US Manufacturing Slump Eases Slightly in December

Eurozone and UK Struggle Amid Demand Weakness, While Canada and India Show Resilience

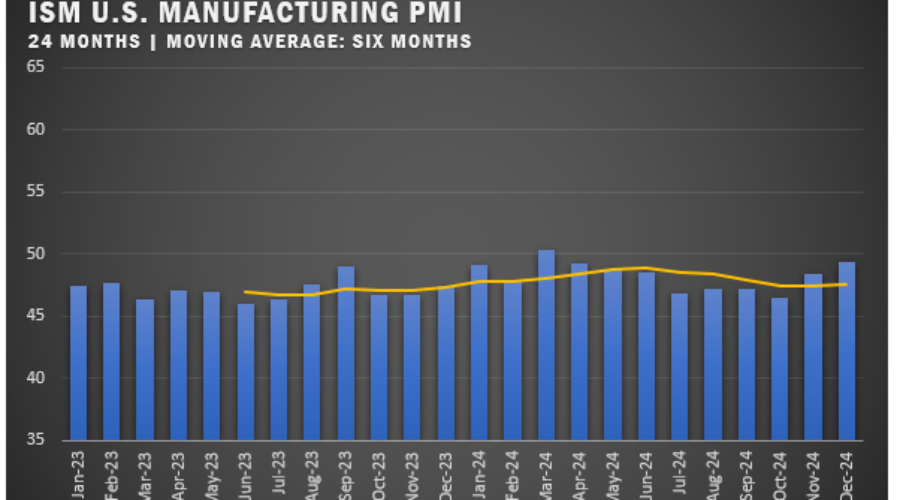

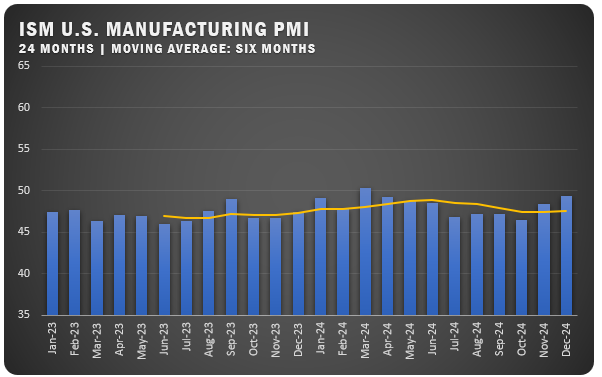

The US manufacturing industry faced contraction for the ninth consecutive month in December, marking the 25th month of decline out of the past 26, according to the latest Manufacturing ISM Report On Business. Released by Timothy R. Fiore, CPSM, C.P.M., Chair of ISM’s Manufacturing Business Survey Committee, the report offers a mixed outlook with some signs of stabilization amid ongoing challenges.

Key Metrics and Highlights

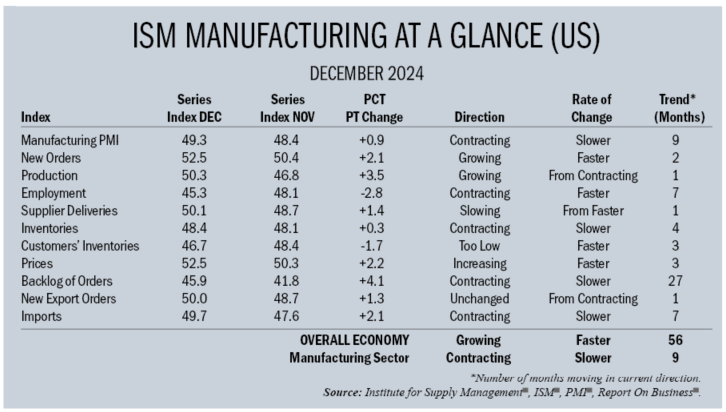

The Manufacturing PMI reached 49.3 percent in December, a 0.9 percentage-point rise from November’s 48.4 percent, indicating a slower rate of contraction. Historically, a PMI above 42.5 percent signifies overall economic expansion, which continued for the 56th month despite manufacturing sector struggles.

Several sub-indices revealed encouraging trends:

● The New Orders Index rose to 52.5 percent, up 2.1 percentage points, marking its second month of expansion after seven months of decline.

● The Production Index rebounded to 50.3 percent, 3.5 percentage points higher, returning to growth after six months in contraction.

● The Prices Index climbed to 52.5 percent, reflecting rising prices for inputs, a 2.2 percentage-point increase over November.

Other indicators showed mixed results. The Backlog of Orders Index improved to 45.9 percent (+4.1 points), while the Employment Index dropped to 45.3 percent (-2.8 points), suggesting continued workforce reductions. Meanwhile, supplier delivery times slowed marginally, with the Supplier Deliveries Index registering 50.1%, up 1.4 percentage points.

Broader Insights

Fiore noted that while manufacturing contracted overall, the pace of decline slowed compared to November. Demand conditions showed signs of recovery, with new orders and export orders strengthening. Factory output stabilized, but employment contracted further, likely due to year-end adjustments for 2025 readiness.

On the input side, inventories and imports showed slight improvements but remained in contraction territory, while prices rose moderately. “Inputs generally supported future demand growth,” Fiore explained, adding that production execution aligned with November’s plans.

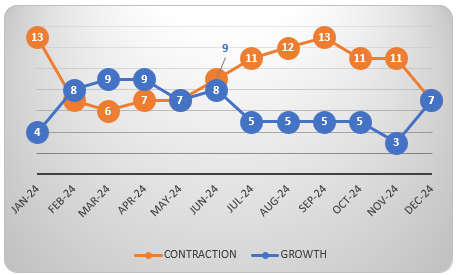

Despite these developments, the manufacturing sector continued to face headwinds. Approximately 52 percent of the sector’s gross domestic product (GDP) was in contraction in December, down from 66 percent in November. Additionally, nearly half of the industry reported PMI readings below 45%, signaling ongoing challenges.

Fiore says, “While demand improved and production steadied, the sector remains under pressure. None of the six largest manufacturing industries saw growth in December, underscoring the difficulties facing the industry as it heads into 2025.”

COMMODITIES

Up in Price: Aluminum (13); Caustic Soda (2); Copper (3); Electronic Components; Labor — Temporary; Methanol; Natural Gas (3); Packaging Materials; Steel — General*; Steel — High Carbon; and Steel-Making Elements*.

Down in Price: Diesel Fuel (2); Plastic Resin (2); Polypropylene Resin; Solvents (2); Steel — General*; Steel — Hot Rolled (2); Steel — Scrap; and Steel-Making Elements*.

In Short Supply: Electrical Components (51); Electronic Components (9); and Labor — Construction Services and Skilled.

*Indicates both up and down in price.

US SECTOR REPORT

ISM GROWTH SECTORS (7): Primary Metals; Electrical Equipment, Appliances and Components; Wood Products; Furniture and Related Products; Paper Products; Miscellaneous Manufacturing; and Plastics and Rubber Products.

ISM CONTRACTION SECTORS (7): Textile Mills; Fabricated Metal Products; Printing and Related Support Activities; Machinery; Chemical Products; Transportation Equipment; and Nonmetallic Mineral Products.

DECEMBER ISM REPORT COMMENTS

(U.S. Manufacturers)

● There is definitely an uptick this month, though not a stable one.” Primary Metals

● “The orders have increased slightly due to seasonal restocking.” Plastics and Rubber Products

● “Combo of seasonal factors plus increased demand outlook for 2025.” Miscellaneous Manufacturing

● “Slightly lower due to seasonality and end-of-year destocking.” Chemical Products

● “Automotive and powersport volume decreases.” Transportation Equipment

● “We are seeing a softening in sales. This is concerning as it’s our peak season.” Food, Beverage and Tobacco Products

● “We are constrained by technical labor, despite higher-than-normal backlog.” Computer and Electronic Products

● “Significant slowdown in production requirements in the last two months of the year.” Machinery

● “Order levels well below forecast projections.” Fabricated Metal Products

● “The increase in new orders has our plant at full capacity.” Electrical Equipment, Appliances and Components

GLOBAL PMI NOTES

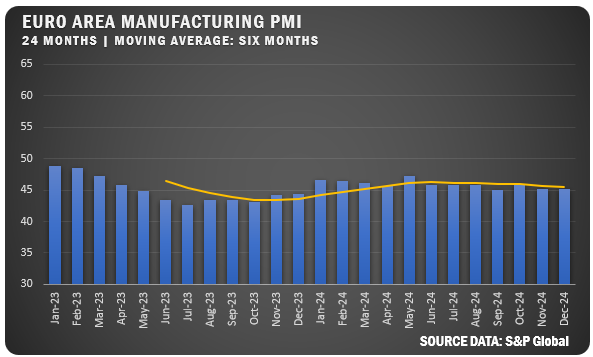

EUROZONE: Eurozone manufacturing activity continued its downturn in December, with the HCOB Manufacturing PMI slipping to 45.1 percent, the sharpest decline in three months. Weak demand led to reduced output and new orders, while employment fell, particularly in Germany and France, and purchasing activity saw a notable drop. Output costs declined for the fourth consecutive month, while backlogs decreased further despite lower capacity utilization. Although business confidence showed slight improvement, it remained muted amid persistent contractionary pressures.

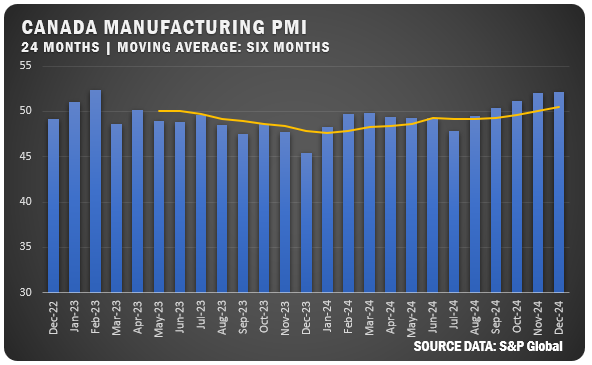

CANADA: Canada’s manufacturing PMI increased to 52.2 percent in December, marking the strongest growth since February 2023 and the fourth consecutive month of expansion. Gains were driven by higher output and new orders, alongside sustained employment growth. Export activity remained steady despite rising US tariff concerns, while strikes in postal and port services worsened vendor performance and drove record-high finished goods inventories. Input price inflation reached its highest level since April 2023, but overall confidence in the sector hit its highest point in 18 months.

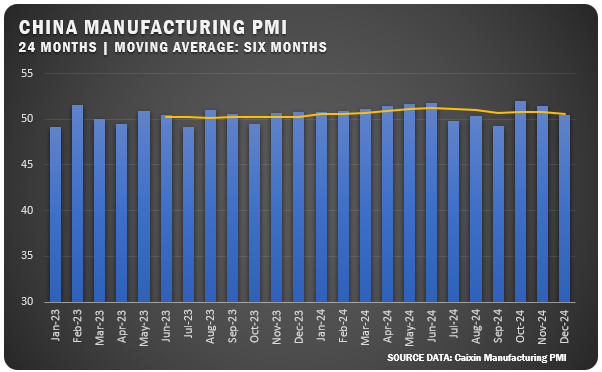

CHINA: China’s manufacturing sector expanded for the third straight month, with the PMI at 50.5 percent in December, though down from November’s five-month high of 51.5 percent. Growth slowed in output and new orders, while foreign orders contracted, reversing gains seen in November. Employment continued to decline, leading to backlogs rising for a third month. Buying levels increased as firms built safety stocks, but confidence dipped to a three-month low due to trade uncertainties and concerns about US tariffs.

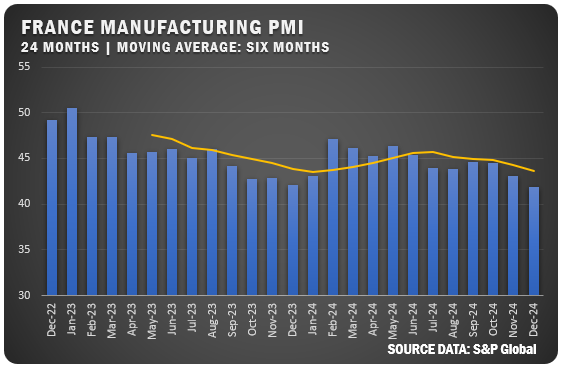

FRANCE: France’s manufacturing PMI fell to 41.9 percent in December, the sharpest decline since May 2020, as weak demand caused new orders and output to drop significantly. Input purchasing was slashed, inventories were reduced and employment shrank at the steepest rate in five months. To stimulate sales, manufacturers lowered prices for the third consecutive month despite rising input costs. Business sentiment remained negative, with concerns over demand softness and political uncertainty clouding the outlook.

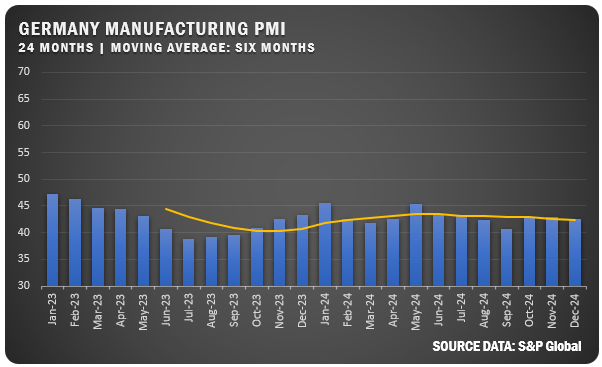

GERMANY: Germany’s manufacturing PMI was confirmed at 42.5 percent in December, marking a sharp contraction as weak demand led to further declines in output and new orders. Companies continued cutting jobs and inventories, though the pace of reductions slowed. Input lead times improved and purchase prices fell further, though overall business confidence remained subdued amid economic and political concerns.

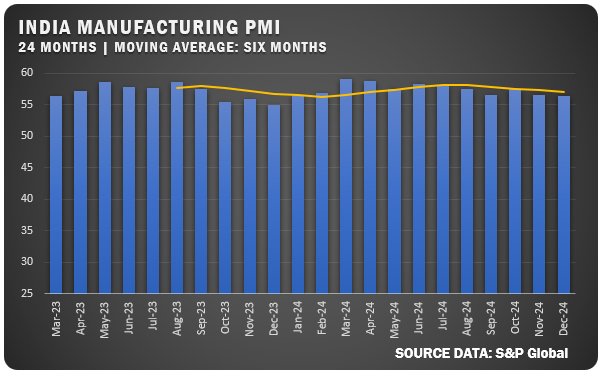

INDIA: India’s manufacturing PMI dipped slightly to 56.4 percent in December, the slowest growth since the year began, but operating conditions remained robust. Output, new orders and employment continued to rise, with job creation accelerating to its fastest pace in four months. Input cost inflation stayed moderate while selling prices increased at a strong pace. Optimism for 2025 remained high, driven by expectations of strong demand and investment in advertising and infrastructure.

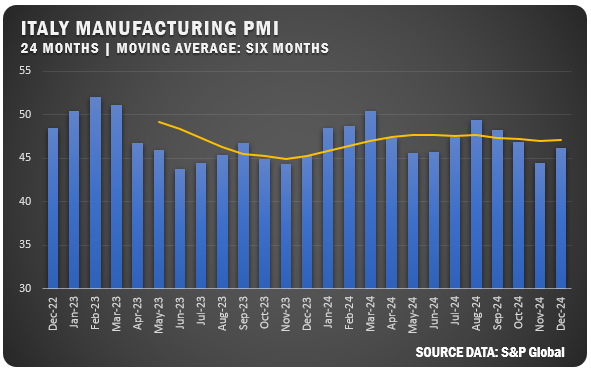

ITALY: Italy’s manufacturing PMI improved to 46.2 percent in December, signaling a slower but still solid decline in the sector. Output and new orders remained weak, particularly in automotive and export demand, marking the 21st consecutive month of falling new export orders. Input prices rose for the first time in three months, prompting firms to cut jobs and reduce purchasing activity. Despite these challenges, manufacturers expressed the highest confidence levels since August 2024, anticipating a recovery in demand.

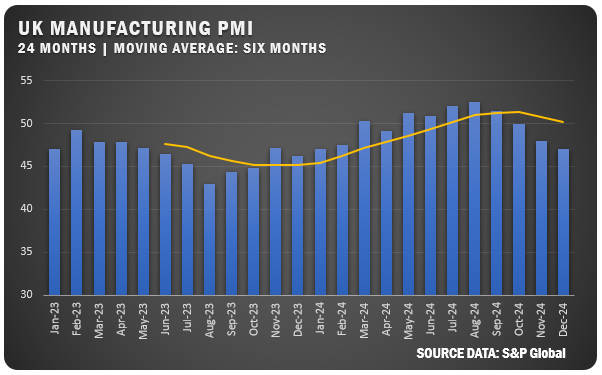

UNITED KINGDOM: The UK’s manufacturing PMI fell to 47 percent in December, the fastest contraction in 11 months, with output and new orders declining sharply. Export sales suffered the steepest drop since October 2023 due to weaker European demand and customer destocking. Input prices rose at the fastest rate since January 2023, contributing to further job cuts. Business optimism dropped to a two-year low as sentiment weakened across all sectors and company sizes.

Source: Institute for Supply Management®, PMI® (Purchasing Manager Index), Report On Business®. For more information, visit the ISM® website at www.ismworld.org.