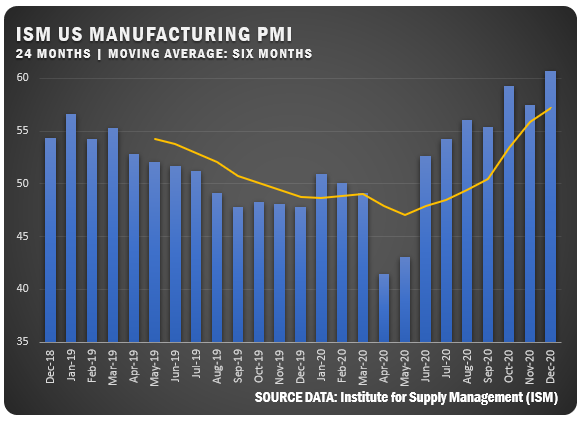

US PMI Drives Higher in December

The Institute for Supply Management® (ISM®) reported a December PMI® of 60.7 percent for US manufacturing, up 3.2 percentage points from the November reading of 57.5 percent. That figure was the highest since August of 2018 and also indicates expansion in the overall economy for the eighth month in a row after contracting in March, April, and May.

“The manufacturing economy continued its recovery in December. Survey Committee members reported that their companies and suppliers continue to operate in reconfigured factories, but absenteeism, short-term shutdowns to sanitize facilities and difficulties in returning and hiring workers are causing strains that are limiting manufacturing growth potential,” says Timothy R. Fiore, ISM® Chair. “However, panel sentiment remains optimistic (three positive comments for every cautious comment), an improvement compared to November.”

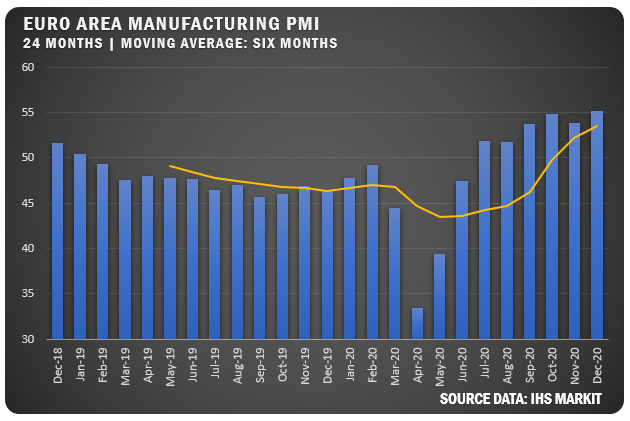

EUROZONE: IHS Markit reported a Eurozone Manufacturing PMI of 55.2 for December indicates the strongest growth in factory activity since 2018. Export orders were up from November and new orders rose for the sixth straight month, but the report indicated that manufacturers reduced staffing levels (20 months of decline for staffing). On the upside, confidence rose to a new three-year high as manufacturers feel operating conditions will drift toward normal by the end of the year.

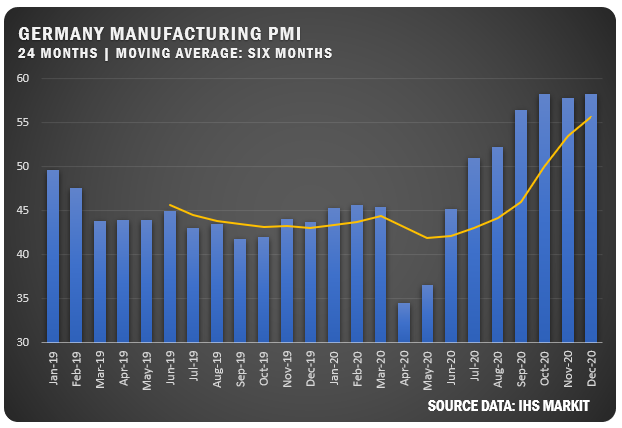

GERMANY: The IHS Markit/BME Germany Manufacturing PMI registered 58.3 in the final month after a dip in November. The new figure is the highest mark for Germany since December of 2017 the figure pointed to the strongest growth in factory activity since February of 2018. Production continued to increase; however, German manufacturers matched the Eurozone trend of reductions in the factory workforce.

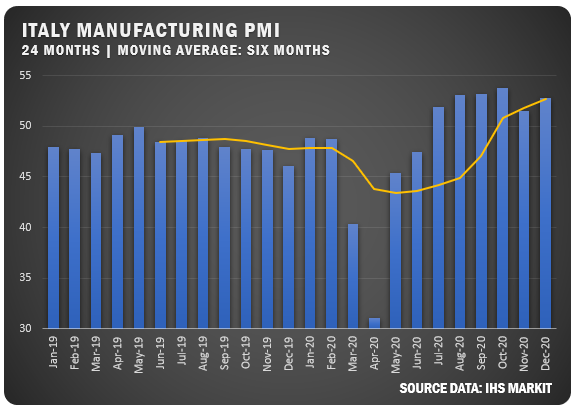

ITALY: IHS Markit reported a manufacturing PMI of 52.8 for Italy in December 2020 which improved from the November dip to 51.5 percent. That put the index right at the six-month average but did not match the two-year high set in October. Italian manufacturers have now had seven consecutive months of increased output. Bucking the Eurozone trend, employment improved to its highest level in two-plus years and backlogs of work declined.

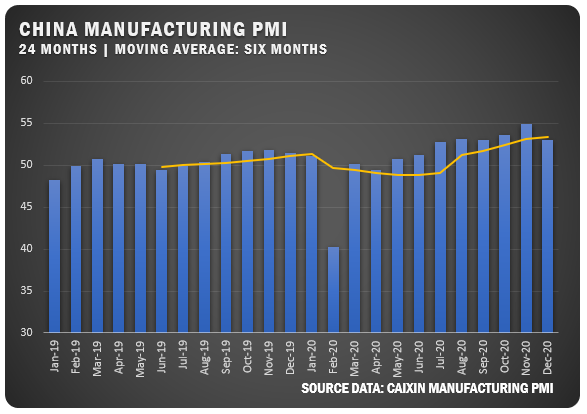

CHINA: The Caixin China General Manufacturing PMI dropped to 53 percent in December after reaching a 10-year-high of 54.9 in November. Caixin indicated manufacturers had been cautious on hiring and the workforce numbers were broadly stagnant. Wang Zhe, senior economist at Caixin Insight Group says, “We expect the economic recovery in the post-epidemic era to continue for several months, and macroeconomic indicators will be stronger in the next six months.”

ADDITIONAL US REPORT NOTES

ISM REPORT HIGHLIGHTS

- The Production Index hit a 10-year high, as the last reading above 64.8 percent was in January 2011 (65.3 percent), with five of the top six industries reporting moderate to strong expansion.

- The New Orders Index registered 67.9 percent, up 2.8 percentage points from the November reading of 65.1 percent.

- The Production Index registered 64.8 percent, an increase of 4 percentage points compared to the November reading of 60.8 percent.

- The Backlog of Orders Index registered 59.1 percent, 2.2 percentage points higher compared to the November reading of 56.9 percent.

- The Employment Index returned to expansion territory at 51.5 percent, 3.1 percentage points higher from the November reading of 48.4 percent.

- The Supplier Deliveries Index registered 67.6 percent, up 5.9 percentage points from the November figure of 61.7 percent.

- The Inventories Index registered 51.6 percent, 0.4 percentage point higher than the November reading of 51.2 percent.

- The Prices Index registered 77.6 percent, up 12.2 percentage points compared to the November reading of 65.4 percent.

- The New Export Orders Index registered 57.5 percent, a decrease of 0.3 percentage point compared to the November reading of 57.8 percent.

- The Imports Index registered 54.6 percent, a 0.5-percentage point decrease from the November reading of 55.1 percent.

US SECTOR REPORT

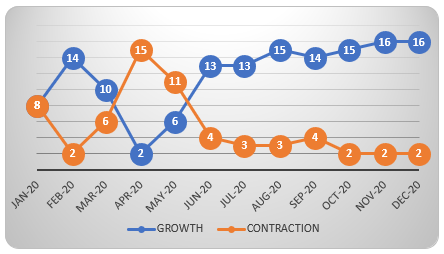

ISM GROWTH SECTORS (16): Apparel, Leather & Allied Products; Furniture & Related Products; Wood Products; Fabricated Metal Products; Machinery; Computer & Electronic Products; Transportation Equipment; Plastics & Rubber Products; Paper Products; Chemical Products; Petroleum & Coal Products; Primary Metals; Textile Mills; Electrical Equipment, Appliances & Components; Food, Beverage & Tobacco Products; and Miscellaneous Manufacturing.

ISM CONTRACTION SECTORS (2): Printing & Related Support Activities; and Nonmetallic Mineral Products.

RESPONDENTS TO ISM REPORT

- “Our company and industry are continuing to have tailwinds from the COVID-19 pandemic research support for vaccines and treatments. While our services are delayed, many customers are not canceling outright, and business picked up for us in the last month — especially in China, where business growth is back on track.” (Computer & Electronic Products)

- “Continued to survive COVID-19 shutdowns, customer restrictions and personnel issues (work from home and COVID-19 outbreaks) and managed to maintain slight growth over 2019.” (Chemical Products)

- “COVID-19 outbreaks are causing supply chain issues for Tier-1 and Tier-2 suppliers. More work needs to (be done to) ensure suppliers keep us in the loop with any problem in their supply chain. But end-customer demand for products is keeping production and future outlook positive.” (Transportation Equipment)

- “COVID-19 is affecting us more strongly now than back in March. Vendors/service suppliers unable to maintain levels of service due to employee shortages. Logistic issues also hurting us due to coronavirus-related problems.” (Food, Beverage & Tobacco Products)

- “Current business outlook is strong through the first quarter of 2021. We are anticipating 20 percent growth in sales for 2021.” (Fabricated Metal Products)

- “Sales are now slightly above pre-COVID-19 sales.” (Machinery)

- “Sales are now exceeding pre-COVID-19 levels, but uncertainty remains through the winter months while COVID-19 is still rampant.” (Miscellaneous Manufacturing)

- “Business is stronger than expected, with higher demand for many products. Volatility continues due to the very persistent pandemic and associated risks.” (Electrical Equipment, Appliances & Components)

- “Suppliers are having difficulty finding and retaining labor leading to supply constraints.” (Plastics & Rubber Products)

- “Fourth-quarter production improved more than anticipated, both against the rolling forecast and compared to typical Q4 business.” (Primary Metals)