ISM Reports Uptick For US Manufacturers

Overall US Economy Has 15th Consecutive Month of Growth

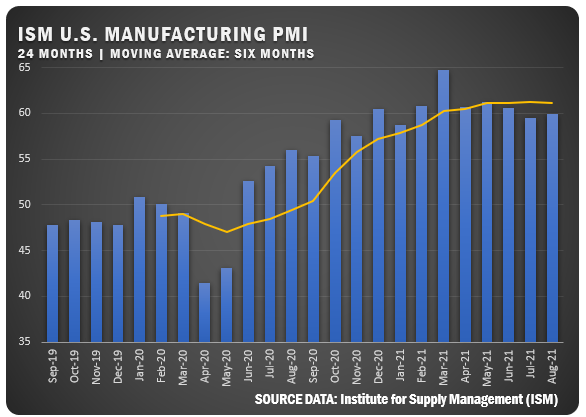

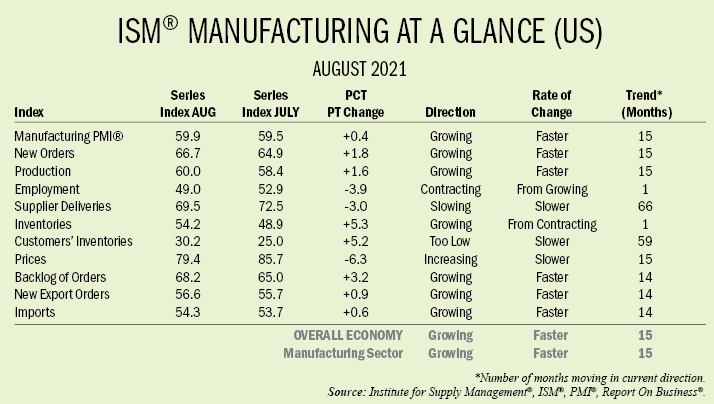

ISM® is reporting a manufacturing PMI® of 59.9 percent for US manufacturers for the month of August — an increase of 0.4 percentage points from the July reading of 59.5 percent. Despite the improvement, ISM panelists from the report say their companies and suppliers continue to struggle at unprecedented levels to meet increasing demand.

“Manufacturing performed well for the 15th straight month, with demand, consumption and inputs registering month-over-month growth, in spite of unprecedented obstacles. Panelists’ companies and their supply chains continue to struggle to respond to strong demand due to difficulties in hiring and a clear cycle of labor turnover as workers opt for more attractive job conditions,” says Timothy R. Fiore, Chair of the Manufacturing Business Survey Committee. “Disruptions from COVID-19, primarily in Southeast Asia, are having dramatic impacts on many industry sectors. Ports congestion in China continues to be a headwind as transportation networks remain stressed. Demand remains at strong levels, despite increased prices for nearly everything.”

The report says optimistic panel sentiment remained strong, with eight positive comments for every cautious comment. Demand expanded, with the (1) New Orders Index growing, supported by continued expansion of the New Export Orders Index, (2) Customers’ Inventories Index remaining at very low levels and (3) Backlog of Orders Index staying at a very high level. Consumption (measured by the Production and Employment indexes) declined in the period, with a combined 2.3-percentage point decrease to the Manufacturing PMI® calculation. The Employment Index returned to contraction after one month of expansion; hiring difficulties at panelists’ companies were the most significant hurdle to further output in August, as validated by the growth in inventory accounts. Inputs — expressed as supplier deliveries, inventories, and imports — continued to support input-driven constraints to production expansion, at slower rates compared to July. The Supplier Deliveries Index softened while the Inventories Index made a strong move into expansion territory due to improvements in raw material deliveries as well as work in progress inventory being held longer due to key part shortages. The Prices Index expanded for the 15th consecutive month, indicating continued supplier pricing power and scarcity of supply chain goods.

All of the six biggest manufacturing industries — Computer and Electronic Products; Fabricated Metal Products; Chemical Products; Food, Beverage and Tobacco Products; Transportation Equipment; and Petroleum and Coal Products, in that order — registered moderate to strong growth in August.

RELATED: Full Global Manufacturing Report (August 2021)

ISM® REPORT COMMENTS (U.S.)

- “Customer order backlog continues to climb because we are unable to raise production rates due to supplier parts and manpower challenges. Continue to see price increases with key commodities, and logistics is an ongoing challenge that has no end in sight.” Machinery

- “We continue to see extended lead times due to port delays and sea container tightness. Manufacturing capacities are impacted by a lack of workers reducing output. Several chemical facilities have experienced fires, explosions and spills, further challenging suppliers’ ability to deliver on time and in full.” Chemical Products

- “The chip shortage is impacting supply lines. So far, we’ve been able to manage it without impacting clients.” Computer and Electronic Products

- “Some factories have been impacted by COVID-19 cases. Malaysian government says factories can operate at only 60 percent of capacity.” Computer and Electronic Products

- “Strong sales continue, but production is limited due to supply issues with chips.” Transportation Equipment

- “Supply chain functions have been relentlessly challenging. All things from freight (both over the road and ocean), already constrained labor forces are further exacerbated by COVID-19 absenteeism. Also, high prices everywhere are wearing our employee base down.” Food, Beverage and Tobacco Products

- “Oil prices have remained higher than planned and is helping to secure capital funds and project sanctions for 2021-22 projects.” Petroleum and Coal Products

- “Bookings/sales continue to be strong. Persistent supply issues — including availability of materials, freight/logistics/containers, and allocation of key commodities — continue to hamper production ramp to meet demand. Also struggling with lack of labor in several factories. Commodities are still inflationary, but price increases have leveled.” Furniture and Related Products

- “Business is strong. Part shortages are our largest business constraint. We cannot fulfill orders to customers in reasonable lead times. Now booking out into 2022, and it will get worse as we hit our cyclical high demand in the fourth quarter.” Electrical Equipment, Appliances and Components

- “Business is going strong, but raw material prices still under increasing price pressure. Labor is still an issue.” Plastics and Rubber Products

- “Continue to be unable to hire hourly personnel or machine operators due to few applicants. Steel and aluminum remain in short supply. New business continues to grow and come in. Unable to handle influx of orders without staff, both hourly and salaried.” Fabricated Metal Products

US SECTOR REPORT

ISM GROWTH SECTORS (15): Furniture and Related Products; Computer and Electronic Products; Machinery; Primary Metals; Electrical Equipment, Appliances and Components; Fabricated Metal Products; Plastics and Rubber Products; Chemical Products; Miscellaneous Manufacturing; Food, Beverage and Tobacco Products; Transportation Equipment; Wood Products; Printing and Related Support Activities; Paper Products; and Petroleum and Coal Products.

ISM CONTRACTION SECTORS (2): Textile Mills and Nonmetallic Mineral Products.

Credit: Institute for Supply Management®, ISM®, PMI®, Report On Business®. For more information, visit the ISM® website at www.ismworld.org.