US Manufacturing Breaks Through in March

Italy and the UK Also Move Into Growth Territory

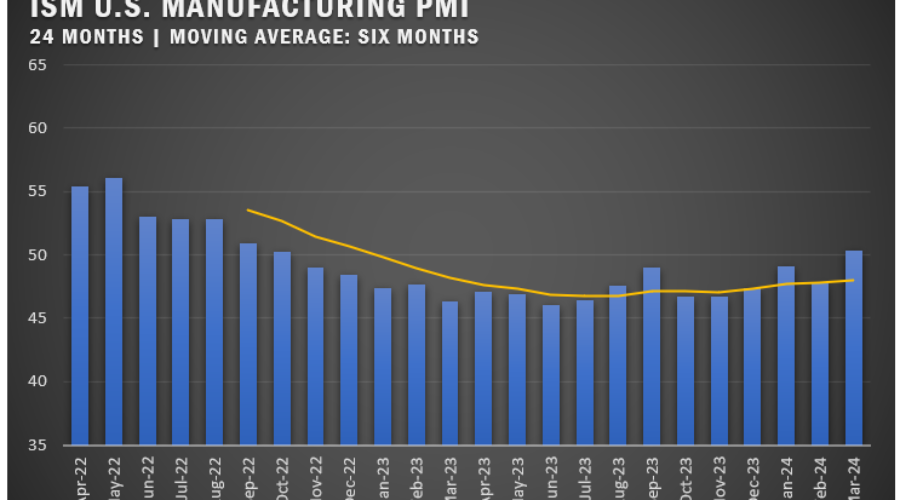

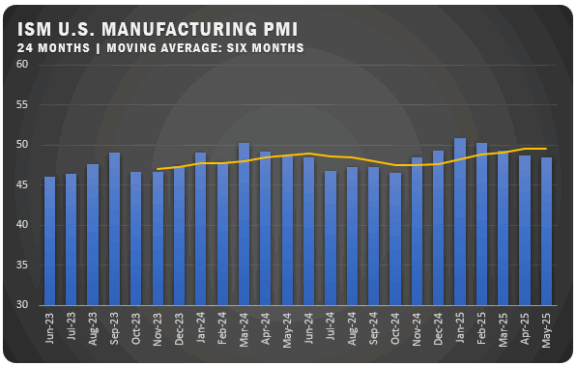

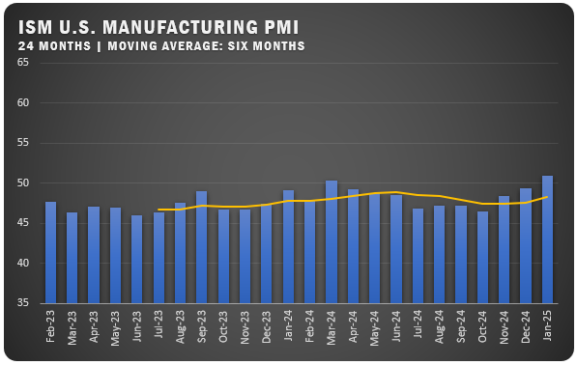

The ISM U.S. Manufacturing PMI® jumped to 50.3 percent in March, up 2.5 percentage points from the 47.8 percent figure recorded in February. The reading put U.S. manufacturing into growth territory for the first time since October of 2022.

“Demand remains at the early stages of recovery, with clear signs of improving conditions. Production execution surged compared to January and February, as panelists’ companies re-enter expansion,” says Timothy R. Fiore, Chair of the ISM® Manufacturing Business Survey Committee. “Suppliers continue to have capacity but are showing signs of struggling, due in large part to their raw material supply chains.”

According to the report, the overall economy continued expansion for the 47th month after one month of contraction in April 2020. A Manufacturing PMI® above 42.5 percent, over a period of time, generally indicates an expansion of the overall economy.

The New Orders Index moved back into expansion territory at 51.4 percent, 2.2 percentage points higher than the 49.2 percent recorded in February. The March reading of the Production Index (54.6 percent) is 6.2 percentage points higher than February’s figure of 48.4 percent. The Prices Index registered 55.8 percent, up 3.3 percentage points compared to the reading of 52.5 percent in February. The Backlog of Orders Index registered 46.3 percent, the same reading as in February. The Employment Index registered 47.4 percent, up 1.5 percentage points from February’s figure of 45.9 percent.

Panelists’ companies notably increased their production levels month over month. Headcount reductions continued in March, with sizable layoff activity reported. Inputs — defined as supplier deliveries, inventories, prices and imports — continued to accommodate future demand growth and showed signs of stiffening. The Supplier Deliveries Index dropped marginally, moving into ‘faster’ territory, and the Inventories Index improved but remained in slight contraction territory. The Prices Index moved further upward in moderate expansion (or ‘increasing’) territory as commodity-driven costs remain unstable.

US SECTOR REPORT

ISM® GROWTH SECTORS (9): Textile Mills; Nonmetallic Mineral Products; Paper Products; Petroleum and Coal Products; Primary Metals; Food, Beverage and Tobacco Products; Fabricated Metal Products; Chemical Products; and Transportation Equipment.

ISM® CONTRACTION SECTORS (6): Furniture and Related Products; Plastics and Rubber Products; Electrical Equipment, Appliances and Components; Machinery; Computer and Electronic Products; and Miscellaneous Manufacturing.

MARCH ISM® REPORT COMMENTS

(U.S. Manufacturers)

- “Business activity is up. Many manufacturers are anticipating better business in the second quarter and much better in the third quarter. They are reporting that second-quarter bookings are just starting to ramp up.” Wood Products

- “Performance continues to defy projections of a downturn in activity. Demand remains strong, and the pipeline for orders is robust.” Chemical Products

- “Expecting to see orders and production pick up for the second quarter. Suppliers are working with us to help drive costs down, which will help improve the margin for the rest of the year and deliver growth in 2025.” Transportation Equipment

- “Commodity prices continue to hold steady.”

Food, Beverage and Tobacco Products - “Demand remains soft, but optimism is high that orders are ‘just on the horizon.’ Expectations are for a strong second quarter. Supply chain issues are minimal, with only semiconductors and select electronic parts being an issue.”

Computer and Electronic Products - “Noticing an increase in suppliers’ selectiveness regarding orders they quote and take. Additionally, there’s been a noticeable increase in manufacturing companies targeted for acquisition by larger entities (established companies, investment firms and the like).” Machinery

- “Business is still strong — we are meeting and exceeding our forecasts. So far, we’re not hearing anything negative with our customers as far as ongoing business is concerned — it’s the same for raw material suppliers, nothing negative.”

Fabricated Metal Products - “As an energy-intensive manufacturer, energy pricing continues to be a concern for our business. The move to electrification has increased demand, and supply is not stable because we’re not in an ideal geography for wind and solar power.” Paper Products

- “Continue to experience a softness in the industrial sector. There is optimism that order activity will increase in the late second quarter, leading to improvement in this segment for the second half of the year. The aerospace and defense market is continuing to ramp up, and demand is outpacing supply in our supply chain.” Primary Metals

GLOBAL PMI NOTES

EUROZONE: The HCOB Eurozone Manufacturing PMI was reported at 46.1 percent for March, down from February, which was also down from the January figure. The downward trend seems to be the result of supply chain issues following the Suez Canal problem. New and export orders declined but at a slower rate. Growth projections were soft, but business optimism was up for the region.

CANADA: The S&P Global Canada Manufacturing PMI pushed up slightly in March to 49.8 percent continuing a third straight month of upward movement. The trend has Canadian manufacturing near growth territory, but the latest reading still represented an 11th straight month below the 50 percent line. Business optimism is still lukewarm but improved from the previous month. Businesses were optimistic enough to push up employment in anticipation of increased demand ahead.

CHINA: The Caixin China General Manufacturing PMI was reported at 51.1 percent in March as Chinese manufacturing continues to tick up slightly each month going back to a dip in October 2023. The trend is fueled by an increase in new domestic and export orders. Input prices were slightly lower which led to a third straight month of cuts to selling prices. Employment declined, but business optimism was strong based on predictions of improvement in global economic conditions.

FRANCE: After a jump of four points in February, the S&P Global France Manufacturing PMI slipped from 47.1 to 46.2 percent in March. The surge in February halted an overall downward trend for French manufacturers that dates back to May of 2021. While still firmly in contraction territory, output still declined but at a slower rate, resulting in a decline in employment. Business optimism is hopeful as the country’s manufacturers are anticipating improved economic conditions ahead.

GERMANY: German manufacturing saw a three-point drop in February that halted a six-month trend of improvement. For March, the HCOB Germany Manufacturing PMI registered further downward movement with a reading of 41.9 percent. The unexpected drop in February was attributed to weak demand in the country and abroad, dropping both new orders and output. Accordingly, employment also fell sharply. Looking ahead though, business optimism was up based on projections of improvement in economic conditions over the next 12 months.

INDIA: Manufacturing in India continues to be on a hot streak as the HSBC India Manufacturing PMI was reported at 59.1 percent for March, up 2.2 percent from February. According to the report, the March numbers represented the highest growth in manufacturing activity since February of 2008. Additionally, the country’s manufacturers have been in growth territory since June of 2021. Exports and purchasing were both up sharply and that led to strong growth in employment. Despite all of the positives, inflation did accelerate and that resulted in lower business optimism.

ITALY: Italian manufacturing jumped in March to move into growth territory as the HCOB Italy Manufacturing PMI was reported at 50.4 percent. The figure was up 1.7 percent from February and the first time Italian manufacturing has been in expansion territory since last March. New orders and output saw moderate growth, and factories added jobs for a second straight month. Input costs fell slightly and companies passed along the savings with a sharp drop in selling prices. Based on positive projections for the overall economy, business optimism was strong.

UNITED KINGDOM: U.K. manufacturing also jumped on the trend as the S&P Global U.K. Manufacturing PMI offered a reading of 50.3 percent for March, up from 47.5 percent in February. The push into growth territory ended a streak that dated back to August of 2022. The improvement resulted from increases in output and new orders with the consumer goods sector showing strong growth. From an inflation perspective, manufacturers saw increases in both input costs and output charges. The jobs decline slowed as business optimism improved sharply.

Source: Institute for Supply Management® , PMI® (Purchasing Manager Index), Report On Business® . For more information, visit the ISM® website at www.ismworld.org.