Economic Forecast 2025: A Welcome Economic Rebound

By Phillip M. Perry

Healthy economic growth will help bolster profits for construction and manufacturing operations in 2025. Lower interest rates, a decline in inflation, a rebound in housing activity and governmental infrastructure support will generate tailwinds. However, businesses must beware of supply chain disruptions resulting from geopolitical tensions, as well as the growing threat of tariffs.

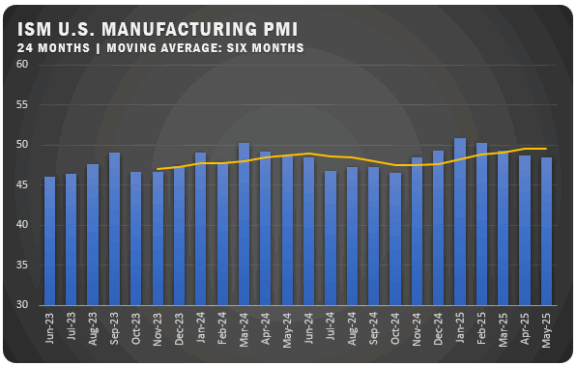

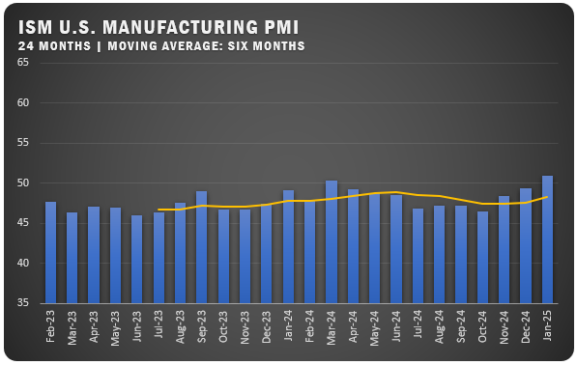

Manufacturers can look forward to a gradually improving operating environment in 2025, thanks to lower interest rates, moderating inflation and steady if unspectacular growth in the nation’s overall economic activity.

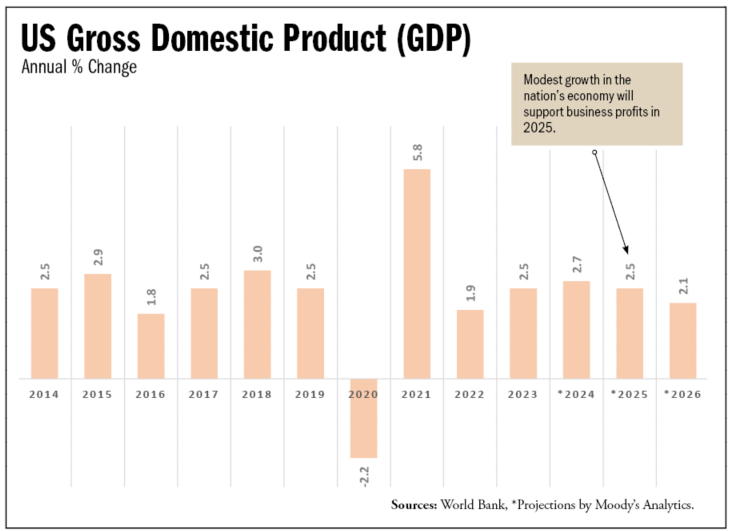

“We look for real GDP growth of 2.5 percent in 2025,” says Bernard Yaros Jr., Lead U.S. Economist at Oxford Economics (www.oxfordeconomics.com). (Gross Domestic Product, the total value of the nation’s goods and services, is the most commonly utilized measure of economic growth. “Real” GDP subtracts the effects of inflation).

The good news is that the 2.5 percent boost is not far off what economists peg as the nation’s “natural growth rate” — one that supports business activity and maintains full employment. And reduced volatility in the GDP growth pattern in recent years suggests the nation is on a glide path to a so-called “soft landing,” avoiding a recession after a lengthy inflationary binge (see chart, page 30).

Despite its positive nature, the GDP figure for 2025 is slightly lower than the 2.7 percent anticipated when 2024 numbers are finally tallied. That’s because the nation is in a so-called “late-stage expansion,” characterized by a tendency to slow down while maintaining sufficient force to invigorate commercial operations.

Fair Winds

In 2025, construction operations and manufacturers can look forward to a decline in both interest rates and inflation — two bugbears that have drained profits in recent times. “We anticipate a federal funds interest rate of 2.75 percent by the end of 2025, down from a recent 4.75 percent,” says Yaros. “And we look for inflation to average 2.2 percent in the final quarter of 2025, which will be within spitting distance of the Fed’s two-percent target.” That’s an improvement from the 2.5 percent inflation level toward the end of 2024. (These figures represent the Federal Reserve’s preferred measure of inflation: the “core personal consumption expenditure deflator [PCED]” which strips out volatile food and energy prices).

Relief from the costs of interest and inflation will help fatten the bottom lines of businesses everywhere. “We anticipate corporate profits will increase 9.6 percent in 2024 and 9.0 percent in 2025, up from their 6.9 percent gain in 2023,” says Yaros.

Reports from the field confirm the economists’ optimistic view. “Our members are looking forward to a growth year in 2025, largely from expectations that interest rates will decline,” says Tom Palisin, Executive Director of The Manufacturers’ Association, a York, Pa., based consortium with nearly 500 member companies (www.mascpa.org). The change in fortunes can’t come soon enough, he adds. “High interest rates have been putting constraints on many of our members who have been trying to maintain their financial margins, so relief in this area will be helpful.”

Construction Rebounds

Analysts expect construction companies and manufacturers to share in the nationwide economic upsurge. Economists expect healthy growth in housing activity, a mighty driver for the economy. “We forecast housing starts to increase by 6.2 percent in 2025, after falling by 4.7 percent in 2024 and declining 8.4 percent in 2023,” says Yaros.

Why the rebound? A decline in the cost of money and a concomitant loosening of credit standards. “Lower mortgage rates should help the single-family home market,” says Bill Conerly, Principal of his own consulting firm in Lake Oswego, Oregon (www.conerlyconsulting.com). “It will be a little less painful for people with three percent or four percent mortgages to give them up, sell their current houses and move up.”

Housing is not the only construction sector that will do well. “This is the era of the megaproject, and future prospects are quite positive for contractors who are able to participate in major public works,” says Anirban Basu, Chairman & CEO of Sage Policy Group

(www.sagepolicy.com). Basu noted that much construction activity is being driven by the re-emergence of industrial policymaking in America, an economic transformation that has led to programs such as the Inflation Reduction Act, the Chips and Science Act and the Infrastructure Investment and Jobs Act.

“Manufacturers are receiving billions of dollars in subsidies for large-scale infrastructure projects, computer chip and battery manufacturing plants and data centers, many in support of technological transformation such as the growth of artificial intelligence,” says Basu.

For contractors dependent upon multifamily construction, hotels or retrofits of existing office space, the 2025 outlook is a bit more bleak. “High interest rates have led to very high financing costs, along with the general inflation experienced within the construction sector,” says Basu. “And banks have become more reluctant to lend, partly because of an increase in regulatory oversight. As a result, certain contractors have become vulnerable to a lack of work and they are quite concerned about 2025.”

A change in fortune will not happen overnight. “With lower interest rates, there’ll be an easier time lining up project financing at an acceptable cost,” says Basu. “But these things take time. We might see some softness in a meaningful fraction of contractors in 2025. And then perhaps things get a bit better in 2026 as these lower interest rates prompt more activity.”

Healthy Employment

The economy does better when people are optimistic, since consumer spending accounts for a large portion of the nation’s business activity. While consumers remain troubled by the residual effects of inflation in the form of high prices for gas and groceries, they remain in a fairly good mood. “We look for consumer confidence to move slightly higher in 2025,” says Scott Hoyt, Senior Director of Consumer Economics for Moody’s Analytics (www.economy.com).

Why the optimism? Healthy employment levels. “We look for the unemployment rate to end 2025 at 4.2 percent and 2026 at 4.2 percent,” says Yaros. This is roughly in line with the 4.1 percent reported toward the end of 2024. Many economists peg an unemployment rate of 3.5 percent to 4.5 percent as the “sweet spot” that balances the dual risks of inflationary wage escalation and economic recession.

If favorable unemployment figures will encourage consumer spending, employers should also enjoy relief from the deleterious effects of the past year’s tight labor conditions. “While many contractors continue to view the lack of skilled labor as their number one challenge, it is not necessarily of the same magnitude as a year ago,” says Basu. “The number of available unskilled job openings has shrunk, particularly in construction, thanks to a slowing economy, so hiring has slowed. Residential contractors in particular appear to be looking for fewer workers.”

Softening employment growth has given workers less bargaining power, so employers are experiencing some much-needed relief from the rising trendline of worker wages. Entry-level hourly wage increases came to 3.7 percent in 2024 at Palisin’s member companies, markedly lower than the vigorous eight to 10 percent levels clocked for each of the previous two years. Historically, such increases have tended to settle in the 2.5 percent to 3.0 percent range.

National figures concur. “The Employment Cost Index (ECI) is slowing,” says Hoyt, referring to a common measure of average worker wages. “We are forecasting 2.8 percent growth in 2025, compared to 3.9 percent in 2024 and 4.5 percent in 2023.”

Despite the ongoing de-escalation in the ECI, Hoyt says it remains healthy enough to support consumer spending, as does the expected increase in the nation’s total personal income level, an important driver of business activity. Like the ECI, it is expected to follow a familiar 2025 trendline: a healthy increase despite de-escalation. “Mainly because of slower job growth, we have the increase in wage and salary income slowing to 4.7 percent in 2025, compared to our expectation of 6.6 percent for 2024, and 5.4 percent for 2023,” says Hoyt.

Maybe it’s a looser labor market, but employers are in no hurry to trim their employee rosters. “Employers want to maintain their ability to jump on the growth side once the economy rebounds a little,” says Hoyt. “So employment levels have held fairly steady.”

Supply Chains

Construction companies will benefit from a national commitment to reposition supply chains in the United States. “Logistical issues are persuading many CEOs to place production closer to final consumers,” says Basu. “There is also a trend toward favoring nations that provide significant protection for intellectual property.”

Indeed, many contractors are concerned about the re-emergence of supply chain issues. “It’s taking longer to ship equipment around the world, in part because of issues in the Red Sea,” says Basu. “Cargo is being diverted and having to travel much longer distances in many instances, especially cargo from Asia. That leads to increases in the cost of transportation and insurance, which squeezes margins for contractors.”

Palisin confirmed that supply chain disruptions are not a thing of the past. “We are seeing shortages around semiconductor chips and some other technological products, as well as chemicals, equipment assemblies and metal parts. That’s causing production delays and late deliveries.”

There are a number of causes for the problem. Over the past year, the nation has lacked sufficient skilled workers to meet production demands. And in an environment of high interest rates and slowing growth, companies did not invest as much as required in new facilities. “As for the semiconductor situation specifically, there’s this huge demand coming up against a shortfall in global supply,” says Palisin.

While the U.S. is committed to the reshoring of production, the task of increasing domestic manufacturing and delivery systems will take time. “We are not going to turn things around right away,” says Palisin.

The Road Ahead

Despite optimism on the part of businesses and consumers, economists eye some dark clouds on the horizon. In the opening months of 2025, they advise construction companies and manufacturers to keep a close watch on the following areas for any deleterious changes:

Interest Rates: “Going forward, the major concern for businesses will be the pace of interest rate cuts and where they will end up,” says Yaros.

Inflation: “If the consumer price index returns to positive territory, that could throw a monkey wrench into many business plans,” says Conerly.

Tariffs: “Tariffs amount to price increases for our members who have to buy materials from abroad,” says Palisin.

Geopolitics: “An increasing level of turmoil around the world can disrupt supply chains,” says Conerly.

Concerning as these risks are, economists anticipate a fairly benign operating environment in 2025. “The U.S. economy has been remarkably resilient despite all the hits it’s taken over the past few years,” says Yaros. “We don’t anticipate a recession, as the Federal Reserve will be dialing back the restrictiveness of monetary policy, and there are no glaring imbalances in the economy.

This article appears in the 2024 November-December issue of Brushware and can also be viewed in the full digital edition.