US Manufacturing PMI Sees Third Month of Decline

Indian and UK Manufacturers Post Good Numbers for June

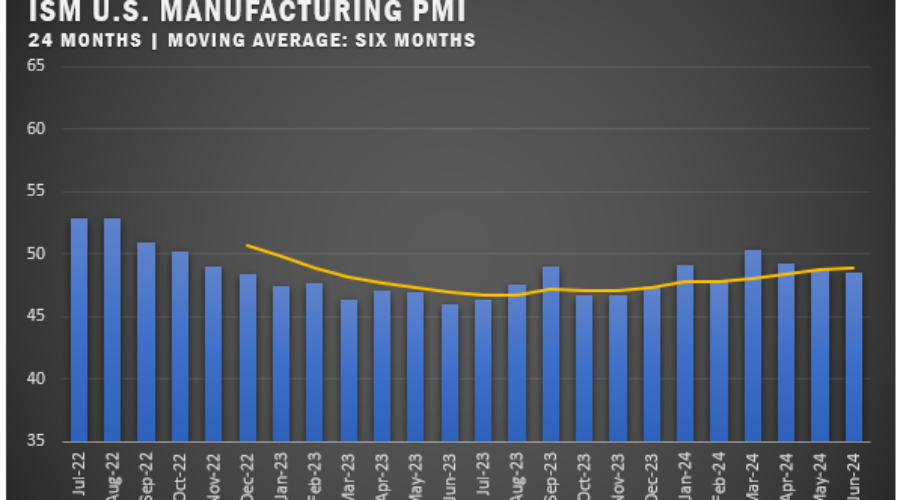

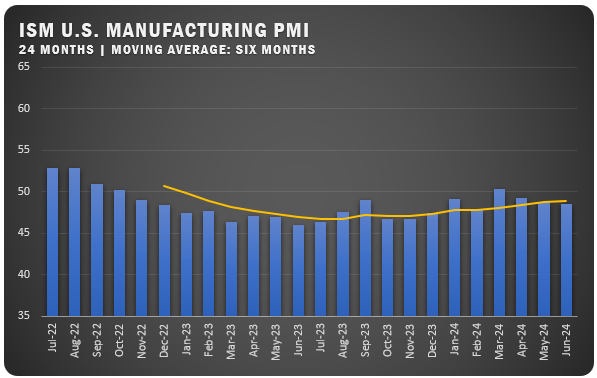

The ISM U.S. Manufacturing PMI® was reported at 48.5 percent for June to represent a third straight month of decline for the index. Excluding a reading of 50.3 percent in March, the index has been below the 50 percent mark since October of 2022.

“Demand remains subdued, as companies demonstrate an unwillingness to invest in capital and inventory due to current monetary policy and other conditions,” says Timothy R. Fiore, Chair of the ISM® Manufacturing Business Survey Committee. “Production execution was down compared to the previous month, likely causing revenue declines, putting pressure on profitability. Suppliers continue to have capacity, with lead times improving and shortages not as severe.”

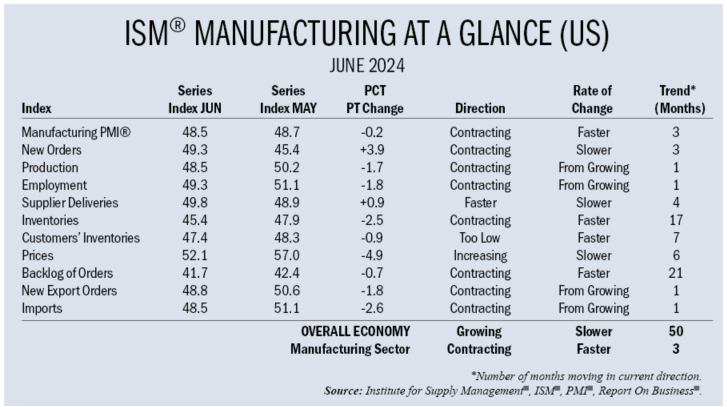

According to the report from ISM, U.S. manufacturing activity remained in contraction in June and demand was weak again with output also declining. Other key highlights from the report included:

- The New Orders Index improved to marginal contraction.

- The New Export Orders Index returning to contraction.

- The Backlog of Orders Index dropped into stronger contraction territory.

- The Customers’ Inventories Index moved to the low side of the ‘just right’ range, neutral for future production.

- Output (measured by the Production and Employment indexes) declined compared to May, with a combined 3.5-percentage point downward impact on the Manufacturing PMI® calculation.

US SECTOR REPORT

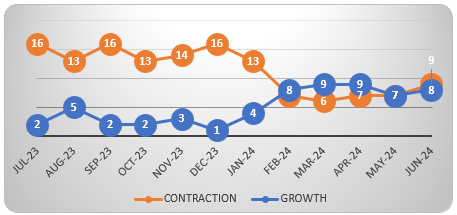

ISM® GROWTH SECTORS (8): Printing and Related Support Activities; Petroleum and Coal Products; Primary Metals; Furniture and Related Products; Paper Products; Chemical Products; Miscellaneous Manufacturing; and Nonmetallic Mineral Products.

ISM® CONTRACTION SECTORS (9): Textile Mills; Machinery; Fabricated Metal Products; Wood Products; Transportation Equipment; Plastics and Rubber Products; Food, Beverage and Tobacco Products; Electrical Equipment, Appliances and Components; and Computer and Electronic Products.

MAY ISM® REPORT COMMENTS

(U.S. Manufacturers)

- “High volume of customer orders.” Chemical Products

- “Customers continue to cut orders with short notice, causing a ripple effect throughout lower-tier suppliers.” Transportation Equipment

- “Consumer demand and inventories are no longer stable at retail and food service establishments.” Food, Beverage and Tobacco Products

- “While orders are still steady, inventory from the previous month is enough to satisfy current- and near-term commitments.” Computer and Electronic Products

- “Customers ordering more to create buffer stocks (in case of) future shortages.” Electrical Equipment, Appliances and Components

- “Order levels in two of our main divisions are indicating weak demand, and now we must work to reduce inventory levels.” Fabricated Metal Products

- “Sales backlog is decreasing. We have furloughed a portion of our workforce as a result.” Machinery

- “The level of production is lower due to decreased demand for products.” Miscellaneous Manufacturing

- “Elevated financing costs have dampened demand for residential investment. We have reduced inventories of production components.” Wood Products

- “Orders have increased slightly due to seasonal restocking.” Plastics and Rubber Products

GLOBAL PMI NOTES

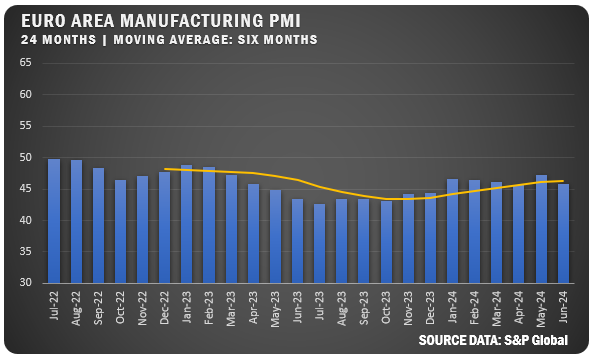

EUROZONE: The HCOB Eurozone Manufacturing PMI fell to 45.8 percent in June as new orders, purchasing and employment all saw significant declines. Input charges also increased, but output charges were down slightly. The business outlook for the region remained positive.

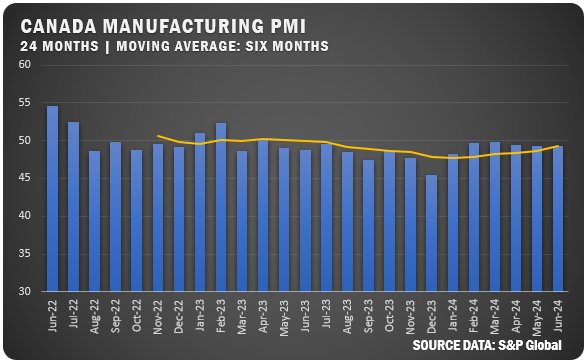

CANADA: The S&P Global Canada Manufacturing PMI for June matched the May reading of 49.3 percent. Factory output and new orders continued to decrease based on weak demand internationally and on the domestic front. Weaker sales caused inventory levels to push up and employment fell for the first time since January. Firms reported issues with supply chain delays and input costs continued to increase. The business outlook was pessimistic.

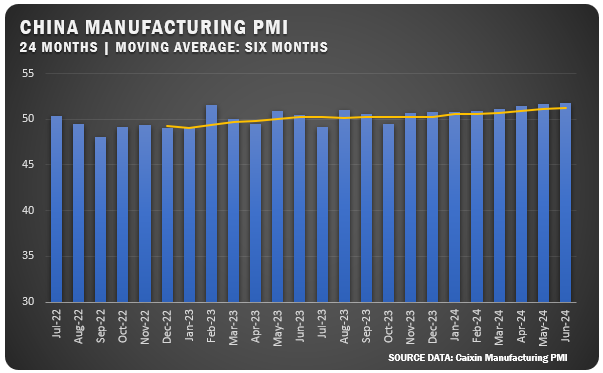

CHINA: The Caixin China General Manufacturing PMI was reported at 51.8 percent for June to edge up slightly from the May reading of 51.7 percent. in May, beating market forecasts of 51.2 and marking the highest figure since May 2021. It was the fifth straight month of upward movement for the index and the eighth month above the 50-percent line. Output reached a two-year high new orders continued to increase. Purchasing also surged with export sales still growing but at a slower pace than previous months. Employment was flat and the supply chain saw slowdowns based on materials shortages. The business outlook reached a four-year low.

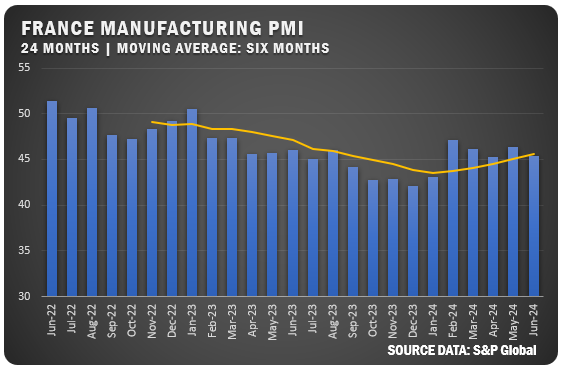

FRANCE: The HCOB France Manufacturing PMI slipped a full percentage point to register 45.4 percent for June. French manufacturing has now been in contraction territory since January of 2023. The key headwind remains a decline in new business and firms have responded by reducing production output. Employment continued to decline and the dropoff was more severe in June. Input costs hit a 17-month high, which pushed up output pricing. Business optimism continues to fall.

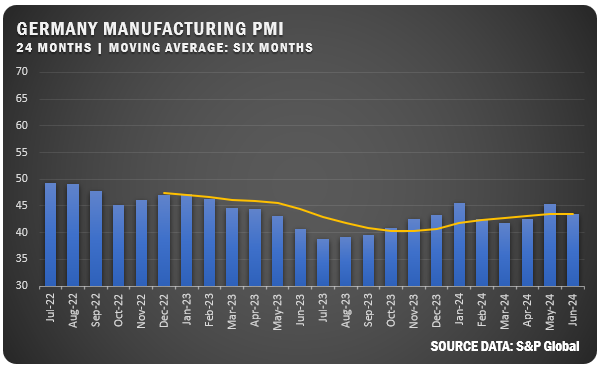

GERMANY: The HCOB Germany Manufacturing PMI dropped to 43.5 percent for June 2024 erasing a positive surge in the index from May (45.4 percent). Output and new orders fell companies continued to lower inventories. Backlogs also decreased and employment accordingly declined. Soft demand led to a reduction in both input and output pricing. Surprisingly, the business outlook was up slightly. compared to a preliminary of 43.4 and a

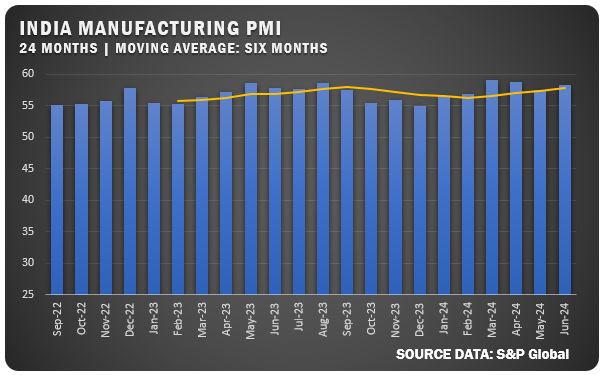

INDIA: The HSBC India Manufacturing PMI was reported at 58.3 percent for June to buck the global trend. Strong demand drove up new orders and purchasing and firms increased input to fill the pipeline. That helped to drive up job growth. Input cost increases slowed, but prices are still at their highest since August of 2022. And that led to higher output pricing as well. The business outlook for Indian firms remains optimistic.

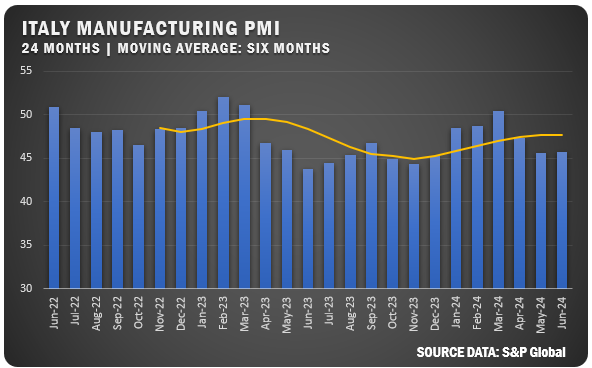

ITALY: The HCOB Italy Manufacturing PMI ticked up to 45.7 percent in June after falling to 45.6 percent in May. Demand continued to fall and new orders in particular are dropping at an increased pace. Output decreased and inventories fell which led to a further decline in employment, but not as sharply as reported for May. Input costs continue to rise and hit an 18-month high based on raw material prices and increased freight charges. The business outlook still remains optimistic.

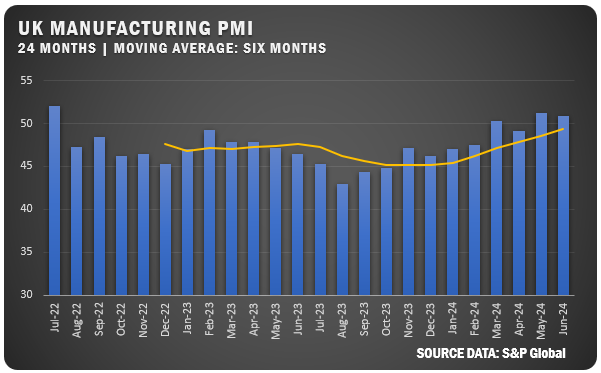

UNITED KINGDOM: The S&P Global UK Manufacturing PMI slipped three-tenths for a reading of 50.9 percent for June, but the figure represented a second straight month in growth territory. Output and new orders both pushed up, but delivery times started to increase. Inventory and employment both fell and input prices saw a sharp increase. The business outlook is positive as U.K. manufacturers see a market recovery ahead.

Source: Institute for Supply Management®, PMI® (Purchasing Manager Index), Report On Business®. For more information, visit the ISM® website at www.ismworld.org.