US Manufacturing Pushes Up In May

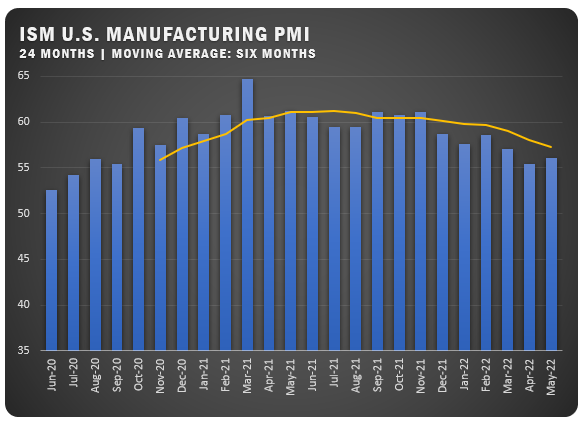

The May PMI for US Manufacturers was reported at 56.1 percent in the latest ISM® Report On Business®. The figure was up from the April reading of 55.4 percent and ended a three-month downward trend. The figure also indicates a 24th straight month of expansion for the overall US economy after the contraction in 2020 sparked by the pandemic.

“The U.S. manufacturing sector remains in a demand-driven, supply chain-constrained environment,” says Timothy R. Fiore, Chair of the ISM®Manufacturing Business Survey Committee. “Despite the Employment Index contracting in May, companies improved their progress on addressing moderate-term labor shortages at all tiers of the supply chain, according to Business Survey Committee respondents’ comments. Panelists reported slightly lower rates of quits compared to April. May was a second straight month of slight easing of prices expansion, but instability in global energy markets continues. Surcharge increase activity appears to be stabilizing across all industry sectors. Sentiment remained strongly optimistic regarding demand, with five positive growth comments for every cautious comment.”

The report also says panelists continue to note supply chain and pricing issues as their biggest concerns. Demand expanded, with the (1) New Orders Index improving, supported by stronger growth of new export orders, (2) Customers’ Inventories Index remaining at a very low level and (3) Backlog of Orders Index increasing. Consumption (measured by the Production and Employment indexes) was mixed during the period, with a combined minus-0.7-percentage point change to the Manufacturing PMI® calculation. The Employment Index contracted after expanding for eight straight months, but panelists indicated improvement in the ability to hire in May compared to April. Challenges with turnover (quits and retirements) and resulting backfilling continue to plague efforts to adequately staff organizations, but to a slightly lesser extent compared to April. Inputs — expressed as supplier deliveries, inventories and imports — continued to constrain production expansion. The Supplier Deliveries Index indicated deliveries slowed at a slower rate, which was supported by the Inventories Index increase in May. The Imports Index contracted in May after six consecutive months of expansion, reflecting the impact of COVID-19 lockdowns in China. The Prices Index increased for the 24th consecutive month, at a slower rate compared to April.

“Manufacturing performed well for the 24th straight month, with demand registering faster month-over-month growth and consumption softening due to labor force constraints,” says Fiore. “Overseas partners’ disruptions are beginning to impact U.S. manufacturing, creating a near-term headwind for factory output growth. Ten percent of panelists’ general comments expressed difficulty obtaining material from their Asian partners, which will impact reliable deliveries in the summer months.”

ISM® REPORT COMMENTS (US Manufacturers)

- “Our order books are still strong. Material prices continue to rise, with energy and freight noted as the underlying influences on increased costs.” Machinery

- “Supply chain issues are causing us to dramatically extend our lead times. Our production lines have (run) low on or out of parts needed to complete rates every week this month.” Miscellaneous Manufacturing

- “Price increases haven’t let up. I thought 2022 was going to be better, but it hasn’t been. Shortages (among other issues) are still disrupting the supply chain.” Plastics and Rubber Products

- “While orders remain strong and backlogs exist, there’s a softening in forecasted orders for leading indicator-type customers and business units.” Chemical Products

- “Shanghai has been shut down since mid-March. All of the (population) is in lockdown, with no production or port activities. Steel remains in allocation. Electronics lead times are more than 12 months.” Fabricated Metal Products

- “Input costs, particularly grain, oil, dairy and protein, are rising faster than can be passed along at retail and food service, with no relief in sight.” Food, Beverage and Tobacco Products

- “Suppliers are seeing a light at the end of the tunnel for restoration of (semiconductor) component supply. Second-quarter and Q3 supply appears to be loosening.” Computer and Electronic Products

- “The challenge with semiconductors hasn’t softened; the situation is worsening due to Chinese COVID-19 lockdowns.” Transportation Equipment

- “We’ve continued to transition to North American sales to avoid ocean vessels, and we are apprehensive about the West Coast ports’ labor contract negotiations. A challenge of doing more business by rail is the backlog of rail cars and embargos.” Paper Products

US SECTOR REPORT

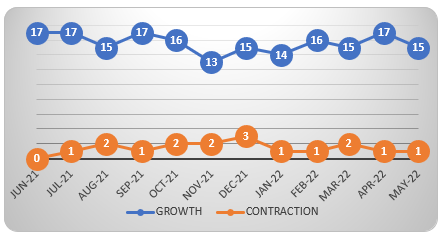

ISM® GROWTH SECTORS (15): Apparel, Leather and Allied Products; Printing and Related Support Activities; Machinery; Nonmetallic Mineral Products; Computer and Electronic Products; Food, Beverage and Tobacco Products; Transportation Equipment; Paper Products; Petroleum and Coal Products; Plastics and Rubber Products; Fabricated Metal Products; Chemical Products; Miscellaneous Manufacturing; Primary Metals; and Electrical Equipment, Appliances and Components

ISM® CONTRACTION SECTORS (1): Furniture and Related Products.

GLOBAL MANUFACTURING

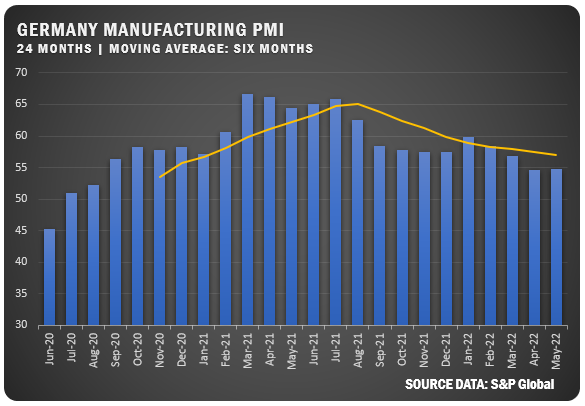

GERMANY: S&P Global/BME reported a May PMI of 54.8 percent for German manufacturers. The new reading was up slightly from April’s mark of 54.6 percent and ended a three-month slide. Despite the improvement, the figure is below last year’s reading for the same month as demand is weakening due to inflation. Additionally, COVID-19 restrictions in China have impacted new orders. Employment has moved up and there are some reports of material availability improvement.

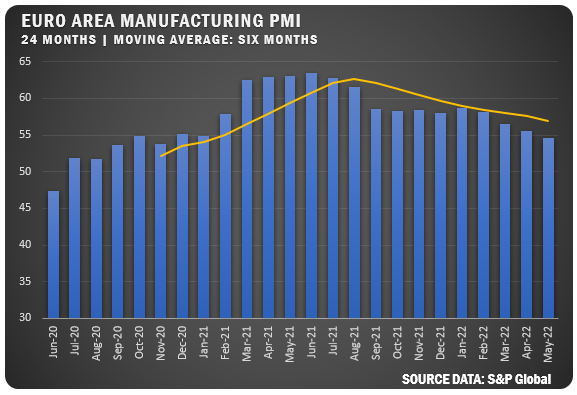

EUROZONE: S&P Global reported a 54.6 percent PMI for Eurozone manufacturers representing a fourth straight month of decline for the index and down from April’s PMI of 55.5 percent. That is well below the May 2021 figure of 63.1 percent and business confidence for the region reached a two-year low. Headwinds include rising prices, weakening demand and continuing supply chain issues, though some bright spots have been reported in that area.

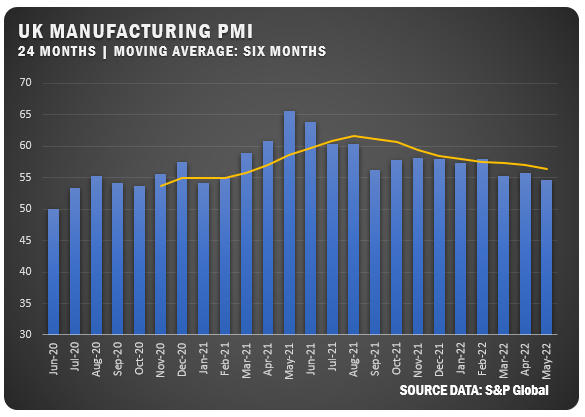

UNITED KINGDOM: The S&P Global/CIPS UK Manufacturing PMI for May was reported as 54.6 percent, down from 55.8 percent in April. The key issues pushing the figure down included weaker domestic demand, supply chain challenges, Chinese lockdowns, exchange rate issues and the impact of the war in Ukraine and the resulting sanctions. Business confidence reached a 17-month low.

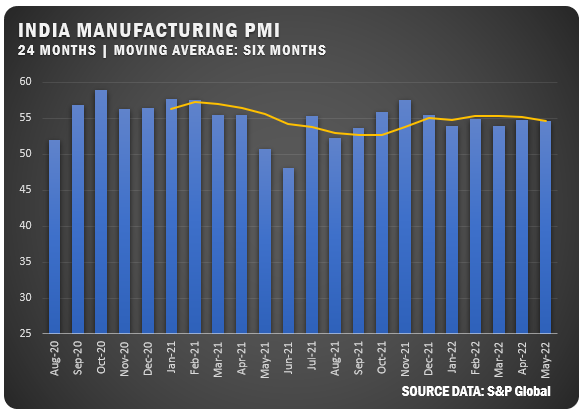

INDIA: S&P Global reported a May PMI of 54.6 percent for Indian manufacturers, which was just under the April reading of 54.7 percent. In fact, Indian manufacturing has remained in a relatively tight range of 54.0 to 55.5 percent since December of 2021. Output and new orders were steady, but new export orders showed strong improvement in May. Input costs rose and supplier delivery times extended. Employment improved but business confidence was near a two-year low.

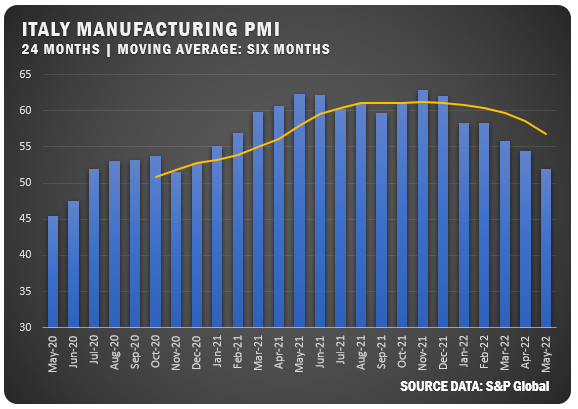

ITALY: S&P Global reported a 2.5 percent drop for the Italian Manufacturing PMI with a figure of 51.9 percent for May versus 54.5 percent in April. Lower levels of output and new orders were cited as the key reasons for the one-month dropoff, which represented a fourth straight month of decline for the country’s PMI reading. Employment did move up and business confidence improved based on an expectation of improvements in the supply chain.

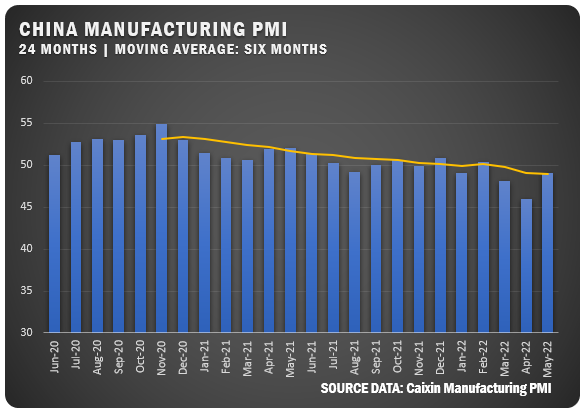

CHINA: The Caixin China General Manufacturing PMI was reported at 49.1 percent for May to jump up 3.1 percent from April’s 26-month low of 46.0 percent. Manufacturers have struggled to cope with China’s strict COVID-19 restrictions, which has resulted in rising backlogs of work. Companies cut purchases and reduced stock. Business outlook was pessimistic and reached a five-month low.

Credits: Institute for Supply Management®, PMI®, Report On Business®. For more information, visit the ISM® website at www.ismworld.org.