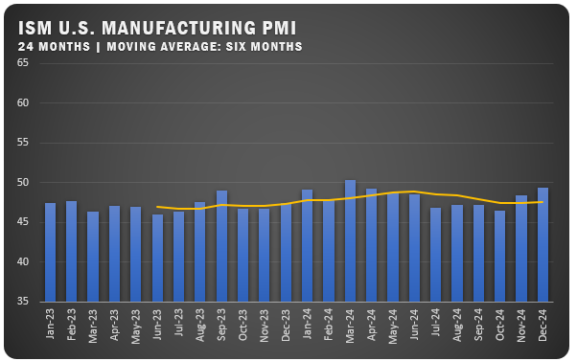

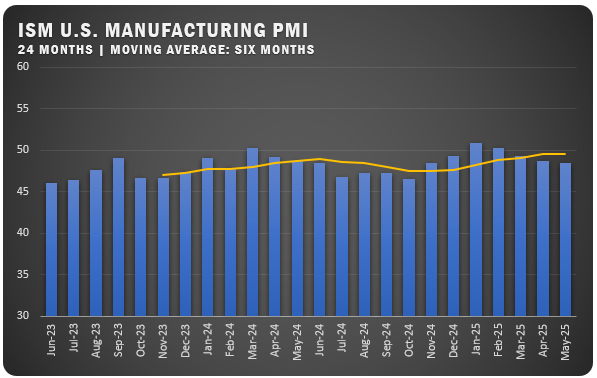

U.S. manufacturing activity declined for the third straight month in May, according to the latest Manufacturing ISM Report On Business. After a brief rebound early in the year, producers are once again navigating headwinds tied to trade policy uncertainty, shifting inventory strategies, and weakening global demand.

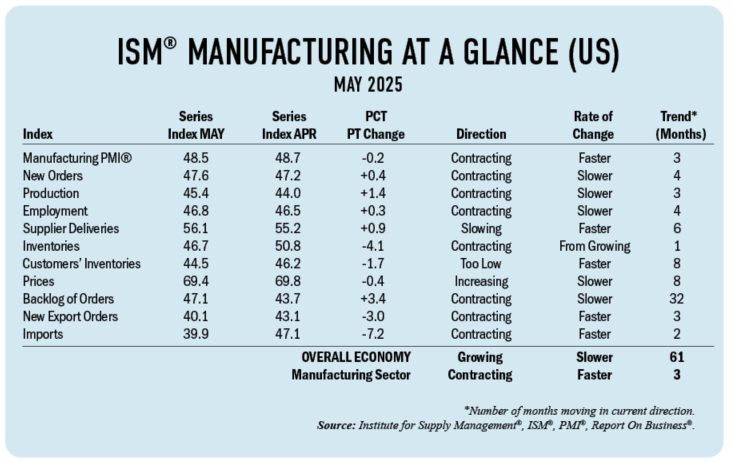

The Manufacturing PMI registered 48.5 percent for May, a slight dip of 0.2 percentage point from April’s 48.7 percent, continuing a downward trend following two short-lived months of expansion. Despite this, the broader U.S. economy expanded for the 61st consecutive month, excluding the brief contraction in April 2020.

Demand conditions remained fragile. The New Orders Index contracted for the fourth consecutive month, ticking up slightly to 47.6 percent. Backlog activity improved modestly, with the index rising 3.4 points to 47.1 percent, suggesting some stabilization in existing order fulfillment. However, new export demand deteriorated further, falling sharply to 40.1 percent, while the Customers’ Inventories Index remained low, typically a positive signal for future restocking.

Production levels also remained under pressure. The Production Index rose to 45.4 percent but reflected contraction for a third consecutive month. The Employment Index edged up to 46.8 percent, though layoffs outpaced hiring as firms cited the need for faster staffing adjustments in response to economic pressure.

Input trends were mixed. The Prices Index remained elevated at 69.4 percent, showing only a marginal slowdown from April and continuing to reflect broad-based inflation linked to tariff increases. Supplier deliveries remained sluggish, with the index increasing to 56.1 percent, while the Inventories Index fell to 46.7 percent, down from 50.8 percent, as companies reduced holdings following early tariff-driven stockpiling. Imports took a major hit, falling into deep contraction at 39.9 percent, down 7.2 points from the prior month.

COMMODITIES

Up in Price: Aluminum (18); Aluminum Products* (3); Corrugated Boxes (3); Critical Minerals (3); Electrical Components (4); Electronic Components (4); Paper Products; Steel (4); Steel — Stainless (3); and Steel Products (3).

Down in Price: Aluminum Products*; Cooking Oils; Diesel Fuel (2); Natural Gas (3); and Polypropylene.

In Short Supply: Electronic Components (3); and Rare Earth Components.

*Indicates commodities reported both up and down in price.

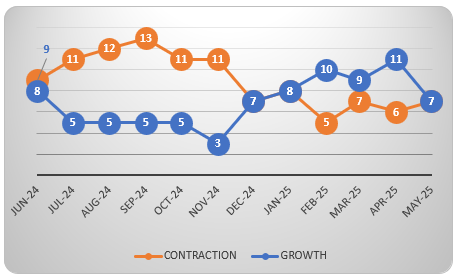

U.S. SECTOR REPORT

ISM Growth Sectors (7): Plastics and Rubber Products; Nonmetallic Mineral Products; Petroleum and Coal Products; Furniture and Related Products; Electrical Equipment, Appliances and Components; Fabricated Metal Products; and Machinery.

ISM Contraction Sectors (7): Paper Products; Wood Products; Printing and Related Support Activities; Food, Beverage and Tobacco Products; Transportation Equipment; Chemical Products; and Primary Metals.

MAY ISM REPORT COMMENTS

Transportation Equipment: “There is continued softening of demand in the commercial vehicle market, primarily related to higher prices and economic uncertainty. The impact of ever-changing trade policies of the current administration has wreaked havoc on suppliers’ ability to react and remain profitable. Vehicle manufacturers have already rolled price increases into their products to protect their bottom lines but have not been as cooperative with their supply bases. This has resulted in a high occurrence of suppliers falling into financial distress.”

Food, Beverage and Tobacco Products: “Tariffs, avian influenza and broader commodity markets continue to impact business conditions. The volatility of all three makes business planning and overall conditions challenging.”

Computer and Electronic Products: “Government spending cuts or delays, as well as tariffs, are raising hell with businesses. No one is willing to take on inventory risk.”

Chemical Products: “Most suppliers are passing through tariffs at full value to us. The position being communicated is that the supplier considers it a tax, and taxes always get passed through to the customer. Very few are absorbing any portion of the tariffs.”

Fabricated Metal Products: “Tariff uncertainty is impacting new international orders. Tariffs are also the main reason our Asia customers are requesting delayed shipments.”

Machinery: “There is continued uncertainty regarding market reaction to the recently imposed tariffs and resulting actions by other countries. The rare earth restrictions being imposed are of high concern in the near term.”

Electrical Equipment, Appliances and Components: “The administration’s tariffs alone have created supply chain disruptions rivaling that of COVID-19.”

Primary Metals: “We have entered the waiting portion of the wait and see, it seems. Business activity is slower and smaller this month. Chaos does not bode well for anyone, especially when it impacts pricing.”

Miscellaneous Manufacturing: “Tariff whiplash continues while the easing of tariff rates between the U.S. and China in May was welcome news, the question is what happens in 90 days. We are doing extensive work to make contingency plans, which is hugely distracting from strategic work, plus it is also very hard to know what plans we should actually implement. The 10-percent tariff on other countries is impactful as well, and it is unclear if/when deals will be made.”

Paper Products: “Uncertainty due to the recent tariffs continue to weigh on profitability and service. An unresolved (trade deal with) China will result in empty shelves at retail for many do-it-yourself and professional goods.

GLOBAL PMI NOTES

Eurozone: Manufacturing activity contracted at its slowest pace in nearly three years, with the PMI rising to 49.4. Output grew modestly, and new orders stabilized, suggesting a potential return to growth in the near term.

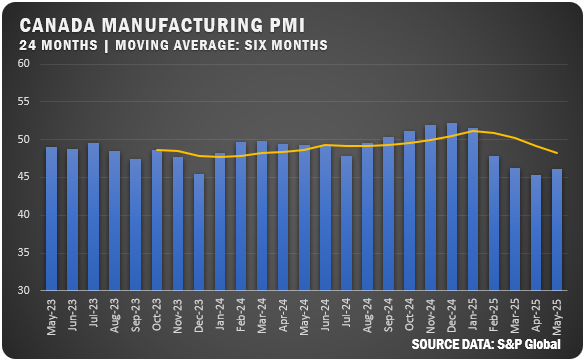

Canada: The PMI edged up to 46.1 in May but remained in contraction for the fourth consecutive month. Tariff pressures and supply chain disruptions continued to weigh on output and employment, though future expectations improved slightly amid proposed policy support.

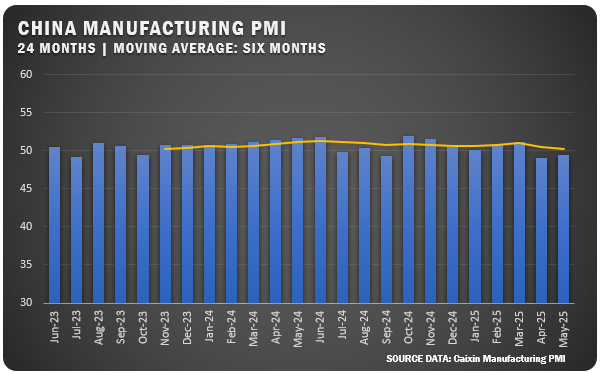

China: Factory activity shrank again, with the official PMI at 49.5. However, the pace of decline eased, aided by a temporary U.S.-China tariff truce that boosted export orders. Ongoing trade tensions and weak domestic demand kept business confidence fragile.

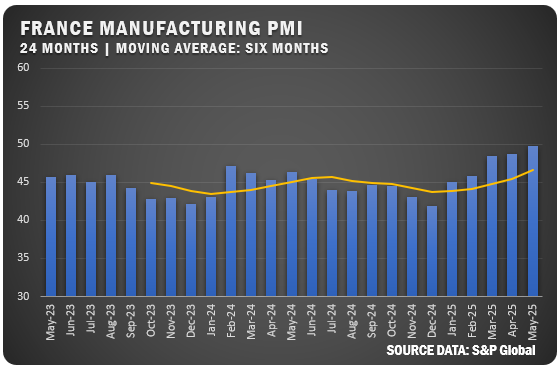

France: The downturn in French manufacturing softened, with the PMI climbing to 49.8. Output expanded for the first time since early 2023, driven by stronger domestic demand and easing cost pressures.

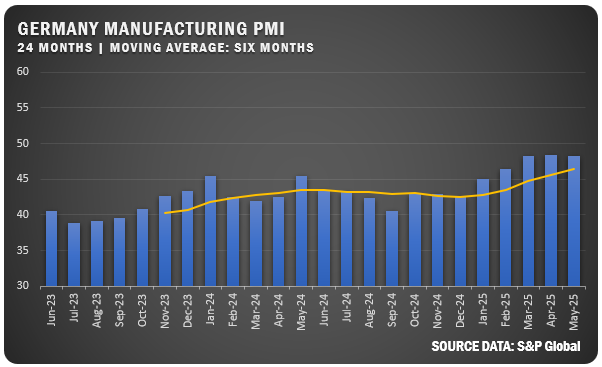

Germany: Germany’s manufacturing sector remained in contraction for a 35th consecutive month in May, with the PMI revised down to 48.3. Output rose for a third straight month on stronger export demand, but domestic orders stayed soft, job cuts continued, and price pressures eased further as manufacturers trimmed factory gate prices to stay competitive.

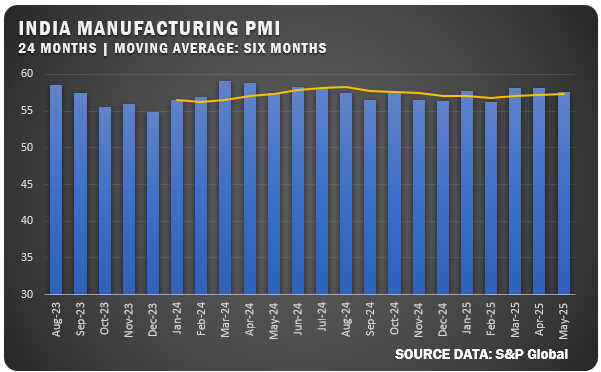

India: India’s manufacturing sector remained robust despite a slight slowdown, with the PMI at 57.6. Growth in new orders and output moderated, but hiring reached a record high, reflecting continued resilience amid inflationary and geopolitical pressures.

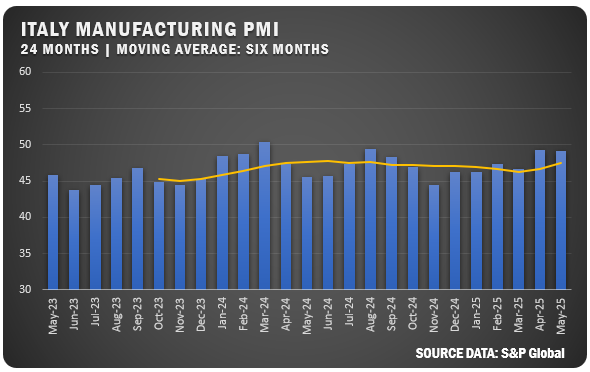

Italy: Italy’s PMI dipped to 49.2, indicating a mild contraction. While output and orders declined slightly, business confidence improved, reaching a three-month high.

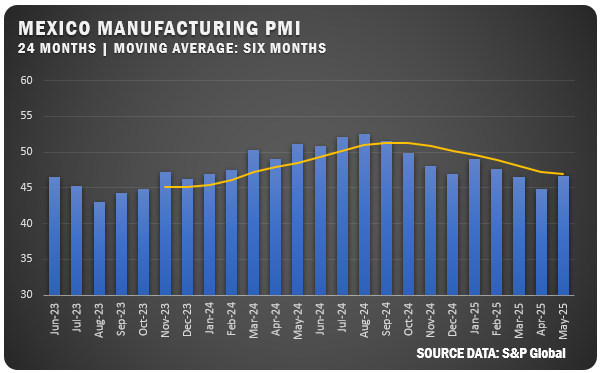

Mexico: Mexico’s manufacturing sector remained under pressure in May, with the PMI ticking up to 46.7 but still signaling a solid contraction. New orders declined for the 11th month, export demand slumped amid U.S. tariffs, and firms responded with steep cuts to purchasing, inventories and staffing.

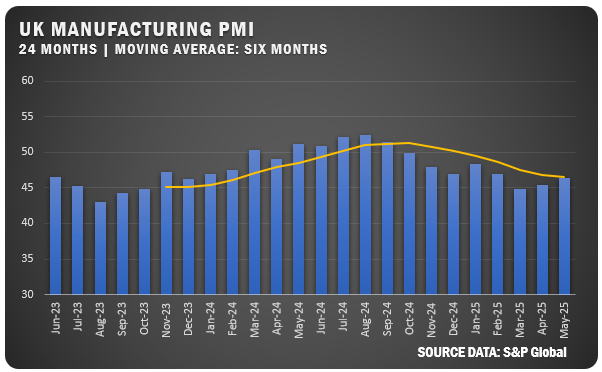

United Kingdom: UK manufacturing conditions remained challenging in May, with the PMI revised up to 46.4, still indicating contraction. Output, new orders, and employment declined amid soft global demand, trade volatility, and tariff concerns, while input cost inflation eased and confidence stayed historically muted despite a slight rebound.

Sources: S&P Global, Trading Economics and Institute for Supply Management, PMI (Purchasing Manager Index), Report On Business.

Learn more about ISM at ismworld.org.