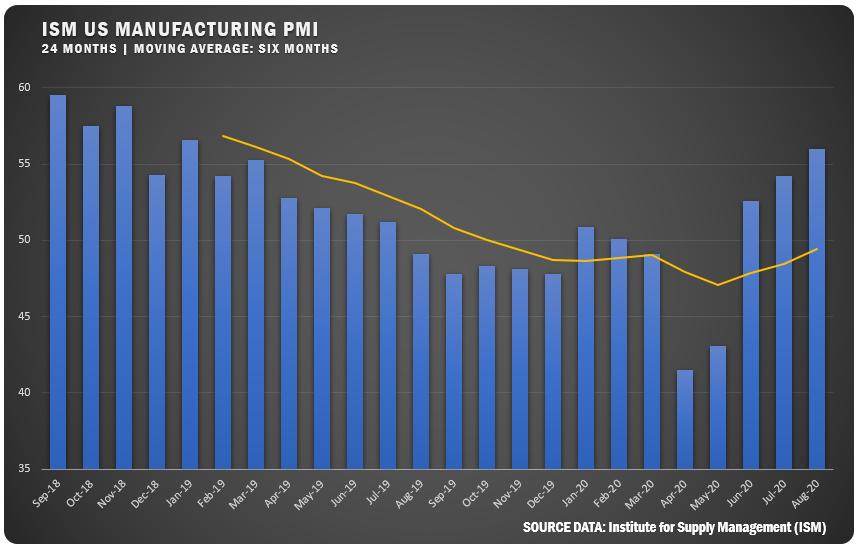

August PMI Figures Continue Upward Trend

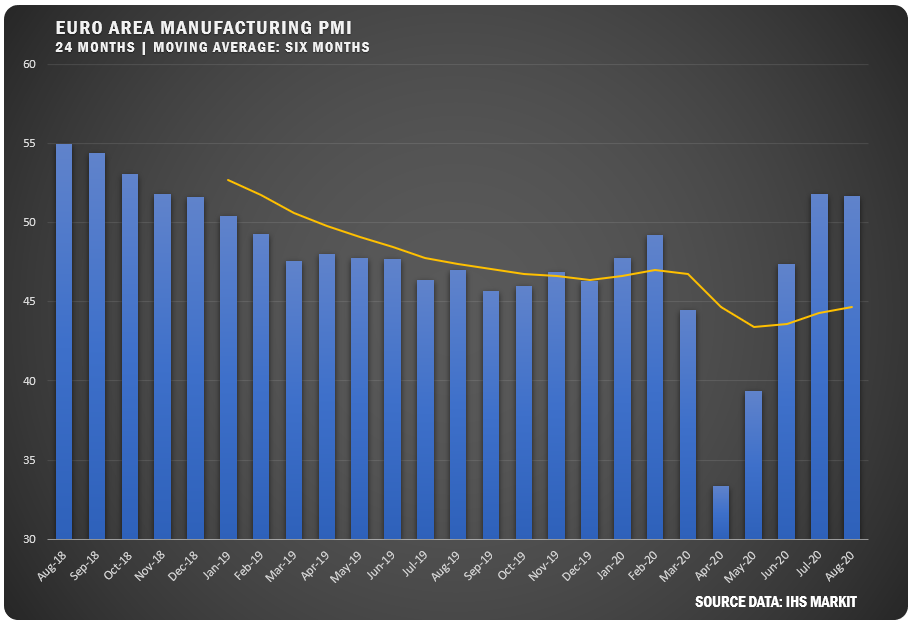

US manufacturers continue to lead the global trend for PMI growth as ISM® reported a PMI of 56 percent for August. While the Euro Area figure slipped from 57.8 to 57.1, Germany and Italy both saw improvement after entering growth territory the previous month.

USA: The Institute for Supply Management’s Report on Business indicated the US manufacturing sector continues to recover, with August as the first full month of operations after supply chains restarted and adjustments were made for employees to return to work since the COVID-19 outbreak. The report noted that survey committee members indicated that companies and suppliers are operating in reconfigured factories, with limited labor due to safety restrictions.

“Impacted by the current economic environment, many panelists’ companies are holding off on capital investments for the rest of 2020, says Timothy R. Fiore, ISM Chair. “In addition, commercial aerospace equipment companies, office furniture and commercial office building subsuppliers and companies operating in the oil and gas markets — as well as their supporting supply bases — are and will continue to be impacted due to low demand. These companies represent approximately 20 percent of manufacturing output. This situation will likely continue at least through the end of the year.”

EUROZONE: The IHS Markit Eurozone Manufacturing PMI registered a slightly lower 51.7 for August 2020. Manufacturing output growth was recorded for a second successive month and improved to reach its highest level for over two years. Confidence about the future also improved and is at it’s highest level in two years.

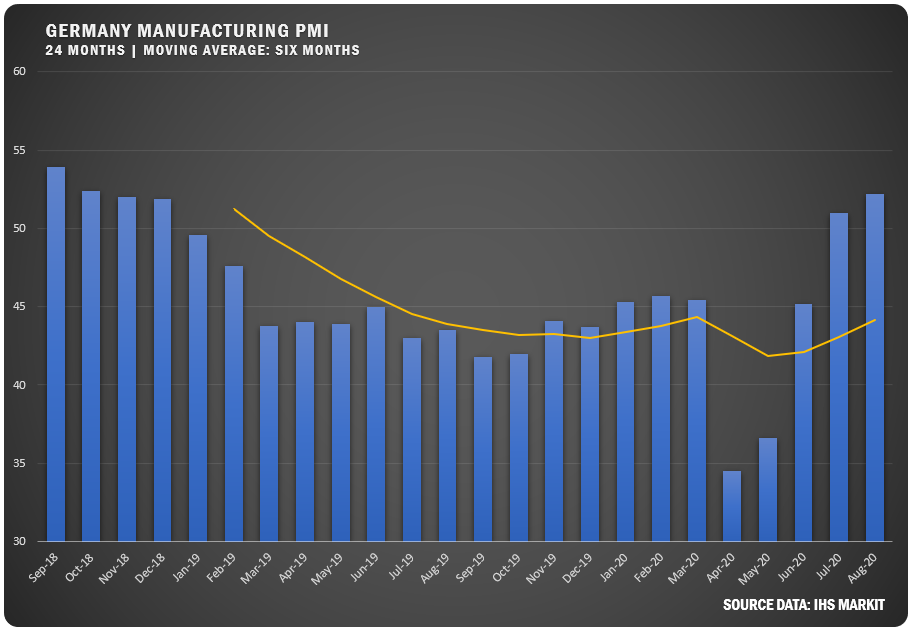

GERMANY: The IHS Markit Germany Manufacturing PMI was 53 percent to push further into growth territory and indicated a second straight month of increasing factory activity and the strongest growth since October of 2018.

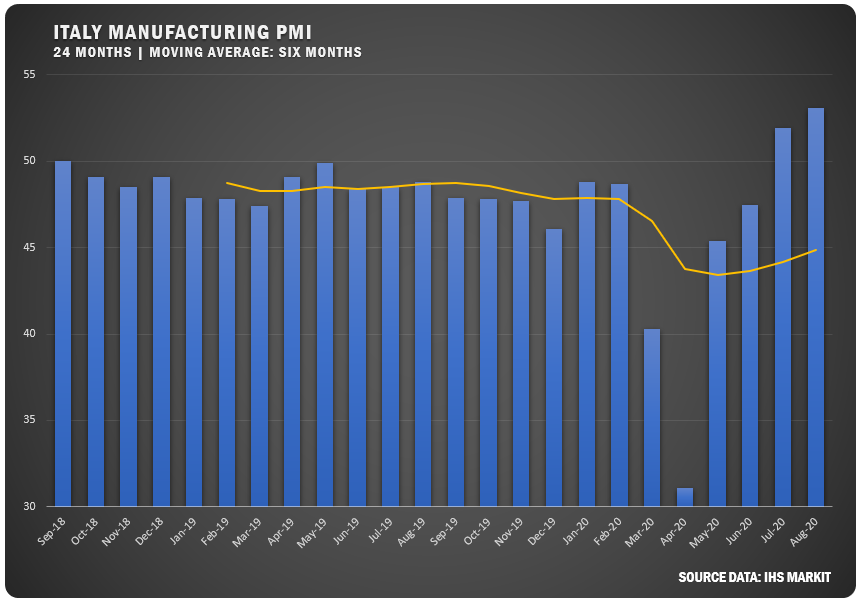

ITALY: The IHS Markit Italy Manufacturing PMI registered 53.1 in August to out pace market expectations of 52.0. Like Germany it represented the second consecutive month of improvement in operating conditions and the strongest since June 2018. Output and new orders grew and purchasing activity rose for the first time since June 2018.

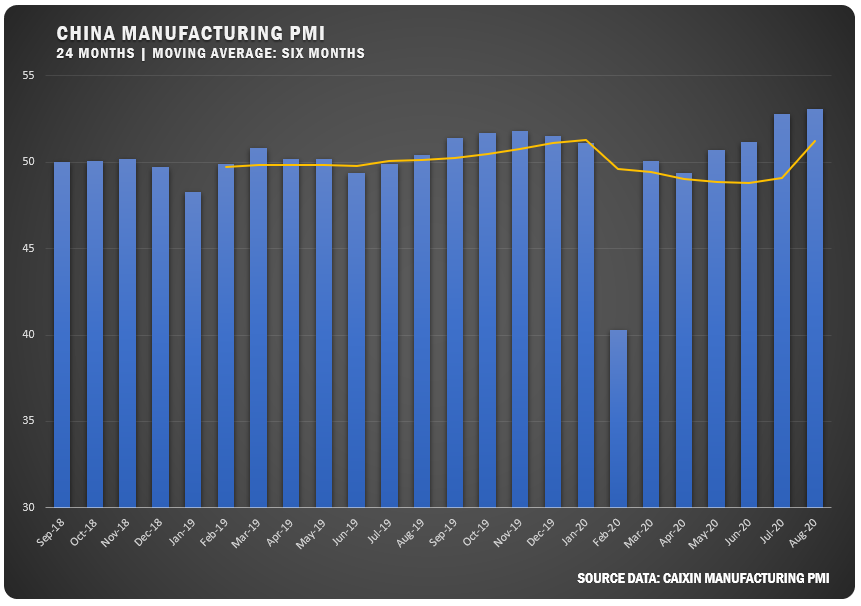

CHINA: The Caixin China General Manufacturing PMI rose to 53.1 to beat the market consensus of 52.6 and improve from the July reading of 52.8 percent. Caixin says the figure pointed to the biggest improvement in the health of the Chinese manufacturing sector with output and new orders growing by the most since the start of 2011. Additionally, new export sales rose for the first time since December 2019.

US GROWTH SECTORS (15): Wood Products; Plastics & Rubber Products; Food, Beverage & Tobacco Products; Textile Mills; Chemical Products; Computer & Electronic Products; Primary Metals; Fabricated Metal Products; Machinery; Apparel, Leather & Allied Products; Nonmetallic Mineral Products; Miscellaneous Manufacturing; Electrical Equipment, Appliances & Components; Paper Products; and Transportation Equipment.

US CONTRACTION SECTORS (3): Printing & Related Support Activities; Petroleum & Coal Products; and Furniture & Related Products.

ISM® RESPONDENT COMMENTS

Watching COVID-19 situations in Mexico, Brazil, Philippines [and] Hong Kong. High rates of COVID-19 surging. Currently, lines of supply no longer impacted by COVID-19 related events.” (Computer & Electronic Products)

“Business is very good. Production cannot keep up with demand. Some upstream supply chains are starting to have issues with raw material and/or transportation availability.” (Chemical Products)

“Airline industry continues to be under great pressure.” (Transportation Equipment)

“Current sales to domestic markets are substantially stronger than forecasted. We expected a recession, but it did not turn out that way. Retail and trade customer markets are very strong and driving shortages in raw material suppliers, increasing supplier orders.” (Fabricated Metal Products)

“Homebuilder business continues to be robust, with month-over-month gains continuing since May. Business remains favorable and will only be held back by supply issues across the entire industry.” (Wood Products)

“We are seeing solid month-over-month order improvement in all manufacturing sectors such as electrical, auto and industrial goods. Looking to add a few factory operators.” (Plastics & Rubber Products)

“Rolling production forecasts are increasing each week compared to prior forecast.” (Primary Metals)

“[Production ramp-up] has been a struggle. We have started and stopped lines numerous times at all 18 of our manufacturing plants due to COVID-19 issues. Surprisingly, our direct suppliers have done an excellent job on shipping ingredients and packaging on time.” (Food, Beverage & Tobacco Products)

“Strong demand from existing and new customers for our products, stable-to-decreasing input costs for our operations, and record numbers of new business opportunities from prospective customers’ reshoring measures. All trends continuing from the first quarter of fiscal year 2017.” (Electrical Equipment, Appliances & Components)

“Capital equipment new orders have slowed again. Quoting is active. Many customers waiting for the fourth quarter to make any commitments.” (Machinery)

“We are starting to see parts of our business rebound in August, while other parts remained weak. Some of our export business has come back for the first time since the start of COVID-19; however, domestic portfolios remain mixed.” (Paper Products)

Source: Institute for Supply Management®, ISM®, PMI®, Report On Business®. For more information, visit the ISM® website at www.ismworld.org.