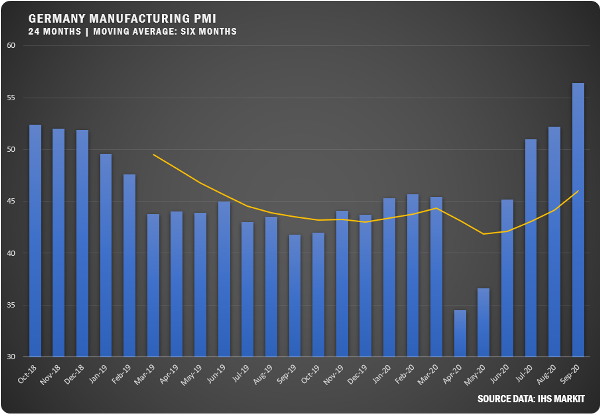

Germany Leads PMI Charge For September

While Euro Area manufacturing had a strong performance in September with a PMI reading 53.7 percent, German manufacturers led the charge with a 4.2 percent increase over August to hit a IHS Markit/BME reported figure of 56.4 percent. That represented the best expansion in the sector since July 2018 while the new order growth figure was among the strongest reported months since 1996. Improved demand across Europe, China and Turkey also saw new export orders reach the highest level for Germany since December 2017.

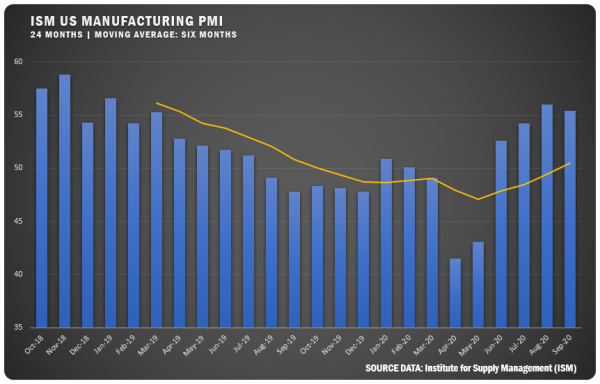

USA: The ISM® Report on Business for September had a US manufacturing PMI of 55.4 percent which was a slight decrease from the August reading of 56 percent but still represented a fourth straight month above the 50 percent line. “Manufacturing performed well in the month with demand, consumption and inputs registering growth indicative of a normal expansion cycle. While certain industry sectors are experiencing difficulties that will continue in the near term, the manufacturing community as a whole has learned to conduct business effectively and deal with the variables imposed by the COVID-19 pandemic,” says Timothy R. Fiore, ISM® Manufacturing Business Survey Committee Chair.

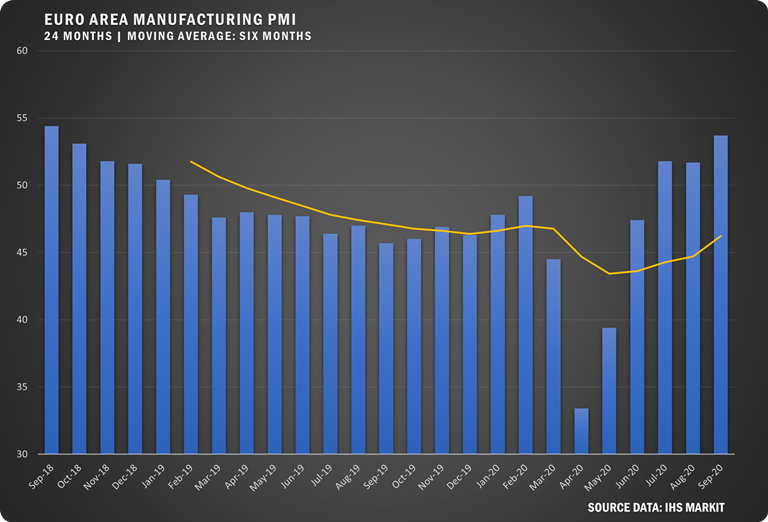

EUROZONE: IHS Markit reported a September Eurozone PMI of 53.7 for European manufacturers which was a solid bump up from the 51.7 reading in August. New orders saw their fastest rate of growth since February 2018 based on improving exports.

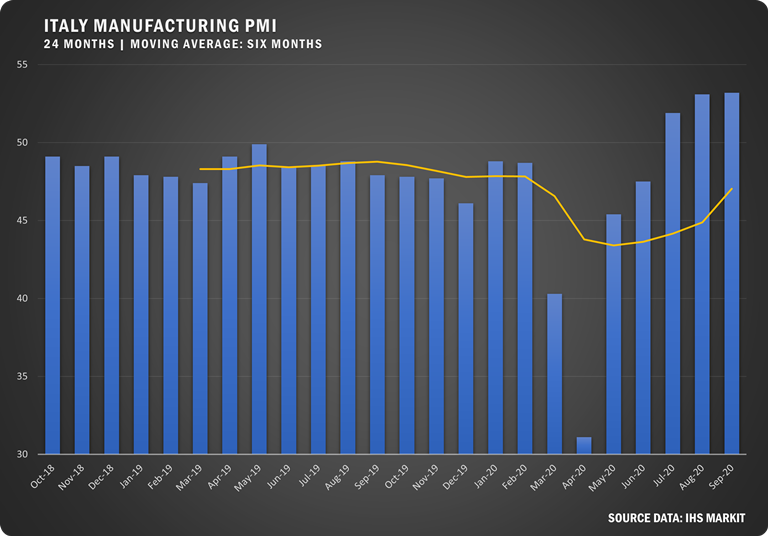

ITALY: IHS Markit reported a PMI of 53.2 percent in September for Italian manufacturers just up slightly from the August reading of 53.2 For the first time since April of 2019, new export orders rose and notably the labor force increased in September after 15 consecutive months of decreases.

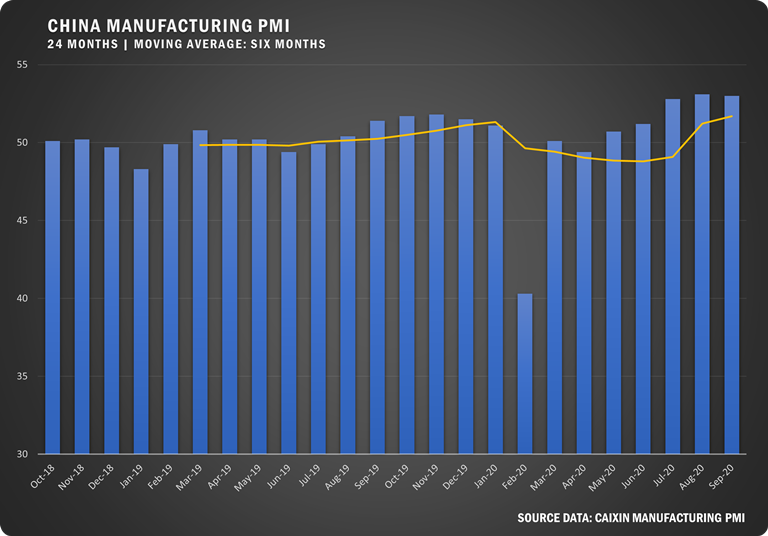

CHINA: The Caixin China General Manufacturing PMI dipped slightly to 53.0 in September after registering 53.1 in August. New orders hit their highest level since early 2011 and Chinese business sentiment improved to a three-month high.

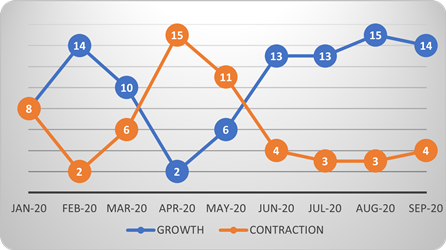

US SECTOR REPORT

ISM GROWTH SECTORS (14): Paper Products; Wood Products; Food, Beverage & Tobacco Products; Furniture & Related Products; Electrical Equipment, Appliances & Components; Nonmetallic Mineral Products; Fabricated Metal Products; Chemical Products; Miscellaneous Manufacturing; Plastics & Rubber Products; Machinery; Textile Mills; Computer & Electronic Products; and Transportation Equipment.

ISM CONTRACTION SECTORS (4): Apparel, Leather & Allied Products; Printing & Related Support Activities; Petroleum & Coal Products; and Primary Metals.

ISM® US RESPONDENT COMMENTS

“Still struggling with long lead times for components coming from China [contract manufacturers].” (Computer & Electronic Products)

“Volume remains lower than one year ago but has steadily improved over the past two periods.” (Chemical Products)

“Business is booming, and the supply chain has been caught off guard. We are working closely with our suppliers to ensure supply and try to control costs. The resin industry, along with plastics, is driving cost increases and scarce availability.” (Transportation Equipment)

“Our business has not begun to recover.” (Petroleum & Coal Products)

“Overall business conditions are improving, but not at the rates we saw them decline.” (Fabricated Metal Products)

“Our customer order intake is increasing significantly for deliveries in the first half of 2021. Outlook is generally positive.” (Machinery)

“Retail sales remain strong, but food service is still down about 15 percent year-over-year. All of our factories are still struggling with manning shifts due to positive COVID-19 cases and/or quarantine because employees came in contact with someone who contracted the virus.” (Food, Beverage & Tobacco Products)

“Demand remains high, strong finish to 2020 projected, with an even stronger 2021 fiscal year. Prices have increased in certain categories, but no major price increases of our own have been implemented yet. We are seeing an uptick in reshoring opportunities in the third quarter across various industries and products.” (Electrical Equipment, Appliances & Components)

“We are seeing a marked increase in international demand in Q4 compared to Q2 and Q3. Still not at historical levels; however, a positive outlook.” (Paper Products)

“Raw material shortages, especially of hardwood logs, are starting to impact overall supply. Domestic market demand is fragmented but remains sound. Export demand, especially to China, is robust.” (Wood Products)

“Business has continued to be strong, with September following August. October is also shaping up to be a good sales month as well.” (Plastics & Rubber Products)

Source: Institute for Supply Management®, ISM®, PMI®, Report On Business®. For more information, visit the ISM® website at www.ismworld.org.