US Manufacturing Report Shows Improvement for December

German Manufacturers See a Fourth Straight Month of Improvement

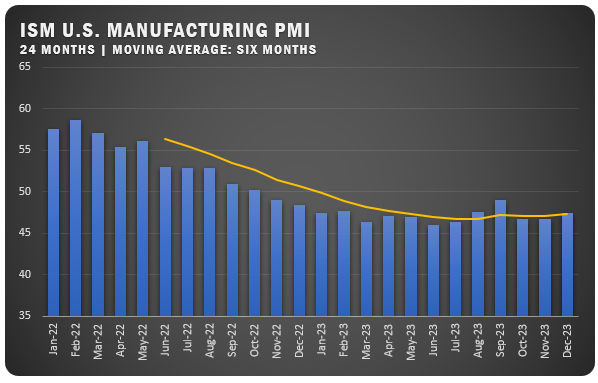

ISM reported a U.S. Manufacturing PMI of 47.4 percent for December to push up slightly from the November reading of 46.7 percent. Despite the improvement, the report from ISM says the figure indicates a 14th consecutive month of contraction for U.S. manufacturers.

Timothy R. Fiore, Chair of the ISM Manufacturing Business Survey Committee, says demand remains soft, and production execution is stable compared to November, as panelists’ companies continue to manage outputs, material inputs and labor costs.

The U.S. manufacturing sector continued to contract, but at a slightly slower rate in December as compared to November. Companies are still managing outputs appropriately as order softness continues. Demand eased, with the New Orders Index contracting at a faster rate, New Export Orders Index essentially flat, and Backlog of Orders Index climbing back above 40 percent but still in fairly strong contraction territory. The Customers’ Inventories Index returned to contraction, becoming more accommodative for future production. Output/Consumption contracted but improved, with a combined 4.1-percentage point upward impact on the Manufacturing PMI® calculation. Panelists’ companies maintained production levels month over month and continued actions to reduce headcounts in December, primarily through layoffs. Inputs — defined as supplier deliveries, inventories, prices and imports — continued to accommodate future demand growth. The Supplier Deliveries Index indicated faster deliveries for the 15th straight month, and the Inventories Index moved downward while remaining in moderate contraction territory. The Prices Index dropped further into ‘decreasing’ territory, signifying soft energy markets, offset by increases in the steel and aluminum markets. Manufacturing supplier lead times continue to decrease (supported by panelists’ comments), a positive for future economic activity.

ISM® REPORT COMMENTS (US Manufacturers)

- “Overall, order intake has picked up over the last quarter and a backlog of projects is beginning to accumulate.” Chemical Products

- “Anticipation of the U.S. Federal Reserve holding off on interest-rate changes will encourage more companies to spend on capital investments again. As budgets get approval after the start of the calendar year, this should help drive investment and increase manufacturing activity once again.” Computer and Electronic Products

- “Demand is up across the board. We are starting to see back orders grow again.” Transportation Equipment

- “Business conditions are good; sales and production are tracking in accordance with forecasts.” Miscellaneous Manufacturing

- “Commodity costs are decreasing. Supply is readily available, and customers are still ordering to last year’s volumes.” Food, Beverage and Tobacco Products

- “Business is slowing. Finished goods inventories are growing.” Machinery

- “We are forecasting a somewhat strong year for 2024. We’re currently mildly optimistic for how next year will play out.” Fabricated Metal Products

- “We are seeing stronger demand from our American Automotive OEM customers now that the United Auto Workers (UAW) strike has been resolved. Looking at a very strong first quarter of 2024.” Primary Metals

- “Higher financing costs have diminished demand for residential investment. Customers are delaying a portion of their plans until borrowing costs are reduced. We are impacted with reduced new orders, diminished backlog of orders and uncertain short-term demand for products and services.” Wood Products

- “Finishing the year similar to 2022; however, 2023 was more erratic. Working to restore inventory position to ensure we have appropriate safety stock.” Electrical Equipment, Appliances and Components

US SECTOR REPORT

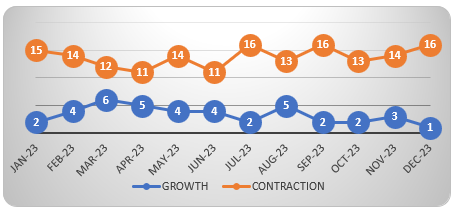

ISM® GROWTH SECTORS (1): Primary Metals.

ISM® GROWTH SECTORS (16): Printing and Related Support Activities; Apparel, Leather and Allied Products; Plastics and Rubber Products; Machinery; Nonmetallic Mineral Products; Textile Mills; Petroleum and Coal Products; Paper Products; Wood Products; Fabricated Metal Products; Computer and Electronic Products; Miscellaneous Manufacturing; Furniture and Related Products; Electrical Equipment, Appliances and Components; Transportation Equipment; and Chemical Products.

GLOBAL MANUFACTURING

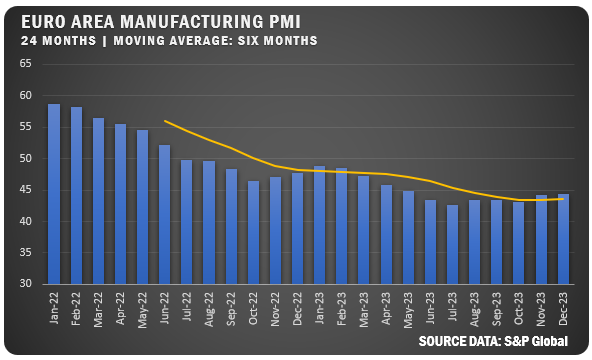

EUROPE: The HCOB Eurozone Manufacturing PMI moved up two points to 44.4 percent in December for a second consecutive month of improvement. Still, Eurozone manufacturing continues to struggle with output remaining and employment falling for a seventh straight month. There are signs of potential improvement as decreases in new orders and purchasing activity slowed. Business confidence registered an eight-month high but manufacturers goods are still reducing stock based on poor demand.

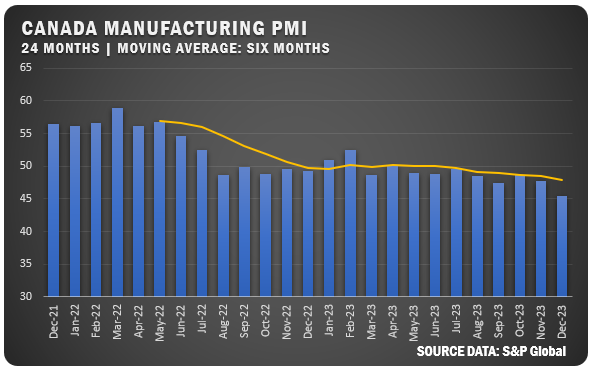

CANADA: The S&P Global Canada Manufacturing PMI dropped 2.3 points to register 45.4 percent in December of 2023. The downward trend for Canadian manufacturers dates back to last March as poor market conditions caused a falloff for new orders. High prices and weak demand factored in causing output to decline. Input costs were high but hit a three-month low, but output prices still moved up. Manufacturing employment declined but the business outlook was moderately confident.

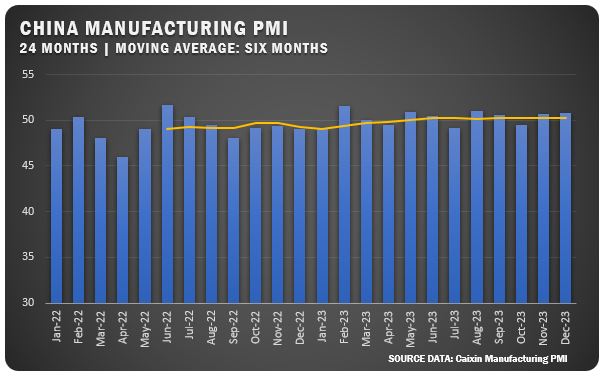

CHINA: The Caixin China General Manufacturing PMI was relatively a flat 50.8 percent for December after registering 50.7 percent in November. Output improved with new orders accelerating. Companies reduced the labor force for a fourth consecutive month as backlogs of work saw a decrease. The supply chain was impacted by shortages of certain raw materials and reduced supplier capacity. Business confidence was weaker.

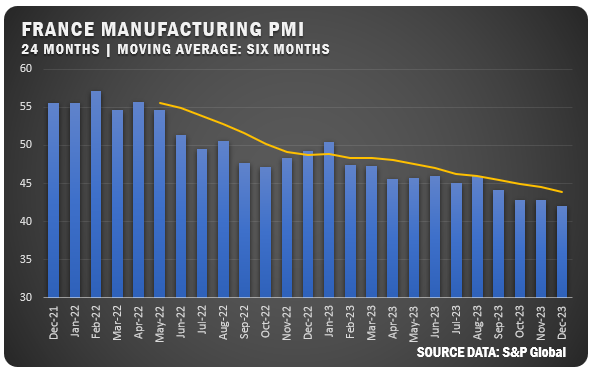

FRANCE: The HCOB France Manufacturing PMI fell to a 42.1 percent reading for December after registering 42.9 percent in November. The new reading continued a downward trend that started last February. New orders continued to decrease which reduced output for a 19th consecutive month. Purchasing activity was off and employment also fell for a seventh consecutive month. Business outlook was pessimistic.

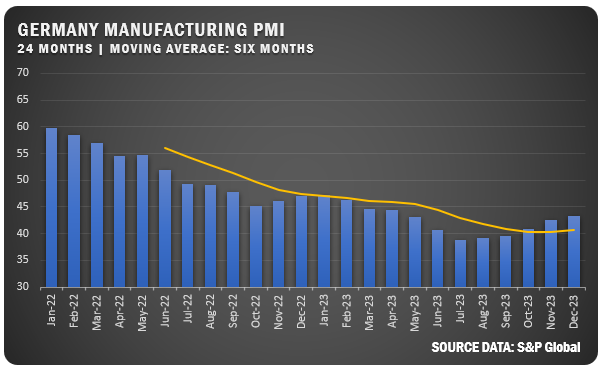

GERMANY: The HCOB Germany Manufacturing PMI moved up to 43.3 percent in December after registering 42.6 in the prior month. Although the reading still indicates German manufacturing is well into contraction territory, the reading did represent a fourth straight month of improvement and was well above the six-month index average. Output and employment fell at a slower rate. The decline in new orders also slowed and business expectations were optimistic for the first time since April of 2023.

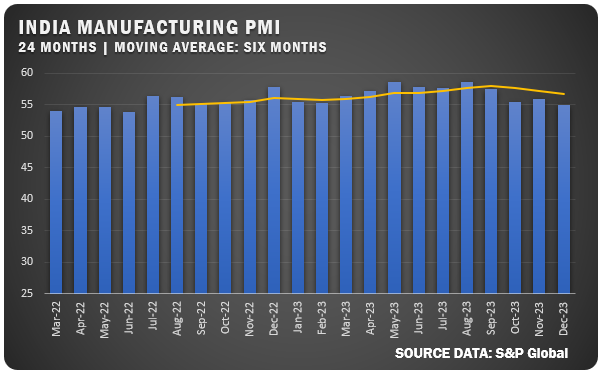

INDIA: The S&P Global India Manufacturing PMI fell to 54.9 percent in December 2023 to reach the lowest reading since June 2022. Despite the falloff from recent highs, manufacturing in India has been in growth territory dating back to July of 2021. The dropoff was related to a slowing in the expansion of output, which is still above the long-run average. New orders growth also slowed. Input costs increased slightly, but not enough to be considered significant. Business confidence was strong.

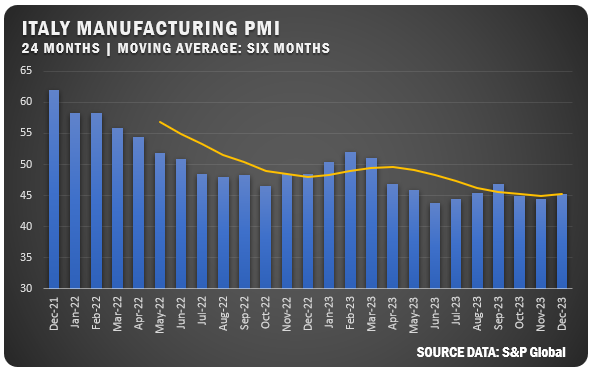

ITALY: The HCOB Italy Manufacturing PMI registered 45.3 in December to push up from 44.4 in November. The increase halted a two-month slid, but Italian manufacturers have been in contraction territory since April of last year. Weak demand continues to be an issue with output and new orders both decreasing. Export orders and production both reduced but at a slower rate. Employment stabilized after two months of headcount reductions. Business optimism was weak.

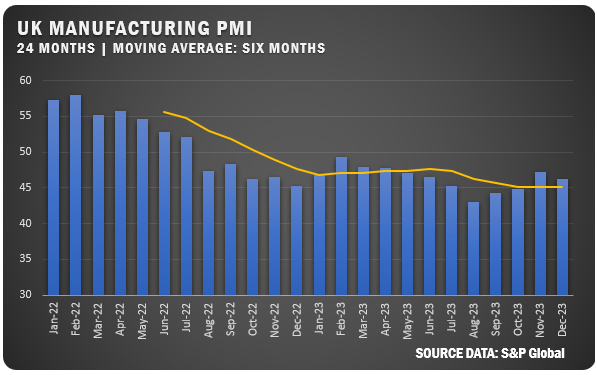

UNITED KINGDOM: The S&P Global UK Manufacturing PMI was reported at 46.2 percent in December 2023 falling from November’s figure of 47.2 percent. The dropoff halted a three-month streak of improvement as output fell based on a reduction in new orders. Export demand also reduced and backlogs of work saw a strong decrease. That led to a 15th consecutive month of employment reductions. Input costs were lower but selling prices were up modestly. Citing the overall economy and high-interest rates, business optimism hit a 12-month low.

Source: Institute for Supply Management®, PMI®(Purchasing Manager Index), Report On Business®. For more information, visit the ISM® website at www.ismworld.org.