German Manufacturing Stays Near Record Levels

Global manufacturers saw varying results in the month of July as many countries face new headwinds with COVID-19 outbreaks hitting specific regions. Additionally, lead times are still extended with supply chain issues continuing. Firms are also facing labor challenges that pre-date the pandemic but have escalated during the past 18 months. Both issues lead to inflationary pressure with most regions reporting input and output price increases. Still, all countries in our report remain above the crucial 50 percent PMI line, but business confidence overall for manufacturers is slipping as companies weigh the impact of prolonged issues from the COVID-19 Delta variant.

GERMANY: IHS Markit/BME reported a PMI of 65.9 percent for German manufacturers in July, which represented a second straight month of growth and the third-highest figure on record. New orders were strong and led to a sharp increase in backlogs. Employment also saw a big increase.

EUROZONE: IHS Markit reported a dip to 62.8 percent for the July PMI reading for Eurozone manufacturers. That was down from 63.4 percent in June, but the region continues an expansion streak that dates back to July of 2020. Output increased slightly but new export orders continued to show a strong increase. With backlogs increasing, the Eurozone followed the German trend with employment increasing.

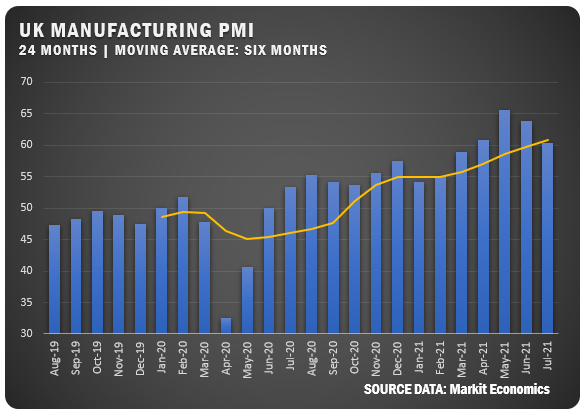

UNITED KINGDOM: The IHS Markit/CIPS UK Manufacturing PMI saw a 3.5 percent drop from the previous month to 60.4 percent for July. Growth in output and new orders slowed, but both are still near record levels based on domestic and overseas demand. Lead times continued to expand due to global supply chain issues resulting from raw material shortages, COVID-19 issues and Brexit. Input and output costs both increased.

ITALY: IHS Markit reported a PMI of 60.3 percent for Italian manufacturers in July after registering 62.2 percent in June. Capacity issues and supply chain logistics led to the decrease, but factory production and order book volumes increased along with employment. Input costs rose leading to higher output prices and business optimism dropped to a 15-month low due to COVID-19 concerns.

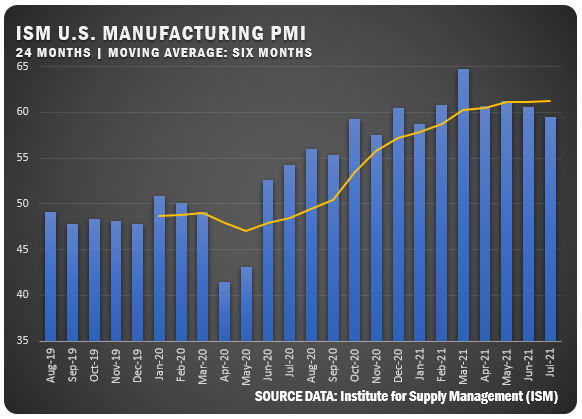

UNITED STATES: US manufacturers registered a 59.5 percent PMI® according to the July Manufacturing ISM® Report On Business®. That was down 1.1 percentage points from the June reading of 60.6 percent and the lowest reading since January. Entering the third quarter, all segments of the US manufacturing economy were impacted by near record-long raw-material lead times, continued shortages of critical basic materials, rising commodities prices and difficulties in transporting products. Worker absenteeism, short-term shutdowns due to parts shortages and difficulties in filling open positions continue to be issues limiting manufacturing growth potential.

“Manufacturing performed well for the 14th straight month, with demand, consumption and inputs registering growth compared to June,” says Timothy R. Fiore, Chair of the ISM® Manufacturing Business Survey Committee. “Panelists’ companies and their supply chains continue to struggle to respond to strong demand due to difficulties in hiring and retaining direct labor. Comments indicate slight improvements in labor and supplier deliveries offset by continued problems in the transportation sector. High backlog levels, too low customers’ inventories and near-record raw-materials lead times continue to be reported. Labor challenges across the entire value chain and transportation inefficiencies are the major obstacles to increasing growth.”

Related: Full ISM July 2021 US Manufacturing Report

INDIA: After falling to 48.1 percent in June, Indian Manufacturers bounced back with a July PMI reading of 55.3 percent according to IHS Markit. Output, new orders, exports and inputs returned to expansion territory and employment rose to end a streak of 15 months with decreases. Business confidence improved in July, but concerns related to COVID-19 are still noted.

CHINA: The Caixin China General Manufacturing PMI registered 50.3 percent for July 2021, down a full percentage point from June. It was the lowest figure for China in 15 months. Higher materials costs, weather and a COVID-19/Delta variant surge of cases in Nanjing were cited as causes. New orders fell but export sales were steady. Employment was relatively unchanged while backlogs increased slightly. Average delivery times increased due to supply chain issues, but inflationary pressures eased as input costs saw only a small increase and output charges rose minimally.

Credit: Institute for Supply Management®, ISM®, PMI®, Report On Business®. For more information, visit the ISM® website at www.ismworld.org.