US Factory Activity Dips in January

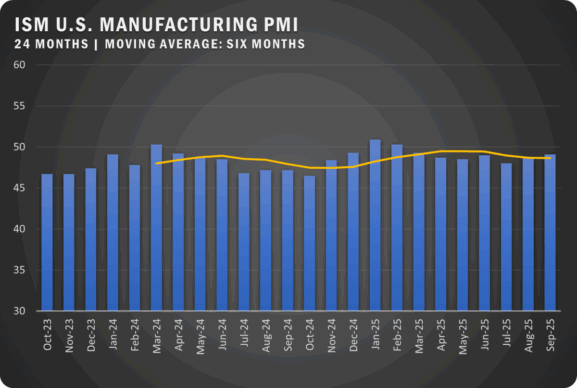

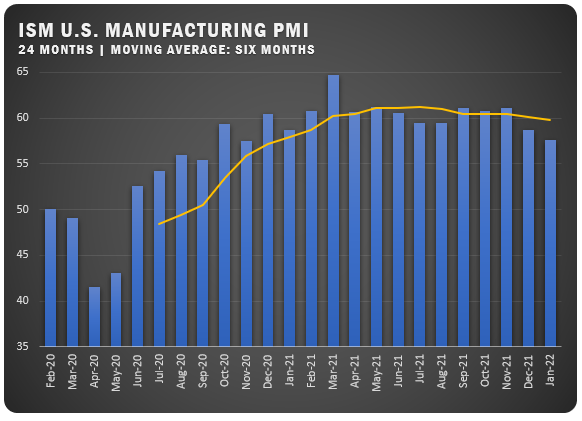

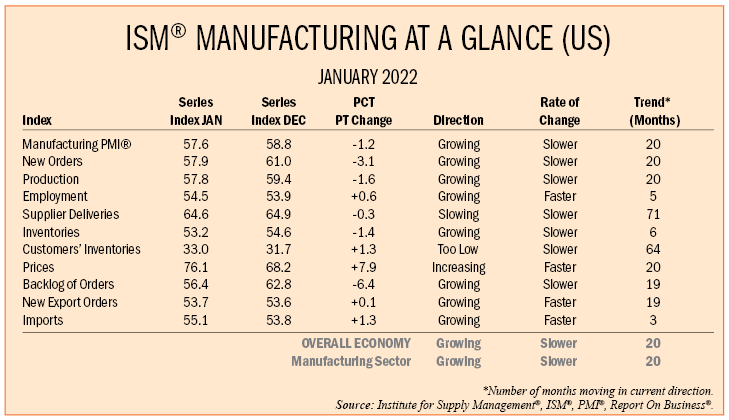

Despite a 20-month streak of growth for the overall economy, ISM’s® January Report On Business® showed a 1.2 percent drop to a PMI of 57.6 percent for US manufacturers. While still in positive territory, the figure was the second straight month to register a decline and it also represented the lowest mark since November 2020.

“Manufacturing performed well for the 20th straight month, with demand and consumption registering month-over-month growth,” says Timothy R. Fiore, Chair of the ISM® Manufacturing Business Survey Committee. “Meeting demand remains a challenge, due to hiring difficulties and labor turnover at all tiers. For the third month in a row, Business Survey Committee panelists’ comments suggest month-over-month improvement on hiring, offset by backfilling required to address employee turnover at a higher rate, supplier performance and improvements in the transportation sector.”

According to the report, the US manufacturing sector remains in a demand-driven, supply chain-constrained environment, but January was the third straight month with indications of improvements in labor resources and supplier delivery performance. Still, there were shortages of critical intermediate materials, difficulties in transporting products and lack of direct labor on factory floors due to the COVID-19 Omicron variant. Notably, quit rates and early retirements are hindering reliable consumption.

ISM® REPORT COMMENTS (US Manufacturers)

Panel sentiment remains strongly optimistic, with seven positive growth comments for every cautious comment, up from December’s ratio of 6-to-1.

- “Transportation restrictions and a lack of supplier manpower continue to create significant shortages that limit our production. This, in turn, limits what we can supply to customers, as well as on-time delivery.” Machinery

- “Transportation, labor and inflation issues continue to hamper our supply chain and ability to service our customers. Fortunately, it’s also hampering our competition as well. Ultimately, the biggest impact is at the consumer level, as (price increases) continue to get passed through.” Transportation Equipment

- “Integrated circuit availability is really causing issues. Shortages of raw materials and other electronic materials continue to hamper deliveries to our customers.” Miscellaneous Manufacturing

- “The supply chain crunch may be loosening a bit; however, specific original equipment manufacturer (OEM) parts and equipment now have lead times that we have not experienced before.” Nonmetallic Mineral Products

- “We are experiencing massive interruptions to our production due to supplier COVID-19 problems limiting their manufacturing of key raw (materials) like steel cans and chemicals.” Chemical Products

- “Lack of skilled production personnel, either from missing work due to (COVID-19) variants or leaving for better opportunities, making it more difficult to complete work. Working off a backlog.” Fabricated Metal Products

- “While there has been some improvement in materials making it to our factories and logistics centers, we are still constrained by (a lack of) qualified labor. Orders so far are not being cancelled, but we are concerned that customers may be losing patience.” Computer and Electronic Products

- “Our suppliers are having difficulty meeting scheduled releases as their suppliers experience delays and shortages, so lead times and inventories are struggling, resulting in lost production.” Food, Beverage and Tobacco Products

- “Strong backlog of orders coming into the new year. Potential to beat target revenue, depending on availability of purchased product.” Electrical Equipment, Appliances and Components

- “Bookings continue to increase as we are still dealing with a shortage of labor and supply chain issues.” Furniture and Related Products

US SECTOR REPORT

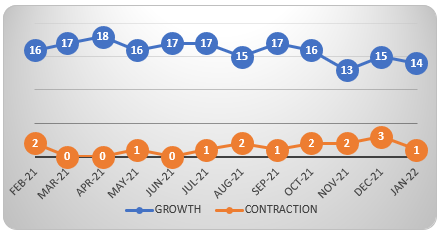

ISM® GROWTH SECTORS (14): Apparel, Leather and Allied Products; Furniture and Related Products; Miscellaneous Manufacturing; Nonmetallic Mineral Products; Machinery; Electrical Equipment, Appliances and Components; Food, Beverage and Tobacco Products; Transportation Equipment; Primary Metals; Fabricated Metal Products; Computer and Electronic Products; Chemical Products; Petroleum and Coal Products; and Plastics and Rubber Products.

ISM® CONTRACTION SECTOR (1): Paper Products.

GLOBAL MANUFACTURING

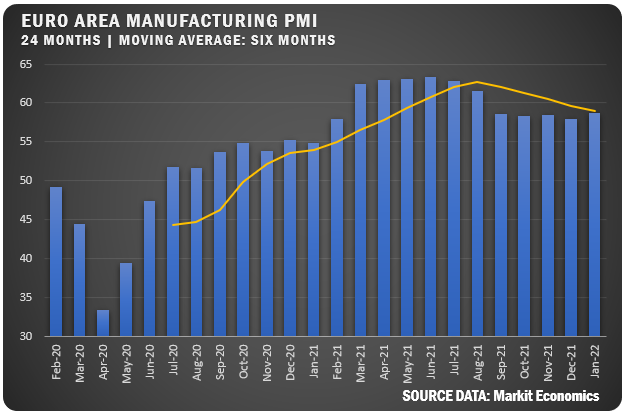

EUROZONE: IHS Markit reported a Eurozone Manufacturing PMI of 58.7 percent for January. This was up 0.7 percent from the previous month and the data also showed significant increases in production, new orders and employment for manufacturing activity in the region. According to IHS, manufacturers in the region are coping with the current Omicron surge better than previous COVID-19 waves. Supply chain delays seem to be on the decline and manufacturers are expressing optimism on the future business outlook.

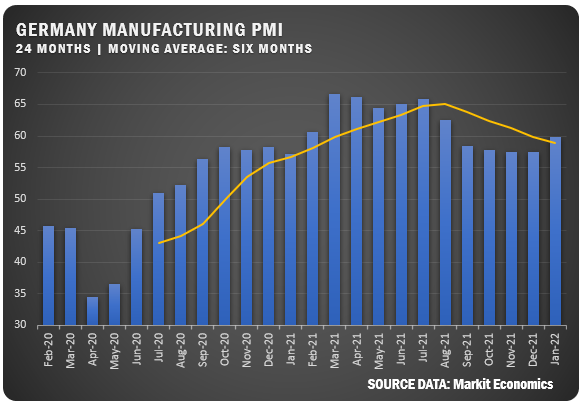

GERMANY: IHS Markit/BME reported a good bump for German manufacturers in January with a 2.4 percent month-over-month increase to record a PMI reading of 59.8 percent. The new figure ended five months of decline as factory activity improved due to increases in new orders and improvements in supply. Employment followed to increase for a second straight month. Business optimism improved for a third straight month.

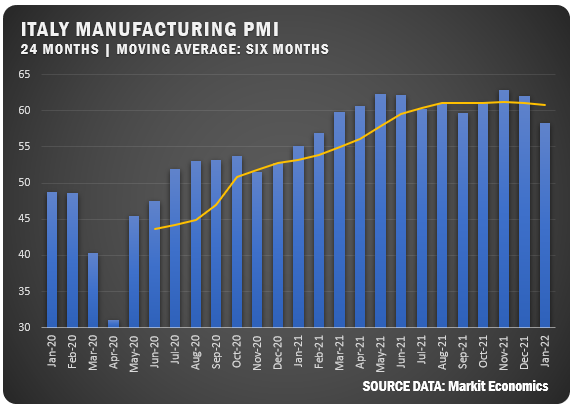

ITALY: IHS Markit reported a January PMI of 58.3 percent for Italian manufacturers – off 3.7 percent from December and the lowest mark since February of 2021. The drop was driven by slower growth in output and new orders. Supply chain delays and labor issues were cited as the big issues, but on the plus side, domestic and foreign markets both saw strong demand.

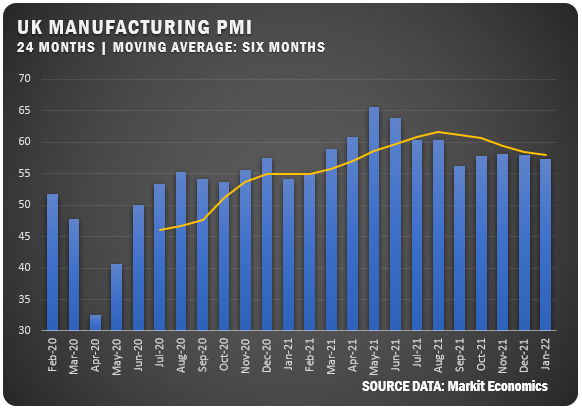

UNITED KINGDOM: According to IHS Markit/CIPS, UK manufacturing register a 57.3 percent PMI for January, down from 57.9 percent in the previous month. New orders slowed, but output and employment increased for manufacturers. Delays in the supply chain continue to put a drag on manufacturing activity, but signs of improvement in that area are starting to manifest.

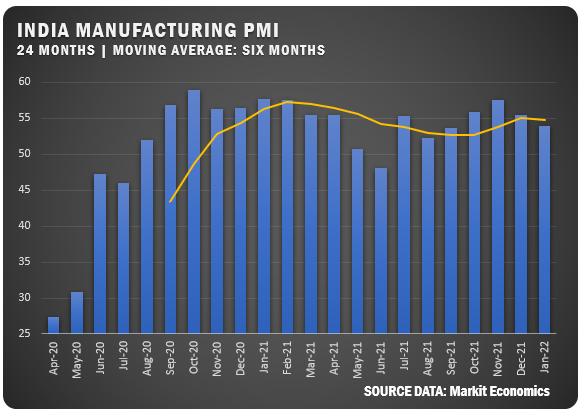

INDIA: IHS Markit reported a 54.0 percent PMI for Indian manufacturers in January. This was down 1.5 percent from the previous month and represented a second straight month of decline. Disruptions due to the pandemic had the biggest impact on the region as output and new orders slowed. Still, manufacturing for India remains strong from a historical perspective. Confidence in the business outlook fell to a 19-month low based on concerns about inflation and COVID-19 uncertainty.

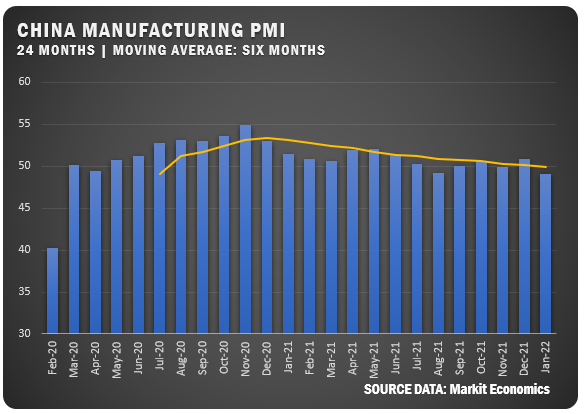

CHINA: The Caixin China General Manufacturing PMI dropped to 49.1 percent for January – well below expectations and the lowest mark since February 2020. This is third time in the last six months that Chinese manufacturing has dipped into contraction territory. The COVID surge and strict government restrictions had the biggest impact as output and new orders saw steep declines. New export orders also dove along with employment levels. However, inflation and selling prices showed signs of a peak. Despite the troubling figures, business optimism improved based on projected improvement in market conditions and positive signs that supply chain issues were improving.

Credits: Institute for Supply Management®, PMI®, Report On Business®. For more information, visit the ISM® website at www.ismworld.org.