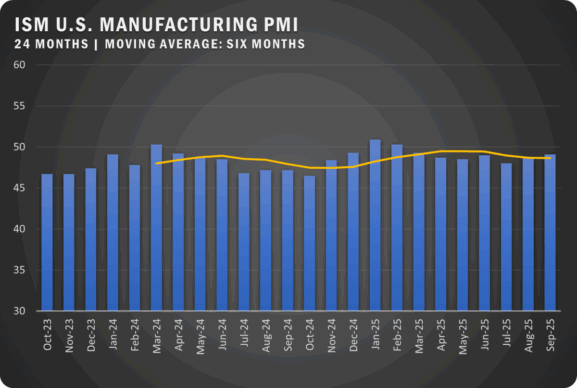

US Manufacturing Stays Flat For August

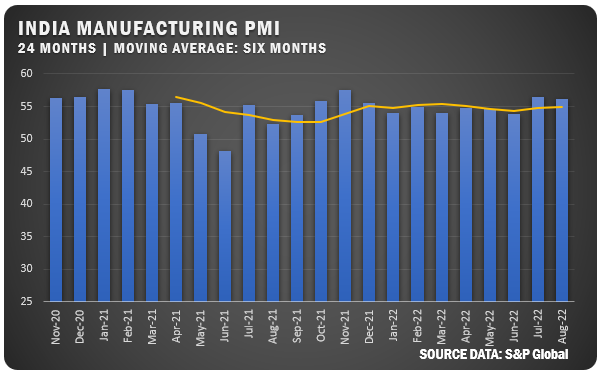

Manufacturing in India remains Strong at 56.2 percent

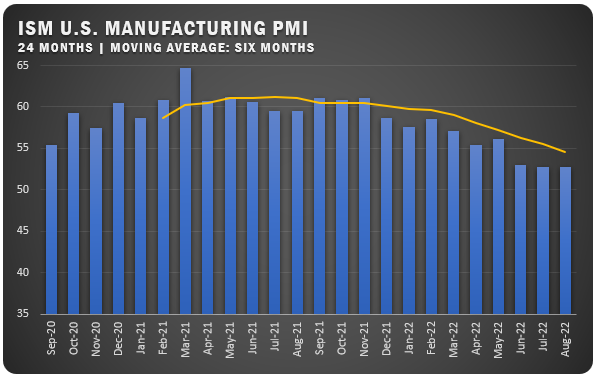

The Institute for Supply Management® (ISM®) reported an August Manufacturing PMI® of 52.8 percent for U.S. manufacturers. The new figure matches the same reading as recorded in July and indicates expansion in the overall economy for the 27th month in a row after a contraction in April and May 2020. For a second straight month, the Manufacturing PMI® figure is the lowest since June 2020, when it registered 52.4 percent. The New Orders Index registered 51.3 percent, 3.3 percentage points higher than the 48 percent recorded in July. The Production Index reading of 50.4 percent is a 3.1-percentage point decrease compared to July’s figure of 53.5 percent. The Prices Index registered 52.5 percent, down 7.5 percentage points compared to the July figure of 60 percent; this is the index’s lowest reading since June 2020 (51.3 percent). The Backlog of Orders Index registered 53 percent, 1.7 percentage points above the July reading of 51.3 percent. After three straight months of contraction, the Employment Index expanded at 54.2 percent, 4.3 percentage points higher than the 49.9 percent recorded in July. The Supplier Deliveries Index reading of 55.1 percent is 0.1 percentage point lower than the July figure of 55.2 percent. The Inventories Index registered 53.1 percent, 4.2 percentage points lower than the July reading of 57.3 percent. The New Export Orders Index contracted at 49.4 percent, down 3.2 percentage points compared to July’s figure of 52.6 percent. The Imports Index remained in expansion territory at 52.5 percent, but 1.9 percentage points below the July reading of 54.4 percent.”

“The U.S. manufacturing sector continues expanding at rates similar to the prior two months. New order rates returned to expansion levels, supplier deliveries remain at appropriate tension levels and prices softened again, reflecting movement toward supply/demand balance,” says Timothy R. Fiore, Chair of the Manufacturing Business Survey Committee. “According to Business Survey Committee respondents’ comments, companies continued to hire at strong rates in August, with few indications of layoffs, hiring freezes or head-count reductions through attrition. Panelists reported lower rates of quits, a positive trend. Prices expansion eased dramatically in August, which — when coupled with lead times easing — should bring buyers back into the market, improving new order levels. Sentiment remained optimistic regarding demand, with five positive growth comments for every cautious comment.

Panelists continue to express unease about a softening economy, with 18 percent of comments noting concern about order book contraction. Twelve percent of panelists’ comments reflect growing worries about total supply chain inventory. Demand increased, with the (1) New Orders Index returning to expansion, (2) Customers’ Inventories Index remaining at a low level, retreating slightly compared to July and (3) Backlog of Orders Index increasing its rate of growth. Consumption (measured by the Production and Employment indexes) improved during the period, with a combined positive 1.2-percentage point impact on the Manufacturing PMI® calculation. The Employment Index returned to expansion after three months of contraction, and the Production Index lost ground but remained in growth territory. With the gains in hiring and fewer supplier delivery issues, production expansion should improve in September. Inputs — expressed as supplier deliveries, inventories and imports — continued to constrain production expansion, but to a lesser extent compared to July. The Supplier Deliveries Index indicated deliveries slowed at a slower rate in August, while the Inventories Index grew at a slower rate as well. The Imports Index expanded in August for the third consecutive month, but at a slower rate compared to July. The Prices Index increased for the 27th consecutive month, at a much slower rate compared to July.

“Of the six biggest manufacturing industries, five — Petroleum & Coal Products; Transportation Equipment; Computer & Electronic Products; Machinery; and Food, Beverage & Tobacco Products — registered moderate-to-strong growth in August.

ISM® REPORT COMMENTS (US Manufacturers)

- “Demand from customers is still strong, but much of that is because there is still fear of not getting product due to constraints. They are stocking up. There will be a reckoning in the market when the music stops, and everyone’s inventories are bloated.” [Computer & Electronic Products]

- “Sales in target business softening month-over-month, down 12 percent by revenue. Inventory days are increasing.” [Chemical Products]

- “Strong sales continue. The impact of the chip shortage is slowing, and the decreasing COVID-19 resurgence in Asia is now affecting production more than chips.” [Transportation Equipment]

- “Supply in most groups is slowly increasing, but demand appears to be outpacing — causing pricing to either stabilize or increase.” [Petroleum & Coal Products]

- “Inventories are far too high, and we are on pins and needles to see how quickly and at what magnitude our busy season begins. We will start seeing that in the next few weeks.” [Food, Beverage & Tobacco Products]

- “Continue to struggle with electronic component shortages. Several smaller machine shops are (manufacturing) the pacing item for our production due to lack of direct labor machinists.” [Machinery]

- “Overall, I have seen much improvement in the availability of raw materials. However, trucking issues continued, and production capacity within some industries remains tight. I have growing concerns that as cement and mineral companies run ‘all out’ to meet demand, we will see more downtime due to maintenance (issues).” [Nonmetallic Mineral Products]

- “Demand is softening; however, we are continuing to produce to replenish inventory.” [Primary Metals]

- “Orders are still strong through the end of the year, but there is a feeling that customers may start pulling back on orders, either cancelling them or pushing them into 2023.” [Plastics & Rubber Products]

- “Business conditions are good, and demand is strong. Securing enough raw material supply to keep up is still a challenge.” [Miscellaneous Manufacturing]

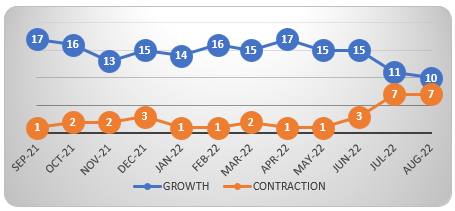

US SECTOR REPORT

ISM® GROWTH SECTORS (10): Nonmetallic Mineral Products; Petroleum & Coal Products; Transportation Equipment; Computer & Electronic Products; Printing & Related Support Activities; Plastics & Rubber Products; Primary Metals; Machinery; Miscellaneous Manufacturing; and Food, Beverage & Tobacco Products.

ISM® CONTRACTION SECTORS (7): Wood Products; Apparel, Leather & Allied Products; Furniture & Related Products; Paper Products; Chemical Products; Fabricated Metal Products; and Electrical Equipment, Appliances & Components.

Global Manufacturing

INDIA: The S&P Global India Manufacturing PMI slipped to points to 56.2 percent for August leading all of the countries Brushware tracks. Output and orders increased, as new export orders showed even stronger growth. Input purchasing increased as supplier performance improved. Work backlogs were up, but employment growth slowed. Cost increases slowed and output prices stayed flat. Business outlook rose to a six-year high in anticipation of higher sales.

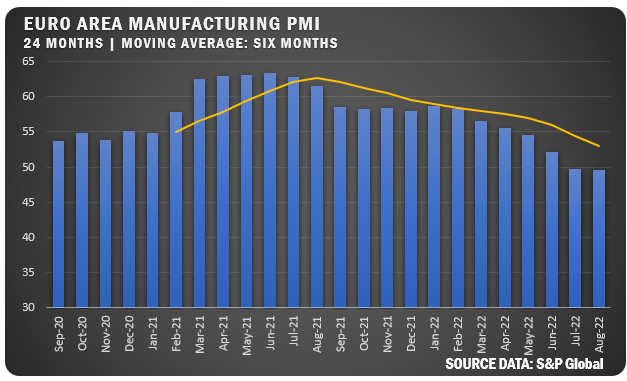

EUROZONE: The S&P Global Eurozone Manufacturing PMI for August slipped further into contraction territory at 49.6 percent after registering 49.8 percent in July. Output declined at a similar rate to July, but new orders fell sharply. In August, weak demand conditions weighed heavily on goods producers as purchasing power across Europe declined due to inflationary pressure. Manufacturers cut back purchasing activity based on the economic outlook, but reduced demand for inputs helped relieve pressure on suppliers. Business outlook rose slightly, but remains at historically low levels.

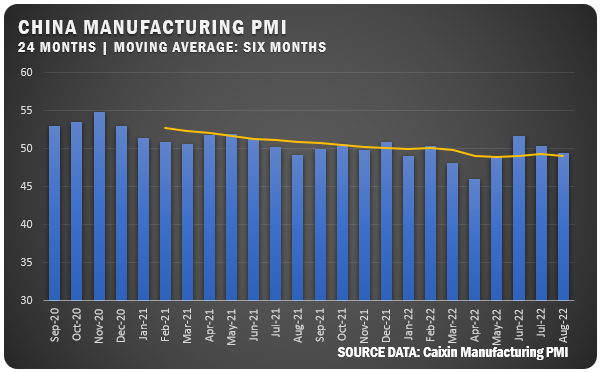

CHINA: The Caixin China General Manufacturing PMI dropped to 49.5 percent in August to slip into contraction territory. The unexpected drop was a result of COVID lockdowns and power outages. Output increased at the slowest rate in the past three months. New orders and purchasing levels fell and employment continued to decline. For the second month in a row, delivery times have extended.

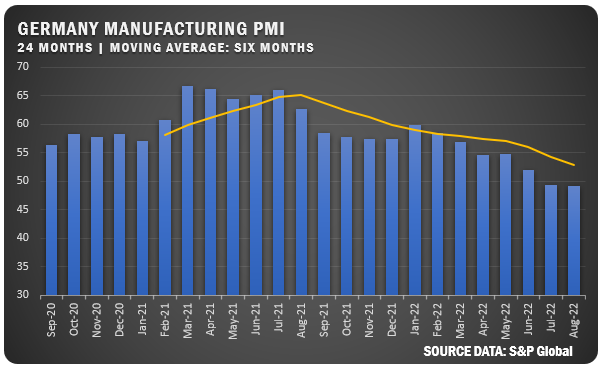

GERMANY: The S&P Global/ ME Germany Manufacturing PMI for Germany slipped to 49.1 percent for August to record a second straight month in contraction territory. A sustained decline in new orders impacted production levels, slowing the factory employment rate. Supply chain constraints eased and the rate of cost inflation came off the recent historic highs but remains at elevated levels primarily based on rising energy prices.

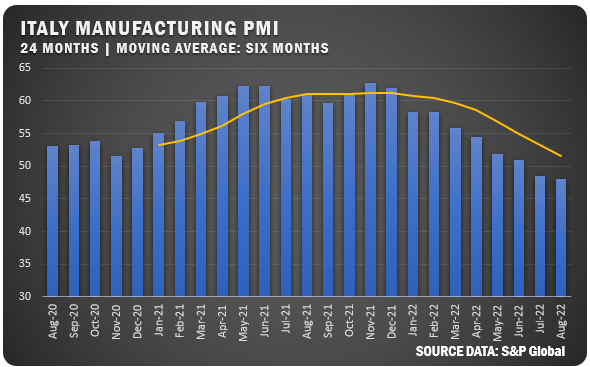

ITALY: S&P Global reported a 48.0 percent Manufacturing PMI for Italian manufacturers for the month of August to continue a decline in factory activity that dates back to December of 2021. New orders dropped and factory output fell for the second month in a row. Lower demand saw manufacturers reduce input purchases and the lower rate of sales caused inventories to increase. Meanwhile, employment grew despite a significant reduction in work backlogs. Lower demand and lower commodity prices allowed inflationary pressure to ease.

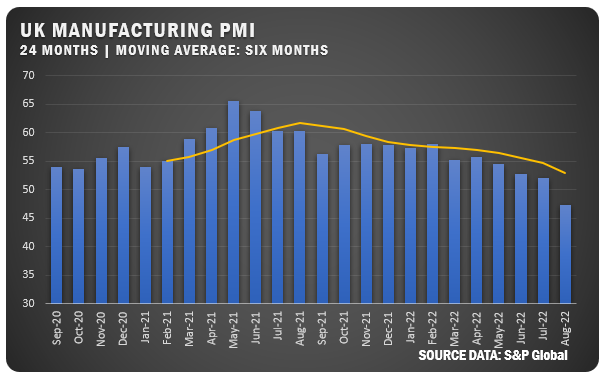

UNITED KINGDOM: The S&P Global/CIPS UK Manufacturing PMI dropped to 47.3 percent for August as the country fell into contraction territory. Output, new orders and exports all fell. However, input cost inflation slowed but still remains at elevated levels.

Credits: Institute for Supply Management®, PMI®, Report On Business®. For more information, visit the ISM® website at www.ismworld.org.