U.S. Manufacturing Slips Deeper into Contraction

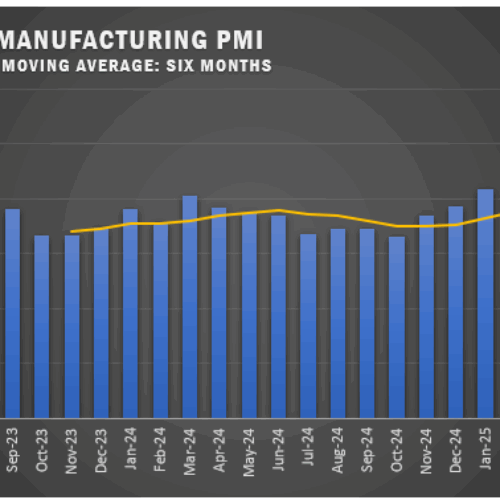

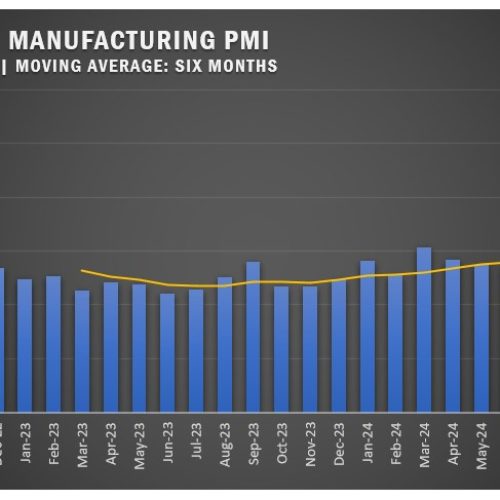

Inventory pullbacks, tariff disruptions and softening export demand weigh on factory performance U.S. manufacturing activity declined for the third straight

Read More

Inventory pullbacks, tariff disruptions and softening export demand weigh on factory performance U.S. manufacturing activity declined for the third straight

Read More

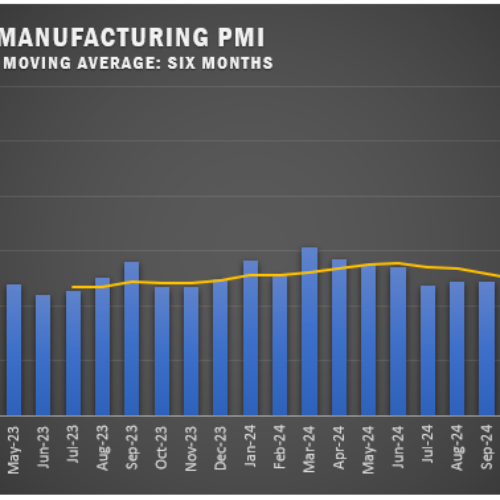

Canada, Mexico and China PMI readings slip based on global trade policy concerns The U.S. manufacturing sector showed signs of

Read More

Eurozone and UK Struggle Amid Demand Weakness, While Canada and India Show Resilience The US manufacturing industry faced contraction for

Read More

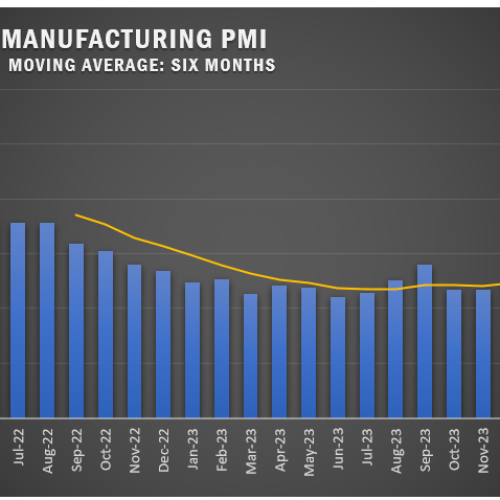

Canadian Strength Continues Four Straight Months of PMI Growth The ISM U.S. Manufacturing PMI registered 48.4 percent in November, a

Read More

By Phillip M. Perry Healthy economic growth will help bolster profits for construction and manufacturing operations in 2025. Lower interest

Read More

Global Manufacturing Slows Overall But Canada Pushes Into Growth Mode The ISM U.S. Manufacturing PMI held steady at 47.2 percent

Read More

Other Countries Follow the Trend, But the UK and India Continue to Soar The ISM U.S. Manufacturing PMI® dropped to

Read More

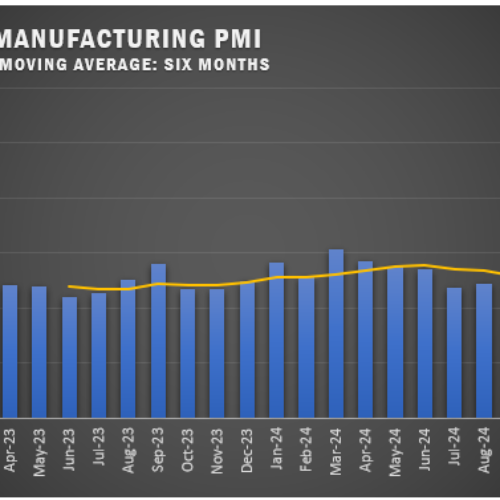

Indian and UK Manufacturers Post Good Numbers for June The ISM U.S. Manufacturing PMI® was reported at 48.5 percent for

Read More

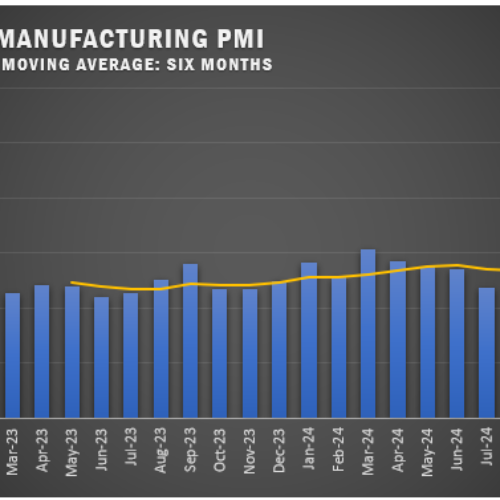

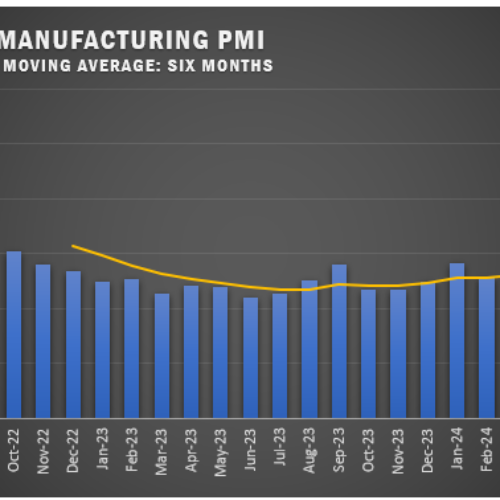

India and China Continue to Post Strong Manufacturing Numbers After a brief push into growth territory in March, the ISM

Read More

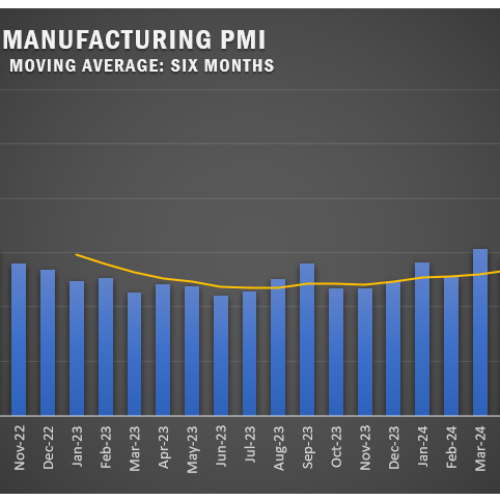

Italy and the UK Also Move Into Growth Territory The ISM U.S. Manufacturing PMI® jumped to 50.3 percent in March,

Read More