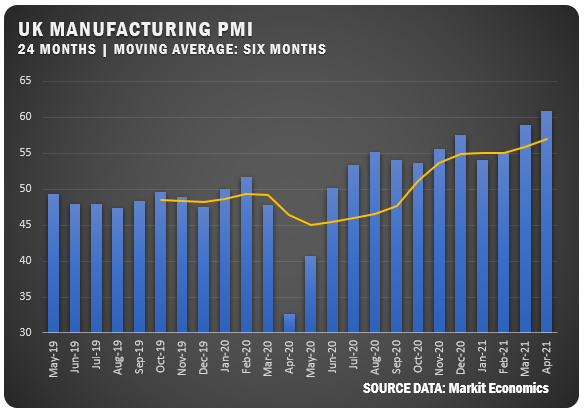

UK Manufacturing Leads the Pack

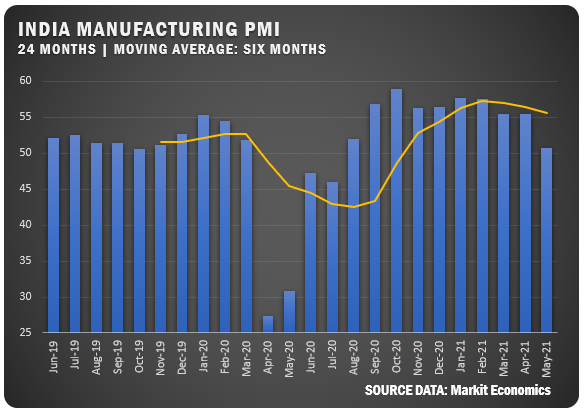

India’s PMI sees a steep drop as COVID-19 strikes the country hard

For the most part, manufacturing showed strength in May as the Eurozone and four additional countries were comfortably above the 60 percent PMI level. UK manufacturers set the pace as the country surged with a 4.7 percent PMI increase to reach a new high of 65.6 percent. On the other hand, India struggled with a COVID-19 resurgence and reversed the UK number and fell by 4.7 percent to a 50.8 percent PMI reading.

UNITED KINGDOM: The IHS Markit/CIPS UK Manufacturing May PMI was reported at 65.6 percent to set the highest mark for countries/regions tracked by Brushware. Pandemic restrictions eased for the UK and pent-up demand also contributed to the new high for UK manufacturers. Raw materials shortages and disruptions to the supply chain led to a steep increase in purchasing costs which in turn pushed up selling prices. Business sentiment was at a record level.

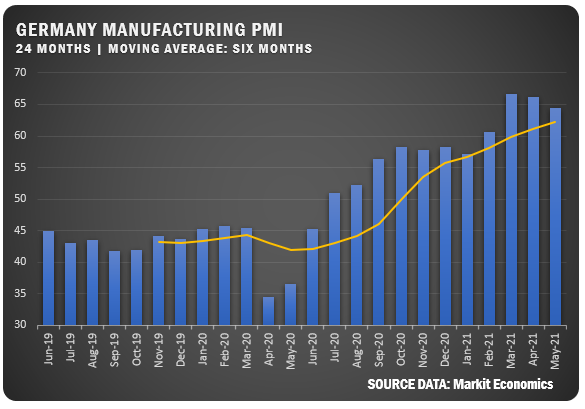

GERMANY: The IHS Markit Germany Manufacturing PMI slipped to 64.4 percent in May – down for a second straight month from a high of 66.6 in March. The figure indicated strong growth in factory activity, but supply-chain issues factored into the slight pull back from prior months. Delays in the receipt of inputs hit a new high and that pushed the rate of cost inflation up beyond previous highs for the series. Business optimism remains strong and job creation has increased to tackle anticipated growth.

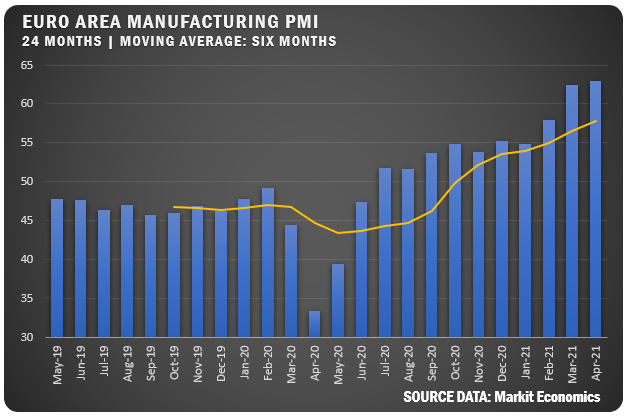

EUROZONE: The IHS Markit Eurozone Manufacturing PMI moved up for a fourth straight month to hit a new high of 63.1 percent in May. Input costs increased substantially and the rate of inflation reached an unprecedented level. Eurozone employment for manufacturers went up for a fourth straight month and business optimism remained high.

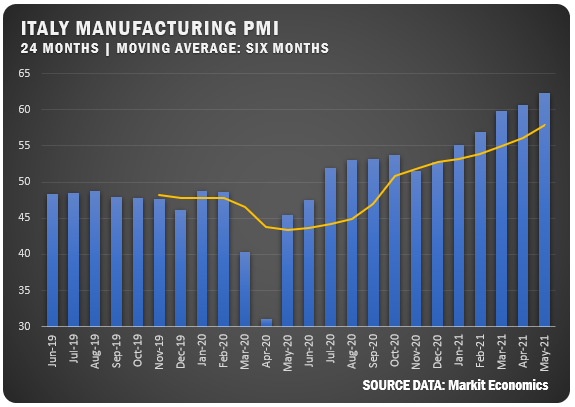

ITALY: IHS Markit reported a new series high for Italian manufacturers with a May PMI reading of 62.3 percent. Output growth, new orders and employment all showed strength as second-quarter demand surged. Supply chain issues were still a problem and inflationary pressure continued to increase. Confidence in the business outlook remained high.

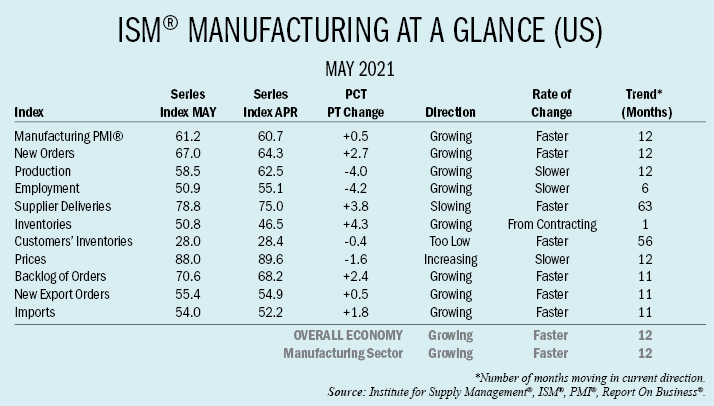

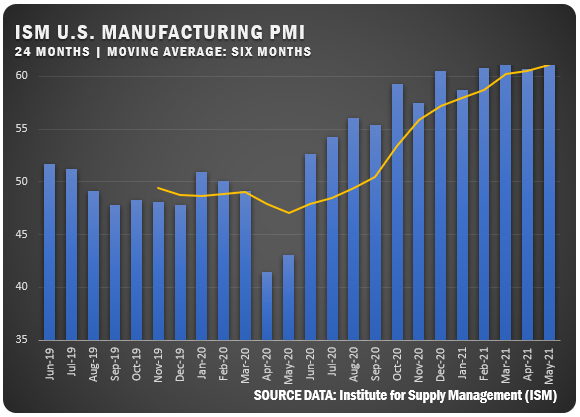

UNITED STATES: The Institute for Supply Management® (ISM®) reported a May PMI of 61.2 percent for U.S. manufacturers, which represented a half percentage point increase from the April reading. The report says U.S. companies and suppliers continue to struggle to meet increasing levels of demand with record-long lead times, wide-scale shortages of critical basic materials, rising commodities prices and challenges in transporting products continuing to affect all manufacturing segments. Worker absenteeism, short-term shutdowns due to part shortages and difficulties in filling open positions continue to limit manufacturing-growth potential. Optimism was strong though as the report indicated there were 36 positive comments for every cautious comment, compared to an 11-to-1 ratio in April. “The manufacturing recovery has transitioned from first addressing demand headwinds, to now overcoming labor obstacles across the entire value chain,” says Timothy R. Fiore, ISM® Manufacturing Business Survey Committee Chair.

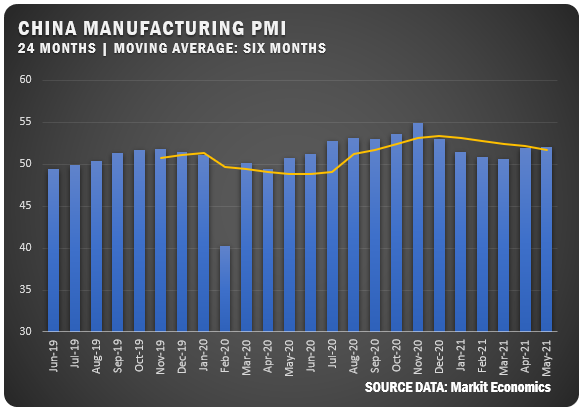

CHINA: The Caixin China General Manufacturing PMI registered a five-month high of 52.0 percent for May. The figure indicates a steady recovery for Chinese manufacturers as new orders rose the most since December 2020, while export orders growth also reached a six-month high. Job creation was stagnant even while backlogs of work rose. “Rapidly rising commodity prices began to disrupt the economy as some enterprises began to hoard goods, while some others suffered raw material shortages,” says Wang Zhe, senior economist at Caixin Insight Group.

INDIA: IHS Markit reported a manufacturing PMI of 50.8 percent for Indian manufacturers. That represents a 10-month low and a steep drop from the 55.5 percent reading in April. The dropoff is primarily related to the recent increase in COVID-19 cases for the country. Firms saw a slowdown in the growth of input purchasing and employment decreased as a result. Business optimism from Indian manufacturers hit a 10-month low.

ISM® REPORT COMMENTS (U.S.)

“(A) lack of qualified candidates to fill both open office and shop positions is having a negative impact on production throughput. Challenges mounting for meeting delivery dates to customers due to material and services shortages and protracted lead times. This situation does not look to improve until possibly the fourth quarter of 2021 or beyond.”

Fabricated Metal Products

“The continued global supply chain tightness and raw material shortages from the Gulf (winter storms) make it less likely that any business can recover this year. Demand is strong, but what good is that if you cannot get the materials needed to produce your finished goods?” Nonmetallic Mineral Products

“Seeing a high demand and backlog of orders.”

Plastics and Rubber Products

“Very busy, but still experiencing labor shortages.”

Primary Metals

“Supplier performance — deliveries, quality, it’s all suffering. Demand is high, and we are struggling to find employees to help us keep up.” Computer and Electronic Products

“Changes in currency exchange rates favorably contributed to our quarterly performance. Continued strong consumer demand for our high-quality products also provided increased sales.” Chemical Products

“Ongoing component shortages are driving dual sourcing and longer-term supply plans to be implemented.”

Transportation Equipment

“Difficulty finding workers at the factory and warehouse level is not only impacting our production, but suppliers’ as well: Spot shortages and delays are common due to an inability to staff lines. Delays at the port continue to strain inventory levels.” Food, Beverage and Tobacco Products

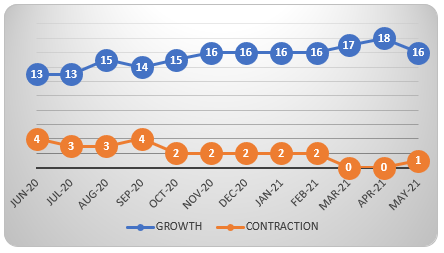

US SECTOR REPORT

ISM GROWTH SECTORS (16): Furniture and Related Products; Nonmetallic Mineral Products; Plastics and Rubber Products; Textile Mills; Primary Metals; Computer and Electronic Products; Electrical Equipment; Appliances and Components; Fabricated Metal Products; Food, Beverage and Tobacco Products; Machinery; Chemical Products; Miscellaneous Manufacturing; Transportation Equipment; Wood Products; Paper Products; and Petroleum and Coal Products.

ISM CONTRACTION SECTORS (1): Printing and Related Support Activities.

Credit: Institute for Supply Management®, ISM®, PMI®, Report On Business®. For more information, visit the ISM® website at www.ismworld.org.