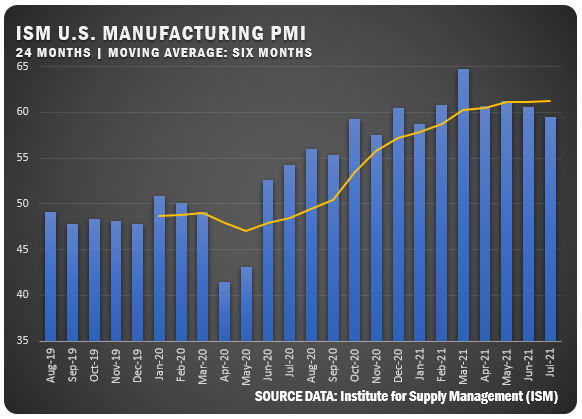

Labor Challenges Cited as US Manufacturing PMI Dips to 59.5 Percent

Overall US Economy Has 14th Consecutive Month of Growth

US manufacturers registered a 59.5 percent PMI® according to the July Manufacturing ISM® Report On Business®. That was down 1.1 percentage points from the June reading of 60.6 percent and the lowest reading since January. In the report, Timothy R. Fiore, Chair of the ISM® Manufacturing Business Survey Committee says Business Survey Committee panelists reported that their companies and suppliers continue to struggle to meet increasing demand levels. Entering the third quarter, all segments of the manufacturing economy are impacted by near record-long raw-material lead times, continued shortages of critical basic materials, rising commodities prices and difficulties in transporting products. Worker absenteeism, short-term shutdowns due to parts shortages and difficulties in filling open positions continue to be issues limiting manufacturing-growth potential.

Optimistic panel sentiment remained strong, with 13 positive comments for every cautious comment. Demand expanded, with the (1) New Orders Index growing, supported by continued expansion of the New Export Orders Index, (2) Customers’ Inventories Index remaining at very low levels and (3) Backlog of Orders Index staying at a very high level. Consumption (measured by the Production and Employment indexes) improved in the period, posting a combined 0.6-percentage point increase to the PMI reading. The Employment Index returned to expansion after one month of contraction; panelists continued to note significant difficulties in attracting and retaining labor at their companies’ and suppliers’ facilities, although there were signs of improvement. Inputs — expressed as supplier deliveries, inventories, and imports — continued to support input-driven constraints to production expansion, at slower rates compared to June as the Supplier Deliveries Index softened while the Inventories Index contracted, likely due to long lead times. The Prices Index expanded for the 14th consecutive month, indicating continued supplier pricing power and scarcity of supply chain goods.

“Manufacturing performed well for the 14th straight month, with demand, consumption and inputs registering growth compared to June,” says Fiore. “Panelists’ companies and their supply chains continue to struggle to respond to strong demand due to difficulties in hiring and retaining direct labor. Comments indicate slight improvements in labor and supplier deliveries offset by continued problems in the transportation sector. High backlog levels, too low customers’ inventories and near record raw-materials lead times continue to be reported. Labor challenges across the entire value chain and transportation inefficiencies are the major obstacles to increasing growth.”

RELATED: Full Global Manufacturing Report (July 2021)

ISM® REPORT COMMENTS (U.S.)

- “Business levels continue to exhibit strong demand, with no signs of backing down. Purchases continue to have long lead times due to shortages of raw materials and labor force, as well as logistics challenges. Increased costs are being passed to customers.” Computer and Electronic Products

- “Supply chains are slowly, very slowly filling up. Like a water hose, starting upstream and slowly flowing downstream. Rumor is a full return to ‘normal’ may be nearer to year’s end, but the situation is progressing. Transportation (equipment and drivers) is the current pinch point, more so than material shortages.” Chemical Products

- “Strong sales continue, and inventories are low as the chip shortage is keeping production numbers down — we have idled several of our assembly plants to reduce the strain on the chip supply base.” Transportation Equipment

- “Still dealing with price increases from force majeure issues as well as overseas shipping premiums and higher costs of items like fuel. Customer demand still high; pushing plant to max production rates.” Food, Beverage and Tobacco Products

- “Strong operations, (with) new programs, orders and launches. Continue to have hiring difficulties and are unable to fill production and salaried jobs (due to) a lack of candidates. Raw materials are still in short supply, with longer lead times.” Fabricated Metal Products

- “Incoming bookings continue to be strong, and economy continues to return. Still struggling with inflation and availability (of materials, labor and freight).” Furniture and Related Products

- “Sales are above last year by a good percentage, but meeting demand is just not possible due to force majeure situations, logistics, and labor shortages. We don’t anticipate this ending until well into 2022.” Nonmetallic Mineral Products

- “Supply chain continues to be extremely challenging in a variety of categories. Having to place orders months ahead of time just to get a place in line.” Machinery

- “Very busy with new orders. Material costs continue to rise, and supplies are sometimes delayed. Labor issues are still affecting us the most with finding proper labor. Labor— costs are increasing as we are competing locally for top talent.” Miscellaneous Manufacturing

- “Business levels continue to be very strong, but we also continue to struggle finding employees. We can only fill 75 percent of our order requirements due to the labor shortage.” Primary Metals

US SECTOR REPORT

ISM GROWTH SECTORS (17): Furniture and Related Products; Printing and Related Support Activities; Apparel, Leather and Allied Products; Miscellaneous Manufacturing; Computer and Electronic Products; Nonmetallic Mineral Products; Machinery; Fabricated Metal Products; Paper Products; Chemical Products; Food, Beverage & Tobacco Products; Primary Metals; Plastics and Rubber Products; Transportation Equipment; Electrical Equipment, Appliances and Components; Wood Products; and Petroleum and Coal Products.

ISM CONTRACTION SECTORS (1): Textile Mills.

Credit: Institute for Supply Management®, ISM®, PMI®, Report On Business®. For more information, visit the ISM® website at www.ismworld.org.