US Manufacturing Shifts to Expansion in January

Canada, Mexico and China PMI readings slip based on global trade policy concerns

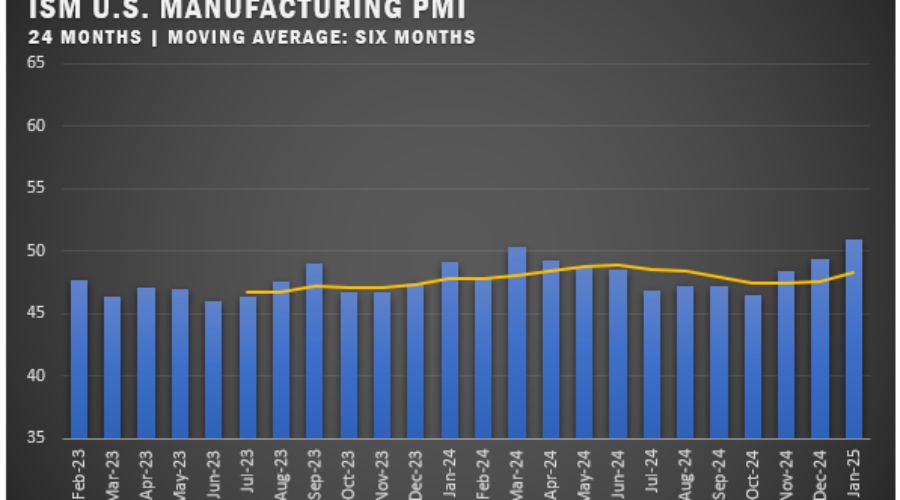

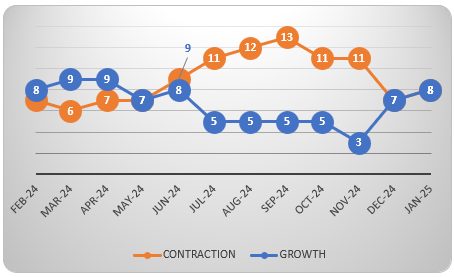

The U.S. manufacturing sector showed signs of recovery in January, marking its first expansion after 26 consecutive months of decline, according to the latest Manufacturing ISM Report On Business. Supply chain executives reported stronger demand, improving production levels and stable employment conditions, signaling positive momentum for the industry.

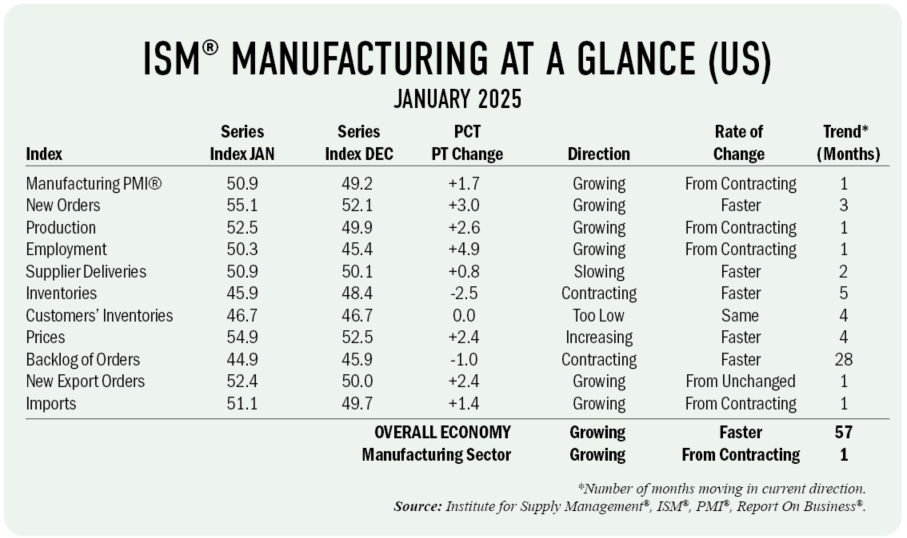

The Manufacturing PMI rose to 50.9 percent, up 1.7 percentage points from December’s adjusted 49.2 percent, indicating a return to growth. This expansion aligns with broader economic resilience, as the overall U.S. economy maintained growth for the 57th consecutive month, excluding a temporary contraction in April 2020.

Key demand indicators pointed to strengthening market conditions. The New Orders Index increased for the third straight month, climbing three percentage points to 55.1 percent, reflecting stronger incoming business. Additionally, export demand rebounded, with the New Export Orders Index reaching 52.4 percent, up 2.4 percentage points from December. Meanwhile, the Backlog of Orders Index declined slightly to 44.9 percent, suggesting that companies are making progress in fulfilling previous commitments.

On the production front, the Production Index jumped 2.6 percentage points to 52.5 percent, returning to expansion after eight months of contraction. Employment conditions also showed improvement, with the Employment Index climbing to 50.3 percent, a 4.9 percentage point increase from December, indicating a more stable labor market as manufacturers adjusted workforce levels.

Supply chain dynamics remained favorable, supporting continued growth. The Supplier Deliveries Index edged up to 50.9 percent, signaling marginally slower deliveries, which typically accompany rising demand. Meanwhile, the Inventories Index declined to 45.9 percent, down 2.5 percentage points, as businesses strategically managed stock levels. Input costs continued to rise at a moderate pace, with the Prices Index increasing 2.4 percentage points to 54.9 percent, reflecting growing cost pressures.

Looking ahead, ISM’s survey panelists remain cautiously optimistic. While four of the six largest manufacturing industries — Petroleum and Coal Products, Chemical Products, Machinery and Transportation Equipment — expanded in January, broader sector growth remains a challenge. Managing price pressures as demand recovers will be a key focus for manufacturers throughout 2025.

COMMODITIES

Up in Price: Aluminum* (14); Aluminum Coil; Freight Rates; Industrial Gases; Natural Gas (4); Packaging Materials (2); Steel — Scrap; and Sulfur.

Down in Price: Aluminum*; Plastic Resins (3); Polypropylene Resin (2); Solvents (3); Steel — General (2); and Steel — Hot Rolled (3).

In Short Supply: Electrical Components (52); Electronic Components (10); Labor — Construction; Rare Earths; and Semiconductors.

*Indicates both up and down in price.

US SECTOR REPORT

ISM Growth Sectors (8): Textile Mills; Primary Metals; Petroleum and Coal Products; Chemical Products; Machinery; Transportation Equipment; Plastics and Rubber Products; and Electrical Equipment, Appliances and Components.

ISM Contraction Sectors (8): Nonmetallic Mineral Products; Miscellaneous Manufacturing; Wood Products; Fabricated Metal Products; Furniture and Related Products; Computer and Electronic Products; Paper Products; and Food, Beverage and Tobacco Products.

JANUARY ISM REPORT COMMENTS

(U.S. Manufacturers)

● “Customer orders slightly stronger than expected. Seeing more general price increases for chemicals/raw materials. No International Longshoremen’s Association strike is a tremendous help.” Chemical Products

● “Although we are in our busy season, our demand for the first two weeks of 2025 has outpaced normal levels for this period of time.” Machinery

● “Business is slowly improving.” Electrical Equipment, Appliances and Components

● “Capital equipment sales are starting 2025 off strong. Normally, we see a soft start to the year, so this strong start is unusual.” Fabricated Metal Products

● “New orders are still good but decreasing compared to previous quarters. Working through current backlog.” Miscellaneous Manufacturing

● “Automotive order demand continues to be consistent and on a steady pace. Beginning to look at hiring additional team members once again. Pricing is holding firm. Having to work overtime to cover plant inefficiency to date.” Primary Metals

● “Looking forward to a year of strong customer demand and higher sales than 2024.” Textile Mills

● “Alleviating supply chain conditions are noticeably pivoting back into acute shortage situations, with headwinds following. For aerospace and defense companies, critical minerals supply chains are tightening dramatically due to Chinese restrictions. Concerns are growing of an environment of more supply chain shortages.” Transportation Equipment

● “As the U.S. administration transfers, we will continue to monitor impact of tariffs on materials used for manufacturing. China stimulus is helping us win orders and increase use of services and consumables. Cost pressures remain for all materials and parts but are starting to stabilize.” Computer and Electronic Products

● “Volume in 2025 is targeting 2-percent growth. The organization is mindful of potential tariffs and what to do with re-routing or cost increases in supply chains that are impacted.” Food, Beverage and Tobacco Products

GLOBAL PMI NOTES

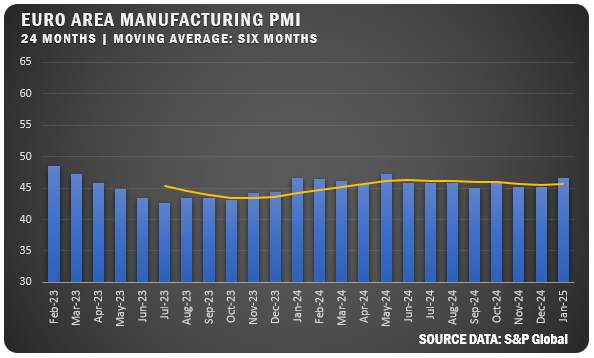

EUROZONE: Eurozone manufacturing showed signs of stabilizing as the HCOB PMI improved to 46.6 percent in January 2025, up from 45.1 percent in December, marking the slowest contraction since May 2024. While new orders and output continued to decline, job cuts persisted and input costs rose for the first time since August, though businesses held off on passing costs to customers.

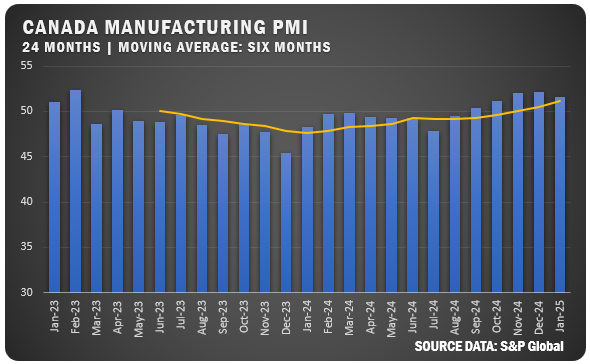

CANADA: Canada’s manufacturing sector expanded for the fifth straight month, with the PMI at 51.6 percent in January, though growth slowed from December’s 52.2 percent. Export sales rebounded for the first time since August 2023 as U.S. buyers accelerated purchases ahead of potential tariffs, but trade uncertainty and rising input costs weighed on confidence.

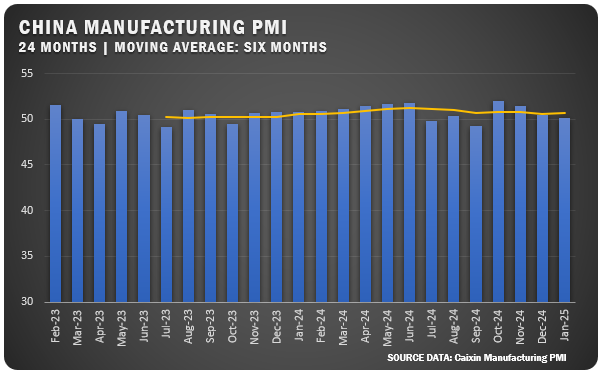

CHINA: China’s factory activity grew for the fourth consecutive month in January, with the Caixin PMI at 50.1 percent, though at a slower pace than December’s 50.5 percent. While output expanded, foreign orders shrank, employment declined sharply, and selling prices fell at the fastest rate since mid-2023, though business confidence improved.

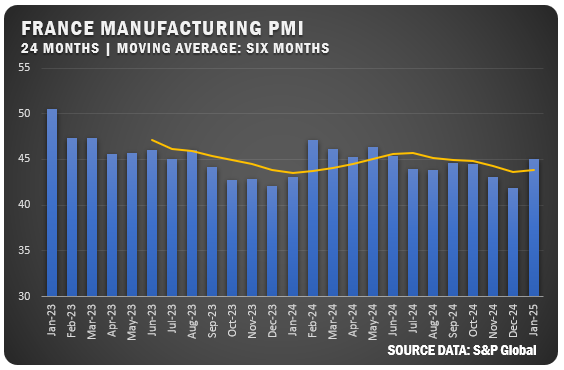

FRANCE: French manufacturing remained in recession but the PMI reading bumped up to 45.0 percent in January from 41.9 percent in December, signaling a milder downturn. Despite weaker demand, firms managed to reduce backlogs, while input cost inflation eased, but persistent job cuts and ongoing price competition kept business sentiment subdued.

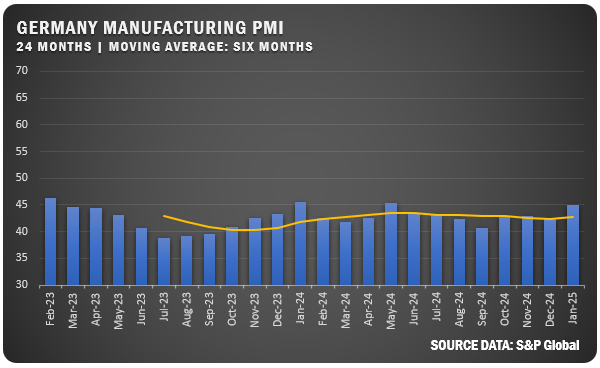

GERMANY: Germany’s manufacturing sector showed tentative improvement as the PMI climbed to 45.0 percent in January from 42.5 percent in December, though it remained in contraction. New orders and output declined at a slower rate, but workforce reductions extended to 19 months, and weak demand continued to limit pricing power.

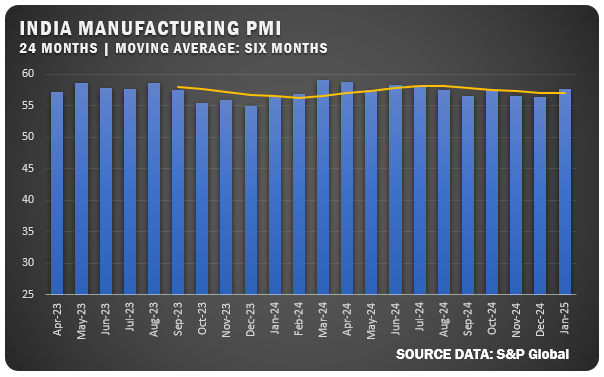

INDIA: India’s manufacturing sector maintained strong momentum, with the PMI at 57.7 percent in January, reflecting the fastest expansion since July 2024. New orders, exports and hiring surged, driving robust production growth. Input price inflation remained modest, supporting continued business optimism.

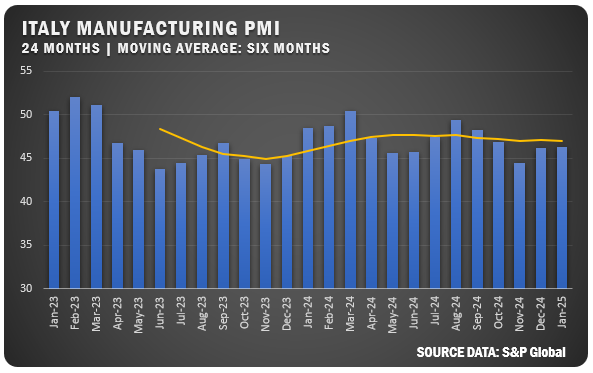

ITALY: Italy’s manufacturing downturn extended for the 10th month, with the PMI at 46.3 percent in January, slightly up from December’s 46.2 percent but below forecasts. While job cuts and weak demand persisted, firms grew more optimistic about 2025, driven by hopes of political stability and stronger client orders.

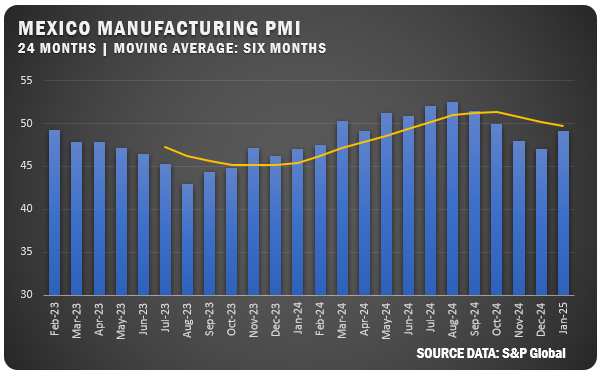

MEXICO: Mexico’s manufacturing sector saw a sharper slowdown in January, with the S&P Global PMI slipping to 49.1 from 49.8 in December, marking the steepest contraction in three months. Weakened demand, declining output and falling international sales contributed to job cuts, while businesses lowered selling prices for the first time since late 2023 amid rising concerns over trade conditions.

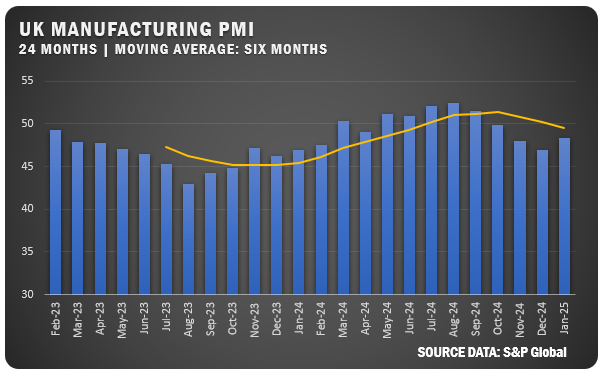

UNITED KINGDOM: U.K. manufacturing showed improvement as the PMI rose to 48.3 percent in January from December’s 47.0 percent, though operating conditions remained tough. Output and new orders continued to shrink, employment declined at the fastest pace in nearly a year, and cost pressures intensified, dampening business confidence.

Sources: S&P Global, Trading Economics and Institute for Supply Management, PMI (Purchasing Manager Index), Report On Business.

Learn more about ISM at ismworld.org.