US Manufacturing PMI Breaks Downward Streak

Outside the US, China and Italy Both Registered Solid PMI Increases for February

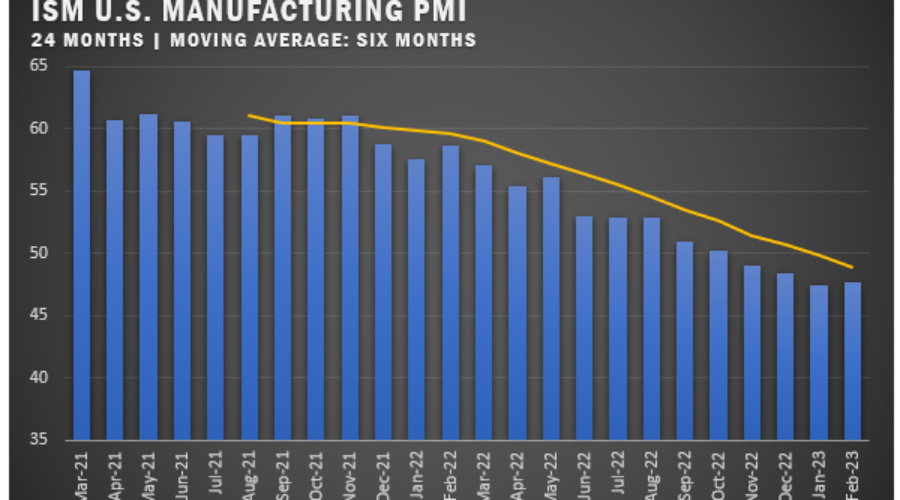

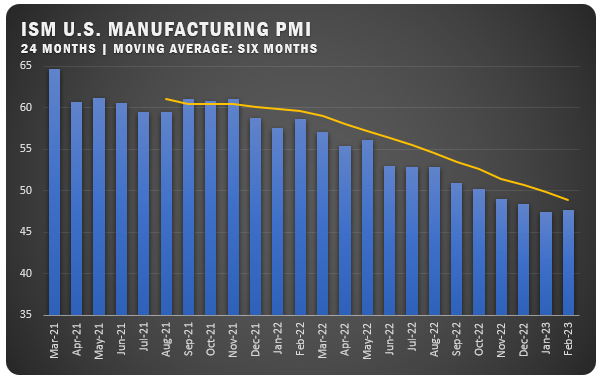

The February ISM® Report On Business® issued a PMI reading of 47.7 percent for US manufacturers to end a five-month downward streak. The number was up three-tenths over the January figure of 47.4 percent.

“New order rates remain sluggish due to buyer and supplier disagreements regarding price levels and delivery lead times; the index increase suggests progress in February,” says Timothy R. Fiore, Chair of the ISM® Manufacturing Business Survey Committee. “Panelists’ companies continue to attempt to maintain head-count levels through the projected slow first half of the year in preparation for a stronger performance in the second half.”

According to the ISM® report, the reading indicates a third month of contraction after a 30-month period of expansion for the overall economy. Additionally, in the last two months, the Manufacturing PMI® has been at its lowest levels since May 2020, when it registered 43.5 percent.

The index reflects companies continuing to slow outputs to better match the demand for the first half of 2023 and prepare for growth in the second half of the year. Demand eased, with the New Orders Index contracting at a slower rate, the New Export Orders Index was still below 50 percent but continues to improve, and panelists’ data has the Customers’ Inventories Index remaining at ‘too low,’ which is a positive for future production. The Backlog of Orders Index recovered for a third month but is still in a moderate contraction.

ISM® REPORT COMMENTS (US Manufacturers)

- “Good start to the year for bookings. Electronic components, specifically processors, continue to be challenging due to the risk of not hitting the commit dates, even with the extended lead times quoted.” [Computer and Electronic Products]

- “A slowdown in new housing construction and concerns of a slowing economy have customers delaying purchases in an effort to destock.” [Chemical Products]

- “Sales remain solid, and most assembly plants are running at capacity. There is concern for the global supply chain now that we are restricting sales of some semiconductors to China.” [Transportation Equipment]

- “Expect the first half of 2023 in the U.S. to be slower than the second half. Expect slower orders throughout 2023 for Europe.” [Food, Beverage and Tobacco Products]

- “Even though our number of quotes are down, we are still staying busy, and our backlog has a lot to do with it. A backlog of 30-plus weeks is not ideal.” [Machinery]

- “Business and new orders are softening, and customers are pushing out current orders.” [Plastics and Rubber Products]

- “New orders are steady; production has been running consistently for several months. Many items remain in short supply (particularly anything electronics) and require daily monitoring to ensure supply.” [Electrical Equipment, Appliances and Components]

- “New orders are still strong; however, we continue to experience price increases (although at a slower rate than a year ago), which we have not accounted for in this year’s budget. Restoring lost margin due to cost increases is a top priority.” [Fabricated Metal Products]

- “We shipped some long-term backlogged orders, enabling some progress on our current backlog.” [Miscellaneous Manufacturing]

- “Business conditions are still strong; however, inventory has exceeded our planned levels. This will impact operations until the inventory situation is resolved.” [Primary Metals]

- “While there are lingering concerns about a recession, we are not expecting a large drop-off in manufacturing this year. Worst case is flat.” [Nonmetallic Mineral Products]

US SECTOR REPORT

ISM® GROWTH SECTORS (4): Apparel, Leather and Allied Products; Transportation Equipment; Petroleum and Coal Products; and Electrical Equipment, Appliances and Components.

ISM® CONTRACTION SECTORS (14): Printing and Related Support Activities; Paper Products; Wood Products; Textile Mills; Furniture and Related Products; Nonmetallic Mineral Products; Plastics and Rubber Products; Food, Beverage and Tobacco Products; Chemical Products; Primary Metals; Computer and Electronic Products; Fabricated Metal Products; Machinery; and Miscellaneous Manufacturing.

GLOBAL MANUFACTURING

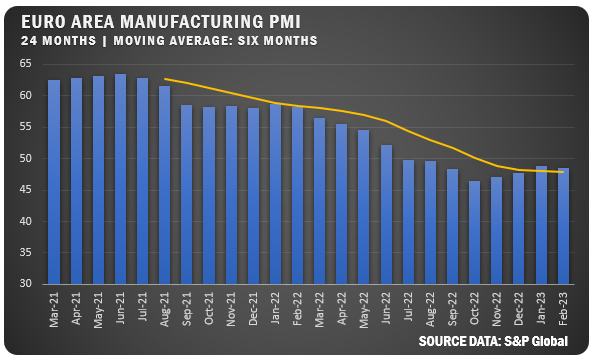

EUROPE: Eurozone manufacturing activity fell for the eighth consecutive month in February 2023, with the S&P Global Eurozone Manufacturing PMI reported at 48.5 percent, slightly lower than January’s 48.8 percent. Eurozone manufacturing activity fell for the eighth consecutive month in February 2023, with the S&P Global Eurozone Manufacturing PMI at 48.5, slightly lower than January’s 48.8. Supply-chain pressures eased, but stocks of purchases declined sharply. However, output, new orders, and employment were all positive, and input cost inflation and output price inflation were both lower. Eurozone manufacturers were slightly more optimistic about the year-ahead outlook.

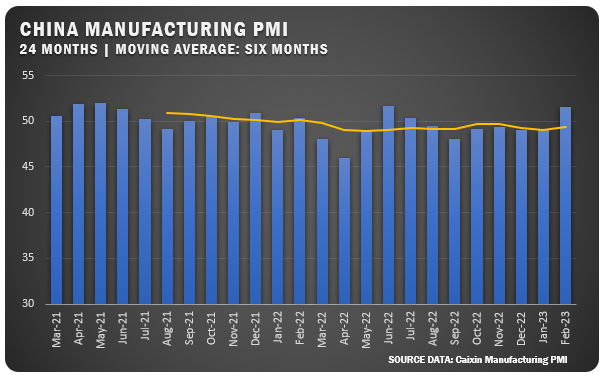

CHINA: China’s Caixin General Manufacturing PMI rose to 51.6 percent in February 2023 from January’s 49.2 percent reading, the first increase since July 2022. Output and new orders grew at the fastest rates since June 2022 and May 2021, respectively, while employment climbed for the first time in 11 months. Input and output cost inflation accelerated as delivery times improved significantly. The business outlook reached a 23-month high, based on projections of continuing improvement in customer demand.

GERMANY: The S&P Global/BME Germany Manufacturing PMI for February 2023 registered a disappointing 46.3 percent reading which was down from the previous month’s figure of 47.3. Percent. The 1.0 percent drop broke a three-month upward trend and was the eighth straight month below the 50 percent line. Improved supplier delivery times and a decline were key factors in the weaker reading. However, output rose for the first time in nine months thanks to the supply-chain improvement. supply-chain bottlenecks. New orders declined at a slower pace, and employment improved. Business outlook hit a 12-month high.

INDIA: The S&P Global India Manufacturing PMI dipped to 55.3 percent in February to register a four-month low of 55.3. The was just 0.1 percent off the January figure of 55.4 percent as the index remained above the 50 percent line (expansion) for the 20th month. Output and new orders grew, but export sales started to slow down. Employment was steady while buying demand showed a strong increase. Costs for inputs pushed up to a four-month high. The business outlook improved over the previous month

ITALY: The S&P Global Italy Manufacturing PMI jumped up to 52 percent in February pushing well above the 50 percent expansion line. Output grew solidly due to the first increase in new orders in 10 months and the delivery of previously ordered inputs. Companies were cautious with purchasing, but stronger output increased and pushed up employment. hiring activity at the fastest pace in 11 months. Input price inflation decreased as energy costs fell along with prices of general commodities. Output prices continued to increase.

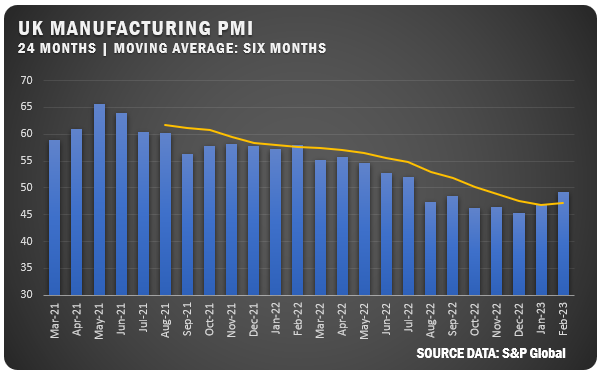

UNITED KINGDOM: The S&P Global/CIPS UK Manufacturing PMI registered 49.3 percent for February up sharply from January’s reading of 47.0 percent. It was also the second straight month for upward movement as the downturn in output ended and production increased. The effect stabilized demand and paired with improved supply logistics the result was the first increase in production output in eight months. The business outlook improved further based on expected new products, projected investment and the improvement in supply chain logistics.

Credits: Institute for Supply Management®, PMI®(Purchasing Manager Index), Report On Business®. For more information, visit the ISM® website at www.ismworld.org.