US Manufacturing Stays Strong in April

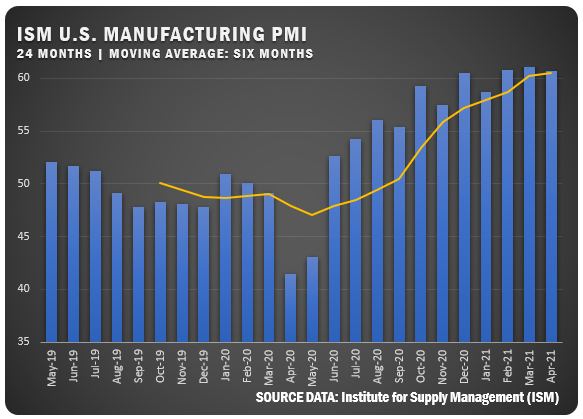

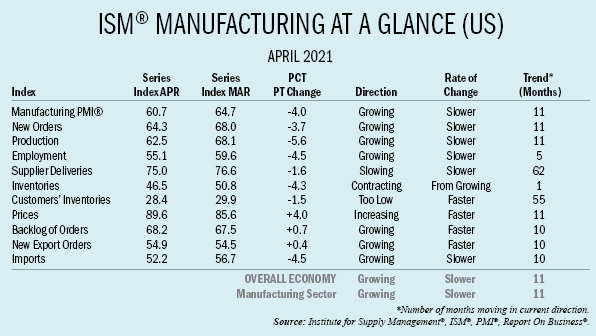

The latest Manufacturing ISM® Report On Business® issued by Timothy R. Fiore, Chair of the ISM® Manufacturing Business Survey Committee reported a 60.7 percent PMI for April. That represented a decrease of four percentage points from the March reading of 64.7 percent.

The report says the manufacturing economy continued expansion in April with survey committee members reporting that their companies and suppliers continue to struggle to meet increasing rates of demand due to coronavirus (COVID-19) impacts limiting the availability of parts and materials. Record-long lead times, wide-scale shortages of critical basic materials, rising commodities prices and difficulties in transporting products are continuing to affect all segments of the manufacturing economy. Worker absenteeism, short-term shutdowns due to part shortages, and difficulties in filling open positions continue to be issues that limit manufacturing growth potential. Optimistic panel sentiment increased, with 11 positive comments for every cautious comment, compared to an 8-to-1 ratio in March.

Demand expanded, with the New Orders Index growing at a strong level, supported by the New Export Orders Index continuing to expand, Customers’ Inventories Index hit another all-time low and the Backlog of Orders Index continued at a record-high level. Consumption (measured by the Production and Employment indexes) indicated some cooling, posting a combined 10.1-percentage point decrease. All top six industries reported moderate to strong consumption expansion. The Employment Index expanded for the fifth straight month, but panelists continue to note significant difficulties in attracting and retaining labor at their companies’ and suppliers’ facilities. Inputs — expressed as supplier deliveries, inventories, and imports — continued to support input-driven constraints to production expansion, at lower rates compared to March, due to an undesired inventory drawdown.

All of the six biggest manufacturing industries — Fabricated Metal Products; Chemical Products; Food, Beverage & Tobacco Products; Computer & Electronic Products; Transportation Equipment; and Petroleum & Coal Products, in that order — registered moderate to strong growth in April.

“Manufacturing performed well for the 11th straight month, with demand, consumption and inputs registering strong growth compared to March,” says Fiore. “Labor-market difficulties at panelists’ companies and their suppliers persist. End-user lead times (for refilling customers’ inventories) are extending. This is due to very high demand and output restrictions, as supply chains continue to respond to strong demand amid COVID-19 impacts.”

ISM® Report Comments (U.S.)

- “Demand continues to be very strong. Supply chain delays hamper our availability and ability to sell more.” (Machinery)

- “In 35 years of purchasing, I’ve never seen everything like these extended lead times and rising prices — from colors, film, corrugate to resins, they’re all up. The only thing plentiful at present, according to my spam filter, is personal protective equipment [PPE].” (Plastics & Rubber Products)

- “Steel prices are crazy high. The normal checks on the domestic steel mills are not functioning — imported steel is distorted by the Section 232 tariffs.” (Fabricated Metal Products)

- “The metals markets remain very challenging at best. Shortages of raw materials have increased, especially in aluminum and carbon steel. Prices continue to rapidly increase. Transportation and trucking [are] also a big challenge.” (Primary Metals)

- “The current electronics/semiconductor shortage is having tremendous impacts on lead times and pricing. Additionally, there appears to be a general inflation of prices across most, if not all, supply lines.” (Computer & Electronic Products)

- “Upstream producers/suppliers are back online and working towards full rates. Demand is outpacing supply and will continue into the third quarter, when the supply chain is expected to be refilled. Supply/demand should be more balanced in Q3/Q4, but demand will continue as customers run hard to meet their demand and rebuild inventory.” (Chemical Products)

- “Continued strong sales; however, we have had to trim some production due to the global chip shortage. Hasn’t affected inventories greatly yet, but a continued decrease will begin to reduce available inventories if we don’t recover chip supply shortly.” (Transportation Equipment)

- “Business is picking up as restaurants open.” (Food, Beverage & Tobacco Products)

- “Oil production has been steady, along with market prices and capital expenditures.” (Petroleum & Coal Products)

- “It’s getting much more difficult to supply production with materials that are made with copper or steel. Lots of work on the floor, but I am worried about getting the materials to support.” (Electrical Equipment, Appliances & Components)

- “Market capacity in most areas is oversold, with no realistic improvement on the horizon. In fact, it appears that demand will continue to strengthen, leading to more significant disruptions.” (Furniture & Related Products)

U.S. SECTOR REPORT

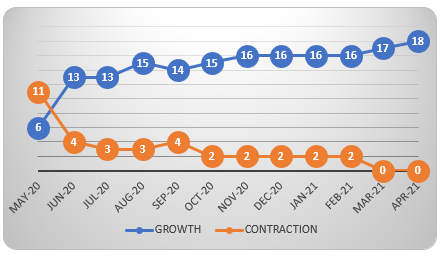

ISM GROWTH SECTORS (18): Electrical Equipment, Appliances & Components; Textile Mills; Furniture & Related Products; Machinery; Fabricated Metal Products; Primary Metals; Miscellaneous Manufacturing; Chemical Products; Plastics & Rubber Products; Food, Beverage & Tobacco Products; Computer & Electronic Products; Nonmetallic Mineral Products; Apparel, Leather & Allied Products; Transportation Equipment; Paper Products; Petroleum & Coal Products; Printing & Related Support Activities; and Wood Products.

ISM CONTRACTION SECTORS (0): No industries reported contraction in March.

Sources: Institute for Supply Management®, ISM®, PMI®, Report On Business®. For more information, visit the ISM® website at www.ismworld.org.

SEE ALSO: