US PMI Jumps By 1.9 Percent in November

Canadian Strength Continues Four Straight Months of PMI Growth

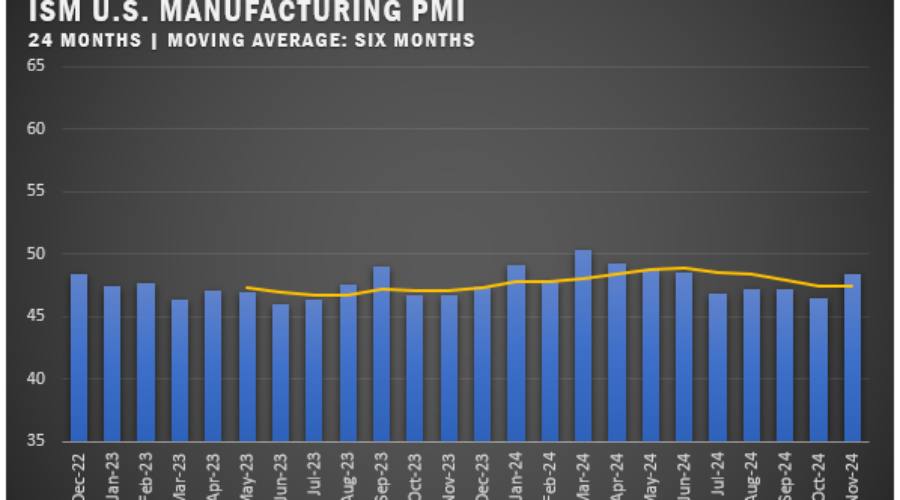

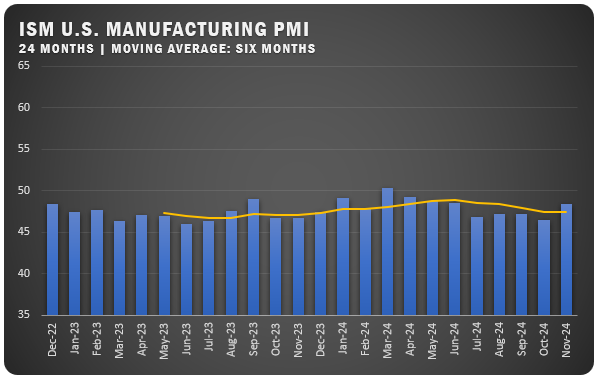

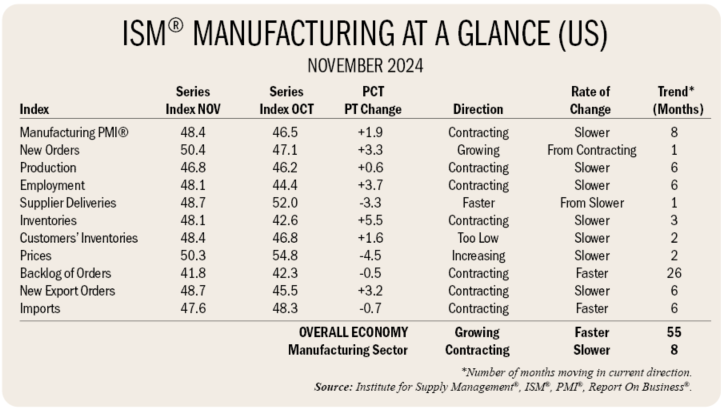

The ISM U.S. Manufacturing PMI registered 48.4 percent in November, a 1.9 percentage-point increase from October’s 46.5 percent, according to Timothy R. Fiore, Chair of the ISM Manufacturing Business Survey Committee. This marks the eighth consecutive month of contraction and the 24th contraction in the last 25 months. Despite the sluggish manufacturing sector, the overall economy remained in expansion for the 55th month following a single month of contraction in April 2020.

The New Orders Index rebounded to 50.4 percent, a 3.3 percentage-point increase from October and its first expansion in seven months. The Production Index improved slightly, registering 46.8 percent, up 0.6 percentage point. Meanwhile, the Employment Index showed signs of easing workforce contraction at 48.1 percent, a 3.7 percentage-point rise from October. Prices, while still expanding, moderated significantly with the Prices Index at 50.3 percent, down 4.5 percentage points.

Supplier deliveries improved as the Supplier Deliveries Index fell to 48.7 percent, indicating faster deliveries. Inventories moved closer to balance, with the Inventories Index rising 5.5 percentage points to 48.1 percent. Export activity strengthened slightly, as the New Export Orders Index climbed to 48.7 percent, up 3.2 percentage points from October. However, imports declined further, with the Imports Index at 47.6 percent.

“U.S. manufacturing continued to contract in November but at a slower rate,” said Fiore. “Demand is showing signs of moderation, with the New Orders Index moving back into expansion and export activity improving, although still weak. Production and employment remain in contraction but are stabilizing. Foundational industries such as Chemical Products and Fabricated Metal Products continue to struggle, signaling recovery may be months away.”

Despite these challenges, inputs — encompassing supplier deliveries, inventories, prices and imports — remained supportive of future growth. Suppliers improved delivery times, and inventories showed gains, although some product shortages persisted. Fiore noted that manufacturers are preparing for 2025 with election-related uncertainties resolved.

COMMODITIES

Up in Price: Aluminum* (12), Caustic Soda, Copper (2), Copper-Based Products, Electrical Components and Natural Gas (2).

Down in Price: Aluminum*; Crude Oil, Diesel Fuel, Plastic Resin, Solvents, Steel — Hot Rolled and Steel Products.

In Short Supply: Electrical Components (50), Electrical Equipment, Electronic Assemblies and Electronic Components (8).

*Indicates both up and down in price.

US SECTOR REPORT

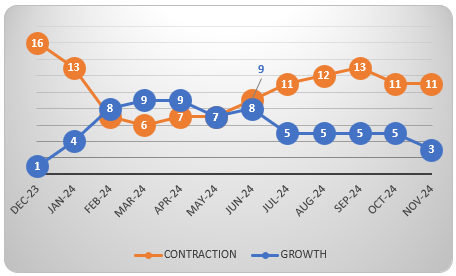

ISM Growth Sectors (3): Food, Beverage and Tobacco Products; Computer and Electronic Products; and Electrical Equipment, Appliances and Components.

ISM Contraction Sectors (11): Printing and Related Support Activities; Plastics and Rubber Products; Chemical Products; Paper Products; Transportation Equipment; Fabricated Metal Products; Furniture and Related Products; Machinery; Nonmetallic Mineral Products; Miscellaneous Manufacturing; and Primary Metals.

NOVEMBER ISM REPORT COMMENTS

(U.S. Manufacturers)

- “High mortgage rates continue to hamper demand for new housing construction, which is a key market for adhesives and sealants.” Chemical Products

- “Business remains slow. We anticipate that the first half of 2025 will be similar and hope that demand increases in the second half of 2025.” Transportation Equipment

- “Inflation, even after easing, continues to impact demand. Consumers are looking for value, and purchasing behaviors are changing as many shoppers reduce consumption, causing softer volume.” Food, Beverage and Tobacco Products

- “Backlog is rising precipitously after 18 months of troughing. The long-awaited pent-up buying has started. Competition for qualified technical labor is a constraint on operational throughput.” Computer and Electronic Products

- “A general construction slowdown in the fourth quarter has created a surplus of finished goods, creating the need for an extra two weeks of shutdown over the Christmas holiday period. We are carefully watching demand in the first quarter to determine if more permanent workforce reductions will be necessary.” Machinery

- “Business is slowing as customers destock and appear uncertain about near-term demand. Preliminary forecast for 2025 is down significantly; we hope to see improvements now that we are beyond U.S. election uncertainties.” Fabricated Metal Products

- “Our supplier has a positive outlook on the U.S. economy going into 2025. Our business is seeing an uptick in sales forecasts for the first quarter of 2025 versus the fourth quarter of 2024. Overall, our outlook for 2025 is optimistic.” Textile Mills

- “We’re finally seeing traction in the last few weeks (with) a higher volume of orders. Backlog is starting to grow.” Electrical Equipment, Appliances and Components

- “Late to the game, we are now working on our buying plan in light of potential increased tariffs on imports from China. Cost and capacity of U.S. manufacturing is a concern; a lack of relationship with alternate low-cost international manufacturers is another.” Miscellaneous Manufacturing

- “After the election, we have seen an uptick in customers wanting to come back to the U.S. for making their products. We are working through these inquiries. They seem very motivated.” Primary Metals

GLOBAL PMI NOTES

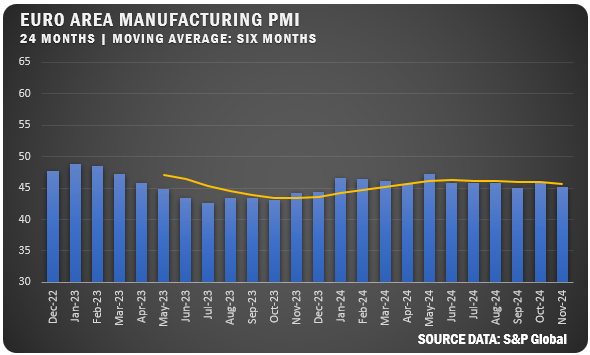

EUROZONE: Manufacturing in the Eurozone weakened further in November as the HCOB Manufacturing PMI slipped to 45.2 percent. The region faced sharper drops in production, orders and inventories, while employment saw its fastest decline since August 2020, primarily in Germany and Austria. Businesses reduced prices aggressively to address sluggish demand, even as input costs decreased for the third month. Backlogs continued to shrink due to overcapacity, though business sentiment improved slightly, reaching a three-month peak with hopes for recovery.

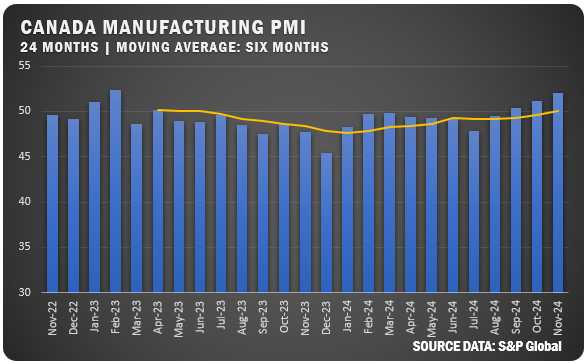

CANADA: The S&P Global Canada Manufacturing PMI climbed to 52.0 percent in November, its highest reading since February 2023 and an increase from October’s 51.1 percent. Domestic demand spurred the strongest growth in new orders in nearly two years, alongside a notable rise in output. Employment expanded for the third month as manufacturers geared up for increased production. However, supply chain disruptions from port strikes and currency pressures caused input costs to hit an 18-month high, resulting in the sharpest increase in output prices in three months. Optimism for 2025 stayed positive despite a slight dip.

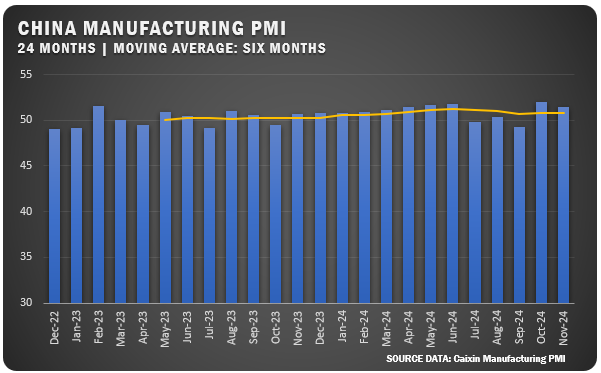

CHINA: The Caixin China Manufacturing PMI reached 51.5 percent in November, up from October’s 50.3 percent and the fastest growth since June. Stronger export orders and increased production bolstered the expansion. Companies also ramped up purchasing to build inventories, though staffing levels continued to decline. Input prices surged, leading to the most significant rise in output prices in over a year. Confidence among manufacturers climbed to an eight-month high, fueled by expectations of better market conditions and supportive policies.

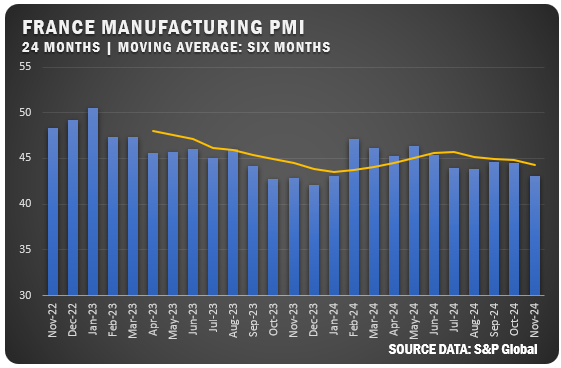

FRANCE: France’s HCOB Manufacturing PMI declined to 43.1 percent in November, marking a 22nd consecutive month of contraction and the steepest decline since January. A sharp drop in orders, both domestic and international, drove reductions in production and inventories. Employment fell as firms avoided replacing temporary workers. Competitive pressures forced companies to lower selling prices, despite moderate increases in input costs. Pessimism persisted, with concerns over economic instability weighing on the outlook for the coming year.

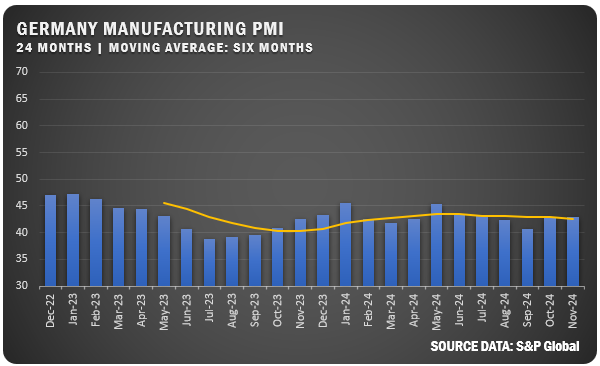

GERMANY: The HCOB Germany Manufacturing PMI held steady at 43.0 percent in November, matching October’s reading. Although the pace of declines in output and new orders eased slightly, employment and purchasing activity fell more sharply. Both input costs and selling prices saw significant reductions, with output prices dropping at one of the fastest rates in 15 years. Business confidence improved marginally but remained muted due to ongoing political and economic uncertainties.

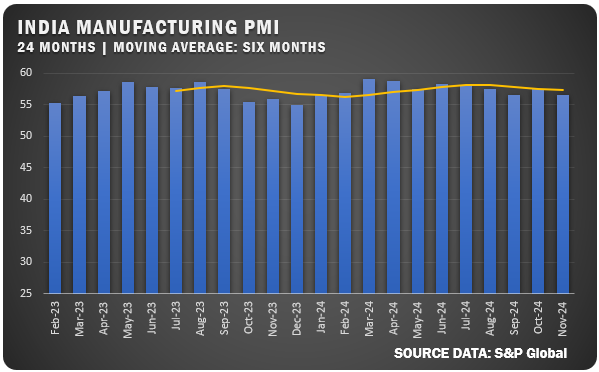

INDIA: India’s HSBC Manufacturing PMI softened to 56.5 percent in November from 57.5 percent in October, indicating slower but steady growth. New orders and production continued to expand, supported by strong domestic demand, though competition tempered the pace. Employment increased for the ninth month, while lead times improved as suppliers maintained efficiency. Input costs rose to their highest level in five months, resulting in the steepest hike in selling prices since 2013. Manufacturers expressed optimism for 2025, driven by new product launches, marketing initiatives and capacity expansion plans.

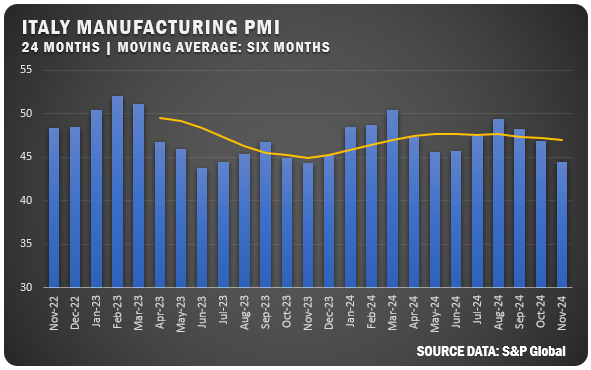

ITALY: Italy’s HCOB Manufacturing PMI fell to 44.5 percent in November from 46.9 in October, signaling the steepest contraction in a year. The decline was driven by a sharp drop in new orders, leading to reductions in output and staffing. Backlogs fell at their fastest pace in over 15 years, easing input costs. Manufacturers expressed cautious optimism for a recovery in 2025, buoyed by hopes of increased stability following the U.S. election.

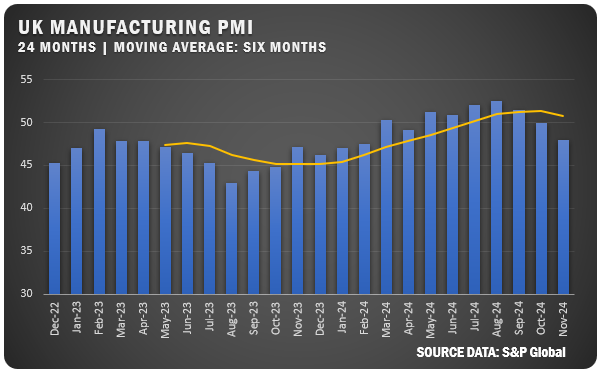

UNITED KINGDOM: The UK’s S&P Global Manufacturing PMI declined to 48.0 percent in November from October’s 49.9 percent, marking the most significant contraction since February. Output and new orders contracted sharply due to weak export demand and economic uncertainty. Supply chain disruptions, caused by geopolitical tensions and regulatory challenges, extended delivery times and raised input costs. Despite these setbacks, manufacturers retained a positive long-term outlook for the sector.

Source: Institute for Supply Management, PMI (Purchasing Manager Index), Report On Business.

For more information, visit the ISM® website at www.ismworld.org.