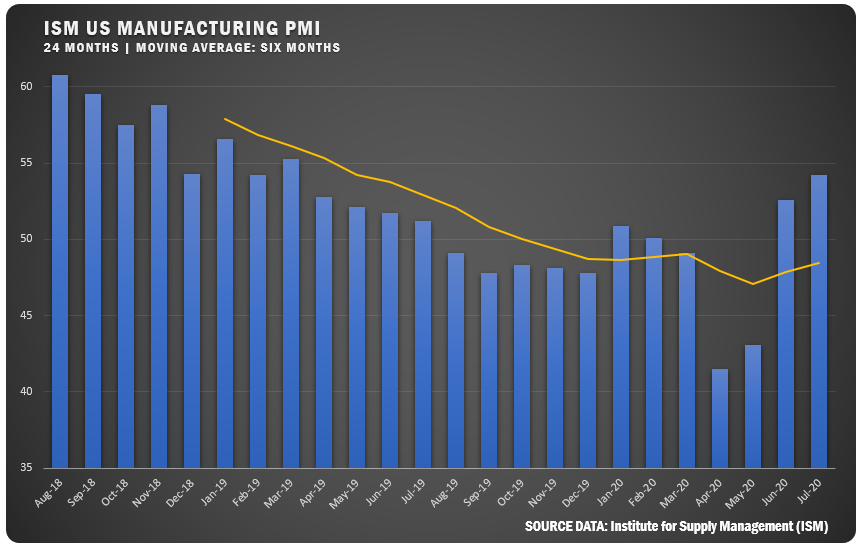

US PMI Leads the Charge in July

The Institute for Supply Management® (ISM®) reported a July PMI of 54.2 percent for US manufacturers. That was up 1.6 percent from the June figure and was the highest point since March 2019.

The Institute for Supply Management® (ISM®) reported a July PMI of 54.2 percent for US manufacturers. That was up 1.6 percent from the June figure and was the highest point since March 2019.

“The growth cycle continues for the second straight month after three prior months of COVID-19 disruptions,” says Timothy R. Fiore, chair of the ISM® Manufacturing Business Survey Committee. “Demand and consumption continued to drive expansion growth with inputs remaining at parity with supply and demand. Among the six biggest industry sectors, food, beverage and tobacco products remain the best-performing industry sector with chemical products, computer and electronic products and petroleum and coal products growing respectably. Transportation equipment and fabricated metal products continue to contract, but at soft levels.”

The new orders index registered 61.5 percent, an increase of 5.1 percentage points from the June reading of 56.4 percent. The production index registered 62.1 percent, up 4.8 percentage points compared to the June reading of 57.3 percent. The backlog of orders index registered 51.8 percent, an increase of 6.5 percentage points compared to the June reading of 45.3 percent. The employment index registered 44.3 percent, an increase of 2.2 percentage points from the June reading of 42.1 percent. The supplier deliveries index registered 55.8 percent, down 1.1 percentage points from the June figure of 56.9 percent.

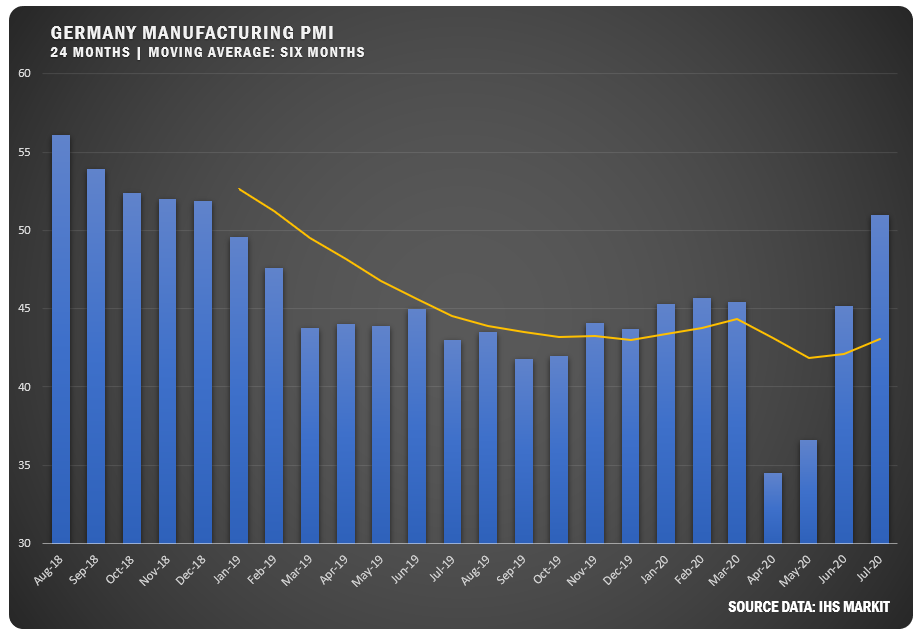

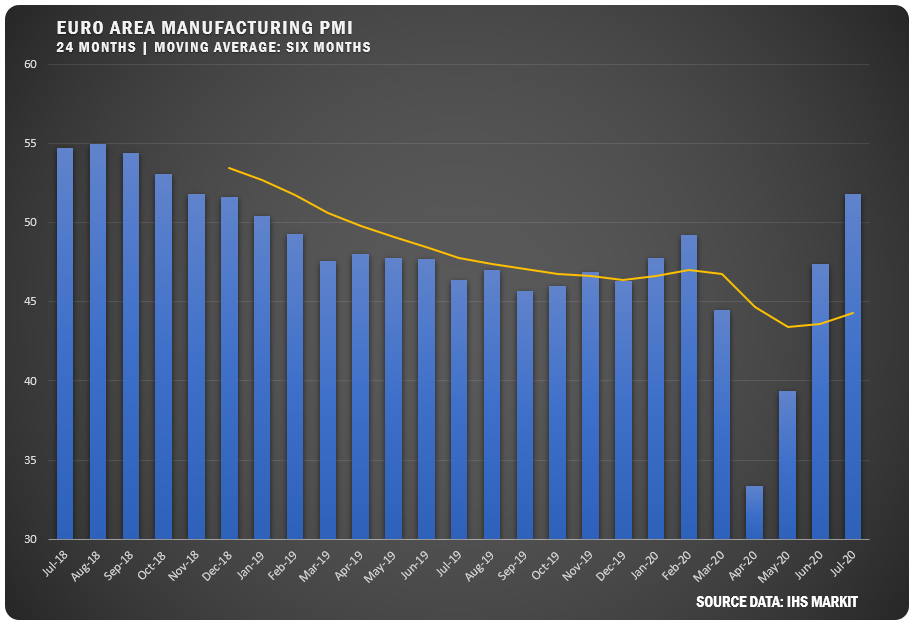

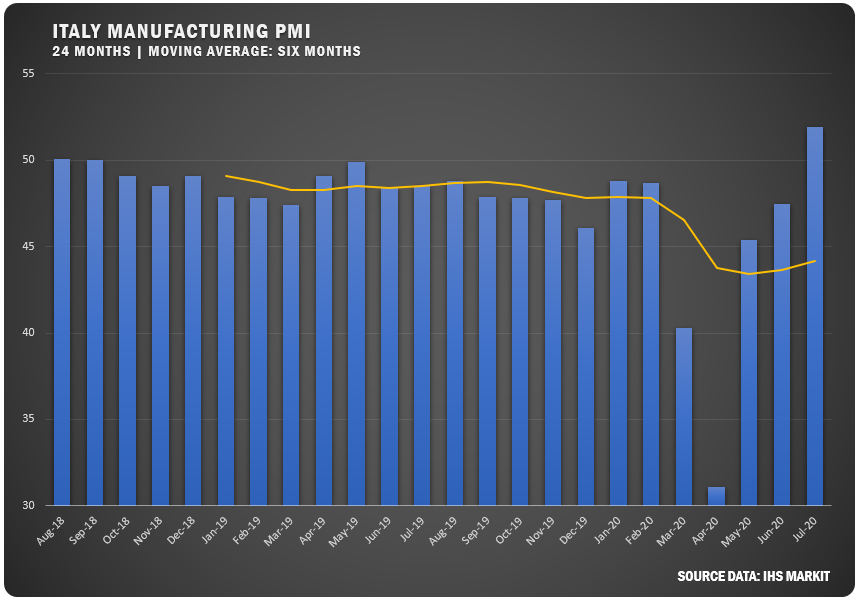

Global markets followed suit as the eurozone went into expansion territory for the first time since January 2019 with a PMI of 51.8 percent. Both production and new orders returned to growth, with new export orders rising for the first time since September 2018. Germany and Italy both followed the trend as the IHS Markit/BME Germany Manufacturing PMI grew by 5.8 percent from June to reach 51 percent. The Italian figure of 51.9 percent beat the market expectation of 51.2 and was Italy’s highest mark since July 2018.

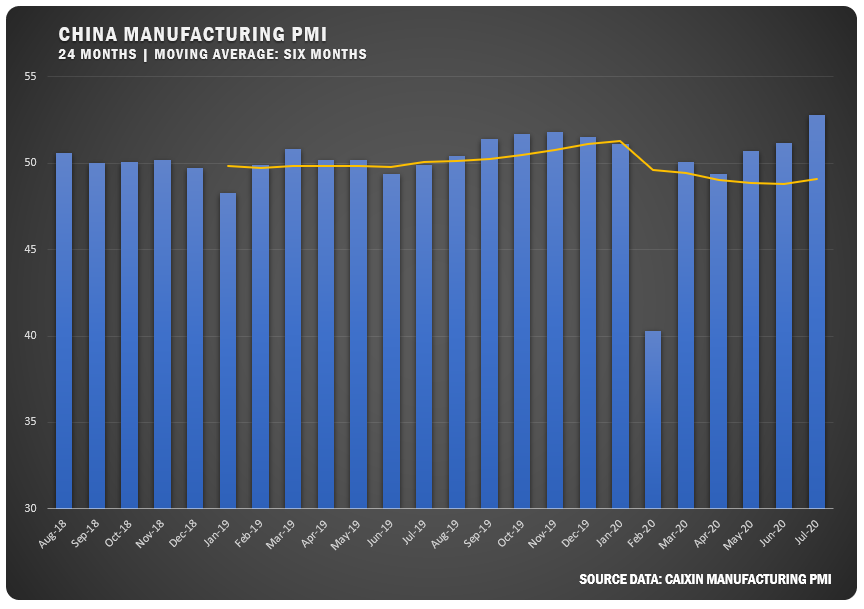

China reached even higher as the Caixin China General Manufacturing PMI rose to 52.8 in July 2020 to beat the market consensus estimate of 51.3. The number represented the third straight month in expansion territory for Chinese factories, as consumer demand continued to improve. Output and new orders grew the most since January 2011.

“Overall, flare-ups of the epidemic in some regions did not hurt the improving trend of the manufacturing economy,” says Wang Zhe, senior economist at Caixin Group.

US GROWTH SECTORS (13): Wood Products; Furniture and Related Products; Textile Mills; Printing and Related Support Activities; Food, Beverage and Tobacco Products; Plastics and Rubber Products; Chemical Products; Apparel, Leather and Allied Products; Computer and Electronic Products; Primary Metals; Petroleum and Coal Products; Miscellaneous Manufacturing; and Electrical Equipment, Appliances and Components.

US GROWTH SECTORS (13): Wood Products; Furniture and Related Products; Textile Mills; Printing and Related Support Activities; Food, Beverage and Tobacco Products; Plastics and Rubber Products; Chemical Products; Apparel, Leather and Allied Products; Computer and Electronic Products; Primary Metals; Petroleum and Coal Products; Miscellaneous Manufacturing; and Electrical Equipment, Appliances and Components.

US CONTRACTION SECTORS (3): Transportation Equipment; Machinery; and Fabricated Metal Products.

ISM® RESPONDENT COMMENTS

Orders starting to pick up. [An] increase of about 35 percent to 40 percent. Chemical Products

Overall business remains down almost 70 percent. We are hanging on to as many employees as possible, but we will have to lay off 30 percent or more for at least two to three months until September or October. Transportation Equipment

While demand in [the] coming six months is stabilizing, it is at a significant reduction and clear [that] customers have little confidence in the forecasts. Export orders to Brazil, South Africa [and the] Middle East are largely cancelled for balance of 2020. Fabricated Metal Products

Manufacturing outlook has improved greatly in June as business has resumed at nearly 100 percent. We have implemented a number of safeguards that are costing extra money, but we are running. Computer and Electronic Products

Stabilizing demand for refrigerated and frozen beverages and dessert, but still at a higher level than a year ago. Uncertainty of school opening in the fall: How much demand will continue or shift will be dictated by students returning to school or not. Food, Beverage and Tobacco Products

Uncertainty regarding our industry and business has not improved. We are developing the 2021 budget around multiple scenarios. Petroleum and Coal Products

Incoming orders are slow. This is usually our busiest time of the year, but production is reduced due to lack of demand. Additional layoffs expected

Furniture and Related Products

General business climate continues to be subdued, driving highly conservative forecasting due to variability in the ongoing pandemic-driven conditions and economic response. Machinery

We are still seeing our customers shut down or affected by COVID-19. We are hoping for a bounce-back in September.

Miscellaneous Manufacturing

General business conditions are in a general slowing pattern. Many of the plants are on reduced hours and/or furloughs. About 20 percent to 25 percent of plants are scheduled to be consolidated in the next six months to improve margins and profitability.

Nonmetallic Mineral Products

Source: Institute for Supply Management®, ISM®, PMI®, Report On Business®. For more information, visit the ISM® website at www.ismworld.org.