US Manufacturing Remains Flat For November

German and UK Manufacturing Register Strong Improvement in November

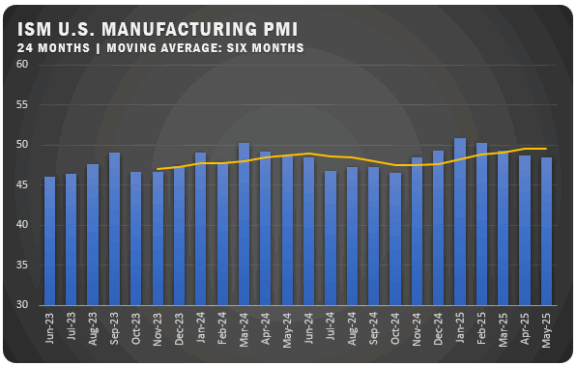

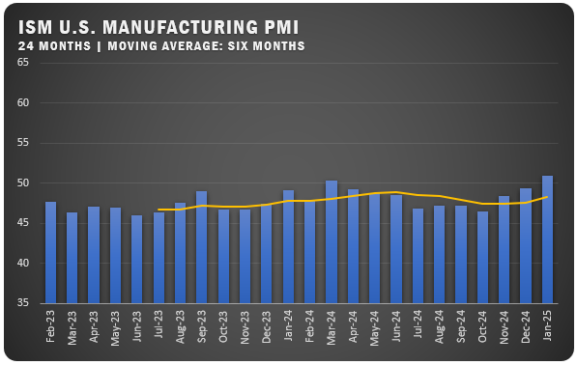

ISM® reported a U.S. Manufacturing PMI® of 46.7 percent in November matching the same figure in October. The stagnant readings for both months halted a three-month uptrend from July through September that seemed to show U.S. manufacturing on track to move above the 50 percent mark before year-end. According to the report issued by Timothy R. Fiore, Chair of the ISM® Manufacturing Business Survey Committee, demand remains soft and production execution is slightly down compared to October as U.S. companies continue to manage outputs, material inputs and labor costs.

The overall economy continued in contraction for a second month after one month of weak expansion preceded by nine months of contraction and a 30-month period of expansion before that. (A Manufacturing PMI® above 48.7 percent, over a period of time, generally indicates an expansion of the overall economy.) The New Orders Index remained in contraction territory at 48.3 percent, 2.8 percentage points higher than the figure of 45.5 percent recorded in October. The Production Index reading of 48.5 percent is a 1.9-percentage point decrease compared to October’s figure of 50.4 percent. The Prices Index registered 49.9 percent, up 4.8 percentage points compared to the reading of 45.1 percent in October. The Backlog of Orders Index registered 39.3 percent, 2.9 percentage points lower than the October reading of 42.2 percent. The Employment Index registered 45.8 percent, down one percentage point from the 46.8 percent reported in October.

“Suppliers continue to have capacity. Sixty-five percent of manufacturing gross domestic product (GDP) contracted in November, down from 75 percent in October,” says Fiore. “More importantly, the share of sector GDP registering a composite PMI® calculation at or below 45 percent — a good barometer of overall manufacturing weakness — was 54 percent in November, compared to 35 percent in October and 6 percent in September. Three of the top six industries by contribution to manufacturing GDP were at or below 45 percent, same as the previous month.”

ISM® REPORT COMMENTS (US Manufacturers)

- “Economy appears to be slowing dramatically. Customer orders are pushing out, and all efforts are being made to right-size inventory levels, both to mitigate carrying costs on pushed-out orders and to load up on inventory where costs are exploding, like cold-rolled steel.” Computer & Electronic Products

- “Starting to feel softening in the economy, with labor still a challenge to backfill critical roles. The 2024 forecast looks challenging, especially from a cost perspective.” Chemical Products

- “Nearly all microchip supply issues have been resolved, finally bringing an end to the three-year chip shortage. Material prices are remaining relatively flat. Supply chain issues continue in several areas, resulting from difficulties during the United Auto Workers (UAW) strike.” Transportation Equipment

- “Our executives have requested that we bring down inventory levels considerably, and it has started causing customer shortages. Both finished goods, and low inventories of raw and packing materials are creating issues in fulfilling customer demand, and in some cases causing serious (production) delays.” Food, Beverage & Tobacco Products

- “The end of the major construction season and an early pullback in customer capital expenditures purchases have resulted in a lower backlog in the fourth quarter.” Machinery

- “Automotive sales still impacted by UAW strike. Still waiting for orders to come in, and we also need to work down inventory levels that increased during the strike period. This will most likely happen in December.” Fabricated Metal Products

- “Customer orders have pushed into the first quarter of 2024, resulting in inflated end-of-year inventory.” Miscellaneous Manufacturing

- “(Our situation is) good but guarded, as next year is hard to predict. There are undertones of uncertainty in the market and the impact of inflation on maintenance and project costs has become apparent.” Nonmetallic Mineral Products

- “Customers back online after the UAW strike. Consuming inventory that was built as a strike bank. Still (having) issues with hiring quality candidates for both hourly and salaried positions. Current inventory levels are too high, but the order book remains strong.” Primary Metals

- “Elevated financing costs have dampened demand for residential investment. Our business has been negatively impacted through reduced new orders for our products and services. We are purchasing less for production and finished goods inventories.” Wood Products

US SECTOR REPORT

ISM® GROWTH SECTORS (3): Food, Beverage & Tobacco Products; Nonmetallic Mineral Products; and Transportation Equipment.

ISM® GROWTH SECTORS (14): Paper Products; Printing & Related Support Activities; Electrical Equipment, Appliances & Components; Computer & Electronic Products; Apparel, Leather & Allied Products; Textile Mills; Machinery; Primary Metals; Furniture & Related Products; Miscellaneous Manufacturing; Chemical Products; Fabricated Metal Products; Wood Products; and Plastics & Rubber Products.

Commodities Up in Price: Cocoa; Electrical Components; Electronic Components (3); Labor — Temporary (3); Natural Gas (5); Polyethylene; Polypropylene (2); Steel (5); Steel — Carbon; Steel — Cold Rolled; and Steel — Hot Rolled.

Commodities Down in Price: Aluminum (6); Corrugated Boxes (4); Crude Oil; Diesel; Nickel; and Steel Products (6).

Commodities in Short Supply: Electrical Components (38); Electrical Equipment (2); Electronic Components (36); and Semiconductors.

NOTE: The number in parentheses indicates consecutive months at the same status.

GLOBAL MANUFACTURING

EUROPE: For November, the HCOB Eurozone Manufacturing PMI showed signs of resilience, climbing to 44.2 percent, the highest since May. The figure was 1.2 percent up from October’s 43.1 percent reading. Despite the progress, Austria continued to lead the bloc’s manufacturing sector recession, trailed closely by Germany and France. New orders, export sales and output declined but at a slower pace than in previous months. Backlogs continued to decline and job losses hit their fastest pace since August 2020. Supply delivery times continued to shorten to extend a 10-month streak. Business optimism reached a three-month high.

CHINA: After a slip in October, the Caixin China General Manufacturing PMI rose to 50.7 percent for November surpassing expectations and pushing the country’s manufacturing sector back into growth territory. Beijing’s efforts to stimulate the slowing economy bore fruit, leading to increased output and buying. Employment losses slowed and new orders experienced the most significant growth in four months. Supply delivery was somewhat improved for a second straight month. Despite minimal cost pressures, input costs rose slightly. Strong sales curbed any upward price movement to keep output charges stable. Business optimism soared to a four-month high.

GERMANY: Although the HCOB Germany Manufacturing PMI for November of 42.6 percent was the highest reading in six months, the manufacturing sector is still deep in contraction territory. But the reading did represent a fourth straight month of steady improvement and output and new order declines were the slowest in six months. Companies saw reduced purchasing levels to match decreasing output and stock needs. Prices fell due to reduced demand and increased competition and employment levels fell at a faster pace.

INDIA: The S&P Global India Manufacturing PMI climbed to 56 percent in November to rebound from October’s eight-month low of 55.5 percent. The country’s manufacturing sector has now been in growth territory since June 2021. Several factors contributed to the rebound with new orders improving with the help of a 20-month growth streak for international sales. The strong performance boosted employment and delivery times remained stable. Surprisingly though, business optimism slipped to a seven-month low due to heightened inflation predictions.

ITALY: The HCOB Italy Manufacturing PMI fell to 44.4 percent to extend the contraction territory streak to eight months. The poor reading was impacted by weak demand which caused output and new orders to decline at the fastest rate in three months. The tough conditions meant factory layoffs increased and employment fell at the fastest rate since July 2020. The business outlook was pessimistic.

UNITED KINGDOM: The S&P Global/CIPS UK Manufacturing PMI rose to 47.2 percent in November to notch the highest reading since April. After reaching a low in August, the new figure represented a third straight month of improvement. Still, the country’s manufacturers remain in contraction territory — a streak that dates back to July 2022. The headwinds include sluggish domestic demand, reduced foreign business and destocking efforts. The country’s firms continued to lower employment and reduce input purchases. Input costs did decrease while selling prices surged as firms looked to improve margins. Business confidence edged higher, signaling resilience amidst challenging circumstances.

Source: Institute for Supply Management®, PMI®(Purchasing Manager Index), Report On Business®. For more information, visit the ISM® website at www.ismworld.org.