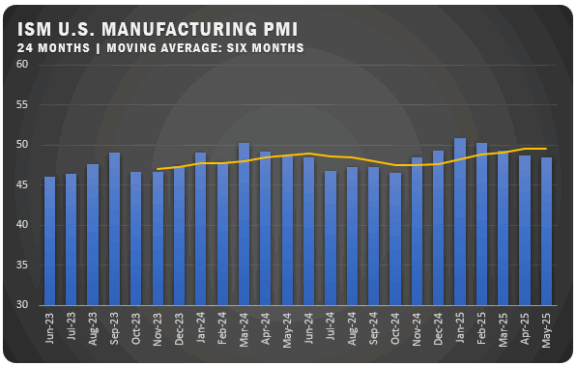

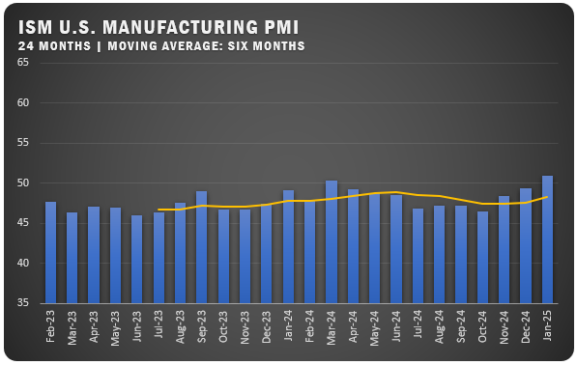

US Manufacturing PMI Below 50 Percent for November

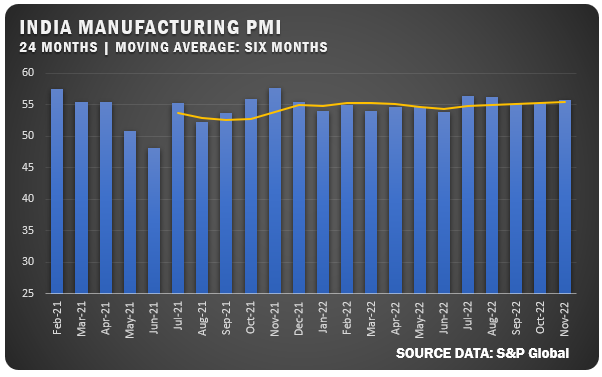

Indian Manufacturing PMI edges up to remain in growth territory for 17th straight month

The November Institute for Supply Management® Report On Business® reported a PMI reading of 49 percent for U.S. manufacturers which represented a move into contraction territory for the first time since May 2020. The new figure supported an overall downward trend that started in November of 2021 for U.S. manufacturers.

“Manufacturing contracted in November after expanding for 29 straight months,” says Timothy R. Fiore, Chair of the ISM®; Manufacturing Business Survey Committee. “Panelists’ companies continue to judiciously manage hiring. Other than October 2022, the month-over-month supplier delivery performance was the best since February 2012, when it registered 47 percent. Material lead times declined approximately nine percent from the prior month and approximately 18 percent over the last four months. Managing head counts and total supply chain inventories remain primary goals. Order backlogs, prices and now lead times are declining rapidly, which should bring buyers and sellers back to the table to refill order books based on 2023 business plans.”

Survey panelists reported new softening of new order rates over the previous six months with the November composite PMI (purchasing manager index) figure indicating that companies are preparing for lower output in the future. Demand eased, with new orders remaining in contraction territory and the new export orders index registering below 50 percent for a fourth consecutive month. The customer inventory index was effectively in “just right” territory, as it climbed 7.1 percentage points. Order backlogs decreased and employment fell as panelists say companies are managing headcount through a combination of hiring freezes, employee attrition and now layoffs. The supplier delivery index indicated faster deliveries and the inventories expanded at a slower rate as panelists’ companies continued to manage the total supply chain inventory.

ISM® REPORT COMMENTS (US Manufacturers)

- “General economic uncertainty has created a slowdown in orders as we approach the end of the year; and many of our key customers are reducing their capital expenditures spend.” Machinery

- “The market remains consistent: sales match expectations; there are concerns about the impact of rising interest rates on customers; most suppliers have recovered on labor, but some are still struggling; and inflation seems to have peaked, but commodity price decreases have not been passed through to us. Lots of unknowns regarding impact to the European Union from the Russia-Ukraine war and questions about customer behavior in 2023.” Miscellaneous Manufacturing

- “Future volumes are on a downward trend for the next 60 days.” Chemical Products

“Looking into December and the first quarter of 2023, business is softening as uncertain economic conditions lie ahead.”

Plastics and Rubber Products - “Slight improvement on overall business conditions from the previous month.”

Primary Metals - “Customer demand is softening, yet suppliers are maintaining high prices and record profits. Pushing for cost reductions based on market evidence has been surprisingly successful.”

Computer and Electronic Products - “Orders for transportation equipment remain strong. Supply chain issues persist, with a minimal direct effect on output.”

Transportation Equipment - “Consumer goods are slowing down in several of our markets, although the U.S. economy seems decent. Cannot say the same for the European economy.”

Food, Beverage and Tobacco Products - “Overall, things are worsening. Housing starts are down. We’re doing well against our competitors, but the industry overall is down. We’re sitting on cash (that is) tied up in inventory.” Electrical Equipment, Appliances and Components

- “There is caution going into 2023, but the commercial section of construction seems to still be going strong.”

Nonmetallic Mineral Products

US SECTOR REPORT

ISM® GROWTH SECTORS (6): Apparel, Leather and Allied Products; Nonmetallic Mineral Products; Primary Metals; Miscellaneous Manufacturing; Petroleum and Coal Products; and Transportation Equipment.

ISM® CONTRACTION SECTORS (12): Printing and Related Support Activities; Wood Products; Paper Products; Textile Mills; Fabricated Metal Products; Furniture and Related Products; Chemical Products; Plastics and Rubber Products; Computer and Electronic Products; Food, Beverage and Tobacco Products; Machinery; and Electrical Equipment, Appliances and Components.

GLOBAL MANUFACTURING

EUROPE: The S&P Global Eurozone Manufacturing PMI for November was reported as 47.1 percent, which did represent a move up from the October reading of 47.3 percent (the lowest since May 2020). Despite the uptick, it represented a fifth straight month of falling factory activity as output continued to shrink and the incoming orders dropped off with demand decreasing. That eased inflationary pressure, but companies in Europe offered a pessimistic outlook for the next year.

INDIA: The S&P Global India Manufacturing PMI pushed up to 55.7 percent for November after registering a solid 55.3 percent mark in October. Demand spurred growth as manufacturers saw a strong increase in new orders and output. The purchasing rate also accelerated with inflation pressure easing and notably employment grew for a ninth straight month. Additionally, supplier delivery times improved and materials were delivered on time to improve overall manufacturer performance. With the strong demand, companies were optimistic about the business outlook as sentiment hit an eight-year high.

CHINA: The Caixin China General Manufacturing PMI had a second straight month of improvement registering 49.4 percent for November, but the continuing struggles with COVID containment kept manufacturers in contraction territory for a fourth straight month. Output fell, new orders were weak and export sales were also disappointing. Companies cut back on purchasing and that impacted employment, which also fell. The business outlook was still pessimistic but did hit a three-month high.

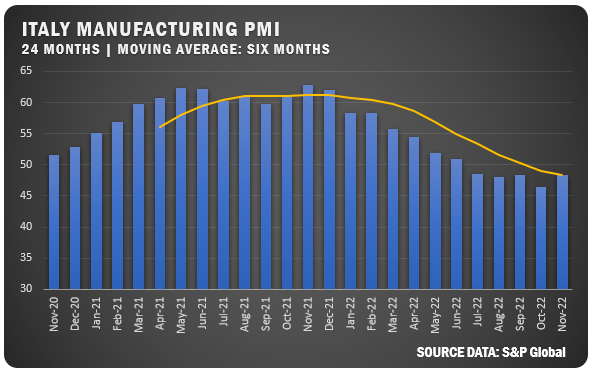

ITALY: The S&P Global Italian Manufacturing PMI bumped up to 48.4 percent in November to reach a four-month high. However, manufacturing in the country still remains in contraction territory dating back to July of this year. Inflation and recession concerns impacted new orders and client demand. Employment did improve as firms were anticipating increased demand. Cost inflation did continue to increase and the business outlook remained weak.

UNITED KINGDOM: The S&P Global/CIPS U.K. Manufacturing PMI moved up slightly in November to register 46.5 percent. That was up 0.3 percent from 46.2 percent for October. Even with the upward move, the figure continues a ninth straight month of an overall downward trend and the fourth month in contraction territory for factory activity for U.K. manufacturing. Issues include lower output, a decrease in new work and lower employment. New exports took a dive as demand fell from many key trading partners. Inflation pressure decreased; however, business outlook hit the lowest mark since April 2020 as recession fears are weighing on U.K. companies.

GERMANY: The S&P Global/BME Germany Manufacturing PMI came in at 46.2 percent for November. The reading kept German manufacturers in contraction territory for the fifth straight month, but it was the first positive move for the German index since May of 2022. Headwinds for the country include weaker demand related to higher energy costs resulting from the Russia-Ukraine War.

Credits: Institute for Supply Management®, PMI®(Purchasing Manager Index), Report On Business®. For more information, visit the ISM® website at www.ismworld.org.