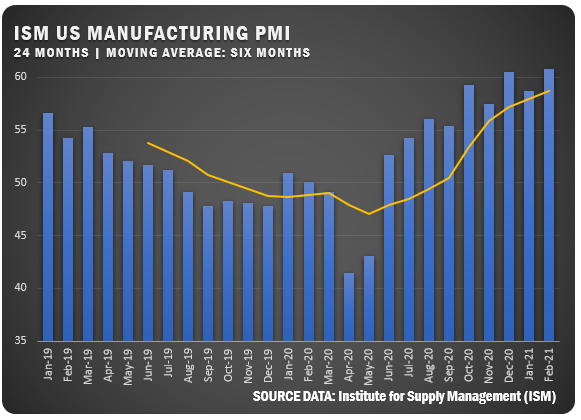

US Manufacturing PMI Soars in February

U.S. manufacturing registered a PMI of 60.8 percent for February according to the latest ISM® Report On Business® to reach the highest figure since the start of the COVID-19 global pandemic.

“Manufacturing performed well for the ninth straight month, with demand, consumption and inputs registering strong growth compared to January,” says Timothy R. Fiore, Chair of the ISM® Manufacturing Business Survey Committee. “Labor-market difficulties at panelists’ companies and their suppliers continued to restrict manufacturing-economy expansion and will remain the primary headwind to production growth until employment levels and factory operations can return to normal across the entire supply chain.”

ISM® REPORT NOTES (U.S.)

- The New Orders Index registered 64.8 percent, up 3.7 percentage points from the January reading of 61.1 percent.

- The Production Index registered 63.2 percent, an increase of 2.5 percentage points compared to the January reading of 60.7 percent.

- The Backlog of Orders Index registered 64 percent, 4.3 percentage points above the January reading of 59.7 percent.

- The Employment Index registered 54.4 percent, 1.8 percentage points higher from the January reading of 52.6 percent.

- The Supplier Deliveries Index registered 72 percent, up 3.8 percentage points from the January figure of 68.2 percent.

- The Inventories Index registered 49.7 percent, 1.1 percentage points lower than the January reading of 50.8 percent.

- The Prices Index registered 86 percent, up 3.9 percentage points compared to the January reading of 82.1 percent.

- The New Export Orders Index registered 57.2 percent, an increase of 2.3 percentage points compared to the January reading of 54.9 percent.

- The Imports Index registered 56.1 percent, a 0.7-percentage point decrease from the January reading of 56.8 percent.

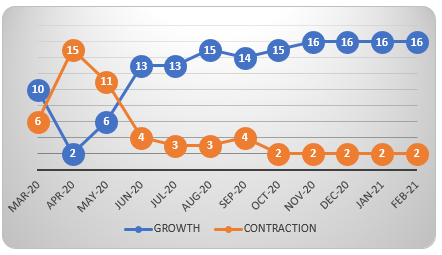

US SECTOR REPORT

ISM GROWTH SECTORS (16): Textile Mills; Electrical Equipment, Appliances & Components; Primary Metals; Paper Products; Chemical Products; Machinery; Fabricated Metal Products; Transportation Equipment; Wood Products; Plastics & Rubber Products; Computer & Electronic Products; Apparel, Leather & Allied Products; Food, Beverage & Tobacco Products; Miscellaneous Manufacturing; Furniture & Related Products; and Nonmetallic Mineral Products.

ISM CONTRACTION SECTORS (2): Printing & Related Support Activities; and Petroleum & Coal Products.

RESPONDENTS TO ISM REPORT

- “Prices are going up, and lead times are growing longer by the day. While business and backlog remain strong, the supply chain is going to be stretched very [thin] to keep up.” (Machinery)

- “We have seen our new-order log increase by 40 percent over the last two months. We are overloaded with orders and do not have the personnel to get the product out the door on schedule.” (Primary Metals)

- “A sense of urgency is being felt regarding new orders. Customers are giving an impression that a presence of stability is forthcoming and order flow is increasing.” (Textile Mills)

- “Prices are rising so rapidly that many are wondering if [the situation] is sustainable. Shortages have the industry concerned for supply going forward, at least deep into the second quarter.” (Wood Products)

- “Things are now out of control. Everything is a mess, and we are seeing wide-scale shortages.” (Electrical Equipment, Appliances & Components)

- “The coronavirus [COVID-19] pandemic is affecting us in terms of getting material to build from local and our overseas third- and fourth-tier suppliers. Suppliers are complaining of [a lack of] available resources [people] for manufacturing, creating major delivery issues.” (Computer & Electronic Products)

- “Supply chains are depleted; inventories up and down the supply chain are empty. Lead times increasing, prices increasing, [and] demand increasing. Deep freeze in the Gulf Coast expected to extend the duration of shortages.” (Chemical Products)

- “Steel prices have increased significantly in recent months, driving costs up from our suppliers and on proposals for new work that we are bidding. In addition, the tariffs and anti-dumping fees/penalties incurred by international mills/suppliers are being passed on to us.” (Transportation Equipment)

- “We have experienced a higher rate of delinquent shipments from our ingredient suppliers in the last month. We are still struggling keeping our production lines fully manned. We anticipate a fast and large order surge in the food-service sector as restaurants open back up.” (Food, Beverage & Tobacco Products)

- “Overall capacities are full across our industry. Logistics times are at record times. Continuing to fight through shipping and increased lead times on both raw materials and finished goods due to the pandemic.” (Fabricated Metal Products)

- “Labor shortages at suppliers are affecting material deliveries and prices.” (Plastics & Rubber Products)

GLOBAL MANUFACTURING

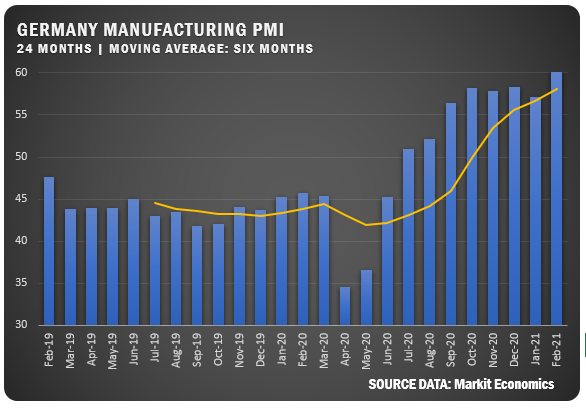

GERMANY: IHS Markit/BME reported a Germany Manufacturing PMI 60.7 for February — the highest level since early 2018. Order book growth increased with increased demand from Asia, the U.S, and Europe. However, delivery delays and supply chain issues are increasing which is increasing costs. German manufacturers remain strongly optimistic.

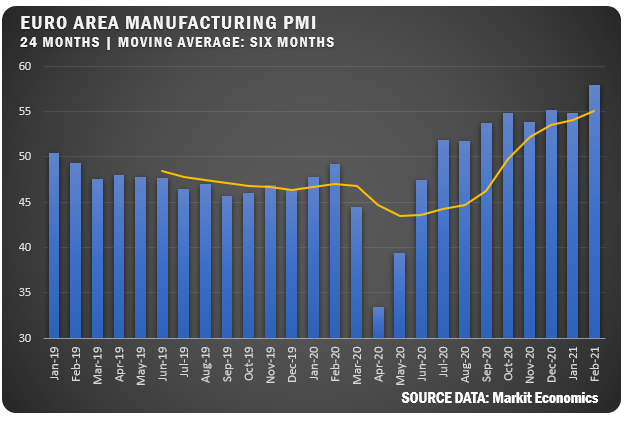

EUROZONE: According to IHS Markit, the Eurozone Manufacturing PMI hit a three-year high of 57.9 percent for February, well above the January figure of 54.8. Export trade increased at the highest level since early 2018 and employment grew for the first time in nearly two years. Lead times continue to grow and input cost and output prices soared.

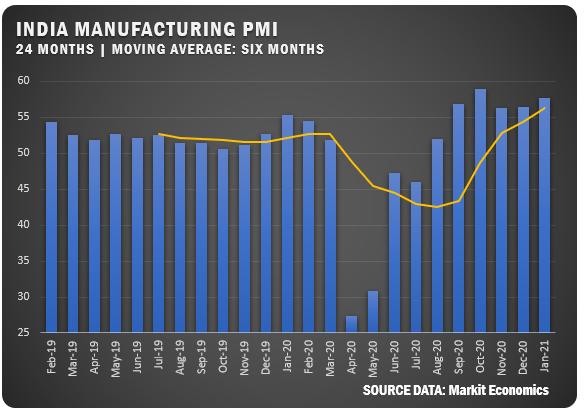

INDIA: Manufacturing ticked down slightly in February as IHS Markit reported a figure of 57.5 in February for India following a three-month high of 57.7 in January. Output and new orders grew, but employment is still decreasing. Increased prices for chemicals, metals, plastics and textiles, caused a further acceleration of input cost inflation and that caused small increase in output charges. Business outlook remains positive.

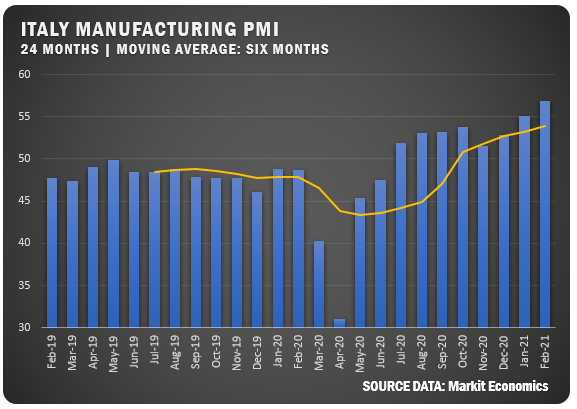

ITALY: IHS Markit reported a February PMI of 56.9 for Italian manufacturers to register a 1.8 percent increase over the January reading of 55.1. It was the highest mark since January 2018 as output and new orders showed strength based on solid improvement in export orders. Employment grew but input cost inflation was the highest since 2011.

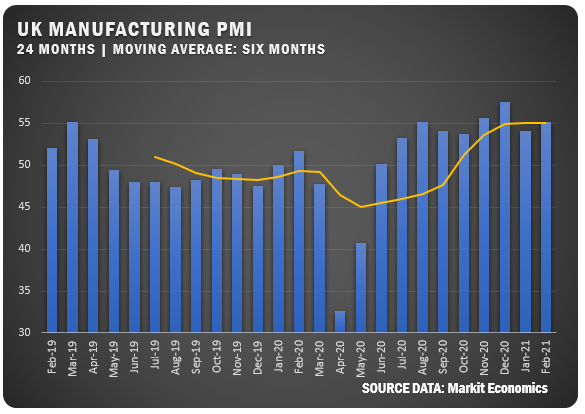

UNITED KINGDOM: IHS Markit/CIPS UK Manufacturing PMI was reported as 55.1 percent to improve by 1.0 percent from January. Output rose at the weakest pace during the current nine-month sequence of increase. Domestic demand improved and new exports pushed up slightly to drive new orders higher. Numbers could have been better, but COVID-19, Brexit and shipping issues impacted exports despite the improvement. Business outlook was positive for UK manufacturers.

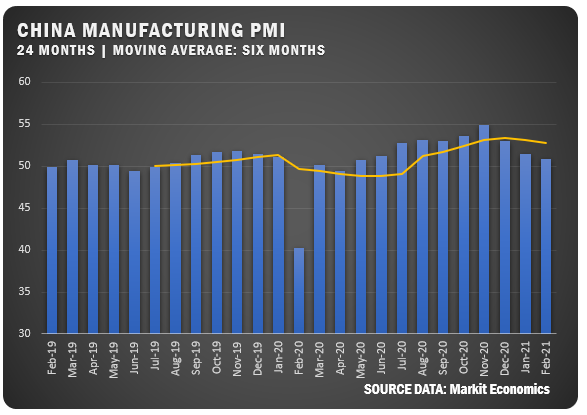

CHINA: The Caixin China General Manufacturing PMI dropped to 50.9 percent to register a third straight month of decline. The figure was also the lowest since May of 2020. Output fell to a ten-month low and employment continued to fall. Backlogs decreased and raw material shortages and shipping delays extended delivery times. Input costs and output prices continued to increase, but business sentiment strengthened.

Source: Institute for Supply Management®, ISM®, PMI®, Report On Business®. For more information, visit the ISM® website at www.ismworld.org.