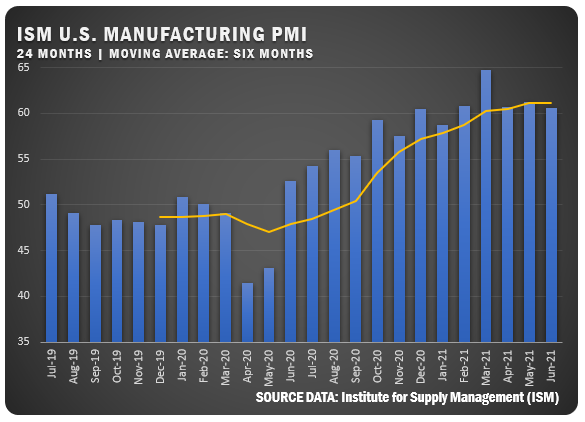

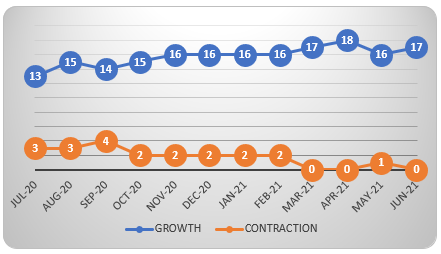

US Manufacturing PMI Stays Strong in June

13 Straight Months Above The 50 Percent Line for US Manufacturers

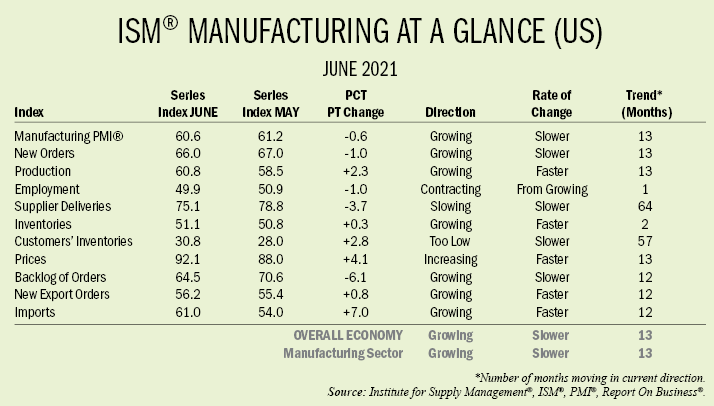

The ISM® Report On Business® for June reported a US PMI of 60.6 percent, down slightly from the May reading of 61.2 percent. Panelists from the survey reported that their companies and suppliers continue to struggle to meet increasing levels of demand. Record-long raw-material lead times, wide-scale shortages of critical basic materials, rising commodities prices and difficulties in transporting products are continuing to affect all segments of the US manufacturing economy. Worker absenteeism, short-term shutdowns due to parts shortages, and difficulties in filling open positions continue to be issues that limit manufacturing growth potential. Optimistic panel sentiment remained strong, with 16 positive comments for every cautious comment. Demand expanded, with the (1) New Orders Index growing, supported by the New Export Orders Index continuing to expand, (2) Customers’ Inventories Index continuing at very low levels and (3) Backlog of Orders Index continuing at a very high level. Consumption (measured by the Production and Employment indexes) improved in the period, posting a combined 1.3-percentage point increase to the Manufacturing PMI® calculation. The Employment Index, which held back further expansion, contracted after six straight months of expansion, as panelists continued to note significant difficulties in attracting and retaining labor at their companies’ and suppliers’ facilities. Inputs — expressed as supplier deliveries, inventories, and imports — continued to support input-driven constraints to production expansion, at higher rates compared to May, due to continued trouble in supplier deliveries. The Prices Index expanded for the 13th consecutive month, indicating continued supplier pricing power and scarcity of supply chain goods.

GLOBAL PMI UPDATE

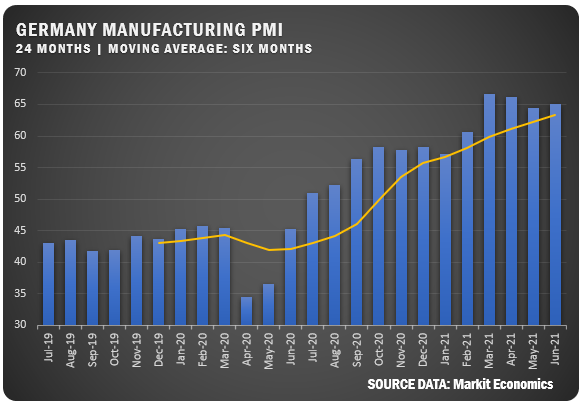

GERMANY: The IHS Markit/BME reported a 65.1 percent PMI for German Manufacturers in June to reverse a two-month decline. Still, the reading was near the March series high of 66.6. Output and new order growth increased, but supply shortages led to higher backlogs of work. The 12-month business outlook was positive as optimism hit a new all-time high.

UNITED KINGDOM: The IHS Markit/CIPS UK Manufacturing PMI registered 63.9 percent in June as it came down from the record mark of 65.6 in May. The strong reading is a result of COVID-19 restrictions continuing to ease and improvement in the worldwide economy.

EUROZONE: The IHS Markit report hit a record high of 63.4 percent Eurozone Manufacturing PMI in June for a 12th straight month of expansion. New orders and new export orders both saw sharp increases. Employment also surged but backlogs of work set a series record as manufacturers struggled to keep pace. Supply issues continue affecting lead times while input and output costs drove prices higher

ITALY: The IHS Markit reported a 62.2 percent manufacturing PMI for Italy ‒ just below the record high 62.3 percent in May. Output continued to rise as sales remained strong leading to big gains in employment.

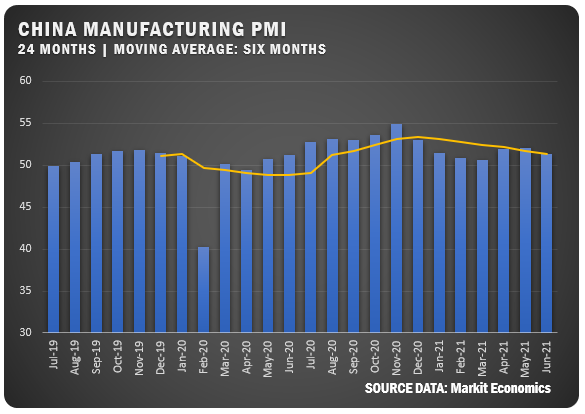

CHINA: The Caixin China General Manufacturing PMI dipped to 51.3 percent in June 2021 from a 52.0 reading in May. China is now experiencing supply chain issues and an increase in COVID-19 cases. Output, new order growth and export sales were weak, but employment had a strong increase and backlogs of work had a four-straight month of improvement.

INDIA: A COVID-19 resurgence has put Indian manufacturers under pressure and IHS Markit India reported a manufacturing PMI of 48.1 percent for June 2021 from 50.8. Output, new orders and export orders all declined with buying levels hitting their lowest point in series history.

ISM® REPORT COMMENTS (U.S.)

- “Demand continues to be strong, and customer-ordering patterns are shifting to include long-term demand. Customers are now placing orders for fourth-quarter 2021 and first quarter 2022 due to global supply chain issues.” Fabricated Metal Products

- “Other than material availability/volatility and rising prices, the outlook for our company is good. We can’t keep up with the increase in orders and have projects that may require a second shift to be added temporarily, but that might not be possible if material availability — for example, lumber products — remains an issue for us.” Furniture & Related Products

- “Customer demand remains strong. Supply chain issues continue to hamper materials availability and impact production scheduling. Supplier costs continue to rise due to increasing materials, labor and shipping costs.” Machinery

- “Higher prices, inflation and lack of available labor are impacting all organizations in our supply chain.” Electrical Equipment, Appliances & Components

- “Supply disruptions continue, with no end in sight!” Nonmetallic Mineral Products

- “We continue to be oversold, based on what we are currently capable of producing. Lack of labor is killing us.” Primary Metals

- “Supply chain constraints, from mechanical to electronics (products) continue to be challenging, from both availability and logistics perspectives. Inflationary pressure on materials due to supply and demand imbalance. Electronic components by far the biggest challenge, with lead times going from 16 weeks to 52-plus weeks. Processors are a critical shortage, leading to us working 24/7 to redesign printed circuit board assemblies to change components. We are extending our PO coverage over 12 months in many cases and committing to non-cancelable, non-returnable (NCNR) terms to assure supply.” Computer & Electronic Products

- “Continue to see very strong demand across all business units. In many cases, we are limited on our ability to supply by raw-materials availability. Still running at record volume but could be producing much more. Even if we were able to get all the raw materials needed, we would have capacity issues on many of our production units. Manpower has been a concern.” Chemical Products

- “Strong sales continue, and production output is at 100 percent. COVID-19 restrictions have been mostly lifted. Global chip allocation continues to limit some feature offerings — production schedules have been updated to restrict content affected by the chip shortage.” Transportation Equipment

- “Poultry markets are higher, as demand for chicken has been very strong. Higher costs are starting to be passed along to customers.” Food, Beverage & Tobacco Products

- “No major concerns or activity to report this month. Oil prices have continued to steadily rise, which gives our executive-level management confidence that our capital budgets are set to the correct amounts, and we can proceed with already planned projects without fear that they’ll need to be deferred or canceled due to dynamic oil markets.” Petroleum & Coal Products

US SECTOR REPORT

ISM GROWTH SECTORS (17): Furniture and Related Products; Machinery; Electrical Equipment, Appliances and Components; Computer and Electronic Products; Plastics and Rubber Products; Chemical Products; Fabricated Metal Products; Transportation Equipment; Miscellaneous Manufacturing; Nonmetallic Mineral Products; Textile Mills; Primary Metals; Food, Beverage and Tobacco Products; Paper Products; Printing and Related Support Activities; Wood Products; and Petroleum and Coal Products.

ISM CONTRACTION SECTORS (0): No industry reported a decrease in June.

Credit: Institute for Supply Management®, ISM®, PMI®, Report On Business®. For more information, visit the ISM® website at www.ismworld.org.