US Manufacturing Still Strong Despite Challenges

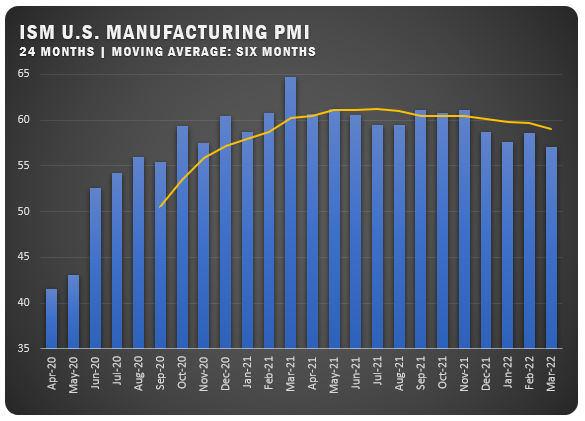

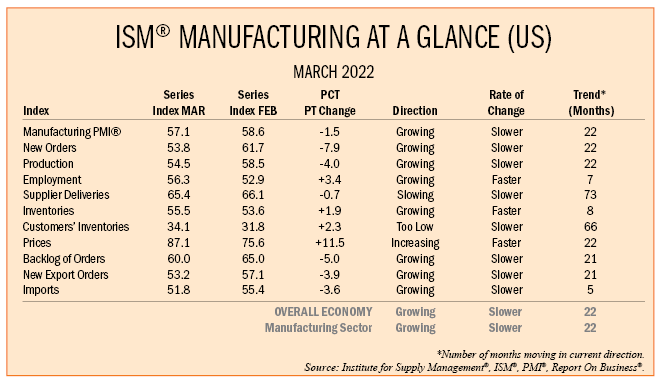

The March PMI for US Manufacturers was reported at 57.1 percent in ISM’s® March Report On Business®. The figure was down 1.5 percentage points from the February reading of 58.6 percent and the lowest reading for the index since September of 2020. However, the figure still indicates a 22nd straight month of expansion for the overall US economy.

“The US manufacturing sector remains in a demand-driven, supply chain-constrained environment,” says Timothy R. Fiore, Chair of the ISM® Manufacturing Business Survey Committee. “In March, progress was made to solve the labor shortage problems at all tiers of the supply chain, which will result in improved factory throughput and supplier deliveries. Panelists reported lower rates of quits and early retirements compared to previous months, as well as improving internal and supplier labor positions.”

Additionally, the ISM report says demand expanded in March, with the (1) New Orders Index remaining in growth territory, supported by weaker growth of new export orders, (2) Customers’ Inventories Index remaining at a very low level and (3) Backlog of Orders Index continuing in strong growth territory. Consumption (measured by the Production and Employment indexes) grew during the period, though at a slower rate, with a combined minus 0.6-percentage point change to the Manufacturing PMI® calculation. The Employment Index expanded for a seventh straight month with panelists indicating their ability to hire continues to improve.

Panel sentiment remained strongly optimistic regarding demand, with six positive growth comments for every cautious comment, but that ratio was still down from February’s ratio of 12-to-1.

ISM® REPORT COMMENTS (US Manufacturers)

- “Prices are increasing on steel and steel products after a slight decrease from highs last month. Transportation costs are going up significantly with the increase in fuel prices.” Machinery

- “The supply situation is getting worse, with lead times extending over 12 months, material not available, and suppliers not quoting or taking orders. Prices on the rise daily.” Miscellaneous Manufacturing

- “Customer orders are brisk in the face of significant price increases, while we continue to struggle with inbound supplier service and raw material availability issues.” Chemical Products

- “Generally speaking, the business environment is slowly improving for aerospace component manufacturers. Supply chain disruptions and still-extending lead times continue to keep purchasing busy. This further causes reevaluation of the current year’s business plan and cost assumptions.” Transportation Equipment

- “Overall business conditions are challenging in both domestic and international transportation. The Russian invasion of Ukraine has created uncertainty in the grain markets, causing upward pricing pressure. In addition, inflationary pressures across all categories have made it challenging to manage cost and profitability.” Food, Beverage and Tobacco Products

- No letup yet in supply chain challenges, especially electronic components. Relying more and more on the broker market.” Computer and Electronic Products

- “Backlog continues to be strong as we ship delinquent orders resulting from COVID-19 slowdowns.” Fabricated Metal Products

- “Demand continues to be strong. Backlog is still increasing — currently at about three months of production. Availability of purchased material continues to constrain production, causing the increased backlog.” Electrical Equipment, Appliances and Components

- “Business continues to be strong, with incoming sales higher but still combating labor and material issues like availability and inflation. Still determining impact of the Russian invasion of Ukraine.” Furniture and Related Products

- “Supply chain is still unstable. While we have seen improvements, there are still a lot of issues that have yet to be resolved.” Primary Metals

US SECTOR REPORT

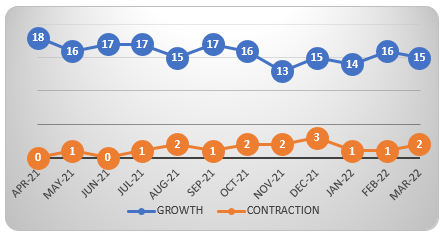

ISM® GROWTH SECTORS (15): Apparel, Leather and Allied Products; Furniture and Related Products; Food, Beverage and Tobacco Products; Electrical Equipment, Appliances and Components; Miscellaneous Manufacturing; Machinery; Textile Mills; Transportation Equipment; Fabricated Metal Products; Paper Products; Chemical Products; Computer and Electronic Products; Nonmetallic Mineral Products; Primary Metals; and Plastics and Rubber Products.

ISM® CONTRACTION SECTORS (2): Wood Products; and Petroleum and Coal Products.

GLOBAL MANUFACTURING

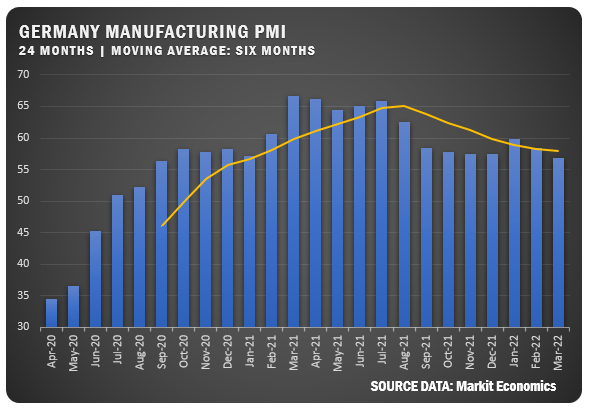

GERMANY: S&P Global/BME reported a PMI of 56.9 percent for German manufacturers, which was off the March reading of 58.4 percent. The War in Ukraine impacted Germany as exports decreased and new supply chain issues developed. The increase in COVID cases also impacted the supply chain and raw materials. Price increases for oil, gas and other commodities pushed up the rate of inflation. Manufacturers had a negative outlook for business for the first time since 2020.

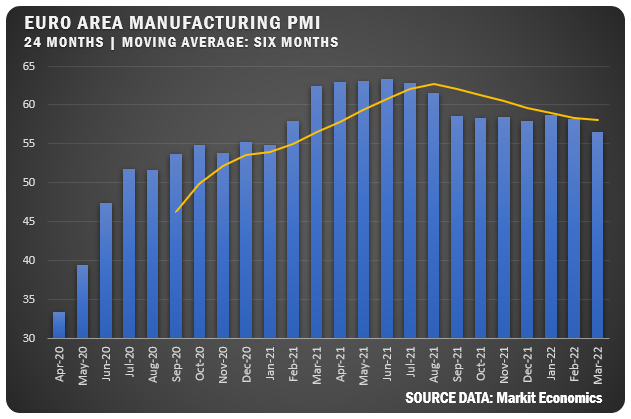

EUROZONE: The S&P Global reported a Eurozone Manufacturing PMI of 56.5 percent for March, down from the February figure of 58.2 percent. It was the lowest reported figure since January 2021 and the decrease is attributed to the wide-ranging impact of the War in Ukraine. Business confidence was reported to be at the weakest level since May of 2020, just a few months into the COVID-19 pandemic. Of note, employment for European manufacturers grew in March.

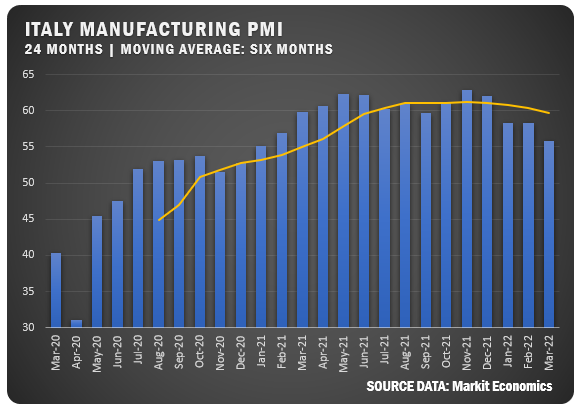

ITALY: S&P Global reported a 2.5 percent PMI index drop for Italian manufacturers in March with a reading of 55.8 percent. Continuing supply-chain issues coupled with concerns over the War in Ukraine slowed demand and costs increased. While supply chain issues pressured manufacturing capacity, backlogs continued to increase, pushing up employment. Despite the challenges, business outlook remained positive.

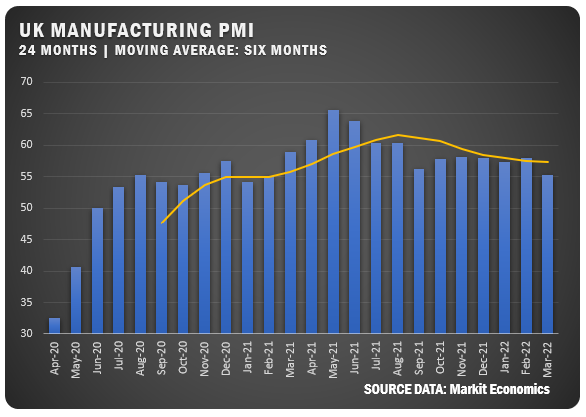

UNITED KINGDOM: S&P Global/CIPS reported a UK Manufacturing PMI of 55.2 percent for March. That reading represented a drop of 2.8 percent from February as new orders and exports both saw decreased activity due to supply shortages and a more cautious approach from buyers. Inflationary pressures continued and business confidence reached a 14-month low for the UK.

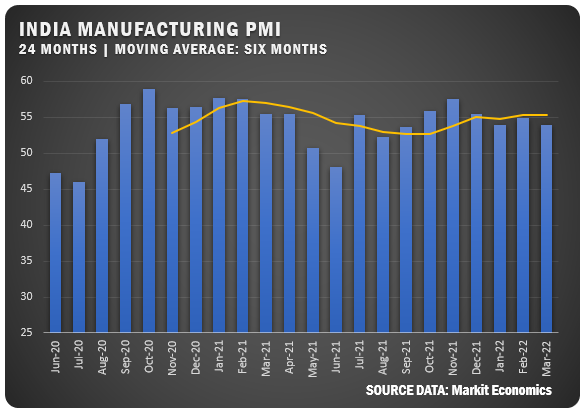

INDIA: S&P Global reported a 54.0 percent PMI index reading for Indian manufacturers, just off the February figure of 54.9 percent. Despite the dip, the figure still represented a ninth straight month above the 50 percent line. Additionally, backlogs remained relatively unchanged from March, and employment stabilized following three straight months of decreases. Price pressure caused business outlook optimism to be at its lowest level in 24 months.

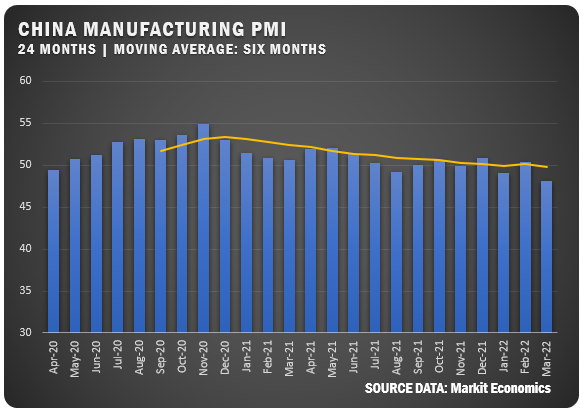

CHINA: The Caixin China General Manufacturing PMI registered 48.1 percent for Chinese manufacturers in March, reaching the lowest level since February of 2020. The surprising decrease followed an uptick in February that saw the Chinese index at 50.4. COVID-19 outbreaks and the resulting restrictions impacted the fall as output and new orders decreased sharply along with exports. Delivery times extended due to the challenges with global transportation. The one positive was an increase in employment, the first since July of 2021.

Credits: Institute for Supply Management®, PMI®, Report On Business®. For more information, visit the ISM® website at www.ismworld.org.