Global Manufacturing Cools Off in November

After surging to two-year highs in October, the US and Eurozone manufacturing numbers for November dipped slightly with Germany and Italy also following the pattern. China was the exception as the Caixin PMI registered 54.9 to hit a new series high.

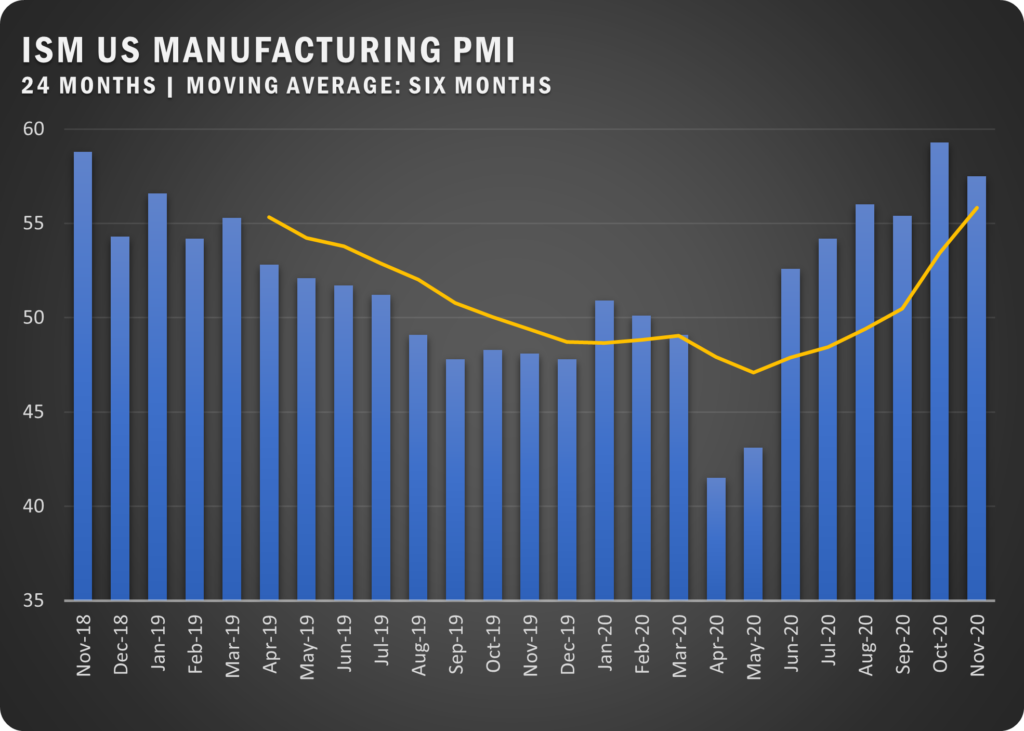

US: ISM® reported a US manufacturing PMI of 57.5 percent for November after reaching 59.3 percent in October. Following the COVD-19 driven contraction in April, ISM® says US manufacturing has now experienced seven straight months of expansion.

“Manufacturing performed well for the sixth straight month with demand, consumption and inputs registering growth, but at slower rates compared to October. Labor market difficulties, both current and anticipated at panelists’ companies and their suppliers, will continue to dampen the manufacturing economy until the coronavirus crisis ends,” says Timothy R. Fiore, ISM® Manufacturing Business Survey Committee Chair.

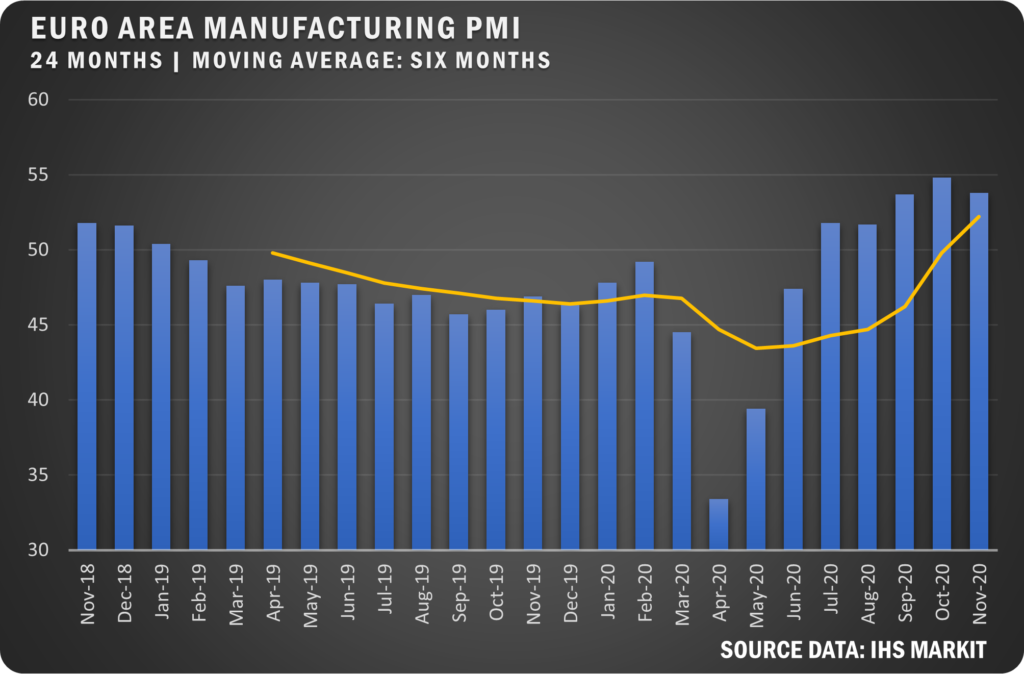

EUROZONE: IHS Markit reported a November PMI of 53.8 percent for European manufacturers, which fell below the October figure of 54.8. With the exception of Ireland and the Netherlands, all countries in the region dropped in November.

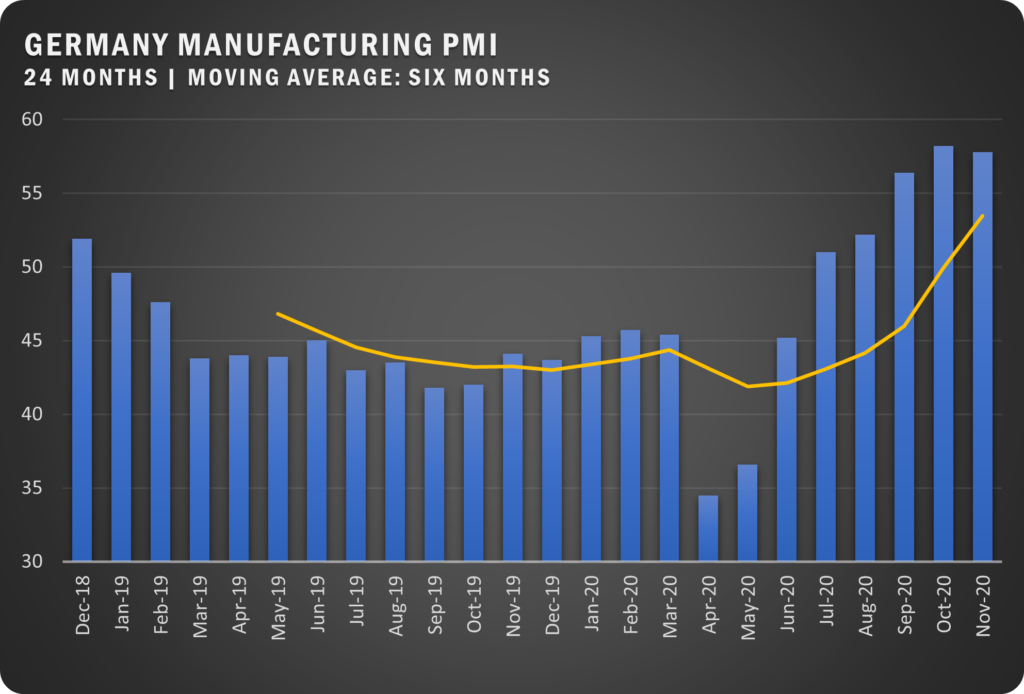

GERMANY: Despite a half-point pull back from the October three-year high, Germany’s November IHS Markit PMI of 57.8 was the strongest in the Eurozone. The slight drop off was attributed to the COVID-19 resurgence and new lockdown restrictions in Germany and other countries. Export orders dipped but are still strong due to increased sales in Europe and China.

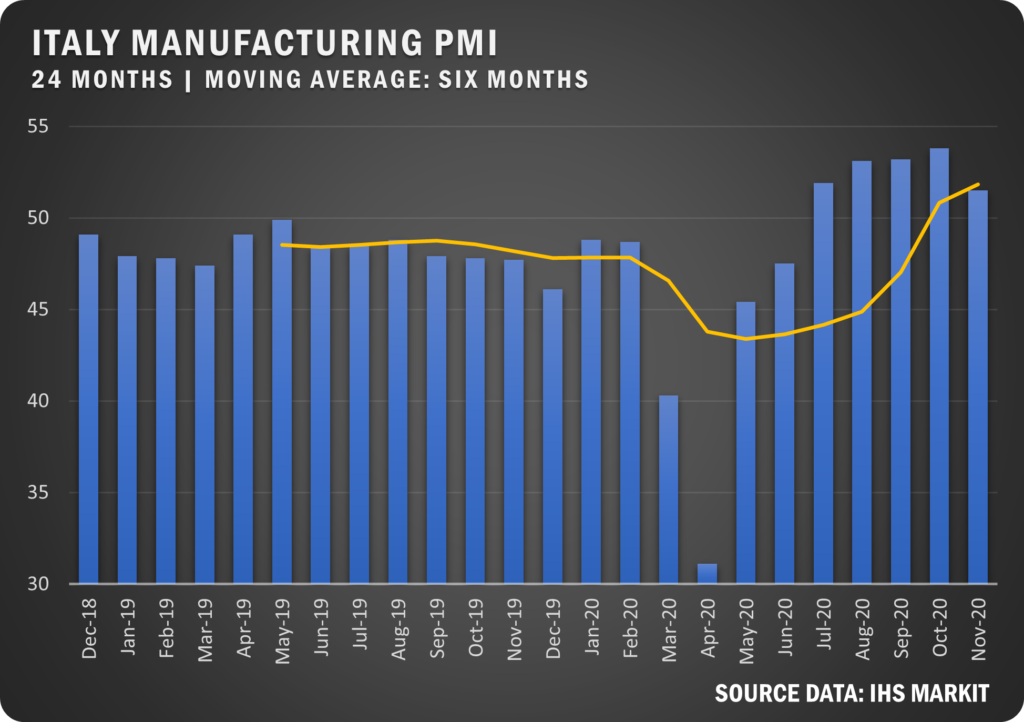

ITALY: After hitting a 31-month high in October of 53.8 percent, IHS Markit reported 2.3 percent pullback in November for Italian manufacturers at 51.5. It was still the fifth consecutive month of expansion, but IHS says manufacturers reported the lowest level of positive sentiment for the business outlook since May—although sentiment is still historically higher than normal.

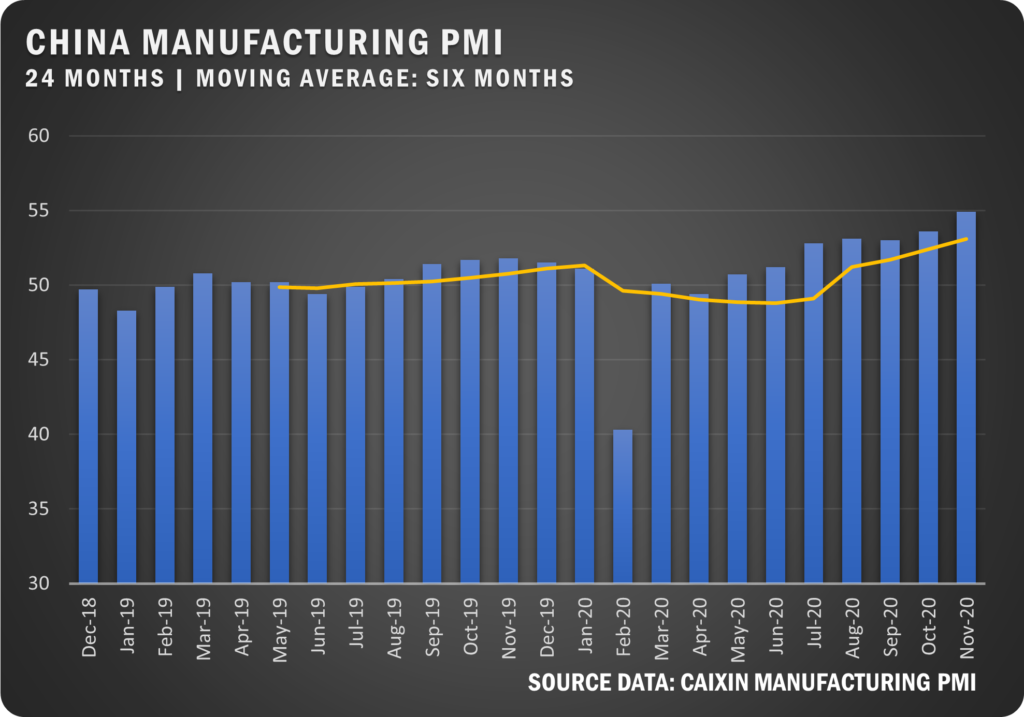

CHINA: The Caixin China General Manufacturing PMI surged to 54.9 percent in November building on the new high of 53.6 set in October. Output and new orders surged while employment grew the most since May 2011. Capacity issues are a concern with the rate of backlog accumulation increasing the most since April and the active market led to extended delivery times from suppliers.

US SECTOR REPORT

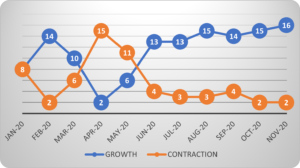

ISM GROWTH SECTORS (16): Apparel, Leather and Allied Products; Nonmetallic Mineral Products; Textile Mills; Wood Products; Electrical Equipment, Appliances and Components; Fabricated Metal Products; Plastics and Rubber Products; Primary Metals; Chemical Products; Machinery; Computer and Electronic Products; Paper Products; Miscellaneous Manufacturing; Transportation Equipment; Furniture and Related Products; and Food, Beverage and Tobacco Products.

ISM CONTRACTION SECTORS (2): Printing and Related Support Activities; and Petroleum and Coal Products.

ISM® RESPONDENT COMMENTS

- “Business continues to be strong with significant back-orders. Suppliers have struggled to hire people, as we have to support the increased business. We are seeing significant delays in getting parts and material from China through US ports, especially [at the Port of] Long Beach. Material costs continue to hold steady. The national election and continued COVID-19 uncertainty are concerns.” (Machinery)

- “We will finish out the fourth quarter very strong. Customers have increased demand and 2021 is expected to continue to grow.” (Fabricated Metal Products)

- “Customer order volumes are very strong, but our suppliers are having issues meeting our orders due to people shortages.” (Plastics and Rubber Products)

- “Production issues for petrochemicals are getting resolved after a very active hurricane season. That is helping balance supply and demand.” (Chemical Products)

- “The resurgence in COVID-19 cases is adding strain on our Tier-1 and Tier-2 suppliers. Multiple suppliers mentioned that finding new people is an issue with the COVID-19 situation. And there is a learning curve for new [supplier] hires, impacting production efficiency at their places.” (Transportation Equipment)

- “Our business is booming, as many customers need products ASAP. A great situation.” (Primary Metals)

- “We are getting a lot more COVID-19 hits in our factories. We are also sending employees home for 14 days to quarantine if they were in close proximity to individuals that tested positive. We have had to shut down production lines due to lack of staffing. Cost of goods sold [COGS] is much higher than normal due to labor and production inefficiencies.” (Food, Beverage and Tobacco Products)

- “Jet fuel being down in consumption really hurts the refining market.” (Petroleum and Coal Products)

- “Sales have been steady, but down 30 percent year over year. Work hours for production are going up, but still have several on lay-off. Starting to see some inflationary pressure on materials.” (Furniture and Related Products)

- Suppliers are still experiencing labor shortages resulting in component constraints. However, we’re seeing life from customers, so there’s a positive outlook moving into the first quarter of 2021.” (Computer and Electronic Products)

Source: Institute for Supply Management®, ISM®, PMI®, Report On Business®. For more information, visit the ISM® website at www.ismworld.org.