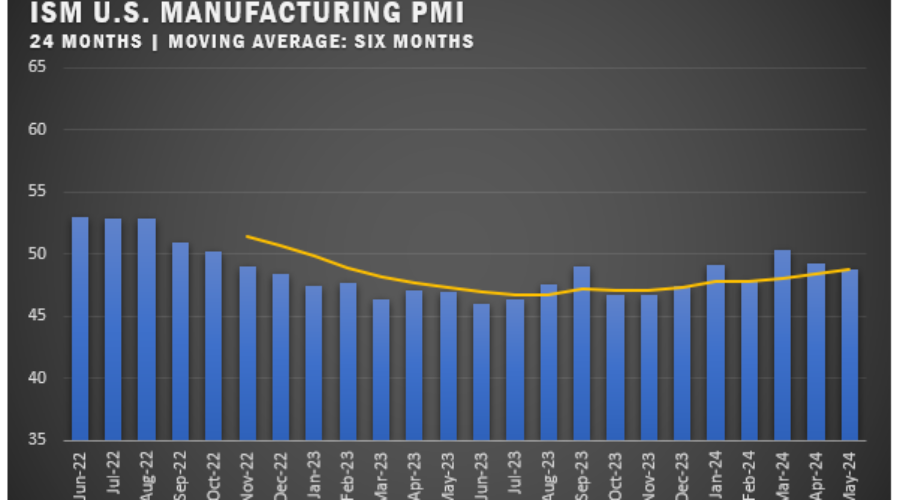

US Manufacturing PMI Slips in May

India and China Continue to Post Strong Manufacturing Numbers

After a brief push into growth territory in March, the ISM U.S. Manufacturing PMI® slipped in April to 49.2 percent and followed in May with a 48.7 percent reading. The overall economy continued in expansion territory for the 49th straight month.

“Demand remains elusive as companies demonstrate an unwillingness to invest due to current monetary policy and other conditions,” says Timothy R. Fiore, Chair of the ISM® Manufacturing Business Survey Committee. “These investments include supplier order commitments, inventory building and capital expenditures. Production execution continued to expand but was essentially flat compared to the previous month. Suppliers continue to have capacity, with lead times improving and shortages not as severe.”

The New Orders Index remained in contraction territory, registering 45.4 percent, 3.7 percentage points lower than the 49.1 percent recorded in April. The May reading of the Production Index (50.2 percent) is 1.1 percentage points lower than April’s figure of 51.3 percent. The Prices Index registered 57 percent, down 3.9 percentage points compared to the reading of 60.9 percent in April. The Backlog of Orders Index registered 42.4 percent, down 3 percentage points compared to the 45.4 percent recorded in April. The Employment Index registered 51.1 percent, up 2.5 percentage points from April’s figure of 48.6 percent.

“U.S. manufacturing activity continued in contraction after growing in March, the first expansion for the sector since September 2022,” says Fiore. “Demand was soft again, output was stable, and inputs stayed accommodative.”

US SECTOR REPORT

ISM® GROWTH SECTORS (7): Printing & Related Support Activities; Petroleum & Coal Products; Paper Products; Textile Mills; Primary Metals; Fabricated Metal Products; and Chemical Products.

ISM® CONTRACTION SECTORS (7): Wood Products; Plastics & Rubber Products; Machinery; Computer & Electronic Products; Furniture & Related Products; Transportation Equipment; and Food, Beverage & Tobacco Products.

MAY ISM® REPORT COMMENTS

(U.S. Manufacturers)

- “Backlog is dwindling as we get caught up on orders; new orders are not coming in as robust as the backlog is going down. Inflation continues to be a problem with pricing of raw material and interest rates. We expect a flat rest of calendar year 2024, especially given that it’s a presidential election year.” Machinery

- “Seems like a minor slowdown is happening. With less spending in the economy, less pressure on us for our products.” Chemical Products

- “Business is picking up, with incoming bookings increasing.” Furniture and Related Products

- “Overall softening of markets for the month of June. Some impacts on a regional basis with the continued weather in the northeast, south and southeast regions. Delays in shipments continue across multiple regions.” Petroleum and Coal Products

- “General concern about overall industry economics. Pricing weakness continues, and we anticipate more headwinds in the coming months for spot orders and inflation. Contract order book remains steady.” Primary Metals“Business conditions are pacing with budget and forecast for 2024. Certain markets are soft, but others are ahead of forecast, allowing us to maintain overall. Concerns with the economy continue to drive business decisions.” Transportation Equipment

- “Volume continues to be challenging, mostly due to inflationary impacts.” Food, Beverage and Tobacco Products

- “Orders have started to rebound, but inventory levels remain high enough for no impact on our supplier orders. It will take a few more strong months before supplier orders are reactivated or increased.” Computer and Electronic Products

- “Export shipments continue to be soft as capital equipment sales remain lower than forecast. As a result, production is also trending lower and inventory that is not able to be pushed out is growing.” Fabricated Metal Products

- “Demand has been strong the first few months — ahead of budget, consistent with last year. Bookings are starting to slow down for May and June. We are monitoring this data closely to determine if it is a sign of decline or our typical cyclical demand.” Electrical Equipment, Appliances and Components

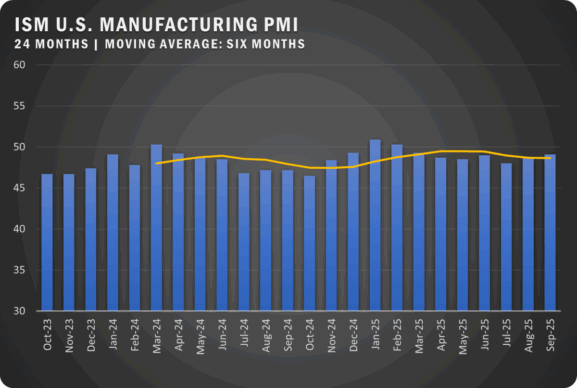

GLOBAL PMI NOTES

EUROZONE: The HCOB Eurozone Manufacturing PMI surged to 47.3 percent in May, up 1.6 percent from the April figure of 45.7 percent. It was the highest reading for Euro manufacturers since March of 2023 and also ended a three-month downward trend. The improvement was aided by a slowing in declines for new orders, exports and purchasing activity. The business outlook was positive with optimism reaching its highest level since early 2022.

CANADA: The S&P Global Canada Manufacturing PMI slipped to 49.3 in May as the Canadian manufacturing sector continues to hover just below the 50 percent mark. Factory output and new orders declined amid concerns about the economy and the political arena. Purchasing declined, but inventory levels still saw a slight increase. Employment was up and input costs also saw an increase but market competition kept output prices in check. Business confidence was up as Canadian companies are still projecting stability in the economy later this year.

CHINA: The Caixin China General Manufacturing PMI continued to march upward registering a a solid 51.7 percent reading for May to sustain a four-month growth trend. It was also the seventh straight month in growth territory. Purchasing hit a three-year high, but input prices pushed up due to higher energy costs and higher prices for metals and plastics. Employment was down and backlogs of work grew as demand increased. The business outlook was positive as Chinese firms are projecting increased domestic and export activity in the year ahead.

FRANCE: After two months of decline, the S&P Global France Manufacturing PMI moved up to 46.4 percent in May. The reading represented a 1.1 percent increase from the April reading of 45.3 percent. Despite the uptick, it has now been 16 months since French manufacturers saw growth territory and exports fell sharply and factory activity also declined which led to a decrease in employment. Input prices increased and manufacturers reacted with higher output pricing. Still, the business outlook was positive with manufacturer sentiment hitting its highest level since February of 2022.

GERMANY: The HCOB Germany Manufacturing PMI had a reading of 45.4 percent for May, up 2.2 percent from the April reading of 42.5 percent. The decline in output and new orders slowed while export orders showed stability based on demand from China and the U.S. Market competition resulted in lower input and output prices. Employment also fell, but the business outlook was positive as firms look for growth in the second half of the year.

INDIA: The HSBC India Manufacturing PMI registered 57.5 percent in May down from a March high of 59.1 percent. Despite the pullback, manufacturing for the country is still well into growth territory and has now been above the 50-percent line since July of 2021. The new reading was the result of a slight pullback in increases for new orders and factory output. In addition, working hours were reduced based on a heatwave during May. On the upside, export orders surged and that led to record employment growth. Input costs increased based on freight pricing increases and rising costs for raw materials. The business outlook hit a nine-year high as Indian firms project strong demand and a favorable economic climate in the months ahead.

ITALY: The HCOB Italy Manufacturing PMI dropped sharply in May to 45.6 percent after also seeing a significant decline in April (47.3 percent). The two-month slide followed a brief trip above the 50-percent line in March. The fall was tied to sharply declining order volume based on weaker demand. Export sales also fell due to geopolitical issues. Input costs rose, but output prices fell as companies looked to drive sales in a competitive environment. The business outlook weakened but was still relatively optimistic for the longer term.

UNITED KINGDOM: The UK Manufacturing PMI jumped to 51.2 percent in May up sharply from 49.1 percent in April. The April figure appeared to be an aberration as U.K. manufacturing shows an upward trend that started in September of 2023 with March and May both in growth territory. New orders and good market conditions helped push up the reading despite a continuing decline in export orders. The business outlook was positive, as 63 percent of firms expect to see factory output continue to expand.

Source: Institute for Supply Management®, PMI® (Purchasing Manager Index), Report On Business®. For more information, visit the ISM® website at www.ismworld.org.